Global Industrial Nitrogen Market - Key Trends & Drivers Summarized

Why Is Industrial Nitrogen a Vital Component Across Multiple Industries?

Industrial nitrogen plays a crucial role in a wide range of industries, serving as an inert gas for numerous applications requiring oxidation prevention, contamination control, and enhanced process efficiency. Extracted primarily from air through cryogenic distillation and pressure swing adsorption (PSA) technologies, nitrogen is used extensively in industries such as chemicals, food and beverage, healthcare, pharmaceuticals, electronics, and metal fabrication. One of its most significant applications is in the food and beverage industry, where nitrogen is used for modified atmosphere packaging (MAP) to extend the shelf life of perishable goods by preventing microbial growth and oxidation. In the chemical and petrochemical industries, nitrogen is employed for blanketing and purging storage tanks to prevent explosive reactions, ensuring workplace safety. The metal fabrication industry utilizes nitrogen for laser cutting and heat treatment processes, enhancing the quality and precision of finished products. Additionally, nitrogen is widely used in the electronics industry for semiconductor manufacturing, where maintaining ultra-pure, moisture-free environments is critical for preventing defects in microchips and circuit boards. With the increasing complexity of industrial processes and stricter regulatory standards for safety and quality control, the demand for high-purity nitrogen is surging across various sectors, driving innovation in production and distribution methods.How Are Technological Advancements Enhancing Industrial Nitrogen Production and Utilization?

Technological advancements have significantly transformed the industrial nitrogen market, improving production efficiency, purity levels, and application flexibility. The evolution of on-site nitrogen generation systems, particularly membrane and PSA nitrogen generators, has revolutionized how industries access nitrogen, reducing dependency on traditional cylinder and bulk supply methods. These on-site systems provide cost-effective, scalable, and energy-efficient solutions, enabling industries to produce nitrogen at customized purity levels to meet specific operational needs. The advent of cryogenic air separation plants with enhanced automation and digital monitoring capabilities has further improved large-scale nitrogen production, ensuring higher yields and reduced operational costs. Innovations in storage and transportation technologies, such as liquid nitrogen tanks with advanced insulation materials and cryogenic pipelines, have facilitated safer and more efficient nitrogen distribution, especially for remote industrial sites. Additionally, the integration of Internet of Things (IoT) and AI-driven predictive maintenance systems in nitrogen production plants has optimized energy consumption, reduced equipment downtime, and enhanced safety measures. The rising emphasis on sustainability has also driven the development of eco-friendly nitrogen production technologies, such as energy-efficient air separation units and renewable energy-powered nitrogen generators. With industries demanding higher purity levels and customized nitrogen solutions, manufacturers are investing in research and development to improve nitrogen filtration, drying, and purification technologies, further expanding the scope of nitrogen applications in emerging sectors.Why Is the Demand for Industrial Nitrogen Surging Across Diverse End-Use Sectors?

The increasing demand for industrial nitrogen is largely attributed to the expansion of critical industries where nitrogen plays an indispensable role in maintaining process efficiency, product quality, and safety. The healthcare and pharmaceutical industries have witnessed a substantial rise in nitrogen consumption due to its application in cryopreservation of biological samples, pharmaceutical packaging, and anesthesia delivery systems. The growing biotechnology sector has also contributed to increased nitrogen usage in cell culture preservation and genetic research. In the oil and gas industry, nitrogen is extensively used for enhanced oil recovery (EOR), gas well drilling, and pipeline inerting, ensuring operational safety and efficiency. The rising adoption of nitrogen in the automotive industry for tire inflation and heat treatment of metal components has further fueled market demand. In the aerospace and defense sectors, nitrogen is employed in aircraft fuel tank inerting, pressurization systems, and missile testing, where maintaining an inert environment is critical for safety and functionality. Furthermore, the emergence of additive manufacturing (3D printing) has introduced new nitrogen applications in metal powder storage and sintering processes, ensuring consistency in printed components. The push for advanced semiconductor manufacturing and data center cooling solutions has also driven nitrogen consumption, as these industries require ultra-pure nitrogen to prevent contamination and thermal fluctuations. As industrial nitrogen continues to gain traction across multiple high-tech industries, the market is poised for significant expansion, driven by evolving application requirements and technological advancements.What Are the Key Factors Driving the Growth of the Industrial Nitrogen Market?

The growth in the industrial nitrogen market is driven by several factors, including increasing demand from high-growth industries, advancements in nitrogen generation technologies, and evolving regulatory and safety requirements. The rapid expansion of the food and beverage sector, particularly in packaged and processed food production, has intensified the need for nitrogen-based preservation techniques such as MAP and flash freezing. The shift toward on-site nitrogen generation solutions in manufacturing and healthcare facilities has further contributed to market growth by offering cost-effective, sustainable, and uninterrupted nitrogen supply alternatives. The rising investments in semiconductor fabrication and electronics manufacturing have fueled the demand for ultra-high purity nitrogen, necessitating advancements in air separation and purification technologies. The continued reliance on nitrogen in the energy sector, particularly for enhanced oil recovery, refining processes, and gas transportation, remains a crucial driver of market expansion. The growing emphasis on industrial safety and regulatory compliance has also increased nitrogen adoption in hazardous environments, where inert atmospheres are required to mitigate explosion risks and product degradation. Furthermore, as industries move toward digital transformation, the integration of IoT-enabled nitrogen monitoring systems and AI-driven predictive maintenance tools is expected to enhance efficiency, reliability, and operational flexibility. The increasing focus on sustainability has led to the development of energy-efficient nitrogen production methods and carbon-neutral supply chains, aligning with global environmental goals. As industrial applications continue to diversify and demand for high-purity nitrogen escalates, the market is set to experience sustained growth, driven by technological innovation, expanding end-use industries, and evolving industrial requirements.Report Scope

The report analyzes the Industrial Nitrogen market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Form (Compressed Gas, Liquid Nitrogen); End-Use (Food & Beverage, Metal Manufacturing & Fabrication, Oil & Gas, Petrochemicals, Pharmaceutical & Healthcare, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Compressed Gas segment, which is expected to reach US$24.2 Billion by 2030 with a CAGR of 5.4%. The Liquid Nitrogen segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.3 Billion in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Nitrogen Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Nitrogen Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Nitrogen Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide SA, Air Products and Chemicals, Inc., Aspen Air Corp., Bhuruka Gases Limited, Bombay Oxygen Corporation Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 22 companies featured in this Industrial Nitrogen market report include:

- Air Liquide SA

- Air Products and Chemicals, Inc.

- Aspen Air Corp.

- Bhuruka Gases Limited

- Bombay Oxygen Corporation Ltd.

- Canair Nitrogen Inc.

- Cross Country Infrastructure Services Inc.

- Cryotec Anlagenbau GmbH

- Ellenbarrie Industrial Gases Limited

- Emirates Industrial Gases (Airtec)

- Gulf Cryo

- Linde AG

- Messer Group GmbH

- Nexair LLC.

- Praxair, Inc.

- Southern Industrial Gas Sdn Bhd

- Sudanese Liquid Air Company Ltd. (Sudan)

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

- Yingde Gases Group Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide SA

- Air Products and Chemicals, Inc.

- Aspen Air Corp.

- Bhuruka Gases Limited

- Bombay Oxygen Corporation Ltd.

- Canair Nitrogen Inc.

- Cross Country Infrastructure Services Inc.

- Cryotec Anlagenbau GmbH

- Ellenbarrie Industrial Gases Limited

- Emirates Industrial Gases (Airtec)

- Gulf Cryo

- Linde AG

- Messer Group GmbH

- Nexair LLC.

- Praxair, Inc.

- Southern Industrial Gas Sdn Bhd

- Sudanese Liquid Air Company Ltd. (Sudan)

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

- Yingde Gases Group Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 234 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

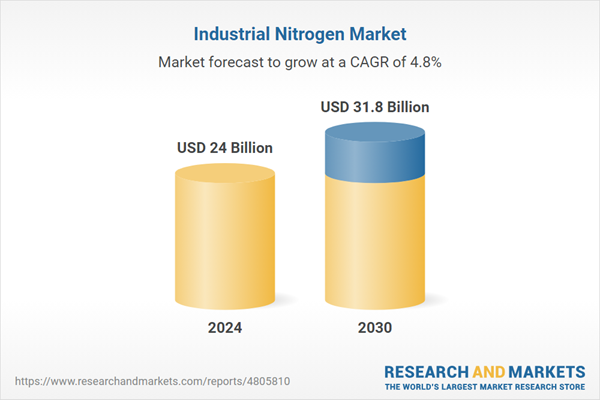

| Estimated Market Value ( USD | $ 24 Billion |

| Forecasted Market Value ( USD | $ 31.8 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |