Global Monoethylene Glycol (MEG) Market - Key Trends & Drivers Summarized

What Is Monoethylene Glycol and How Is It Integral to Various Industries?

Monoethylene Glycol (MEG) is a vital organic compound in the chemical industry, primarily used as an antifreeze agent and a precursor to polyester fibers and polyethylene terephthalate (PET) resins. This colorless, odorless, and slightly viscous liquid is produced on a large scale from ethylene via ethylene oxide, which is then hydrated. MEG's primary applications are in the production of polyester fibers, which are fundamental to the textile industry, and the manufacture of PET bottles and containers, which are ubiquitous in the packaging industry. Additionally, MEG is essential in the automotive industry as an ingredient in coolant and antifreeze formulations, which prevent the freezing of fluids and overheating of engines.Why Are PET Production and Textile Applications Crucial for MEG Demand?

The demand for MEG is heavily influenced by its use in producing polyester and PET, which are pivotal to the textile and packaging sectors respectively. As global textile markets expand with rising fashion consumption and growing populations, the requirement for polyester fibers intensifies, directly boosting MEG consumption. Similarly, the escalating demand for PET, driven by its use in lightweight, recyclable bottles and packaging solutions, underscores the growth in MEG usage. These industries are experiencing transformative growth in emerging markets where economic development and increasing consumer spending power elevate the demand for products that require MEG.How Are Environmental Concerns and Technological Advances Affecting MEG Production and Use?

Environmental concerns and technological advancements are significantly reshaping the MEG industry. There is a growing push for sustainable production processes and the development of bio-based alternatives to traditional petroleum-derived MEG, driven by environmental regulations and sustainability goals. Companies are investing in technology to produce MEG from renewable sources like sugar and CO2, which could revolutionize the market by reducing reliance on fossil fuels and decreasing carbon emissions. Additionally, advancements in recycling technologies for PET and polyester may affect MEG demand by potentially reducing the need for virgin MEG in the manufacturing process, thereby promoting a more sustainable lifecycle for products made with MEG.What Drives the Growth in the Monoethylene Glycol Market?

The growth in the monoethylene glycol market is driven by several factors. A key driver is the expanding demand for polyester fibers and PET, propelled by increasing applications in textiles, packaging, and consumer goods. Technological innovations in production and recycling methods are also significant, as they improve efficiency and sustainability, making MEG products more competitive and environmentally acceptable. Furthermore, the rising trend of bio-based MEG production meets the increasing consumer and regulatory demands for greener manufacturing processes. These drivers, combined with the global economic expansion, particularly in emerging markets, ensure robust growth prospects for the MEG industry.Report Scope

The report analyzes the Monoethylene Glycol (MEG) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Fiber, PET, Antifreeze & Coolant, Film, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fiber Application segment, which is expected to reach US$12.9 Billion by 2030 with a CAGR of 4.5%. The PET Application segment is also set to grow at 3.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.1 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Monoethylene Glycol (MEG) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Monoethylene Glycol (MEG) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Monoethylene Glycol (MEG) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, BASF SE, Clariant AG, Dow, Inc., DuPont de Nemours, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 21 companies featured in this Monoethylene Glycol (MEG) market report include:

- Akzo Nobel NV

- BASF SE

- Clariant AG

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- EQUATE Petrochemical - MEGlobal

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Huntsman International LLC

- India Glycols Limited

- Indian Oil Corporation Ltd.

- Indorama Ventures Public Company Limited

- Ineos Oxide

- Kuwait Petroleum Corporation

- LG Chem

- Lotte Chemical Corporation

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- PTT Global Chemical Public Company Limited

- Reliance Industries Ltd.

- Royal Dutch Shell PLC

- SABIC (Saudi Basic Industries Corporation)

- SIBUR Holding OJSC

- Sinopec Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- BASF SE

- Clariant AG

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- EQUATE Petrochemical - MEGlobal

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Huntsman International LLC

- India Glycols Limited

- Indian Oil Corporation Ltd.

- Indorama Ventures Public Company Limited

- Ineos Oxide

- Kuwait Petroleum Corporation

- LG Chem

- Lotte Chemical Corporation

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- PTT Global Chemical Public Company Limited

- Reliance Industries Ltd.

- Royal Dutch Shell PLC

- SABIC (Saudi Basic Industries Corporation)

- SIBUR Holding OJSC

- Sinopec Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

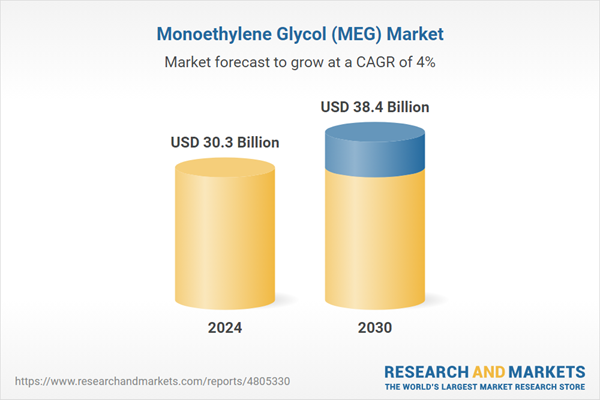

| Estimated Market Value ( USD | $ 30.3 Billion |

| Forecasted Market Value ( USD | $ 38.4 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |