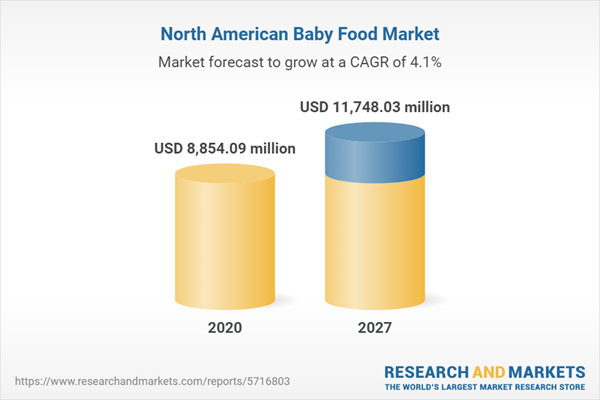

The North America baby food market is anticipated to develop at a CAGR of 4.12% over the course of the forecast period, reaching US$11,748.034 million by 2027, from US$8,854.088 million in 2020.

As the immune systems are still developing, infants and young children are more susceptible to diseases from food than older people. As a result, the safety of the items and their high quality are among the most important aspects influencing the selection of the buyer. The growing popularity of organic baby food among parents is the main factor driving the demand for baby food

Urbanization rates and escalating organized retail marketing activities are predicted to drive the infant food market. Additionally, there is more demand for baby food due to declining infant mortality rates, a growth in the number of working mothers, and consumer awareness of cutting-edge baby food products worldwide.Raising parental awareness of the nutritional requirements of infants

The parents' busy schedules and their growing interest in food, particularly organics, have both greatly influenced the recent changes in the baby food business. Parental spending on organic food is increasing because of parents' growing knowledge, which is boosting the market's expansion for baby food. Additionally, rising consumer demand for gluten-free options is supporting industry expansion in North America. This, along with a change in consumer behavior in nations like the United States, Canada, and Mexico, is aiding the expansion of the baby food business in the region. The baby food market is anticipated to grow as parents become more aware of its importance. 84% of parents prefer organic food for their infants, according to research by the Organic Trade Association. Foods that were grown using the fewest chemicals possible are significantly safer and are advised as choices for feeding babies.By Product Type

By product type, North America baby food market can be segmented as dried baby food, milk formula, prepared baby food and others.By Type

By type, North America baby food market can be segmented as Organic and Non organic. Organic food segment holds a significant share of the market as there is increasing demand of organic food products by parents.By Distribution Channel

By distribution channel, North America baby food market can be segmented as Online and Offline segments. The offline segment accounts for significant market share due to extensive and organized retail sectors.By Country

Geographically, North America baby food market is segmented as United States, Canada and Mexico. United States segments has significant share in the market due to the increased demand caused by a high birth rate. Changing lifestyles brought on by higher living standards may further boost regional market expansion. Additionally, increased consumer knowledge of infant feeding has increased local product sales.Key Developments:

- July 2022: In response to parents' requests for vegetarian and flexible diet options for their baby, Danone announced the introduction of the first-ever dairy and Plants Blend infant formula on July 5, 2022. The new baby formula is the first blended formula for healthy babies that was specifically designed for a vegetarian diet and in which more than half the necessary protein is derived from soy. Soy is a well-known component of infant and subsequent formulae and is acknowledged as an appropriate source of plant-based protein. 60% of the protein in the Dairy & Plants Blend baby formula is derived from high-quality, non-GMO soy, and 40% is made up of casein and whey protein, which are dairy products.

- April 2022: Leading baby food company Nestle recently announced the release of Plant-tastic, its first line of plant-based baby food under the brand name of Gerber. There are a variety of organic plant-based toddler foods available in this collection, including pouches, snacks, and bowls. The products, which were developed to provide a greater source of plant protein, are prepared with nutrient-dense beans, whole grains, and vegetables. The new line includes items like the Mediterranean Medley Harvest Bowl, Lil' Crunchies White Bean Hummus Toddler Snacks, and Banana Berry Veggie Smash Pouch.

Product Offerings:

- Gerber® Good Start® GentlePro Powder: Gerber® Good Start® GentlePro Powder is a routine formula for complete for infants of age range 0-12 months with easy-to-digest proteins, 2'-FL HMO, and probiotic B. lactis, advanced complete nutrition is provided. It contains 100% Pure Whey Protein that has been partially hydrolyzed and small, simple-to-digest proteins. It product promotes softer stools. Clinical research has demonstrated a gastric emptying duration of 30 minutes, which is comparable to breastfeeding. This may help lower the risk of developing atopic dermatitis. B. lactis, a probiotic and Prebiotic 2’-FL HMO** Human Milk Oligosaccharide) present supports gastrointestinal health and is clinically demonstrated to encourage a healthy micro biome and immune system by raising the important antibody IgA.

- Baby Gourmet baked apple, cinnamon, and chia: The Chia pudding, which is rich in omega-3 fatty acids and contains baked apples and cinnamon, is a kid favorite product. Without any additional salt, sugar, or additives, the puree is straightforward and delicious. It is gluten-free and contains omega-3 fatty acids. Ingredients in the product include organic apple, water, chia, cinnamon, organic lemon juice concentrate, and ascorbic acid. Chia seeds are a fantastic supplement to a baby's diet because they are loaded with omega-3 fatty acids, fibre, and minerals.

Market Segmentation:

By Product Type

- Dried Baby Food

- Milk Formula

- Prepared Baby Food

- Others

By Type

- Organic

- Non-Organic

By Distribution Channel

- Online

- Offline

By Country

- USA

- Mexico

- Canada

Table of Contents

INTRODUCTION1.1. Market Overview

1.2. COVID-19 Scenario

1.3. Market Definition

1.4. Market Segmentation

RESEARCH METHODOLOGY

2.1. Research Data

2.2. Assumptions

EXECUTIVE SUMMARY

3.1. Research Highlights

MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

NORTH AMERICA BABY FOOD MARKET BY PRODUCT TYPE

5.1. Dried Baby Food

5.2. Milk Formula

5.3. Prepared Baby Food

5.4. Others

NORTH AMERICA BABY FOOD MARKET BY TYPE

6.1. Organic

6.2. Non-Organic

NORTH AMERICA BABY FOOD MARKET BY DISTRIBUTION CHANNEL

7.1. Online

7.2. Offline

NORTH AMERICA BABY FOOD MARKET BY COUNTRY

8.1. USA

8.2. Canada

8.3. Mexico

COMPETITIVE INTELLIGENCE

9.1. Major Players and Strategy Analysis

9.2. Emerging Players and Market Lucrativeness

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Vendor Competitiveness Matrix

COMPANY PROFILES

10.1. Nestle

10.2. Danone North America Public Benefit Corporation

10.3. Abbott

10.4. Reckitt Benckiser Group PLC

10.5. Hero Group

10.6. Hain Celestial

10.7. Plum Organics (a Sun-maid Company)

10.8. Baby Gourmet

10.9. Beech-Nut

Companies Mentioned

- Nestle

- Danone North America Public Benefit Corporation

- Abbott

- Reckitt Benckiser Group PLC

- Hero Group

- Hain Celestial

- Plum Organics (a Sun-maid Company)

- Baby Gourmet

- Beech-Nut

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | January 2023 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 8854.09 million |

| Forecasted Market Value ( USD | $ 11748.03 million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |