Availability of Reimbursement and Insurance Coverage for Scans Present Lucrative Opportunities

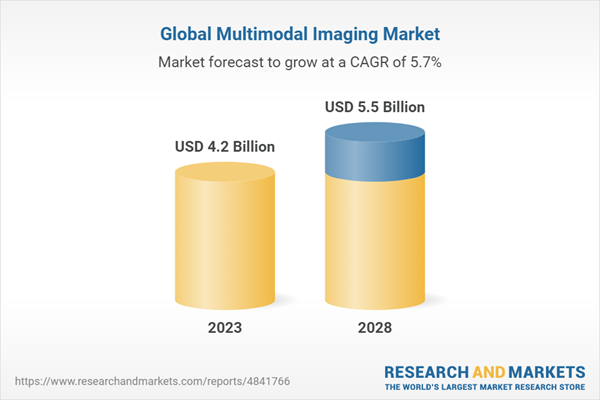

The global multimodal market is projected to reach USD 5.5 billion by 2028 from USD 4.2 billion in 2023, at a CAGR of 5.7% from 2023 to 2028. Factors such as the high incidence/prevalence of target diseases, the growing number of diagnostic imaging centers/procedures, increasing awareness about the benefits of early diagnosis of diseases, and the rapid adoption of technologically advanced imaging systems, features and modalities are responsible for the increasing growth of this market.

The PET-CT segment of technology segment l held the largest share of the market in 2022

Based on technology, the multimodal market is segmented into PET-CT, PET/MR, SPECT-CT, OCT/FMT and other multimodal imaging . The PET-CT segment held a major share of the market. Conducting PET and CT scans in a single session reduces radiation exposure and scan time, while its clinical versatility spans oncology, cardiology, neurology, and infectious diseases. Despite initial costs, the cost-effectiveness of PET-CT emerges from improved diagnostics, reduced need for additional tests, and research advancements, making it a valuable tool that significantly benefits patient outcomes and medical research are driving the growth of this product segment.

The oncology segment is projected to register the highest CAGR during the forecast period

Based on application, the multimodal market is segmented into brain & neurology, cardiology, oncology, ophthalmology, research and other applications. The oncology segment accounted for the largest market share in 2022. The large share of this segment is attributed to the system’s versatility, image quality, enhanced, easy to use features, and due to the increased usage of it in acute care settings and emergency care in hospitals and healthcare institutions.

The diagnostic imaging centers segment for end-user segment is projected to register a significant CAGR during the forecast period

On the basis of end-user, the multimodal market is segmented into hospitals, diagnostic imaging centers, academic and research institutes. The diagnostic imaging centers segment accounted for the largest share of the multimodal market in 2022. By integrating multiple imaging modalities, such as PET-CT, MRI-PET, or SPECT-CT, diagnostic imaging centers can provide more accurate and reliable diagnoses, leading to better treatment planning and improved patient outcomes. Moreover, the versatility of multimodal imaging enables these centers to cater to a wide range of medical specialties, effectively serving patients with diverse healthcare needs.

The market in the North America region is expected to witness the highest growth during the forecast period

The multimodal market in the North America region is expected to register a CAGR during the forecast period, primarily due to the high healthcare spending in the region, rising prevalence of target diseases, increasing research activities, growing number of cosmetic surgeries, and technological advancements in imaging systems.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 - 48%, Tier 2 - 36%, and Tier 3 - 16%

- By Designation: Director-level - 14%, C-level - 10%, and Others - 76%

- By Region: North America - 40%, Europe - 32%, Asia-Pacific - 20%, Latin America - 5%, and the Middle East & Africa - 3%

The prominent players in the multimodal market are GE Healthcare (US), Koninklijke Philips N.V. (Netherlands), Canon Medical Systems Corporation (Japan), Siemens AG (Germany), Neusoft (China), Topcon Corporation (Japan), and Bruker (US) among others.

Research Coverage

This report studies the multimodal market based on technology, display, portability, component, application, enduser, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall multimodal market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

- Analysis of key drivers (rising target patient population, growing adoption of multimodal imaging devices, technological advancement, and increasing investment, funds, and grants by public-private organizations), restraints (high capital and operational cost, unfavorable regulatory guidelines), opportunities (improving healthcare infrastructure across emerging countries, PET utilization for breast imaging, promising product pipeline), and challenges (availability of alternate imaging technologies) influencing the growth of the multimodal market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the multimodal market.

- Market Development: Comprehensive information about lucrative markets-the report analyses the multimodal market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the multimodal market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like GE Healthcare (US), Koninklijke Philips N.V. (Netherlands), Canon Medical Systems Corporation (Japan), Siemens AG (Germany), Neusoft (China), Topcon Corporation (Japan), and Bruker (US) among others.

Table of Contents

Companies Mentioned

- Alcon Inc.

- Bruker

- Canon Medical Systems Corporation

- Cubresa Inc.

- Essilor Instruments USA

- Fujifilm Corporation

- GE Healthcare

- Heidelberg Engineering

- InfraredX, Inc. (Part of Nipro Corporation)

- Kindsway Biotech

- Koninklijke Philips N.V.

- Mediso Ltd.

- Minfound Medical Systems Co. Ltd.

- MR Solutions

- Neusoft Corporation.

- Nidek Co. Ltd.

- Positron

- Reflexion Medical, Inc.

- Shanghai United Imaging Healthcare Co. Ltd.

- Siemens Healthineers

- Sofie Biosciences, Inc.

- Spectrum Dynamics Medical

- Topcon Corporation

- Zeiss Group

- Ziemer Ophthalmic Systems AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 213 |

| Published | September 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 5.5 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |