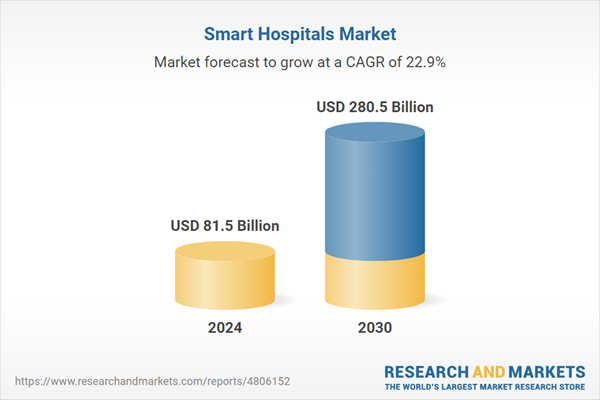

The global market for Smart Hospitals was estimated at US$81.5 Billion in 2024 and is projected to reach US$280.5 Billion by 2030, growing at a CAGR of 22.9% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Smart Hospitals market.

Smart technology and connected medical wearables are enabling the creation of hospitals without walls, in which outpatient and long-term care can be delivered remotely by healthcare professionals to patients in their homes, thus freeing up vital bed space for patients who need more intensive care. IoT combined with the power of emerging technologies such as AI and blockchain is expected to enable the creation of smart hospitals of the future. Blockchain technology is being explored for secure management of medical records and supply chain logistics, ensuring transparency and efficiency in hospital operations. These technologies together create a more connected and seamless healthcare environment that not only enhances patient outcomes but also optimizes resource allocation and management. Though the emergence of robotics in the medical sector is a relatively more recent event when compared to other industries, they today form an integral component of modern medicine. Robotic technology plays a vital role in delivering neuro-rehabilitation therapy to patients suffering from stroke, performing health related tasks, assisting people with disabilities and even carrying out delicate surgical procedures. While initially robots were used purely to assist surgeons during surgeries, the increasing desire of surgeons as well as patients to maximize effectiveness and efficacy led to the debut of additional telemedicine and assistive technologies based automation tools.

The growth in the smart hospital market is driven by several factors, including increasing healthcare costs, which compel healthcare facilities to improve efficiency and reduce operational expenses. Aging populations and the subsequent rise in chronic diseases also necessitate more advanced healthcare infrastructure capable of providing continuous and intensive care. Technological integration into healthcare is further supported by governmental initiatives and investments aimed at improving healthcare quality and accessibility. Moreover, the COVID-19 pandemic accelerated the adoption of digital health technologies as hospitals turned to telemedicine, remote monitoring, and data analytics to manage patient care amidst social distancing protocols. Consumer behavior has also shifted, with more patients now expecting and embracing the use of technology in their healthcare journey. Together, these drivers ensure that the demand for smart hospitals will continue to grow, as they represent a critical evolution in the effort to meet the increasing demands of modern healthcare.

Global Smart Hospitals Market - Key Trends and Drivers Summarized

Smart hospitals represent a transformation in healthcare delivery by integrating advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), robotics, and data analytics into hospital operations and patient care. These hospitals leverage these technologies to enhance all aspects of hospital management and clinical operations, from patient registration to surgery, providing more efficient, personalized, and effective healthcare. Smart hospitals not only optimize workflow automation and patient monitoring but also improve the accuracy of diagnostics and the effectiveness of treatments. The architecture of a smart hospital involves a comprehensive network of interconnected devices that collect, analyze, and manage health data in real time, thus enabling healthcare providers to make informed decisions faster and with greater accuracy.Smart technology and connected medical wearables are enabling the creation of hospitals without walls, in which outpatient and long-term care can be delivered remotely by healthcare professionals to patients in their homes, thus freeing up vital bed space for patients who need more intensive care. IoT combined with the power of emerging technologies such as AI and blockchain is expected to enable the creation of smart hospitals of the future. Blockchain technology is being explored for secure management of medical records and supply chain logistics, ensuring transparency and efficiency in hospital operations. These technologies together create a more connected and seamless healthcare environment that not only enhances patient outcomes but also optimizes resource allocation and management. Though the emergence of robotics in the medical sector is a relatively more recent event when compared to other industries, they today form an integral component of modern medicine. Robotic technology plays a vital role in delivering neuro-rehabilitation therapy to patients suffering from stroke, performing health related tasks, assisting people with disabilities and even carrying out delicate surgical procedures. While initially robots were used purely to assist surgeons during surgeries, the increasing desire of surgeons as well as patients to maximize effectiveness and efficacy led to the debut of additional telemedicine and assistive technologies based automation tools.

The growth in the smart hospital market is driven by several factors, including increasing healthcare costs, which compel healthcare facilities to improve efficiency and reduce operational expenses. Aging populations and the subsequent rise in chronic diseases also necessitate more advanced healthcare infrastructure capable of providing continuous and intensive care. Technological integration into healthcare is further supported by governmental initiatives and investments aimed at improving healthcare quality and accessibility. Moreover, the COVID-19 pandemic accelerated the adoption of digital health technologies as hospitals turned to telemedicine, remote monitoring, and data analytics to manage patient care amidst social distancing protocols. Consumer behavior has also shifted, with more patients now expecting and embracing the use of technology in their healthcare journey. Together, these drivers ensure that the demand for smart hospitals will continue to grow, as they represent a critical evolution in the effort to meet the increasing demands of modern healthcare.

SCOPE OF STUDY:

The report analyzes the Smart Hospitals market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Component (Services, Hardware, Systems & Software); Application (Remote Medicine Management, Electronic Health Record & Clinical Workflow, Medical Assistance, Outpatient Vigilance, Medical Connected Imaging)

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Services segment, which is expected to reach US$151.9 Billion by 2030 with a CAGR of a 21.8%. The Hardware segment is also set to grow at 23.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $22.1 Billion in 2024, and China, forecasted to grow at an impressive 25.8% CAGR to reach $38.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Smart Hospitals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Smart Hospitals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Smart Hospitals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as IBM Corporation, Huawei Technologies Co., Ltd., Honeywell International, Inc., GE Healthcare, Cerner Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Smart Hospitals market report include:

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Honeywell International, Inc.

- GE Healthcare

- Cerner Corporation

- Hill-Rom Holdings, Inc.

- Epic Systems Corporation

- Allscripts Healthcare Solutions, Inc.

- IBI Group Inc.

- IBM Watson Health

- Alphabet, Inc.

- AdhereTech

- Capsule Technologies, Inc.

- Enlitic

- Electronics and Telecommunications Research Institute (ETRI)

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

I. METHODOLOGYII. EXECUTIVE SUMMARY2. FOCUS ON SELECT PLAYERSIII. MARKET ANALYSISIV. COMPETITION

1. MARKET OVERVIEW

3. MARKET TRENDS & DRIVERS

4. GLOBAL MARKET PERSPECTIVE

UNITED STATES

CANADA

JAPAN

CHINA

EUROPE

FRANCE

GERMANY

ITALY

UNITED KINGDOM

REST OF EUROPE

ASIA-PACIFIC

REST OF WORLD

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Honeywell International, Inc.

- GE Healthcare

- Cerner Corporation

- Hill-Rom Holdings, Inc.

- Epic Systems Corporation

- Allscripts Healthcare Solutions, Inc.

- IBI Group Inc.

- IBM Watson Health

- Alphabet, Inc.

- AdhereTech

- Capsule Technologies, Inc.

- Enlitic

- Electronics and Telecommunications Research Institute (ETRI)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 290 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 81.5 Billion |

| Forecasted Market Value ( USD | $ 280.5 Billion |

| Compound Annual Growth Rate | 22.9% |

| Regions Covered | Global |