Global Machine Control Systems Market - Key Trends & Drivers Summarized

How Are Machine Control Systems Revolutionizing Construction and Agriculture?

Machine control systems are transforming the construction and agriculture industries by enabling more precise and efficient operations. These systems utilize technologies such as GPS, lasers, and inertial sensors to guide machinery, ensuring accuracy in tasks like grading, excavation, and planting. In construction, machine control systems reduce the need for manual staking and surveying, leading to faster project completion and reduced costs. Similarly, in agriculture, these systems enhance productivity by enabling precision farming techniques, where crops are planted, fertilized, and harvested with unparalleled accuracy. This level of control not only optimizes resource usage but also minimizes environmental impact, aligning with the increasing demand for sustainable practices in these sectors.What Technological Advancements Are Driving the Evolution of Machine Control Systems?

Technological advancements are at the forefront of the evolution in machine control systems, significantly enhancing their capabilities and applications. The integration of advanced GPS technology with real-time kinematic (RTK) positioning allows for centimeter-level accuracy, which is critical in tasks requiring high precision. Additionally, the development of 3D machine control systems enables operators to visualize and execute complex tasks with greater efficiency and fewer errors. The adoption of cloud-based platforms and IoT connectivity further enhances these systems by allowing real-time data sharing and remote monitoring, enabling more informed decision-making and improved fleet management. These innovations not only boost productivity but also contribute to safety by reducing the potential for human error in operating heavy machinery.What Challenges and Opportunities Exist in the Machine Control Systems Market?

While machine control systems offer significant benefits, the market faces several challenges that need to be addressed to maximize their potential. One of the primary challenges is the high cost of implementing these systems, which can be a barrier for small to mid-sized firms, particularly in developing regions. Additionally, the complexity of integrating machine control systems with existing machinery and workflows can pose a significant hurdle, requiring specialized training and support. However, these challenges also present opportunities for growth, particularly in the development of more affordable and user-friendly solutions. As the demand for automation and precision in construction and agriculture continues to rise, there is significant potential for companies that can offer scalable, cost-effective machine control systems tailored to a broader range of users.Growth in the Machine Control Systems Market Is Driven by Several Factors

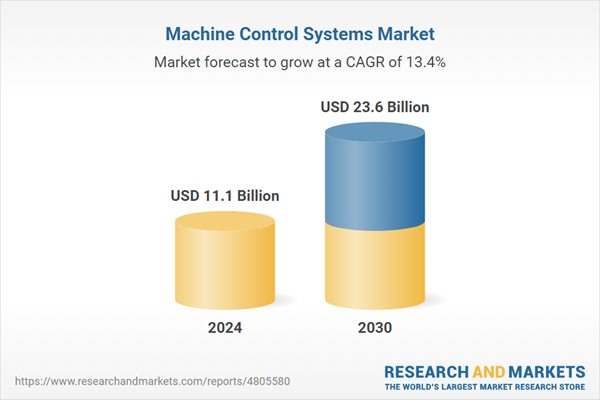

The growth in the machine control systems market is driven by several factors, including the increasing adoption of automation in construction and agriculture, the need for enhanced precision in operations, and ongoing technological innovations. The rising demand for infrastructure development, particularly in emerging economies, is a significant driver, as it necessitates efficient and accurate construction methods. In agriculture, the push towards precision farming, driven by the need to maximize yields and reduce environmental impact, is fueling the adoption of advanced machine control systems. Additionally, technological advancements, such as the integration of IoT and cloud computing, are expanding the capabilities and accessibility of these systems, further stimulating market growth. As industries continue to seek ways to improve efficiency and sustainability, the demand for advanced machine control systems is expected to grow, making this a dynamic and rapidly evolving market.Report Scope

The report analyzes the Machine Control Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Equipment (Excavators, Loaders, Paving Systems, Graders, Other Equipment); Type (GNSS, Total Stations, Laser Scanners, Airborne Systems); End-Use (Construction, Agriculture, Oil & Gas, Mining, Marine, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Excavators segment, which is expected to reach US$14.3 Billion by 2030 with a CAGR of 13.3%. The Loaders segment is also set to grow at 12.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.1 Billion in 2024, and China, forecasted to grow at an impressive 12.6% CAGR to reach $3.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Machine Control Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Machine Control Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Machine Control Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accurate Instruments (NZ) Limited, Ambrose Equipment Company Inc., Andritz Automation, BARTEC FEAM, BIA Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Machine Control Systems market report include:

- Accurate Instruments (NZ) Limited

- Ambrose Equipment Company Inc.

- Andritz Automation

- BARTEC FEAM

- BIA Group

- CHC Navigation

- China Machinery Engineering Co., Ltd.

- Didac International

- Eagle Platforms

- Emrich Industries Pty., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accurate Instruments (NZ) Limited

- Ambrose Equipment Company Inc.

- Andritz Automation

- BARTEC FEAM

- BIA Group

- CHC Navigation

- China Machinery Engineering Co., Ltd.

- Didac International

- Eagle Platforms

- Emrich Industries Pty., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.1 Billion |

| Forecasted Market Value ( USD | $ 23.6 Billion |

| Compound Annual Growth Rate | 13.4% |

| Regions Covered | Global |