An increase in the number of K-12 schools worldwide and growing awareness about the importance of education has led to a rise in the enrollment of students, which, in turn, is driving the demand for desks and chairs. The development of innovative products, such as portable furniture and flip classrooms, owing to technological development with the increasing demand for eco-friendly furniture, also boosts the market growth. The rising demand for ergonomically-designed furniture from educational institutes is one of the major factors driving the market growth.

K-12 learning space requires a unique solution to deliver comfort, focus, and support for students and teachers. K-12 furniture is used in classrooms, cafeterias, libraries, offices, and other areas. School furniture transforms a classroom from a static physical space into a dynamic learning environment. As technology evolves, it is not shocking to note how massively classrooms have been transformed in the past few years.

Usually made from wood, metal, and plastic, the latest classrooms are designed in a way that is considered effective for use and beneficial for physical health. The rising demand for ergonomically-designed furniture from educational institutes is one of the major factors driving the market growth. Today's students are getting more real-world experience creating solutions, exploring new ideas, and deconstructing things in maker spaces. Supporting these kinetic hands-on activities requires different tools, such as adaptable storage, tables, and mobile whiteboards that bring students closer to their work.

North America K-12 Furniture Market Trends

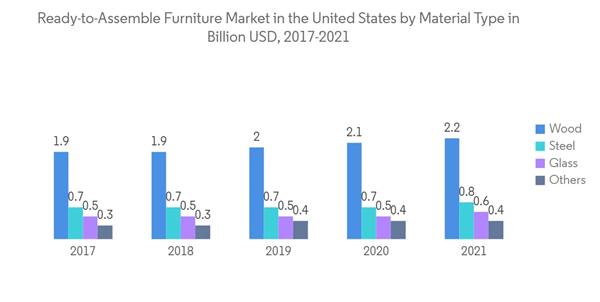

Wood Furniture is Dominating the Market in United States

Wooden furniture is the most common in North American schools due to the high manufacturing output of wooden products compared to other materials. Furthermore, wood is conventionally considered the most preferred material for furniture production.America is one of the countries with high forest cover; thus, the availability of wood for furniture making is high in the country. Thus, wood holds the highest market share for school furniture by material. With developing technology, manufacturers can cut wood in newer ways to create different furniture styles that suit each school setting. This has allowed wood to remain the major North American K-12 furniture market segment.

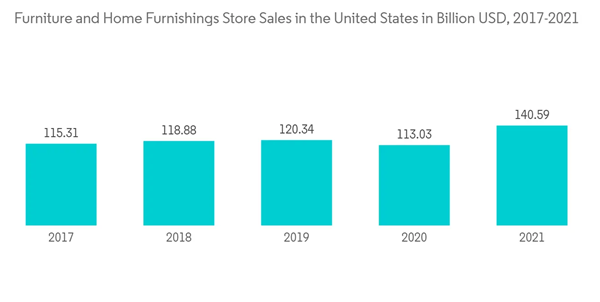

Increasing Furniture and Home Furnishing Store Sales In United States

In 2021, furniture and home furnishings store sales in the United States amounted to about 140.6 billion U.S. dollars, up from around 113 billion recorded a year earlier. The home furnishings retail industry allows consumers to make their homes truly their own with their very choices of furniture and décor to adorn them. Style, affordability, and functionality are the main reasons consumers give for shopping at lifestyle furniture stores, such as Ikea, Williams-Sonoma, Crate & Barrel, and RH (Restoration Hardware). Demand for home furnishings is cyclical, influenced by housing starts, as desires to remodel and redesign are not necessary during slow economic times. Demand is also driven by consumer income. Large companies compete through volume purchasing, breadth of products, and effective merchandising and marketing. Small companies focus on a market segment and compete through a depth of products and superior customer serviceNorth America K-12 Furniture Industry Overview

The report covers major international players operating in the North American K-12 Furniture Market. The India mattresses market is domestically dominated by players such as Steelcase, Knoll Inc, Haworth Inc, Krueger International, and others. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Krueger International Inc.

- Steelcase Inc.

- Herman Miller Inc.

- Knoll Inc.

- VS America Inc.

- HNI Corporation

- Haworth Inc.

- Virco Manufacturing Corporation

- Fleet Wood Furniture

- Agati Inc.

- Hertz Furniture Systems LLC*