Global Desktop Virtualization Market - Key Trends & Drivers Summarized

Why Is Desktop Virtualization Emerging as a Strategic Pillar for Enterprise Flexibility, Endpoint Security, and IT Infrastructure Optimization?

Desktop virtualization is transforming how organizations manage, deploy, and secure their computing environments by decoupling the operating system and applications from physical client devices. This technology enables users to access a fully functional desktop interface remotely from virtually any endpoint - be it a thin client, laptop, or mobile device - while centralizing data and processing in secure data centers or cloud infrastructure. As digital workplaces become the norm, desktop virtualization is gaining traction as a foundational layer in enterprise IT strategy, enabling workforce mobility, business continuity, and standardized user experiences.Enterprises are increasingly adopting virtual desktop infrastructure (VDI) and Desktop-as-a-Service (DaaS) models to reduce hardware dependency, streamline IT support, and ensure consistent policy enforcement across distributed teams. These solutions also offer compelling benefits in terms of scalability, faster provisioning, and the ability to support bring-your-own-device (BYOD) programs without compromising compliance or security. As a result, sectors such as finance, healthcare, education, and government are turning to desktop virtualization to modernize legacy infrastructure while aligning with evolving operational models.

The shift toward hybrid work, accelerated by the global pandemic, has further elevated the relevance of desktop virtualization. Organizations now require secure, on-demand access to critical applications and data for remote workers without exposing themselves to endpoint vulnerabilities. By isolating user environments from physical hardware, desktop virtualization mitigates risks associated with device theft, data leakage, and inconsistent software configurations.

How Are Cloud Integration, Graphics Acceleration, and AI-Driven Automation Enhancing the Capabilities of Desktop Virtualization Platforms?

The transition from on-premises VDI to cloud-hosted DaaS is redefining scalability, accessibility, and cost predictability for desktop virtualization. Major cloud providers are offering fully managed DaaS solutions with flexible subscription models, enabling enterprises to spin up virtual desktops in minutes, scale across geographies, and integrate with identity management and single sign-on systems. This is particularly advantageous for businesses with seasonal workforce fluctuations or global operations requiring unified IT control.Graphics Processing Unit (GPU) virtualization is a key innovation enabling resource-intensive applications - such as CAD, 3D modeling, and video editing - to operate within virtualized environments. By allocating virtual GPU resources dynamically, virtualization platforms are now capable of supporting creative professionals, engineers, and researchers without degrading performance. This removes previous limitations that confined desktop virtualization to knowledge workers and light compute users.

AI and automation are also improving performance monitoring, anomaly detection, and resource allocation within virtual desktop environments. Predictive analytics can forecast usage spikes, optimize load balancing, and identify configuration drift, enabling proactive management. Policy-based automation ensures that updates, patches, and user provisioning are applied consistently across virtual desktops, minimizing administrative overhead while maintaining compliance.

Which Enterprise Use Cases, Industry Verticals, and Regional Markets Are Driving Growth in the Desktop Virtualization Market?

Use cases for desktop virtualization span employee onboarding, secure contractor access, call center management, and education delivery. Enterprises leverage virtual desktops to quickly provision secure workspaces for remote staff or external vendors, ensuring separation of corporate data from personal devices. Educational institutions use it to deliver lab environments to students off-campus, while healthcare providers utilize it to enable clinicians to access patient records securely from different facilities.Verticals with strict compliance mandates - such as banking, insurance, pharmaceuticals, and defense - are key adopters of desktop virtualization due to its centralized data governance and audit capabilities. These sectors benefit from the ability to restrict data transfer, enforce endpoint security policies, and track user activity. Meanwhile, SMBs and startups are adopting DaaS to avoid the capital expenditure of maintaining complex on-premise IT infrastructure while gaining enterprise-grade security and agility.

North America leads the desktop virtualization market, driven by early cloud adoption, mature IT governance models, and widespread remote work policies. Europe follows closely, particularly in regulated industries and public sector digitization. Asia-Pacific is emerging rapidly as enterprises in countries like India, China, and Australia modernize their IT infrastructure to support hybrid work and digital transformation. Markets in Latin America and the Middle East are gaining traction through government IT initiatives and growing demand for secure educational and healthcare IT systems.

What Strategic Role Will Desktop Virtualization Play in Supporting Future-Ready Work Models, Cyber Resilience, and Sustainable IT Operations?

Desktop virtualization is positioned to be a strategic enabler of adaptive and resilient enterprise computing. As organizations evolve toward zero-trust security architectures and hybrid cloud ecosystems, virtual desktops offer a controlled, policy-driven environment that bridges legacy systems and modern applications. Their compatibility with device-agnostic access, centralized governance, and remote support workflows makes them ideal for navigating complex digital transformation journeys.In an era of escalating cyber threats, desktop virtualization enhances security posture by minimizing attack surfaces, centralizing data storage, and enabling rapid recovery from breaches or ransomware attacks. Its role in data loss prevention and secure access provisioning is increasingly viewed as non-negotiable for enterprises seeking to mitigate operational risk while expanding globally.

With the growing emphasis on sustainability, desktop virtualization also contributes to greener IT by extending the life of endpoint devices, reducing energy consumption, and enabling server consolidation. As work models diversify and organizations prioritize agility, could desktop virtualization emerge as the architectural backbone supporting secure, scalable, and sustainable digital enterprises?

Report Scope

The report analyzes the Desktop Virtualization market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Virtual Desktop Infrastructure (VDI), Desktop-as-a-Service (DaaS), Remote Desktop Services (RDS)); Organization Size (Large Enterprises, SMEs); Vertical (IT & Telecom, BFSI, Supply Chain & Warehouse, Education & Entertainment, Other Verticals).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Virtual Desktop Infrastructure (VDI) segment, which is expected to reach US$14.1 Billion by 2030 with a CAGR of 8.5%. The Desktop-as-a-Service (DaaS) segment is also set to grow at 9.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.1 Billion in 2024, and China, forecasted to grow at an impressive 10.7% CAGR to reach $3.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Desktop Virtualization Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Desktop Virtualization Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Desktop Virtualization Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cisco Systems, Inc., Citrix Systems, Inc., Commvault Systems, Inc., DELL Technologies Inc., Ericom Software, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 104 companies featured in this Desktop Virtualization market report include:

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Commvault Systems, Inc.

- DELL Technologies Inc.

- Ericom Software, Inc.

- Hewlett Packard Enterprise Company

- Hive-IO

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Microsoft Corporation

- NComputing Co. Ltd.

- Oracle Corporation

- Parallels International GmbH

- Red Hat, Inc.

- VMware, Inc.

- Wipro Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Commvault Systems, Inc.

- DELL Technologies Inc.

- Ericom Software, Inc.

- Hewlett Packard Enterprise Company

- Hive-IO

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Microsoft Corporation

- NComputing Co. Ltd.

- Oracle Corporation

- Parallels International GmbH

- Red Hat, Inc.

- VMware, Inc.

- Wipro Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 714 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

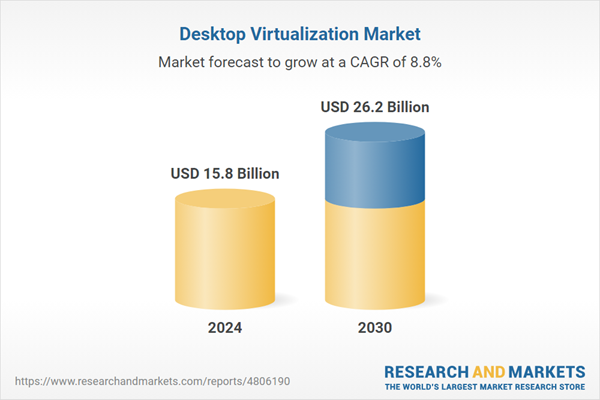

| Estimated Market Value ( USD | $ 15.8 Billion |

| Forecasted Market Value ( USD | $ 26.2 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |