The Chinese agricultural machinery market is projected to record a CAGR of 5.8% during the forecast period 2022-2027.

During the COVID-19 pandemic, the Chinese agricultural machinery market saw a sharp dip, and the most affected businesses were the dealership networks due to disruptions in the supply chain. Additionally, manufacturing units were not 100% active. Due to travel restrictions, production of goods got delayed as supply was interrupted, resulting in a sharp decrease in tractor sales during the pandemic. Thus, the COVID-19 pandemic negatively impacted the Chinese agricultural machinery market.

China is one of the largest manufacturers of farming equipment and the largest market for agricultural machinery globally. Most agricultural machinery industries are mainly concentrated in Shandong, Henan, Jiangsu, Liaoning, and Zhejiang provinces. The bestselling types of agriculture machinery in the country include large tractors and harvesting machinery products with high horsepower and high degrees of automation. Nearly 2,500 agricultural equipment manufacturers are concentrated only in the provinces of Shandong, Henan, Jiangsu, Liaoning, and Zhejiang. Although the agricultural machinery industry is evolving in terms of technology, over the long term, decreasing human capital, increasing labor wages in agriculture, and government initiatives for farm mechanization are expected to boost the market’s growth.

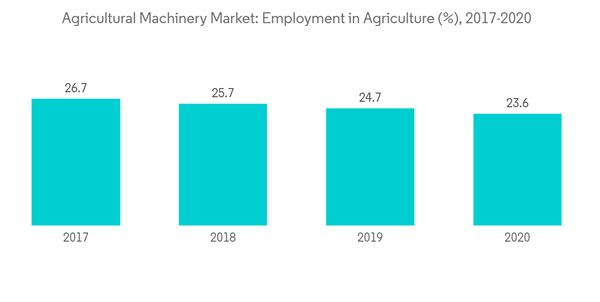

The cost of farm labor directly relates to the percentage of the total population of a country employed in agriculture owing to simple demand-supply economics. This is affecting the Chinese agricultural machinery market. On average, developing economies such as China have larger percentages of their population dependent on agriculture. However, the percentage has decreased over time as a large number of people are migrating to urban areas every year. According to Chinese government statistics, employment in agriculture decreased from 36.7% in 2010 to 23.6% in 2020. Due to decreasing agricultural labor, the cost of farm labor is rising. Similarly, poor rural reforms are leading to decreasing rural labor, leading farmers to mechanize their various farm operations further. Poor labor availability is expected to be one of the major driving factors for the Chinese agricultural machinery market over the coming years. Hence, it is anticipated to increase the demand for agricultural machinery during the forecast period.

According to data from the National Bureau of Statistics of China, the country produced 617,700 tractors in 2019. Large and medium-sized tractors gradually replaced small tractors. As of the end of 2019, China boasted 22.24 million agricultural tractors, including 4.44 million large- and medium-sized tractors. In northern China, high horsepower tractors are used on a large scale, as farm sizes are generally large, unlike in southern China, where farm sizes are pretty small. Large farm tractors are expensive, so many farmers outsource their cropping work to third-party contractors, who value the performance and profitability of their investment. To boost domestic production of farm machinery, the Chinese government has an agricultural machinery subsidy policy to provide financial assistance for purchasing heavy agricultural machinery, including agricultural tractors. The types of subsidy equipment cover 45 items in 23 categories and 11 categories, including farming and land preparation machinery, planting and fertilizing machinery, and field management machinery. Buyers of tractors of 60 HP and above can enjoy a subsidy of CNY 150,000. China also introduced the ‘Made in China 2025’ scheme, which aims at producing 90% of the country’s agricultural equipment with high-end machines, such as agricultural tractors, which held a one-third share of the market segment in 2020. This, in turn, boosts indigenously produced tractors and propels the country's agricultural tractor market. Thus, with the introduction of advanced models by market players, clubbed with supportive government initiatives, the domestic market for agricultural tractors in China is anticipated to grow during the forecast period.

In the Chinese agricultural machinery market, companies are not only competing based on equipment quality and promotion but are also focused on strategic moves in order to gain higher market shares. New product launches, partnerships, and acquisitions are the major strategies being adopted by leading companies in the market studied. The Chinese agricultural machinery market is fragmented in nature. The top five domestic manufacturers account for less than 25% of the market. Major Chinese agricultural equipment companies include First Tractor, the YTO Group, and Changzhou Dongfeng Agricultural Equipment.

This product will be delivered within 2 business days.

During the COVID-19 pandemic, the Chinese agricultural machinery market saw a sharp dip, and the most affected businesses were the dealership networks due to disruptions in the supply chain. Additionally, manufacturing units were not 100% active. Due to travel restrictions, production of goods got delayed as supply was interrupted, resulting in a sharp decrease in tractor sales during the pandemic. Thus, the COVID-19 pandemic negatively impacted the Chinese agricultural machinery market.

China is one of the largest manufacturers of farming equipment and the largest market for agricultural machinery globally. Most agricultural machinery industries are mainly concentrated in Shandong, Henan, Jiangsu, Liaoning, and Zhejiang provinces. The bestselling types of agriculture machinery in the country include large tractors and harvesting machinery products with high horsepower and high degrees of automation. Nearly 2,500 agricultural equipment manufacturers are concentrated only in the provinces of Shandong, Henan, Jiangsu, Liaoning, and Zhejiang. Although the agricultural machinery industry is evolving in terms of technology, over the long term, decreasing human capital, increasing labor wages in agriculture, and government initiatives for farm mechanization are expected to boost the market’s growth.

Key Market Trends

Decreasing Availability of Farm Labor and Rising Cost of Labor Impacting the Market

The cost of farm labor directly relates to the percentage of the total population of a country employed in agriculture owing to simple demand-supply economics. This is affecting the Chinese agricultural machinery market. On average, developing economies such as China have larger percentages of their population dependent on agriculture. However, the percentage has decreased over time as a large number of people are migrating to urban areas every year. According to Chinese government statistics, employment in agriculture decreased from 36.7% in 2010 to 23.6% in 2020. Due to decreasing agricultural labor, the cost of farm labor is rising. Similarly, poor rural reforms are leading to decreasing rural labor, leading farmers to mechanize their various farm operations further. Poor labor availability is expected to be one of the major driving factors for the Chinese agricultural machinery market over the coming years. Hence, it is anticipated to increase the demand for agricultural machinery during the forecast period.

Tractor Segment Dominates the Overall Market

According to data from the National Bureau of Statistics of China, the country produced 617,700 tractors in 2019. Large and medium-sized tractors gradually replaced small tractors. As of the end of 2019, China boasted 22.24 million agricultural tractors, including 4.44 million large- and medium-sized tractors. In northern China, high horsepower tractors are used on a large scale, as farm sizes are generally large, unlike in southern China, where farm sizes are pretty small. Large farm tractors are expensive, so many farmers outsource their cropping work to third-party contractors, who value the performance and profitability of their investment. To boost domestic production of farm machinery, the Chinese government has an agricultural machinery subsidy policy to provide financial assistance for purchasing heavy agricultural machinery, including agricultural tractors. The types of subsidy equipment cover 45 items in 23 categories and 11 categories, including farming and land preparation machinery, planting and fertilizing machinery, and field management machinery. Buyers of tractors of 60 HP and above can enjoy a subsidy of CNY 150,000. China also introduced the ‘Made in China 2025’ scheme, which aims at producing 90% of the country’s agricultural equipment with high-end machines, such as agricultural tractors, which held a one-third share of the market segment in 2020. This, in turn, boosts indigenously produced tractors and propels the country's agricultural tractor market. Thus, with the introduction of advanced models by market players, clubbed with supportive government initiatives, the domestic market for agricultural tractors in China is anticipated to grow during the forecast period.

Competitive Landscape

In the Chinese agricultural machinery market, companies are not only competing based on equipment quality and promotion but are also focused on strategic moves in order to gain higher market shares. New product launches, partnerships, and acquisitions are the major strategies being adopted by leading companies in the market studied. The Chinese agricultural machinery market is fragmented in nature. The top five domestic manufacturers account for less than 25% of the market. Major Chinese agricultural equipment companies include First Tractor, the YTO Group, and Changzhou Dongfeng Agricultural Equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- YTO Group Corporation

- Lovol Heavy Industry Co. Ltd

- Zoomlion

- Weichai Power Co. Ltd

- CNH Industrial NV

- CLAAS KGaA GmbH

- Deere Corporation

- AGCO Corporation

- Iseki & Co. Ltd

- Kubota Corporation

Methodology

LOADING...