Global Roofing Chemicals Market - Key Trends and Drivers Summarized

What Are Roofing Chemicals and Why Are They Essential for Roof Protection?

Roofing Chemicals are specialized formulations used to enhance the performance, durability, and lifespan of roofing materials. These chemicals include waterproofing agents, sealants, adhesives, primers, coatings, and cleaners, each serving a specific purpose in protecting roofs from water, UV radiation, temperature fluctuations, and environmental contaminants. Roofing chemicals are crucial for preventing leaks, reducing maintenance costs, and extending the life of roofing systems in residential, commercial, and industrial buildings. They are applied during both new roof installations and maintenance or repair activities, providing a versatile solution for a wide range of roofing materials, including asphalt shingles, metal, concrete, and membranes. As the construction industry grows and the need for more durable and sustainable roofing solutions increases, the demand for advanced roofing chemicals is on the rise.How Are Technological Advancements Driving the Roofing Chemicals Market?

Technological advancements are significantly enhancing the performance, efficiency, and sustainability of roofing chemicals, making them more effective and versatile. The development of advanced waterproofing solutions, such as liquid-applied membranes and polymer-modified bitumen, is providing superior water resistance and flexibility, enabling roofs to withstand extreme weather conditions. Innovations in reflective and cool roof coatings are improving energy efficiency by reflecting sunlight and reducing heat absorption, aligning with green building standards. The use of nano-coatings and UV-resistant formulations is enhancing the durability and longevity of roofing materials by protecting them from degradation due to UV exposure and environmental pollutants. Additionally, the introduction of eco-friendly and low-VOC (volatile organic compound) roofing chemicals is promoting healthier and more sustainable building environments. The integration of advanced application methods, such as spray-on and roller coatings, is also improving efficiency, coverage, and ease of use.What Challenges and Opportunities Exist in the Roofing Chemicals Market?

The roofing chemicals market faces several challenges, including fluctuating raw material prices, environmental regulations, and the need for compatibility with diverse roofing materials and systems. The volatility in the prices of key raw materials, such as polymers, resins, and solvents, can affect production costs and profitability for manufacturers. Ensuring compliance with environmental regulations, particularly concerning VOC emissions and chemical safety, can also be complex and costly. However, these challenges present significant opportunities for growth and innovation. The increasing demand for durable, energy-efficient, and sustainable roofing solutions is driving the need for advanced roofing chemicals. The expansion of the construction sector, particularly in emerging markets, is further boosting the market potential. Moreover, the growing trend of roof restoration, maintenance, and retrofitting in developed regions is creating new opportunities for roofing chemical providers to offer innovative and high-performance solutions.What Factors Are Driving the Growth of the Roofing Chemicals Market?

The growth in the Roofing Chemicals market is driven by several factors, including the rising demand for durable, energy-efficient, and sustainable roofing solutions in residential, commercial, and industrial sectors. Technological advancements in waterproofing solutions, cool roof coatings, nano-coatings, and eco-friendly formulations are enhancing the performance, durability, and environmental compliance of roofing chemicals, driving their adoption. The increasing emphasis on reducing roof maintenance costs, improving energy efficiency, and achieving green building certifications is also contributing to market growth. Additionally, the expansion of the construction sector, particularly in emerging markets, and the growing trend of roof restoration and retrofitting in developed regions are boosting the demand for roofing chemicals. The focus on enhancing roof protection, longevity, and aesthetics through advanced chemical solutions is further propelling the roofing chemicals market forward.Report Scope

The report analyzes the Roofing Chemicals market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Asphalt, Acrylic Resins, Epoxy Resins, Elastomers, Other Types); End-Use (Residential, Commercial, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Asphalt segment, which is expected to reach US$76.1 Billion by 2030 with a CAGR of 6.2%. The Acrylic Resins segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $34.6 Billion in 2024, and China, forecasted to grow at an impressive 9.4% CAGR to reach $43.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Roofing Chemicals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Roofing Chemicals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Roofing Chemicals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ALCHIMICA S.A., Altec Metalltechnik, Benardini Srl, CEIPO Ceramiche Srl, Community Asphalt Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Roofing Chemicals market report include:

- ALCHIMICA S.A.

- Altec Metalltechnik

- Benardini Srl

- CEIPO Ceramiche Srl

- Community Asphalt Corporation

- Copernit S.P.A.

- Crest Roofing & Co

- Eagle Chemicals

- Easmunt Paving

- Eastman Chemical Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALCHIMICA S.A.

- Altec Metalltechnik

- Benardini Srl

- CEIPO Ceramiche Srl

- Community Asphalt Corporation

- Copernit S.P.A.

- Crest Roofing & Co

- Eagle Chemicals

- Easmunt Paving

- Eastman Chemical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

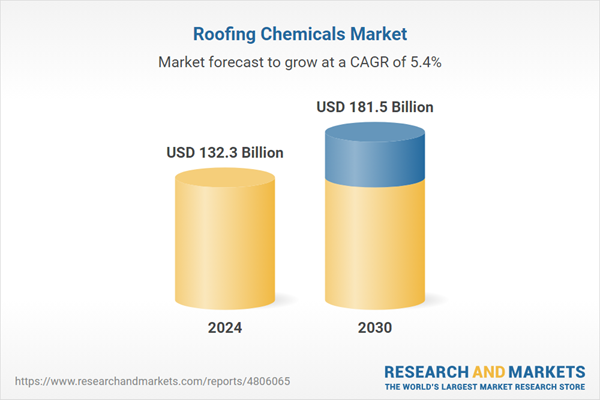

| Estimated Market Value ( USD | $ 132.3 Billion |

| Forecasted Market Value ( USD | $ 181.5 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |