Polypropylene is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The increasing demand for personal hygiene products continues to significantly influence the non-woven fabrics market

Growing global populations and expanding elderly demographics continue to drive demand for hygiene products such as baby diapers, adult incontinence items, and feminine care products, all of which rely heavily on non-woven materials for absorbency, softness, and barrier protection. EDANA reported that European hygiene-related nonwoven deliveries reached 803,000 tonnes in 2023. Simultaneously, nonwovens play a vital role in the healthcare sector, where ongoing emphasis on infection prevention sustains demand for products like surgical gowns, drapes, masks, and wound care materials. Deliveries for medical applications in Europe increased by 3.6% in 2023, according to EDANA. This growing demand is reinforced by continued capacity investments and technological advancements, with INDA noting that North American nonwovens shipments reached 5.54 million tonnes in 2023, underscoring the industry’s adaptability and essential role across multiple sectors.Key Market Challenges

A significant challenging factor impeding the expansion of the global non-woven fabrics market is the volatility of raw material prices

The market faces persistent challenges due to fluctuating prices of petroleum-derived polymers, which form the backbone of many non-woven products. Sudden changes in oil and feedstock prices directly impact manufacturing costs, compress margins, and introduce pricing instability for finished goods. This volatility complicates long-term planning, discourages investment, and affects overall market predictability. Although global nonwoven production grew at an annual rate of 5.4% from 2013 to 2023, according to EDANA and INDA, rising and unpredictable input costs remain a major constraint on profitability and sustained growth, making raw material dependence a critical vulnerability for the industry.Key Market Trends

Sustainable Non-Woven Material Innovation

Sustainability-driven innovation is rapidly shaping the non-wovens landscape, with increased emphasis on bio-based, biodegradable, and recyclable materials. Industry participants are investing heavily in developing environmentally responsible nonwovens aligned with circular economy objectives. Berry Global’s 2024 Sustainability Report highlighted a 28.3% reduction in Scope 1 and 2 emissions compared to its 2019 baseline, surpassing its 2025 target. Demand for sustainable solutions is rising across multiple segments, including building and roofing materials, which recorded 14.2% growth in 2024 according to EDANA. These efforts reflect broader industry momentum toward reducing environmental impact while maintaining high performance standards.Key Market Players Profiled:

- Ahlstrom Oyj

- BERRY GLOBAL INC.

- KIMBERLY-CLARK CORPORATION

- Glatfelter Corporation

- DuPont de Nemours, Inc.

- TORAY INDUSTRIES INC.

- Lydall Inc.

- Fitesa S.A.

- SUOMINEN CORPORATION

- Johns Manville Europe GmbH

Report Scope:

In this report, the Global Non-Woven Fabrics Market has been segmented into the following categories:By Fiber:

- Polyester

- Cotton Rayon

- Polypropylene

- Others

By End User:

- Disposable Applications

- Wipes

- Geotextiles

- Medical Products

- Automotive

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Non-Woven Fabrics Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Non-Woven Fabrics market report include:- Ahlstrom Oyj

- BERRY GLOBAL INC.

- KIMBERLY-CLARK CORPORATION

- Glatfelter Corporation

- DuPont de Nemours, Inc.

- TORAY INDUSTRIES INC.

- Lydall Inc.

- Fitesa S.A.

- SUOMINEN CORPORATION

- Johns Manville Europe GmbH

Table Information

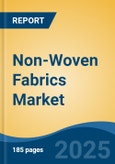

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 46.85 Billion |

| Forecasted Market Value ( USD | $ 62.65 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |