Global Grain and Cereal Crop Protection Market - Key Trends and Drivers Summarized

Why Is Grain and Cereal Crop Protection Becoming Essential for Global Food Security and Sustainable Agriculture?

Grain and cereal crop protection is becoming increasingly essential for ensuring global food security and promoting sustainable agricultural practices. But why is crop protection so critical today? Grains and cereals such as wheat, corn, rice, and barley form the cornerstone of the world's food supply, providing essential calories and nutrients for billions of people. However, these vital crops are constantly threatened by pests, diseases, and environmental factors that can severely impact yields. Crop protection, through the use of pesticides, herbicides, fungicides, and integrated pest management (IPM) strategies, is key to defending these crops against such threats and ensuring a stable and abundant food supply.As the global population continues to grow, the demand for grains and cereals is escalating, placing more pressure on farmers to increase yields and ensure the quality of their crops. Without effective crop protection measures, pest infestations, fungal diseases, and invasive weeds can decimate harvests, leading to food shortages and economic losses for farmers. In addition, climate change has exacerbated the challenges facing crop production, as rising temperatures, unpredictable rainfall, and the spread of new pests and diseases further threaten grain and cereal crops. To meet the rising demand for food while maintaining sustainable agricultural practices, crop protection technologies and strategies are essential for safeguarding harvests and improving productivity.

How Are Technological Advancements Enhancing the Effectiveness of Grain and Cereal Crop Protection?

Technological advancements are significantly improving the effectiveness of grain and cereal crop protection, offering more targeted, sustainable, and efficient solutions to combat pests, diseases, and weeds. One of the most impactful innovations is the development of precision agriculture tools, such as drones, GPS-guided equipment, and satellite imagery, which allow farmers to monitor their fields in real time and apply crop protection products only where they are needed. Drones equipped with advanced sensors can scan large fields, identifying areas with pest infestations, nutrient deficiencies, or signs of disease. This enables farmers to apply pesticides or herbicides with pinpoint accuracy, reducing the amount of chemicals used and minimizing the environmental impact. Precision agriculture reduces waste, lowers costs, and helps maintain soil health by preventing overuse of crop protection products.Another critical advancement is the development of biologically-based crop protection solutions, such as biopesticides and biocontrol agents. These environmentally friendly alternatives to chemical pesticides use naturally occurring organisms, such as bacteria, fungi, or insects, to target specific pests and diseases without harming beneficial organisms or ecosystems. For example, certain species of fungi can be used to control harmful insect populations, while beneficial nematodes can be deployed to target soil-dwelling pests. The use of biopesticides is becoming more prevalent as farmers seek to adopt more sustainable and eco-friendly practices in response to consumer demand and regulatory pressures. Biopesticides offer a lower-risk approach to pest control and are often used as part of integrated pest management (IPM) programs.

Advancements in plant breeding and genetic engineering are also playing a significant role in enhancing crop protection. Scientists are developing genetically modified (GM) grain and cereal crops that are resistant to specific pests, diseases, and herbicides. For instance, Bt corn, which is engineered to produce a protein toxic to certain insects, has been instrumental in reducing crop losses from pests such as the European corn borer. Similarly, crops engineered to be herbicide-tolerant allow farmers to control weeds more effectively without damaging the crops themselves. These genetic innovations reduce the need for chemical treatments, promote higher yields, and lower production costs, making them an essential tool in modern agriculture. Furthermore, advances in gene editing technologies, such as CRISPR, are opening new possibilities for developing crops with enhanced resistance to multiple threats, including drought, heat, and diseases.

The use of artificial intelligence (AI) and machine learning is further revolutionizing crop protection by enabling predictive modeling and early detection of pest and disease outbreaks. AI algorithms can analyze vast amounts of data collected from weather patterns, soil conditions, and crop health to predict when and where pest or disease outbreaks are likely to occur. By providing early warnings, AI helps farmers take proactive measures to prevent damage before it becomes widespread. Additionally, AI-powered decision support systems can recommend the most effective crop protection strategies based on real-time data, helping farmers make more informed decisions and optimize their use of resources.

Moreover, advancements in formulation and delivery systems for crop protection chemicals are making them more effective and safer to use. New formulations, such as microencapsulated pesticides or slow-release herbicides, ensure that active ingredients are delivered at the optimal time and rate, maximizing their efficacy while minimizing environmental exposure. These innovations not only improve the performance of crop protection products but also reduce the risk of off-target impacts on non-crop areas, water sources, and beneficial insects like pollinators.

Why Is Grain and Cereal Crop Protection Critical for Ensuring Yield, Reducing Losses, and Maintaining Marketability?

Grain and cereal crop protection is critical for ensuring high yields, reducing losses, and maintaining the marketability of crops because pests, diseases, and weeds can have devastating effects on agricultural productivity and quality. Without effective crop protection strategies, entire fields of grains and cereals can be lost to infestations or infections, leading to significant economic losses for farmers and food shortages in markets dependent on these staple crops. For instance, the fall armyworm and locust infestations have caused widespread damage to cornfields in many parts of the world, while fungal diseases such as wheat rust can wipe out large portions of wheat crops. Effective crop protection measures help farmers prevent such large-scale losses and protect their livelihoods.Crop protection is also vital for improving yield consistency. By controlling pests, weeds, and diseases, farmers can ensure that their crops reach full maturity and produce optimal yields. For example, herbicides are used to eliminate competition from weeds, allowing crops like wheat and barley to absorb the necessary nutrients, water, and sunlight for healthy growth. Similarly, fungicides protect crops from diseases that can reduce grain quality and size, ensuring that the harvest meets industry standards. Maintaining consistent yields is especially important in global food markets, where fluctuating production levels can lead to price volatility and supply chain disruptions.

In addition to protecting crop yields, crop protection helps ensure the marketability of grain and cereal products by preserving their quality. Contaminated or damaged grains are often rejected by buyers or sold at a reduced price, resulting in financial losses for producers. Pests such as insects can bore into grains, leaving them susceptible to mold and contamination, while diseases like smut and mildew can affect both the appearance and nutritional content of the crop. Proper crop protection helps farmers deliver high-quality, undamaged grains to the market, meeting the demands of consumers, food manufacturers, and international trade partners.

Furthermore, crop protection strategies contribute to the sustainability and efficiency of agricultural systems by helping farmers make the most of their land, water, and resources. With global land resources shrinking due to urbanization, climate change, and environmental degradation, it is crucial for farmers to maximize the productivity of the land they cultivate. Effective crop protection ensures that each acre of farmland produces the highest possible yield, reducing the need for agricultural expansion into forests or other natural ecosystems. This is particularly important for grains like rice and wheat, which are staple foods for billions of people and must be produced in sufficient quantities to meet global demand.

In regions where grain and cereal crops are a primary source of income and food security, crop protection is essential for ensuring economic stability. Countries that rely heavily on grain exports, such as the United States, Canada, and Australia, depend on crop protection to maintain the quality and quantity of their harvests. Similarly, in developing nations, where many smallholder farmers grow grains and cereals for subsistence or local markets, protecting crops from pests and diseases is vital for sustaining food supplies and supporting economic development.

What Factors Are Driving the Growth of the Grain and Cereal Crop Protection Market?

Several key factors are driving the growth of the grain and cereal crop protection market, including the increasing demand for food due to population growth, the rise of resistant pests and diseases, advancements in crop protection technologies, and the growing focus on sustainable agriculture. First, the global demand for food is steadily rising as the world's population is projected to reach nearly 10 billion by 2050. Grains and cereals form the foundation of human diets, and the pressure to increase production is pushing farmers to adopt more advanced crop protection solutions. As arable land becomes more limited, maximizing the productivity of existing farmland through effective crop protection becomes even more critical to ensure food security.Second, the emergence of resistant pests and diseases is fueling the need for innovative crop protection methods. Over time, pests and weeds can develop resistance to traditional chemical pesticides and herbicides, making them less effective. For example, herbicide-resistant weeds, such as glyphosate-resistant pigweed, have become a major challenge for farmers, threatening grain crops like corn and soybeans. The rise of resistant pests and diseases is prompting the development of new chemical formulations, biologically-based controls, and integrated pest management (IPM) strategies that can provide more sustainable and long-lasting solutions.

Advancements in crop protection technologies are also driving market growth. As discussed earlier, the introduction of precision agriculture tools, biopesticides, genetically modified crops, and AI-powered analytics is transforming the way farmers approach crop protection. These innovations enable more targeted and efficient application of pesticides, herbicides, and fungicides, reducing environmental impact while enhancing effectiveness. The increased adoption of these technologies is helping farmers improve yields, reduce crop losses, and respond to the growing demand for eco-friendly farming practices.

The growing focus on sustainable agriculture is another significant factor driving the growth of the grain and cereal crop protection market. Consumers, governments, and organizations are placing greater emphasis on reducing the environmental impact of farming, leading to stricter regulations on the use of synthetic chemicals in agriculture. As a result, there is a rising demand for sustainable crop protection solutions, such as biopesticides, integrated pest management (IPM), and crop rotation practices that minimize chemical use while maintaining crop health. This shift toward sustainability is prompting innovation in the crop protection market, with companies developing new products and methods that align with environmental standards and consumer preferences.

Climate change is also contributing to the growth of the crop protection market. As temperatures rise and weather patterns become more erratic, farmers are facing new challenges in managing pests, diseases, and weeds. Warmer climates can accelerate pest reproduction cycles, leading to more frequent and severe infestations. Similarly, changing precipitation patterns can increase the prevalence of fungal diseases in grain and cereal crops. To mitigate these risks, farmers are investing in more advanced and adaptable crop protection strategies that can help them navigate the uncertainties brought on by climate change.

In conclusion, the growth of the grain and cereal crop protection market is driven by the increasing global demand for food, the rise of resistant pests and diseases, advancements in crop protection technologies, and the growing emphasis on sustainable agriculture. As the world faces mounting challenges in food production, crop protection will continue to play a pivotal role in ensuring that grain and cereal crops are protected from threats, maximizing yields, and supporting the long-term sustainability of agriculture.

Report Scope

The report analyzes the Grain and Cereal Crop Protection market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Herbicides, Fungicides, Insecticides, Other Segments).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

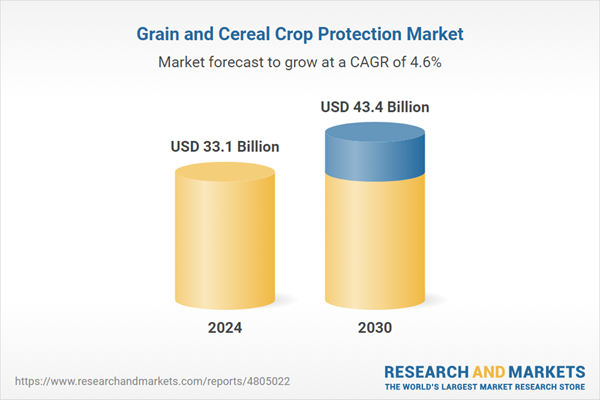

- Market Growth: Understand the significant growth trajectory of the Herbicides segment, which is expected to reach US$27.5 Billion by 2030 with a CAGR of 4.9%. The Fungicides segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.7 Billion in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $9.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Grain and Cereal Crop Protection Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Grain and Cereal Crop Protection Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Grain and Cereal Crop Protection Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Bayer CropScience AG, Dow AgroSciences LLC, FMC Corporation, Monsanto Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Grain and Cereal Crop Protection market report include:

- BASF SE

- Bayer CropScience AG

- Dow AgroSciences LLC

- FMC Corporation

- Monsanto Company

- Sapec Agro S.A.

- Sinochem Group Co., Ltd.

- Syngenta AG

- Yara International ASA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Bayer CropScience AG

- Dow AgroSciences LLC

- FMC Corporation

- Monsanto Company

- Sapec Agro S.A.

- Sinochem Group Co., Ltd.

- Syngenta AG

- Yara International ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 33.1 Billion |

| Forecasted Market Value ( USD | $ 43.4 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |