Global Pharmaceutical Packaging Equipment Market - Key Trends & Drivers Summarized

What Is Pharmaceutical Packaging Equipment and How Does It Impact Product Safety?

Pharmaceutical packaging equipment plays a critical role in the drug delivery system, ensuring the safety, integrity, and stability of pharmaceutical products throughout their lifecycle. This equipment is designed to meet rigorous standards of hygiene and operational efficiency, providing secure packaging solutions that protect medications from contamination, degradation, and counterfeiting. Advanced packaging technologies such as blister packaging machines, bottle filling and capping, sachet packaging, and sophisticated inspection systems are integral to maintaining the stringent quality control required in the pharmaceutical industry. These technologies help to ensure that medications are safely delivered to consumers with their therapeutic properties intact. The reliability of pharmaceutical packaging equipment is vital, as any compromise in packaging can lead to serious health risks. Therefore, continuous innovations are being made to enhance the precision, automation, and adaptability of these machines to handle various packaging materials and drug formulations.How Are Technological Advancements Shaping the Pharmaceutical Packaging Industry?

Innovation in pharmaceutical packaging equipment is driven by the growing need for efficiency, compliance with global regulatory standards, and adaptability to new materials and complex drug chemistries. State-of-the-art equipment now features high levels of automation, integrated robotics, and control systems powered by artificial intelligence to enhance accuracy and speed while minimizing human error. For instance, serialization and track-and-trace technologies have become standard practices, driven by regulations aimed at preventing drug counterfeiting and ensuring supply chain security. These technologies allow individual drug packages to be traced from production to end-user, significantly enhancing the security and transparency of pharmaceutical logistics. Moreover, the shift towards sustainable practices has spurred developments in equipment capable of processing eco-friendly and biodegradable materials, thereby supporting the industry's move towards reducing its environmental footprint while maintaining compliance with safety standards.What Trends Are Influencing the Design and Functionality of Pharmaceutical Packaging Equipment?

Current trends in the pharmaceutical industry, such as the increasing complexity of biological drugs, personalized medicine, and the rise of flexible dosing regimens, are influencing the design and functionality of packaging equipment. There is a growing demand for versatile packaging solutions that can handle a variety of drug formats, including solids, liquids, powders, and injectables, each with specific packaging requirements to optimize shelf life and ease of use. As personalized medicine advances, there is also an increasing need for equipment that can efficiently manage small batch productions that cater to individual patient needs. This trend towards personalization and precision medicine is pushing the boundaries of traditional packaging, requiring highly flexible and modular equipment capable of quick changeovers to manage multiple drug types and packaging designs without compromising operational efficiency or product quality.What Drives the Growth of the Pharmaceutical Packaging Equipment Market?

The growth in the pharmaceutical packaging equipment market is driven by several factors, including the rapid expansion of the pharmaceutical industry, stringent regulatory requirements, and innovations in drug development and packaging technology. As the global demand for pharmaceuticals increases, driven by an aging population and a growing prevalence of chronic diseases, there is a corresponding need for packaging equipment that can support the scale and complexity of modern drug production and distribution. Regulatory pressures to ensure product safety, integrity, and traceability continue to shape market dynamics, compelling pharmaceutical companies to invest in advanced packaging solutions. Additionally, consumer behavior trends towards more sustainable and user-friendly packaging are influencing the development of new packaging materials and technologies. These market drivers, combined with ongoing advancements in automation and data analytics, are fostering a highly dynamic environment for the growth of the pharmaceutical packaging equipment industry, ensuring that it remains at the forefront of pharmaceutical manufacturing and distribution strategies.Report Scope

The report analyzes the Pharmaceutical Packaging Equipment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Primary Packaging Equipment, Secondary Packaging Equipment, Labeling & Serialization Equipment); Type (Liquid Packaging Equipment, Solid Packaging Equipment, Semi-Solid Packaging Equipment, Other Types).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Primary Packaging Equipment segment, which is expected to reach US$16.7 Billion by 2030 with a CAGR of 8.8%. The Secondary Packaging Equipment segment is also set to grow at 8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3 Billion in 2024, and China, forecasted to grow at an impressive 9.8% CAGR to reach $3.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pharmaceutical Packaging Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pharmaceutical Packaging Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pharmaceutical Packaging Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as GEA Group AG, Coesia SpA, ACG Worldwide, Accutek Packaging Equipment Companies, Inc., Glatt GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 98 companies featured in this Pharmaceutical Packaging Equipment market report include:

- GEA Group AG

- Coesia SpA

- ACG Worldwide

- Accutek Packaging Equipment Companies, Inc.

- Glatt GmbH

- Berry Global, Inc.

- CAM (Tecnicam Srl)

- Filamatic

- Groninger & Co. GmbH

- Bausch+Strobel Maschinenfabrik Ilshofen GmbH+Co. KG

- Brevetti C.E.A. Spa

- Busch Machinery

- E-PAK Machine, Inc.

- Brandster Branding Limited

- Apricot Technologies Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- GEA Group AG

- Coesia SpA

- ACG Worldwide

- Accutek Packaging Equipment Companies, Inc.

- Glatt GmbH

- Berry Global, Inc.

- CAM (Tecnicam Srl)

- Filamatic

- Groninger & Co. GmbH

- Bausch+Strobel Maschinenfabrik Ilshofen GmbH+Co. KG

- Brevetti C.E.A. Spa

- Busch Machinery

- E-PAK Machine, Inc.

- Brandster Branding Limited

- Apricot Technologies Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 576 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

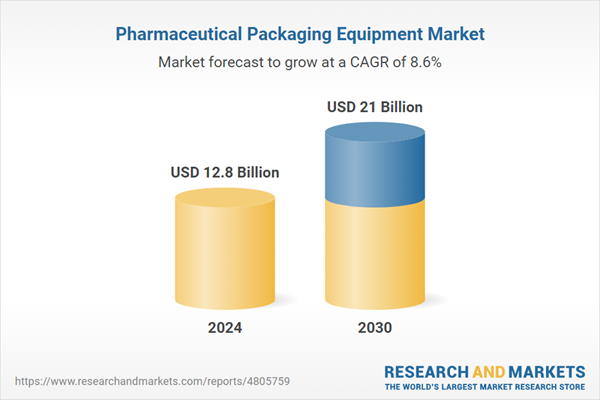

| Estimated Market Value ( USD | $ 12.8 Billion |

| Forecasted Market Value ( USD | $ 21 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |