Benzene is an organic chemical compound with the molecular formula C6H6. It is a colorless and flammable liquid with a sweet odor, and it is an important component in the production of a wide range of chemicals and products. Found naturally in crude oil, it is used as a starting material in the synthesis of many other chemicals, including plastics, resins, synthetic fibers, rubber, dyes, detergents, and pharmaceuticals. Despite its vast industrial applications, exposure to it can pose health risks. Studies have shown that prolonged exposure can lead to various health problems, including an increased risk of cancer. As a result, the handling and use of the product are subject to strict regulations in many countries to protect both workers and the environment. It is essential for industries and researchers to be aware of its properties, potential hazards, and safety measures to ensure its responsible use.

The implementation of stringent environmental and health regulations is a significant factor that is driving the global market. As awareness about the health hazards associated with it exposure grows, industries are compelled to invest in safer, more efficient, and cleaner production methods. These regulations push companies to adopt best practices, invest in research and development, and innovate in their processes. With the rise in vehicle production and increasing demand for lightweight and fuel-efficient vehicles, its need in the automotive sector is expected to increase. As infrastructure development and urban housing projects rise, the demand for its derivatives also grows. In addition, the rise and the consequent demand for increased agricultural production are influencing the need for chemicals that protect crops and enhance yield. This indirectly drives the demand for the product. Moreover, the expansion of consumer electronics is creating a positive market outlook.

Benzene Market Trends/Drivers:

Increased demand in the synthetics industry

The synthetic materials industry, which includes the production of polymers, plastics, resins, and synthetic fibers, has seen a consistent rise in demand over the years. The product plays a pivotal role as a key raw material in the production of styrene, which is used to manufacture polystyrene a polymer used in a variety of applications from packaging materials to household goods. Additionally, the rise in the global population and urbanization trends are driving the need for affordable and durable consumer products. As these synthetic materials find applications in diverse sectors such as automotive, electronics, construction, and consumer goods, the demand for the product, as a foundational ingredient, is expected to grow proportionally. Industries are continuously seeking ways to improve the performance and versatility of synthetic products, further solidifying the market’s position.Growth in the petrochemical sector

The petrochemical industry has been on an upward trajectory, driven by global economic growth and increasing energy needs. As one of the primary derivatives of crude oil refining, it is intrinsically linked to the fortunes of the petrochemical sector. In addition, the expansion of refineries, especially in emerging economies, and the growth in transportation fuels are indicators of a thriving petrochemical industry. With the expansion of this sector, there's an anticipated growth in the availability and demand for the product. As refineries optimize their operations to produce more value-added chemicals, the production capacity is also likely to increase, catering to its growing demand in downstream applications.Technological advancements in production

The industry has witnessed significant technological advancements aimed at optimizing production, reducing costs, and ensuring environmental compliance. In addition, innovations in catalysis, process intensification, and integration with other processes are allowing producers to extract more value from each barrel of oil. By re-engineering production processes to occur in a single, multi-functional unit, companies can perform multiple steps simultaneously. Additionally, technologies that allow the capture and reuse of by-products and waste streams are enhancing the sustainability and efficiency of production. Such advancements bolster the profitability of producers but also cater to the growing global demand by ensuring a consistent and high-quality supply.Benzene Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global benzene market, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on derivative, manufacturing process and application.Breakup by Derivative:

- Ethylbenzene

- Cumene

- Cyclohexane

- Nitrobenzene

- Linear Alkylbenzene

- Maleic Anhydride

- Others

Ethylbenzene holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the derivative. This includes ethylbenzene, cumene, cyclohexane, nitrobenzene, linear alkylbenzene, maleic anhydride, and others. According to the report, ethylbenzene accounted for the largest market share.Ethylbenzene, a direct derivative of benzene, plays a crucial role in the petrochemical sector, primarily due to its use in producing styrene a vital component for various polymers and plastics. A principal driver for the demand for ethylbenzene derivatives stems from the growth in the global polystyrene market. Along with this, polystyrene is extensively used in packaging, electronics, toys, and numerous consumer goods, with its demand closely tied to global economic growth and consumer purchasing power. In addition, the expanding automotive industry is influencing the demand for styrene-based polymers, such as ABS (Acrylonitrile Butadiene Styrene), used for car interiors, exteriors, and consumer electronics. With urbanization trends, particularly in emerging economies, the construction sector is also witnessing considerable growth, leading to increased demand for insulation products made from styrene-based materials. Furthermore, technological advancements and research in newer applications of styrene derivatives are expected to propel the market further.

Breakup by Manufacturing Process:

- Pyrolysis Steam Cracking of Naphtha

- Catalytic Reforming of Naphtha

- Toluene Hydrodealkylation

- Toluene Disproportionation

- From Biomass

Catalytic reforming is an essential process in refineries, turning naphtha into high-octane gasoline components and valuable aromatic compounds. Along with this, the growing global demand for cleaner and higher-octane gasoline is a dominant driver for the catalytic reforming of naphtha. As environmental regulations become stricter, there's a rising need for gasoline blends that produce fewer emissions and have improved combustion efficiency. Catalytically reformed naphtha fulfills this requirement by enhancing the octane number of gasoline. Additionally, the ever-increasing demand for petrochemicals, especially aromatics, such as xylene, and toluene, further strengthens the market for catalytic reforming.

On the other hand, pyrolysis steam cracking is a foundational process in petrochemical manufacturing, transforming naphtha and other hydrocarbons into olefins and aromatics. One primary market driver for this process is the rising global demand for ethylene, propylene, and other olefins used in polymer production. Along with this, the growing demand for xylene drives the toluene disproportionation process. As industries seek efficient production, this method offers an attractive route. Furthermore, the rising use of xylene in petrochemicals reinforces this process's importance, making it integral to meeting global aromatic compound needs.

Breakup by Application:

- Plastics

- Resins

- Synthetic Fibers

- Rubber Lubricants

- Others

The relentless growth in the global plastics market, driven by applications ranging from packaging to automotive components, substantially fuels the product demand. With rapid urbanization, industrialization, and a rise in consumer goods consumption, plastics have become indispensable in everyday life. This ubiquity translates to a consistent demand for polymers, such as polystyrene, ABS, and nylon. Moreover, advancements in plastic technologies, aiming to produce materials with enhanced properties like durability and recyclability, further amplify the product's significance. Apart from this, the integral role of plastics in modern society, coupled with innovative material developments, positions it as a cornerstone in the industry's growth trajectory.

On the other hand, the growing demand for resins, especially in coatings, adhesives, and the construction sector, drives the market. The escalating demand for synthetic fibers, such as nylon and polyester, in textiles, apparel, and home furnishings is a significant market driver. Its utility extends to the rubber lubricants sector, where it's involved in the production of certain key ingredients.

Breakup by Region:

- Asia Pacific

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- United States

- Canada

- Middle East and Africa

- Saudi Arabia

- South Africa

- Latin America

- Brazil

- Argentina

Asia Pacific leads the market, accounting for the largest benzene market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific (China, India, Japan, and South Korea); Europe (Germany, UK, France, and Italy); North America (the United States and Canada); Latin America (Brazil and Argentina); and the Middle East and Africa (Saudi Arabia and South Africa). According to the report, Asia Pacific accounted for the largest market share.The Asia Pacific region, particularly powerhouses, such as China, India, and Southeast Asian countries, is emerging as a focal point for the industry. Additionally, rapid industrialization and urbanization are resulting in an escalated demand for products, such as plastics, resins, and synthetic fibers. The region's booming automotive and construction sectors further fuel this demand. Along with this, the expanding petrochemical infrastructure, driven by both local investments and international collaborations, ensures a steady supply and production capacity for the product and its derivatives.

In addition to this, the inflating disposable income levels are propelling the consumer goods market, which indirectly boosts the market. The region's strategic location, favorable governmental policies, and cost-competitive labor force also make it an attractive hub for petrochemical investments. Lastly, research and innovation in the Asia Pacific region, aiming to harness newer applications and enhance the production efficiency of its derivatives, solidify its position as a dominant player in the global market.

Competitive Landscape:

The key players are constantly optimizing their production processes to produce more efficiently, ensuring high purity and yield. In addition, companies often expand their operations either by increasing the capacity of existing plants or by establishing new production facilities, especially in regions with high demand or favorable business conditions. In addition, firms invest in R&D to find new applications for their derivatives, as well as to develop more sustainable and efficient production methods. Ensuring a robust and agile supply chain is crucial, given the global nature of the petrochemical industry. Companies often seek partnerships, logistics solutions, and digital tools to streamline their supply chain. As global focus shifts towards sustainable solutions, many producers are exploring greener alternatives, recycling methods, and waste reduction strategies.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- BASF

- Sinopec

- Royal Dutch Shell

- China National Petroleum Corporation

- DuPont

- Saudi Basic Industries Corporation

- China Petroleum & Chemical Corporation

- ExxonMobil Corporation

- JX Holdings

- BP

- Borealis AG

- Braskem

- Repsol

- Arsol Aromatics GmbH & Co. KG

Key Questions Answered in This Report

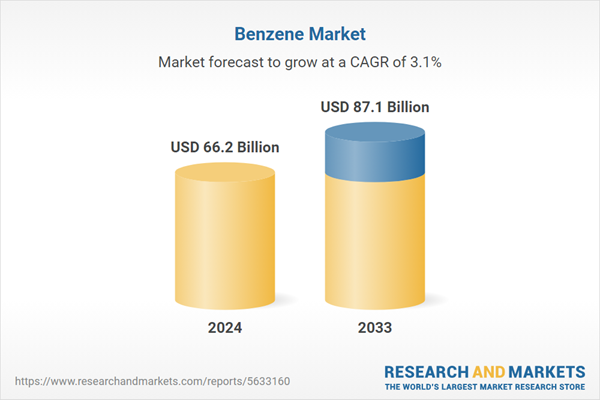

1. What was the size of the global benzene market in 2024?2. What is the expected growth rate of the global benzene market during 2025-2033?

3. What are the key factors driving the global benzene market?

4. What has been the impact of COVID-19 on the global benzene market?

5. What is the breakup of the global benzene market based on the derivative?

6. What are the key regions in the global benzene market?

7. Who are the key players/companies in the global benzene market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Properties

4.3 Key Industry Trends

5 Global Benzene Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Derivative

5.5 Market Breakup by Manufacturing Process

5.6 Market Breakup by Application

5.7 Market Breakup by Region

5.8 Market Forecast

6 Market Breakup by Derivative

6.1 Ethylbenzene

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Cumene

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Cyclohexane

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Nitrobenzene

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Linear Alkylbenzene

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Maleic Anhydride

6.6.1 Market Trends

6.6.2 Market Forecast

6.7 Others

6.7.1 Market Trends

6.7.2 Market Forecast

7 Market Breakup by Manufacturing Process

7.1 Pyrolysis Steam Cracking of Naphtha

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Catalytic Reforming of Naphtha

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Toluene Hydrodealkylation

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Toluene Disproportionation

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 From Biomass

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by Application

8.1 Plastics

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Resins

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Synthetic Fibers

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Rubber Lubricants

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Others

8.5.1 Market Trends

8.5.2 Market Forecast

9 Market Breakup by Region

9.1 Asia Pacific

9.1.1 Market Trends

9.1.2 Major Markets

9.1.2.1 China

9.1.2.2 India

9.1.2.3 Japan

9.1.2.4 South Korea

9.1.3 Market Forecast

9.2 Europe

9.2.1 Market Trends

9.2.2 Major Markets

9.2.2.1 Germany

9.2.2.2 UK

9.2.2.3 France

9.2.2.4 Italy

9.2.3 Market Forecast

9.3 North America

9.3.1 Market Trends

9.3.2 Major Markets

9.3.2.1 United States

9.3.2.2 Canada

9.3.3 Market Forecast

9.4 Middle East and Africa

9.4.1 Market Trends

9.4.2 Major Markets

9.4.2.1 Saudi Arabia

9.4.2.2 South Africa

9.4.3 Market Forecast

9.5 Latin America

9.5.1 Market Trends

9.5.2 Major Markets

9.5.2.1 Brazil

9.5.2.2 Argentina

9.5.3 Market Forecast

10 Trade Data

10.1 Import Breakup by Country

10.2 Export Breakup by Country

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porter’s Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 BASF

15.3.2 Sinopec

15.3.3 Royal Dutch Shell

15.3.4 China National Petroleum Corporation

15.3.5 DuPont

15.3.6 Saudi Basic Industries Corporation

15.3.7 China Petroleum & Chemical Corporation

15.3.8 ExxonMobil Corporation

15.3.9 JX Holdings

15.3.10 BP

15.3.11 Borealis AG

15.3.12 Braskem

15.3.13 Repsol

15.3.14 Arsol Aromatics GmbH & Co. KG

List of Figures

Figure 1: Global: Benzene Market: Major Drivers and Challenges

Figure 2: Global: Benzene Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Benzene Market: Breakup by Derivative (in %), 2024

Figure 4: Global: Benzene Market: Breakup by Manufacturing Process (in %), 2024

Figure 5: Global: Benzene Market: Breakup by Application (in %), 2024

Figure 6: Global: Benzene Market: Breakup by Region (in %), 2024

Figure 7: Global: Benzene Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Benzene Market: Imports Breakup by Country (in %), 2024

Figure 9: Global: Benzene Market: Export Breakup by Country (in %), 2024

Figure 10: Global: Benzene Industry: SWOT Analysis

Figure 11: Global: Benzene Industry: Value Chain Analysis

Figure 12: Global: Benzene Industry: Porter’s Five Forces Analysis

Figure 13: Global: Benzene (Ethylbenzene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Benzene (Ethylbenzene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Benzene (Cumene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Benzene (Cumene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Benzene (Cyclohexane) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Benzene (Cyclohexane) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Benzene (Nitrobenzene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Benzene (Nitrobenzene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Benzene (Linear Alkylbenzene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Benzene (Linear Alkylbenzene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: Benzene (Maleic Anhydride) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: Benzene (Maleic Anhydride) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: Benzene (Other Derivatives) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: Benzene (Other Derivatives) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Benzene (Pyrolysis Steam Cracking of Naphtha) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Benzene (Pyrolysis Steam Cracking of Naphtha) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: Benzene (Catalytic Reforming of Naphtha) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Global: Benzene (Catalytic Reforming of Naphtha) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Global: Benzene (Toluene Hydrodealkylation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Global: Benzene (Toluene Hydrodealkylation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Global: Benzene (Toluene Disproportionation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Global: Benzene (Toluene Disproportionation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: Global: Benzene (From Biomass) Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Global: Benzene (From Biomass) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Global: Benzene (Plastics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Global: Benzene (Plastics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Global: Benzene (Resins) Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Global: Benzene (Resins) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Global: Benzene (Synthetic Fibers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Global: Benzene (Synthetic Fibers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Global: Benzene (Rubber Lubricants) Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Global: Benzene (Rubber Lubricants) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Global: Benzene (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Global: Benzene (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Asia Pacific: Benzene Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Asia Pacific: Benzene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Europe: Benzene Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: Europe: Benzene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: North America: Benzene Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: North America: Benzene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: Middle East and Africa: Benzene Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: Middle East and Africa: Benzene Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: Latin America: Benzene Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: Latin America: Benzene Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

Table 1: Benzene: Physical Properties

Table 2: Benzene: Chemical Properties

Table 3: Global: Benzene Market: Key Industry Highlights, 2024 and 2033

Table 4: Global: Benzene Market Forecast: Breakup by Derivative (in Million USD), 2025-2033

Table 5: Global: Benzene Market Forecast: Breakup by Manufacturing Process (in Million USD), 2025-2033

Table 6: Global: Benzene Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 7: Global: Benzene Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 8: Global: Benzene Market Structure

Table 9: Global: Benzene Market: Key Players

Companies Mentioned

- BASF

- Sinopec

- Royal Dutch Shell

- China National Petroleum Corporation

- DuPont

- Saudi Basic Industries Corporation

- China Petroleum & Chemical Corporation

- ExxonMobil Corporation

- JX Holdings

- BP

- Borealis AG

- Braskem

- Repsol

- Arsol Aromatics GmbH & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 66.2 Billion |

| Forecasted Market Value ( USD | $ 87.1 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |