Global Real World Evidence Solutions Market - Key Trends and Drivers Summarized

Real World Evidence Solutions: Transforming Healthcare with Data-Driven Insights

Real World Evidence (RWE) solutions are transforming healthcare by providing data-driven insights that enhance decision-making across the industry. RWE refers to the clinical evidence regarding the usage and potential benefits or risks of a medical product derived from analysis of real-world data (RWD). This data is collected from various sources, including electronic health records (EHRs), claims databases, patient registries, and wearable devices. RWE is increasingly being used by pharmaceutical companies, regulators, and healthcare providers to inform drug development, regulatory approvals, and patient care strategies. Unlike traditional clinical trials, which are conducted under controlled conditions, RWE provides insights into how treatments perform in everyday clinical settings, offering a more comprehensive understanding of a product's effectiveness and safety. This approach is becoming essential for demonstrating the value of new therapies, especially in personalized medicine and for rare diseases.What Technological Advancements Are Enhancing the Collection and Utilization of RWE?

Technological advancements are significantly enhancing the collection, analysis, and utilization of RWE, making it a more powerful tool for healthcare stakeholders. The integration of big data analytics, artificial intelligence (AI), and machine learning (ML) into RWE platforms allows for the processing of vast amounts of RWD, uncovering patterns and insights that would be impossible to detect manually. Advances in data integration technologies are also enabling the aggregation of data from diverse sources, creating comprehensive datasets that provide a holistic view of patient outcomes. Moreover, the use of natural language processing (NLP) is improving the extraction of meaningful data from unstructured sources, such as physician notes and social media. These technological innovations are not only improving the quality and accuracy of RWE but are also making it more accessible and actionable for decision-makers in healthcare.What Are the Key Applications and Benefits of RWE in Healthcare?

RWE is used in a wide range of applications in healthcare, offering significant benefits that enhance patient outcomes, improve healthcare efficiency, and support regulatory decision-making. In drug development, RWE is used to supplement clinical trial data, providing insights into how a drug performs across different populations and in real-world settings, which can inform labeling and post-market surveillance. Healthcare providers use RWE to identify the most effective treatments for specific patient populations, supporting personalized medicine approaches that tailor care to individual needs. Payers and insurers leverage RWE to assess the cost-effectiveness of treatments, guiding reimbursement decisions and ensuring that resources are allocated to therapies that offer the greatest value. The primary benefits of RWE include its ability to provide insights into the real-world effectiveness and safety of medical products, support evidence-based decision-making, and improve patient care by informing treatment strategies based on actual patient experiences.What Factors Are Driving the Growth in the Real World Evidence Solutions Market?

The growth in the Real World Evidence Solutions market is driven by several factors. The increasing emphasis on value-based care and the need to demonstrate the real-world effectiveness of medical products are significant drivers, as healthcare stakeholders seek to make informed decisions based on robust evidence. Technological advancements in data analytics, AI, and digital health platforms are also propelling market growth by enhancing the capabilities and accessibility of RWE solutions. The rising demand for personalized medicine and the need for data to support regulatory approvals, particularly for rare diseases and complex conditions, are further boosting demand for RWE. Additionally, the growing availability of digital health data, driven by the adoption of EHRs, wearable devices, and patient-reported outcomes, is expanding the scope and scale of RWE studies. These factors, combined with increasing collaboration between pharmaceutical companies, healthcare providers, and regulatory bodies, are driving the sustained growth of the Real World Evidence Solutions market.Report Scope

The report analyzes the Real World Evidence Solutions market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Services, Data Sets); End-Use (Pharmaceutical & Medical Devices Companies, Healthcare Payers, Healthcare Providers, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Services segment, which is expected to reach US$2.9 Billion by 2030 with a CAGR of 15.6%. The Data Sets segment is also set to grow at 12.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $534.3 Million in 2024, and China, forecasted to grow at an impressive 13.3% CAGR to reach $652.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Real World Evidence Solutions Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Real World Evidence Solutions Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Real World Evidence Solutions Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aetion, Cognizant Technology Solutions U.S. Corporation, IBM Corporation, Ignite Data Limited, IQVIA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Real World Evidence Solutions market report include:

- Aetion

- Cognizant Technology Solutions U.S. Corporation

- IBM Corporation

- Ignite Data Limited

- IQVIA

- PAREXEL International Corporation

- PerkinElmer, Inc.

- Pharmaceutical Product Development LLC

- SAS Institute, Inc.

- Syneos Health

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aetion

- Cognizant Technology Solutions U.S. Corporation

- IBM Corporation

- Ignite Data Limited

- IQVIA

- PAREXEL International Corporation

- PerkinElmer, Inc.

- Pharmaceutical Product Development LLC

- SAS Institute, Inc.

- Syneos Health

Table Information

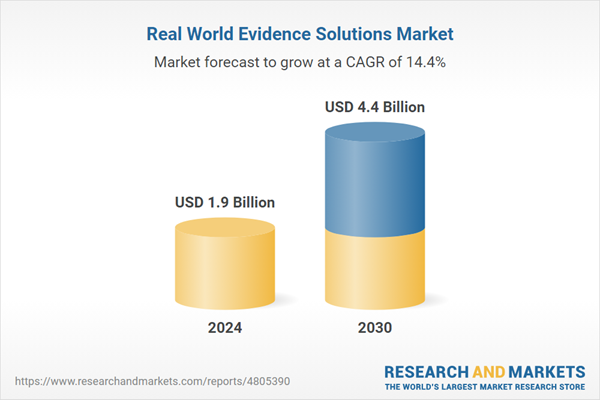

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 4.4 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |