Global Smart Meter Market - Key Trends & Drivers Summarized

Why Are Smart Meters Revolutionizing Energy Management?

Smart meters have emerged as a crucial component in modern energy management systems, facilitating real-time monitoring, data collection, and efficient energy distribution. These advanced devices replace traditional utility meters by providing accurate readings of electricity, gas, and water consumption, thus enabling consumers and utility providers to optimize energy use. The transition towards smart meters is being driven by the need for improved energy efficiency, enhanced grid reliability, and the growing integration of renewable energy sources into existing power systems. Additionally, governments and regulatory bodies across the globe are implementing stringent mandates and incentives to encourage the deployment of smart meters, particularly in residential and commercial sectors. This shift is also being fueled by the rising awareness among consumers regarding energy conservation and cost savings, prompting them to adopt smart metering solutions. The deployment of these systems supports a more decentralized energy grid, facilitating demand response strategies and reducing energy losses through advanced data analytics and two-way communication features.How Are Technological Innovations Shaping the Smart Meter Landscape?

The smart meter market is experiencing rapid evolution driven by technological advancements, which are enhancing the capabilities and functionalities of these devices. Innovations in Internet of Things (IoT), Artificial Intelligence (AI), and machine learning have significantly improved data analytics capabilities, enabling real-time monitoring, predictive maintenance, and fault detection. Moreover, the integration of advanced communication technologies such as Narrowband IoT (NB-IoT), 5G, and Radio Frequency (RF) Mesh networks has facilitated seamless data transmission and remote access to utility data. Smart meters now incorporate enhanced cybersecurity features to protect against potential threats and ensure data integrity, given the rising concerns surrounding data privacy and security breaches. Additionally, the advent of smart home ecosystems and automation technologies is creating new opportunities for interoperability, allowing smart meters to be integrated with home energy management systems (HEMS), smart appliances, and other connected devices. Such advancements are playing a pivotal role in enhancing operational efficiency and reliability, driving further adoption of smart metering solutions across various end-use sectors.What Are the Key Trends Influencing Market Expansion?

Several key trends are shaping the trajectory of the smart meter market, reflecting the evolving needs of consumers and utility providers alike. One of the most significant trends is the push for sustainability and the reduction of carbon footprints, with smart meters enabling better management of energy consumption and facilitating the integration of renewable energy sources such as solar and wind power. The growing adoption of dynamic pricing models and time-of-use tariffs by utilities is another critical trend, allowing consumers to adjust their energy consumption patterns based on real-time pricing information. Furthermore, the rollout of advanced metering infrastructure (AMI) is accelerating the transition towards digital grids, enabling utilities to enhance grid resilience and optimize energy distribution. Emerging economies are also witnessing an upsurge in smart meter installations, driven by rapid urbanization and infrastructure development. In addition, the increasing focus on energy access in remote and underserved regions is driving investments in smart prepaid meters, which enable pay-as-you-go models and provide consumers with greater control over their energy usage. The rising collaboration between technology providers and utility companies is further fostering innovation and expanding the reach of smart metering solutions across different geographic regions.What Factors Are Driving the Growth of the Smart Meter Market?

The growth in the smart meter market is driven by several factors, including the increasing demand for energy efficiency solutions, the expansion of smart grid projects, and the advancements in communication technologies. A major growth driver is the rising implementation of government policies and regulatory mandates that encourage the widespread adoption of smart meters to achieve energy conservation goals. Additionally, the ongoing digital transformation across industries is fueling the need for accurate and real-time energy data, further propelling market growth. The proliferation of smart cities initiatives across developed and developing economies is also contributing to market expansion, as these projects heavily rely on smart metering for efficient resource management. The rising adoption of smart prepaid meters in regions with irregular power supply is another key factor, as they provide consumers with better financial control over their energy usage. The increasing need for grid modernization and resilience, especially in the wake of climate-related disruptions, is further driving investments in smart metering infrastructure. Moreover, the growing trend of electrification in transportation and the need for precise monitoring of energy consumption in electric vehicle (EV) charging infrastructure is augmenting market demand. These factors, coupled with continuous technological advancements and the integration of smart meters with distributed energy resources (DERs), are shaping the future of the smart meter market and unlocking new growth opportunities for stakeholders across the value chain.Report Scope

The report analyzes the Smart Meters market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Smart Electric Meters, Smart Water Meters, Smart Gas Meters); Communication Type (Cellular Communication, Radio Frequency (RF) Communication, Power-Line Communication (PLC)); Application (Residential Application, Commercial Application, Industrial Application).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Smart Electric Meters segment, which is expected to reach US$22.5 Billion by 2030 with a CAGR of 8.8%. The Smart Water Meters segment is also set to grow at 9.6% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Smart Meters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Smart Meters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Smart Meters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Accenture PLC, Aclara Technologies LLC, Apator SA (Apator Group), Arad Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 168 companies featured in this Smart Meters market report include:

- ABB Ltd.

- Accenture PLC

- Aclara Technologies LLC

- Apator SA (Apator Group)

- Arad Group

- Advanced Electronics Company

- AddGroup

- Aqua-Loc South Africa (Pty) Ltd.

- Aquiba Pty., Ltd.

- Advanced Monitoring Solutions

- AEM SA

- Aidon Oy

- Aichi Tokei Denki Co., Ltd.

- Anhui EMI Technology Co., Ltd.

- AMR-G Smart Water Meters

- CyanConnode Holdings PLC.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Accenture PLC

- Aclara Technologies LLC

- Apator SA (Apator Group)

- Arad Group

- Advanced Electronics Company

- AddGroup

- Aqua-Loc South Africa (Pty) Ltd.

- Aquiba Pty., Ltd.

- Advanced Monitoring Solutions

- AEM SA

- Aidon Oy

- Aichi Tokei Denki Co., Ltd.

- Anhui EMI Technology Co., Ltd.

- AMR-G Smart Water Meters

- CyanConnode Holdings PLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 611 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

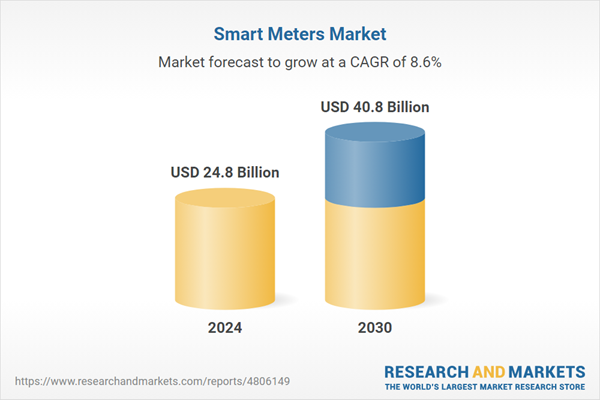

| Estimated Market Value ( USD | $ 24.8 Billion |

| Forecasted Market Value ( USD | $ 40.8 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |