Global LED Driver for Lighting Market - Key Trends & Drivers Summarized

LED drivers are fundamental components in the operation of LED lighting, acting as a power supply that regulates the power to an LED or a string of LEDs. A well-designed LED driver manages the amount of current and voltage reaching the LEDs, ensuring optimal performance and preventing overheating or failure. The necessity for LED drivers arises from the inherent characteristic of LEDs themselves, which are highly efficient but require consistent current and appropriate voltage to maximize lifespan and light output. LED drivers can vary significantly in complexity, offering features such as dimming by controlling the brightness of the light, and integrating smart technologies that allow for color control and connectivity with home automation systems. As LED technology continues to evolve, the sophistication of LED drivers parallels this progression, enhancing the efficiency and capabilities of LED lighting systems.The integration of advanced technology into LED drivers is part of a broader trend towards more energy-efficient and environmentally friendly lighting solutions. Modern LED drivers are increasingly being designed with features such as programmable dimming technology, which allows users to adjust lighting levels to their preferences and activities, contributing to energy conservation. Furthermore, the incorporation of connectivity features compatible with the Internet of Things (IoT) enables smart home and smart building applications, where lighting can be controlled remotely and integrated with other automated systems. This not only improves user convenience but also enhances energy management capabilities. Additionally, the development of compact, high-efficiency LED drivers that can be easily integrated into various lighting applications without compromising performance is critical as the demand for more sustainable and versatile lighting solutions grows.

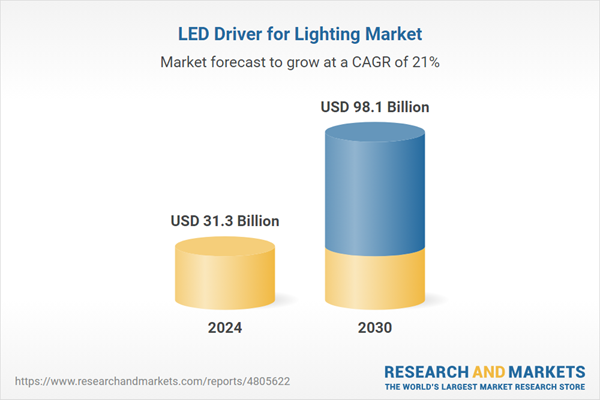

The growth in the LED driver market for lighting is driven by several factors, including the ongoing global shift towards energy efficiency, the continued expansion of smart home technology, and increasing regulatory requirements for energy-saving technologies. As governments worldwide implement stricter energy efficiency standards, the demand for advanced LED drivers that can meet these standards is increasing. This regulatory environment, coupled with growing consumer awareness about the benefits of energy conservation, propels the adoption of LED technology across residential, commercial, and industrial sectors. Additionally, the rising popularity of smart home ecosystems has created a robust market for smart LED drivers that can be controlled via apps and integrated with other home automation systems, providing both convenience and energy savings. Technological advancements that enable the production of more reliable and cost-effective LED drivers also contribute to market growth, making LEDs an increasingly attractive option for a wide range of lighting applications. Collectively, these factors ensure the continued expansion of the LED driver market, reflecting the broader trends of energy conservation, technological integration, and environmental responsibility.

Report Scope

The report analyzes the LED Driver for Lighting market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Luminaire Type (Type A-Lamps, T-Lamps, Integral LED Modules, and Other Luminaire Types); Driving Method (Constant Current LED Driver, and Constant Voltage LED Driver); End-Use (Commercial Lighting, Industrial Lighting, Residential Lighting, Outdoor & Traffic Lighting, and Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Type A-Lamps segment, which is expected to reach US$35.5 Billion by 2030 with a CAGR of 20.6%. The T-Lamps segment is also set to grow at 19.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.1 Billion in 2024, and China, forecasted to grow at an impressive 25% CAGR to reach $27.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global LED Driver for Lighting Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global LED Driver for Lighting Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global LED Driver for Lighting Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Infineon Technologies AG, Cypress Semiconductor Corporation, Analog Devices, Inc., Cree, Inc., Delta Electronics, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 64 companies featured in this LED Driver for Lighting market report include:

- Infineon Technologies AG

- Cypress Semiconductor Corporation

- Analog Devices, Inc.

- Cree, Inc.

- Delta Electronics, Inc.

- Hubbell, Inc.

- ams AG

- Diodes, Inc.

- Allegro MicroSystems, Inc.

- Lutron Electronics Co., Inc.

- Elmos Semiconductor SE

- Helvar Oy AB

- GE Current, a Daintree company

- Fulham Co., Inc.

- Apricot Technologies Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Infineon Technologies AG

- Cypress Semiconductor Corporation

- Analog Devices, Inc.

- Cree, Inc.

- Delta Electronics, Inc.

- Hubbell, Inc.

- ams AG

- Diodes, Inc.

- Allegro MicroSystems, Inc.

- Lutron Electronics Co., Inc.

- Elmos Semiconductor SE

- Helvar Oy AB

- GE Current, a Daintree company

- Fulham Co., Inc.

- Apricot Technologies Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 661 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31.3 Billion |

| Forecasted Market Value ( USD | $ 98.1 Billion |

| Compound Annual Growth Rate | 21.0% |

| Regions Covered | Global |