Global Utility Locator Market - Key Trends & Drivers Summarized

Why Is Utility Location So Critical in Modern Infrastructure Projects?

Utility location is a crucial aspect of modern infrastructure projects, ensuring that underground utilities such as gas lines, water pipes, electrical cables, and telecommunications lines are accurately identified and mapped before any excavation work begins. Accurate utility location is essential for preventing accidental damage to these critical infrastructures, which can lead to costly repairs, service disruptions, and safety hazards. As cities and communities expand, and as the demand for new infrastructure projects grows, the importance of precise utility location has never been greater. This process not only protects workers and the public but also ensures that projects stay on schedule and within budget, avoiding the significant costs associated with utility strikes and the resulting project delays.How Are Technological Advancements Improving Utility Location Accuracy?

Technological advancements are significantly enhancing the accuracy and efficiency of utility location, making it easier to detect and map underground utilities. Modern utility locators are equipped with advanced sensors and technologies such as ground-penetrating radar (GPR), electromagnetic induction, and acoustic detection, which allow for the precise identification of underground utilities, even in challenging environments. The integration of GPS and Geographic Information Systems (GIS) with utility locators enables real-time mapping and data collection, providing a detailed and accurate record of utility locations. Furthermore, the development of multi-frequency locators allows for the detection of different types of utilities simultaneously, improving efficiency and reducing the time required for utility location. These technological innovations are helping to reduce the risks associated with excavation work and are playing a key role in ensuring the safety and success of infrastructure projects.Why Are Construction and Infrastructure Firms Adopting Advanced Utility Locators?

Construction and infrastructure firms are increasingly adopting advanced utility locators to improve the safety, accuracy, and efficiency of their projects. The growing complexity of urban infrastructure, with multiple utilities often buried in close proximity to each other, makes accurate utility location more challenging and more critical than ever. Advanced utility locators provide the precision needed to navigate these complex environments, ensuring that all utilities are accurately identified and mapped before excavation work begins. Additionally, the use of advanced utility locators helps firms comply with regulatory requirements and industry standards for utility location, reducing the risk of legal liabilities and project delays. The ability to accurately locate utilities also supports more efficient project planning and execution, allowing firms to avoid costly mistakes and complete projects on time and within budget. As the demand for new infrastructure continues to grow, the adoption of advanced utility locators is becoming increasingly essential for successful project delivery.What Factors Are Driving the Growth in the Utility Locator Market?

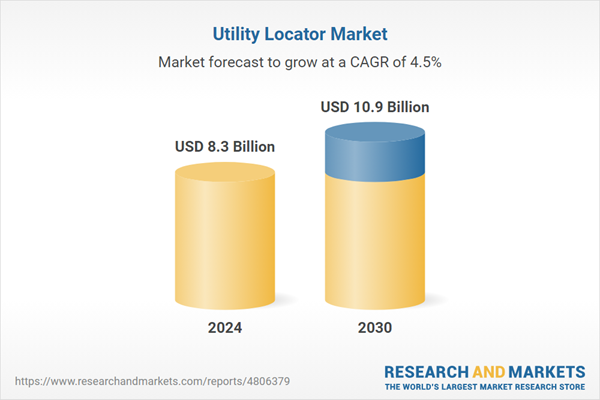

The growth in the Utility Locator market is driven by several factors, including the increasing demand for new infrastructure development, the growing complexity of urban environments, and the rising emphasis on safety and regulatory compliance in construction projects. The global expansion of urban areas and the need to upgrade aging infrastructure are creating a significant demand for utility location services, driving the adoption of advanced utility locators. Technological advancements, such as the integration of GPR, GIS, and multi-frequency detection, are further fueling the market's growth by improving the accuracy and efficiency of utility location. Additionally, the rising focus on safety and the prevention of utility strikes, which can lead to severe accidents and costly project delays, is prompting construction and infrastructure firms to invest in the latest utility location technologies. The increasing regulatory requirements for utility location, particularly in developed markets, are also contributing to the market's expansion, as firms seek to comply with these regulations and avoid potential legal liabilities.Report Scope

The report analyzes the Utility Locator market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Offering (Equipment, Services); Technique (Electromagnetic Field, Ground Penetrating Radar (GPR), Other Techniques); Vertical (Telecom, Electricity, Water & Sewage, Oil & Gas, Other Verticals).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Utility Locator Equipment segment, which is expected to reach US$6.4 Billion by 2030 with a CAGR of a 3.9%. The Utility Locator Services segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 4.2% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Utility Locator Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Utility Locator Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Utility Locator Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Geophysical Survey Systems, Inc., Ground Penetrating Radar Systems, LLC, Guideline Geo AB, Leica Geosystems AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 17 companies featured in this Utility Locator market report include:

- 3M Company

- Geophysical Survey Systems, Inc.

- Ground Penetrating Radar Systems, LLC

- Guideline Geo AB

- Leica Geosystems AG

- Maverick Inspection Ltd.

- Mclaughlin Boring Systems

- MultiView, Inc.

- On Target Utility Services

- One Vision Utility Services

- Radiodetection Ltd.

- RHD Services, Inc.

- Ridge Tool Company

- Sensors & Software Inc.

- The Charles Machine Works

- USIC

- Utilities Plus, LLC.

- Utility Tool Company, Inc.

- Vivax-Metrotech Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Geophysical Survey Systems, Inc.

- Ground Penetrating Radar Systems, LLC

- Guideline Geo AB

- Leica Geosystems AG

- Maverick Inspection Ltd.

- Mclaughlin Boring Systems

- MultiView, Inc.

- On Target Utility Services

- One Vision Utility Services

- Radiodetection Ltd.

- RHD Services, Inc.

- Ridge Tool Company

- Sensors & Software Inc.

- The Charles Machine Works

- USIC

- Utilities Plus, LLC.

- Utility Tool Company, Inc.

- Vivax-Metrotech Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.3 Billion |

| Forecasted Market Value ( USD | $ 10.9 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |