Global Subsea Systems Market - Key Trends & Drivers Summarized

Why Are Subsea Systems Crucial For Offshore Oil and Gas Production?

Subsea systems are integral to the offshore oil and gas industry, playing a pivotal role in the exploration and extraction of underwater resources. These systems encompass a range of technologies and equipment designed to operate on the seabed, facilitating the development of deepwater and ultra-deepwater fields. The primary components include subsea wellheads, blowout preventers, manifolds, and pipelines, which together enable the safe and efficient extraction of hydrocarbons. The ability to operate in harsh underwater environments, often at great depths and under extreme pressure, is essential for accessing reserves that are otherwise unreachable. Subsea systems provide a reliable infrastructure for the transportation of oil and gas from the seabed to production facilities, ensuring continuous and safe operations. Their importance has grown as onshore and shallow water reserves dwindle, pushing exploration efforts further offshore into deeper waters.How Does Technology Drive Innovation In Subsea Systems?

Technological advancements are at the heart of the evolution and efficiency of subsea systems. Innovations in materials science have led to the development of more durable and corrosion-resistant components, capable of withstanding the harsh conditions found on the seabed. Additionally, advancements in robotics and remote-operated vehicles (ROVs) have significantly enhanced the ability to install, inspect, and maintain subsea infrastructure without the need for human divers. These ROVs are equipped with high-definition cameras, sonar, and manipulation tools, allowing for precise and safe operations at great depths. Another critical technological breakthrough is the use of subsea processing systems, which can handle oil and gas separation, boosting, and injection directly on the seabed. This reduces the need for extensive topside processing facilities and minimizes the environmental footprint. The integration of digital technologies, such as real-time monitoring and data analytics, also plays a significant role in optimizing the performance and reliability of subsea systems, enabling predictive maintenance and reducing downtime.What Are The Emerging Trends In The Subsea Systems Industry?

The subsea systems industry is witnessing several emerging trends that are shaping its future landscape. One of the most notable trends is the shift towards electrification of subsea equipment. Electrically powered subsea systems offer greater efficiency and reliability compared to traditional hydraulic systems, enabling more precise control and reducing the risk of leaks. Another trend is the growing focus on modular and standardized designs, which can be more easily adapted to different fields and reduce development costs and time. The industry is also seeing increased collaboration between oil and gas companies and technology providers to develop more innovative and sustainable solutions. This includes the use of renewable energy sources, such as offshore wind power, to supply energy to subsea installations, thereby reducing carbon emissions. Furthermore, there is a trend towards greater use of digital twins - virtual replicas of physical assets - to simulate and optimize subsea operations, leading to improved performance and reduced risks.What Are The Key Drivers Of Growth In The Subsea Systems Market?

The growth in the subsea systems market is driven by several factors that reflect the increasing complexity and demands of offshore oil and gas production. Firstly, the depletion of onshore and shallow water reserves is pushing exploration and production activities into deeper and more challenging offshore environments, necessitating advanced subsea technologies. Secondly, technological innovations, such as improved materials, robotics, and digital solutions, are enhancing the efficiency, safety, and reliability of subsea systems, making them more attractive to operators. The rising demand for energy, particularly in developing regions, is also a significant driver, as it prompts increased investment in offshore projects. Additionally, the industry's focus on sustainability and reducing the environmental impact of oil and gas operations is leading to the adoption of more eco-friendly subsea solutions, such as electrically powered equipment and renewable energy integration. Lastly, the increasing collaboration and partnerships within the industry are fostering the development of new technologies and solutions, further propelling market growth. These factors collectively underscore the critical role of subsea systems in meeting the future energy needs and driving the evolution of offshore oil and gas production.Report Scope

The report analyzes the Subsea Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (SURF, Subsea Trees, Subsea Control Systems, Subsea Manifolds, Subsea Boosting Systems, Subsea Separation Systems, Subsea Injection Systems, and Subsea Compression Systems).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the SURF segment, which is expected to reach US$5.8 Billion by 2030 with a CAGR of 3.9%. The Subsea Trees segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 3.9% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Subsea Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Subsea Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Subsea Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Parker Hannifin Corporation, Halliburton Company, Nexans SA, Aker Solutions ASA, Kongsberg Gruppen ASA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Subsea Systems market report include:

- Parker Hannifin Corporation

- Halliburton Company

- Nexans SA

- Aker Solutions ASA

- Kongsberg Gruppen ASA

- Oceaneering International, Inc.

- NOV, Inc.

- Forum Energy Technologies, Inc.

- McDermott International, Ltd.

- OneSubsea

- Dril-Quip, Inc.

- Hunting Group

- Expro Group

- ITT Bornemann GmbH

- Rongsheng Machinery Manufacture Ltd. Of Huabei Oilfield, Hebei

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Parker Hannifin Corporation

- Halliburton Company

- Nexans SA

- Aker Solutions ASA

- Kongsberg Gruppen ASA

- Oceaneering International, Inc.

- NOV, Inc.

- Forum Energy Technologies, Inc.

- McDermott International, Ltd.

- OneSubsea

- Dril-Quip, Inc.

- Hunting Group

- Expro Group

- ITT Bornemann GmbH

- Rongsheng Machinery Manufacture Ltd. Of Huabei Oilfield, Hebei

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 412 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

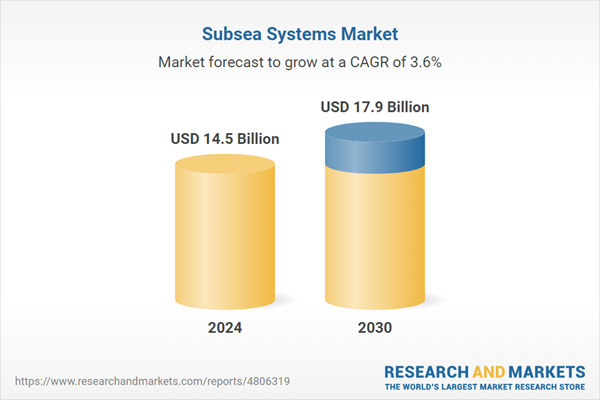

| Estimated Market Value ( USD | $ 14.5 Billion |

| Forecasted Market Value ( USD | $ 17.9 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |