Free Webex Call

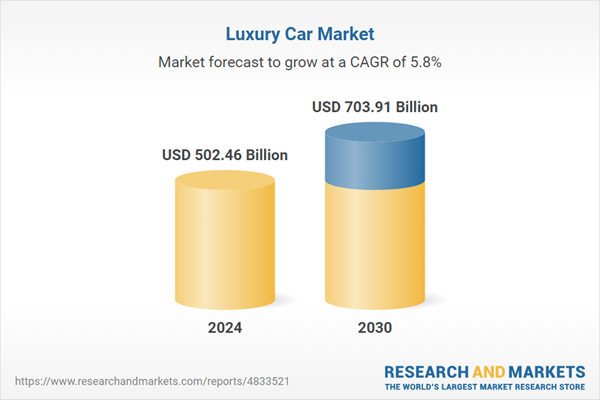

The Luxury Car Market was valued at USD 502.46 Billion in 2024, and is expected to reach USD 703.91 Billion by 2030, rising at a CAGR of 5.78%. The market is gaining momentum as consumer preferences evolve toward technologically advanced, high-performance, and personalized vehicles. Integration of autonomous features, AI-driven infotainment systems, and connected technologies is redefining the luxury car experience, making it synonymous with both innovation and status. The rise of electric luxury vehicles further supports this transformation, appealing to environmentally conscious buyers seeking exclusivity and cutting-edge engineering. In addition, the expanding middle class in emerging economies has broadened the customer base, encouraging brands to diversify their offerings across the premium spectrum. As a result, luxury automakers are focusing on a combination of performance, sustainability, and digital enhancement to meet modern consumer expectations. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Technological Sophistication as a Status Symbol

Today’s luxury car buyers prioritize technology as a key indicator of prestige, favoring vehicles equipped with advanced driver-assistance systems, AI-enabled infotainment, and autonomous driving capabilities. These features enhance comfort and safety while also reinforcing brand image. Automakers are heavily investing in machine learning, augmented reality, real-time analytics, and seamless connectivity to elevate the in-car experience. Features such as voice-controlled digital assistants, biometric access, and smartphone integration have become essential in the luxury segment. Additionally, over-the-air updates help keep vehicles current post-purchase, boosting brand loyalty and enhancing perceived value. As consumers become increasingly tech-driven, brand innovation and digital sophistication have emerged as central drivers of market growth.Key Market Challenges

High Cost of Innovation and Product Development

The pursuit of innovation in the luxury car market demands continuous and costly investments in R&D, advanced materials, and proprietary technologies. Integrating intelligent systems, autonomous functions, and sustainable solutions significantly increases development and production costs. With lower production volumes compared to mass-market vehicles, recovering these costs per unit is more challenging. Moreover, rapid technological shifts and changing consumer trends heighten the risk of low returns on investment. Stricter safety and environmental regulations also add complexity to the development process, often leading to delays and cost overruns. For both established manufacturers and new entrants, managing the financial strain of constant innovation while maintaining pricing competitiveness is a key obstacle to sustained growth.Key Market Trends

Integration of Ultra-Personalized In-Vehicle Experiences

Luxury car buyers are increasingly seeking vehicles that adapt to their individual preferences and digital lifestyles. As a result, ultra-personalized in-car experiences are becoming a key trend. Vehicles now feature AI-driven personalization, including mood-based ambient lighting, behavior-based climate and audio control, and voice-activated digital assistants. Customizable dashboards, biometric recognition, and connected services that sync with calendars and smart home systems are redefining the luxury driving experience. These enhancements turn the vehicle into an extension of the user’s digital ecosystem, fostering deeper engagement and brand loyalty. As artificial intelligence continues to advance, real-time, predictive personalization is expected to become a major differentiator in the luxury automotive market.Key Market Players

- BMW Group

- Mercedes-Benz AG

- General Motors Holdings LLC

- Toyota Motor Corporation

- Volkswagen AG

- Audi AG

- Rolls-Royce Motor Car

- Dr. Ing. h.c. F. Porsche AG

- Tata Motors Limited

- Tesla Inc.

Report Scope:

In this report, the Global Luxury Car Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Luxury Car Market, By Vehicle Type:

- Hatchback

- Sedan

- SUV/Crossover

Luxury Car Market, By Propulsion Type:

- ICE

- Electric

Luxury Car Market, By Engine Capacity:

- < 2500cc

- 2500-5000cc

- >5000cc

Luxury Car Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- France

- U.K.

- Spain

- Italy

- Asia-Pacific

- China

- Japan

- Australia

- India

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global Luxury Car Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

5. Global Luxury Car Market Outlook

6. North America Luxury Car Market Outlook

7. Europe & CIS Luxury Car Market Outlook

8. Asia-Pacific Luxury Car Market Outlook

9. Middle East & Africa Luxury Car Market Outlook

10. South America Luxury Car Market Outlook

11. Market Dynamics

14. Competitive Landscape

Companies Mentioned

- BMW Group

- Mercedes-Benz AG

- General Motors Holdings LLC

- Toyota Motor Corporation

- Volkswagen AG

- Audi AG

- Rolls-Royce Motor Car

- Dr. Ing. h.c. F. Porsche AG

- Tata Motors Limited

- Tesla Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 502.46 Billion |

| Forecasted Market Value ( USD | $ 703.91 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |