Global Industrial Alcohol Market - Key Trends & Drivers Summarized

What Is Industrial Alcohol, and Where Is It Used?

Industrial alcohol, a more purified form of ethanol, is utilized extensively across various sectors due to its solvent and antiseptic qualities. This type of alcohol is produced through the fermentation of sugars derived from agricultural feedstocks, including corn, sugarcane, and other biomass sources. Unlike the ethanol used in beverages, industrial alcohol is denatured to prevent human consumption and is used in applications ranging from pharmaceuticals and cosmetics to fuels and chemical manufacturing. In the pharmaceutical industry, it serves as a solvent and preservative for drugs and as a base for the manufacture of antibacterial hand sanitizers. In the energy sector, it is used as a biofuel additive to gasoline, which helps reduce vehicle emissions and increase octane levels.How Are Advances in Production Technologies Impacting Industrial Alcohol?

The production of industrial alcohol has seen significant advancements aimed at increasing efficiency and sustainability. Modern fermentation technologies have improved yield and speed, reducing costs and enhancing the environmental profile of production. Biotechnology has played a pivotal role, with genetically engineered microbes increasing fermentation efficiency and expanding the range of feedstocks that can be effectively processed. Moreover, innovations in distillation and purification processes have enabled producers to achieve higher purities and qualities of alcohol, which are crucial for medical and electronic applications where impurities can compromise product integrity. Additionally, the push towards sustainability has spurred the development of technologies that enable the use of waste biomass, reducing the industry's carbon footprint and reliance on food-based feedstocks.What Trends Are Shaping the Demand for Industrial Alcohol?

Recent trends in the industrial alcohol market are largely driven by environmental concerns and shifts in consumer preferences towards more sustainable and eco-friendly products. There is an increasing demand for bio-based solvents, which positions industrial alcohol as a key ingredient in green chemistry applications. In the automotive industry, the push for cleaner-burning fuels continues to drive the use of ethanol as a biofuel, supported by government mandates and subsidies in many countries. The outbreak of global health crises, such as the COVID-19 pandemic, has also seen a spike in demand for industrial alcohol in the production of disinfectants and sanitizers. This trend is complemented by growing health consciousness among consumers, which fuels ongoing demand in pharmaceutical and cosmetic applications.What Drives the Growth in the Industrial Alcohol Market?

The growth in the industrial alcohol market is driven by several factors, reflecting a blend of technological, regulatory, and market dynamics. Technological advancements that improve the efficiency and sustainability of alcohol production are key drivers, as they help reduce costs and meet regulatory standards for environmental protection. The broadening scope of applications, from biofuels and pharmaceuticals to personal care products, also propels demand. Regulatory policies promoting biofuels and green chemistry further stimulate the market, particularly in regions with stringent environmental laws. Additionally, the global expansion of the pharmaceutical and cosmetic industries provides a robust platform for the increased consumption of industrial alcohol. Consumer trends towards sustainable and eco-friendly products continue to influence market growth, as industrial alcohol is integral to numerous green formulations. These factors collectively fuel a dynamic and growing market for industrial alcohol, highlighting its critical role in a variety of industrial and commercial applications.Report Scope

The report analyzes the Industrial Alcohol market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Ethyl Alcohol, Methyl Alcohol, Isopropyl Alcohol, Isobutyl Alcohol, Benzyl Alcohol, Other Types); Source (Grains, Molasses, Sugar, Fossil Fuels, Other Sources); Application (Fuel, Chemicals, Personal Care, Pharmaceutical, Food Ingredients, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Grains Source segment, which is expected to reach US$83.1 Billion by 2030 with a CAGR of 7.9%. The Molasses Source segment is also set to grow at 8.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $39.6 Billion in 2024, and China, forecasted to grow at an impressive 11% CAGR to reach $40.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Alcohol Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Alcohol Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Alcohol Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cargill, Inc., Cristalco S.A.S, Dhampur Sugar Mills Limited, Green Plains, Inc., Grain Processing Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 105 companies featured in this Industrial Alcohol market report include:

- Cargill, Inc.

- Cristalco S.A.S

- Dhampur Sugar Mills Limited

- Green Plains, Inc.

- Grain Processing Corporation

- HPCL Biofuels Limited

- Iogen Corporation

- MGP Ingredients, Inc.

- The Andersons Inc.

- Sakthi Sugars Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cargill, Inc.

- Cristalco S.A.S

- Dhampur Sugar Mills Limited

- Green Plains, Inc.

- Grain Processing Corporation

- HPCL Biofuels Limited

- Iogen Corporation

- MGP Ingredients, Inc.

- The Andersons Inc.

- Sakthi Sugars Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 745 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

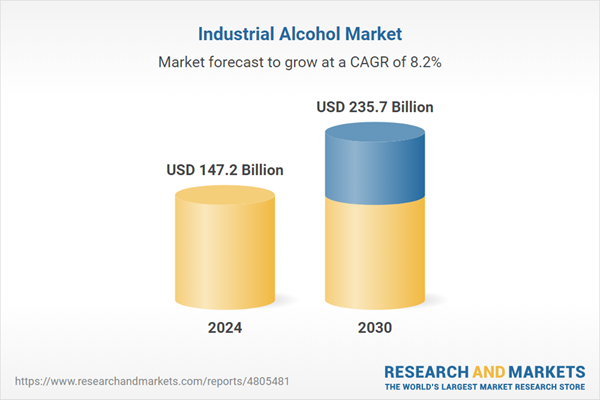

| Estimated Market Value ( USD | $ 147.2 Billion |

| Forecasted Market Value ( USD | $ 235.7 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |