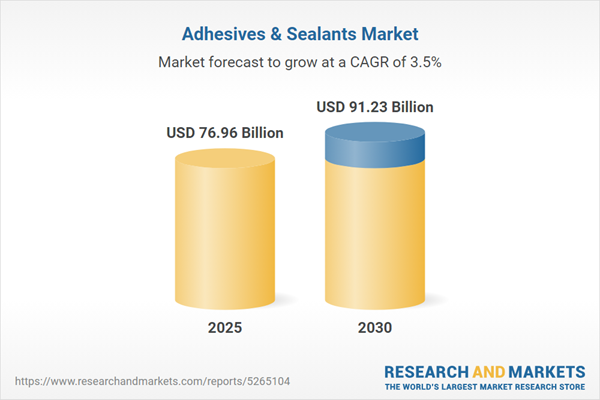

Adhesives & sealants market is projected to grow from USD 76.96 billion in 2025 to USD 91.23 billion by 2030, at a CAGR of 3.46% between 2025 and 2030.

Silicone- and cyanoacrylate-based adhesives are becoming popular in wound closure and surgical fields, while UV-curable and hot-melt adhesives are used in assembling medical devices and equipment. The increased use of high-efficiency adhesives and sealants is likely to accelerate due to the rising popularity of minimally invasive procedures, advanced medical equipment, and personalized healthcare services. Additionally, the aging global population, higher healthcare spending, and growing medical manufacturing centers in Asia Pacific and North America are contributing to this trend, creating growth opportunities for the adhesives and sealants market within the medical industry.

Increasing adoption of adhesives and sealants in the medical sector is driving the market across the globe.

Adhesives and sealants are expanding their applications to medical devices, wound care, surgical procedures, diagnostics, and drug delivery systems, replacing traditional textiles, films, and fasteners such as sutures, tapes, and mechanical fasteners. Their benefits - such as no risk of infection, strong bonding, biocompatibility, and flexibility - make them essential in modern healthcare solutions.Silicone- and cyanoacrylate-based adhesives are becoming popular in wound closure and surgical fields, while UV-curable and hot-melt adhesives are used in assembling medical devices and equipment. The increased use of high-efficiency adhesives and sealants is likely to accelerate due to the rising popularity of minimally invasive procedures, advanced medical equipment, and personalized healthcare services. Additionally, the aging global population, higher healthcare spending, and growing medical manufacturing centers in Asia Pacific and North America are contributing to this trend, creating growth opportunities for the adhesives and sealants market within the medical industry.

The paper & packaging segment was the largest adhesive application of the global adhesives & sealants market in 2024.

In 2024, paper & packaging dominated the adhesive application segment in the adhesives and sealants market due to the rapid growth of the global e-commerce market, increasing pressure to use environmentally friendly packaging materials, and the shift toward lightweight and adaptable packaging products. Adhesives are widely used in sealing cartons, label films, lamination, bookbinding, and throughout the flexible packaging film industry, offering the best bonding ability, resistance to wear and tear, and flexibility against common mechanical fasteners. Growing interest in eco-friendly and recyclable adhesive packaging materials is further supporting the acceptance of water-based and hot-melt adhesives, which deliver comparable performance to meet environmental standards. Additionally, the rise in demand for online food delivery, shipping of consumer goods, and corrugated packaging has significantly increased consumption.By sealant resin type, the polyurethane segment accounted for the second-largest share of the adhesives & sealants market in 2024.

In 2024, polyurethane was the second-largest sealant resin type in the global adhesives & sealants market, after silicone. Polyurethane sealants have a large market share because of their good flexibility, durability, abrasion resistance, and binding strengths to a variety of materials such as concrete, wood, metal, and plastics. They have become a favorite among the building & construction, automotive, and industrial sectors in which performance under dynamic load and harsh environmental conditions is required. Polyurethane sealants can offer structural bonding in addition to being effective sealers, which has further enhanced their use, given that their curing takes a relatively shorter time as compared to that of silicone.Europe was the second-largest market for the adhesives & sealants market in 2024.

In 2024, the European market held the second-largest share of the global adhesives & sealants industry because of its strong automotive, aerospace, packaging, and construction sectors. The region has advanced manufacturing and a well-established industrial base, with ongoing innovations in high-performance adhesives & sealants that meet strict EU environmental and sustainability regulations. The trend toward environmentally friendly, low- and zero-VOC, and recyclable adhesive products is growing in Europe, driven by policies like REACH and the European Green Deal. Additionally, demand for adhesives & sealants in renewable energy, electric vehicles, and infrastructure refurbishment further propels market growth. However, strict regulations are prompting companies to increase R&D investments in bio-based and hybrid adhesive technologies, creating stronger leadership opportunities for Europe to achieve sustainable development.- By Company Type: Tier 1 - 33%, Tier 2 - 25%, and Tier 3 - 42%

- By Designation: Directors - 36%, Managers - 19%, and Others - 45%

- By Region: North America - 25%, Europe - 17%, Asia Pacific - 42%, South America - 8%, Middle East & Africa - 8%

Research Coverage

This report segments the adhesives & sealants market by adhesive technology, adhesive application, sealant resin type, and region, providing estimates of market value (USD million) and volume (kiloton) across different regions. It also features a detailed analysis of major industry players, highlighting their business overviews, services, and key strategies related to the adhesives & sealants market.Reasons to Buy Report

This research report focuses on multiple levels of analysis - industry trends, market share of top players, and company profiles, which together provide a comprehensive view of the competitive landscape, emerging and high-growth segments of the adhesives & sealants market, high-growth regions, and market drivers, restraints, and opportunities.The report provides insights into the following points:

- Market Penetration: Comprehensive information on adhesives & sealants offered by top players in the global market

- Analysis of key drivers (Growth of building & construction industry, Increased demand for adhesives in medical industry, Growth in appliances industry), restraints (Stringent regulations in Europe and North America, Technological limitations in adhesive industry), opportunities (Investments in emerging markets of Asia Pacific, Increased industrial activity due to globalization, Development of hybrid resins for manufacturing high-performance adhesives), and challenges (Regulatory compliance) influencing the growth of the adhesives & sealants market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the adhesives & sealants market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for adhesives & sealants across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global adhesives & sealants market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the adhesives & sealants market.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Markets Covered and Regional Scope

1.3.1 Inclusions and Exclusions

1.3.2 Definition and Inclusions, by Type

1.3.3 Definition and Inclusions, by Adhesive Technology

1.3.4 Definition and Inclusions, by Adhesive Application

1.3.5 Definition and Inclusions, by Sealant Resin Type

1.3.6 Definition and Inclusions, by Sealant Application

1.3.7 Years Considered

1.3.8 Currency Considered

1.3.9 Units Considered

1.4 Stakeholders

1.5 Summary of Changes

1.2 Market Definition

1.3 Markets Covered and Regional Scope

1.3.1 Inclusions and Exclusions

1.3.2 Definition and Inclusions, by Type

1.3.3 Definition and Inclusions, by Adhesive Technology

1.3.4 Definition and Inclusions, by Adhesive Application

1.3.5 Definition and Inclusions, by Sealant Resin Type

1.3.6 Definition and Inclusions, by Sealant Application

1.3.7 Years Considered

1.3.8 Currency Considered

1.3.9 Units Considered

1.4 Stakeholders

1.5 Summary of Changes

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.2.4 Interviews with Experts-Demand and Supply Sides

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Growth Forecast

2.3.1 Supply-Side Forecast

2.3.2 Demand-Side Forecast

2.4 Data Triangulation

2.5 Assumptions

2.6 Limitations

2.7 Risk Assessment

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.2.4 Interviews with Experts-Demand and Supply Sides

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Growth Forecast

2.3.1 Supply-Side Forecast

2.3.2 Demand-Side Forecast

2.4 Data Triangulation

2.5 Assumptions

2.6 Limitations

2.7 Risk Assessment

4 Premium Insights

4.1 Attractive Opportunities for Players in Adhesives & Sealants Market

4.2 Adhesives & Sealants Market, by Region

4.3 Asia-Pacific Adhesives Market, by Adhesive Technology and Country

4.4 Asia-Pacific Sealants Market, by Sealant Resin Type and Country

4.5 Sealants Market, by Application and Region

4.6 Sealants Market, by Country

4.2 Adhesives & Sealants Market, by Region

4.3 Asia-Pacific Adhesives Market, by Adhesive Technology and Country

4.4 Asia-Pacific Sealants Market, by Sealant Resin Type and Country

4.5 Sealants Market, by Application and Region

4.6 Sealants Market, by Country

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of Building & Construction Industry

5.2.1.2 Increased Demand for Adhesives in Medical Industry

5.2.1.3 Growth in Appliance Industry

5.2.2 Restraints

5.2.2.1 Stringent Environmental Regulations in North America and Europe

5.2.2.2 Technological Limitations in Adhesives Industry

5.2.3 Opportunities

5.2.3.1 Investments in Emerging Markets of Asia-Pacific

5.2.3.2 Increased Industrial Activity due to Globalization

5.2.3.3 Development of Hybrid Resins for Manufacturing High-Performance Adhesives

5.2.4 Challenges

5.2.4.1 Regulatory Compliance

5.3 Porter's Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicator

5.4.1 Introduction

5.4.2 GDP Trends and Forecast

5.4.3 Trends of Global Construction Industry

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of Building & Construction Industry

5.2.1.2 Increased Demand for Adhesives in Medical Industry

5.2.1.3 Growth in Appliance Industry

5.2.2 Restraints

5.2.2.1 Stringent Environmental Regulations in North America and Europe

5.2.2.2 Technological Limitations in Adhesives Industry

5.2.3 Opportunities

5.2.3.1 Investments in Emerging Markets of Asia-Pacific

5.2.3.2 Increased Industrial Activity due to Globalization

5.2.3.3 Development of Hybrid Resins for Manufacturing High-Performance Adhesives

5.2.4 Challenges

5.2.4.1 Regulatory Compliance

5.3 Porter's Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicator

5.4.1 Introduction

5.4.2 GDP Trends and Forecast

5.4.3 Trends of Global Construction Industry

6 Industry Trends

6.1 Supply Chain Analysis

6.2 Ecosystem Analysis

6.3 Investment and Funding Scenario

6.4 Trends and Disruptions Impacting Customer Business

6.5 Key Stakeholders & Buying Criteria

6.5.1 Key Stakeholders in Buying Process

6.5.2 Buying Criteria

6.6 Pricing Analysis

6.6.1 Price Range of Adhesives Ofeered by Key Players, by Application

6.6.2 Pricing Range of Adhesives Offered by Key Player, by Application, 2024

6.6.3 Price Range of Sealants Offered by Key Players, by Application

6.6.4 Pricing Range of Sealants Offered by Key Player, by Application, 2024

6.6.5 Average Selling Price Trend of Adhesives, by Region, 2022-2030

6.6.6 Average Selling Price Trend of Sealants, by Region, 2022-2030

6.7 Trade Analysis

6.7.1 Import Scenario (HS Code 3506)

6.7.2 Export Scenario (HS Code 3506)

6.8 Regulatory Landscape

6.8.1 Regulations and Standards

6.8.2 Regulatory Bodies, Government Agencies, and Other Organizations

6.9 Case Study Analysis

6.10 Technology Analysis

6.10.1 Key Technologies

6.10.1.1 Water-based

6.10.1.2 Solvent-based

6.10.1.3 Hot-Melt

6.10.1.4 Reactive & Others

6.10.2 Complementary Technologies

6.10.2.1 Curing Technology

6.10.2.2 Sustainability Technology

6.10.2.3 Testing & Quality Control Technologies

6.11 Key Conferences & Events in 2024-2025

6.12 Patent Analysis

6.12.1 Approach

6.12.2 Document Types

6.12.3 Top Applicants

6.12.4 Jurisdiction Analysis

6.13 Impact of 2025 US Tariff - Adhesives & Sealants Market

6.13.1 Introduction

6.13.2 Key Tariff Rates

6.13.3 Price Impact Analysis

6.13.4 Impact on Country/Region

6.13.4.1 US

6.13.4.2 Europe

6.13.4.3 Asia-Pacific

6.13.5 Impact on End-use Industries:

6.14 Impact of AI/Gen AI on Adhesives & Sealants Market

6.2 Ecosystem Analysis

6.3 Investment and Funding Scenario

6.4 Trends and Disruptions Impacting Customer Business

6.5 Key Stakeholders & Buying Criteria

6.5.1 Key Stakeholders in Buying Process

6.5.2 Buying Criteria

6.6 Pricing Analysis

6.6.1 Price Range of Adhesives Ofeered by Key Players, by Application

6.6.2 Pricing Range of Adhesives Offered by Key Player, by Application, 2024

6.6.3 Price Range of Sealants Offered by Key Players, by Application

6.6.4 Pricing Range of Sealants Offered by Key Player, by Application, 2024

6.6.5 Average Selling Price Trend of Adhesives, by Region, 2022-2030

6.6.6 Average Selling Price Trend of Sealants, by Region, 2022-2030

6.7 Trade Analysis

6.7.1 Import Scenario (HS Code 3506)

6.7.2 Export Scenario (HS Code 3506)

6.8 Regulatory Landscape

6.8.1 Regulations and Standards

6.8.2 Regulatory Bodies, Government Agencies, and Other Organizations

6.9 Case Study Analysis

6.10 Technology Analysis

6.10.1 Key Technologies

6.10.1.1 Water-based

6.10.1.2 Solvent-based

6.10.1.3 Hot-Melt

6.10.1.4 Reactive & Others

6.10.2 Complementary Technologies

6.10.2.1 Curing Technology

6.10.2.2 Sustainability Technology

6.10.2.3 Testing & Quality Control Technologies

6.11 Key Conferences & Events in 2024-2025

6.12 Patent Analysis

6.12.1 Approach

6.12.2 Document Types

6.12.3 Top Applicants

6.12.4 Jurisdiction Analysis

6.13 Impact of 2025 US Tariff - Adhesives & Sealants Market

6.13.1 Introduction

6.13.2 Key Tariff Rates

6.13.3 Price Impact Analysis

6.13.4 Impact on Country/Region

6.13.4.1 US

6.13.4.2 Europe

6.13.4.3 Asia-Pacific

6.13.5 Impact on End-use Industries:

6.14 Impact of AI/Gen AI on Adhesives & Sealants Market

7 Adhesives & Sealants Market, by Type

7.1 Introduction

7.2 Adhesives

7.2.1 Rapid Industrialization and Diverse Applications Driving Adhesives Market Growth

7.3 Sealants

7.3.1 Increasing Urbanization and Industrialization Boost Sealants Industry

7.2 Adhesives

7.2.1 Rapid Industrialization and Diverse Applications Driving Adhesives Market Growth

7.3 Sealants

7.3.1 Increasing Urbanization and Industrialization Boost Sealants Industry

8 Adhesives Market, by Technology

8.1 Introduction

8.2 Water-based Adhesives

8.2.1 Asia-Pacific to be Fastest-Growing Market for Water-based Adhesives

8.2.2 Pva Emulsion Adhesives

8.2.3 Acrylic Polymer Emulsion Adhesives

8.2.4 Vae Emulsion Adhesives

8.2.5 Sbc Latex Adhesives

8.2.6 Others

8.2.6.1 Polyurethane Dispersion Adhesives

8.2.6.2 Water-based Rubber Adhesives

8.3 Solvent-based Adhesives

8.3.1 Stringent Government Regulations to Restrict Use of Solvent-based Adhesives

8.3.2 Polyurethane Adhesives

8.3.3 Acrylic Adhesives

8.3.4 Chloroprene Rubber (Cr) Adhesives

8.3.5 Polyvinyl Acetate (Pva) Adhesives

8.3.6 Polyamide Adhesives

8.3.7 Synthesized Rubber Adhesives

8.3.8 Other Resin Types

8.4 Hot-Melt Adhesives

8.4.1 Fast-Setting Speed and Relatively Lower Cost Driving Demand for Hot-Melt Adhesives

8.4.2 Ethylene-Vinyl Acetate (Eva) Adhesives

8.4.3 Styrenic Block Copolymer (Sbc) Adhesives

8.4.4 Metallocene Polyolefin (Mpo) Adhesives

8.4.5 Polyolefin Adhesives

8.4.6 Amorphous Poly-Alphaolefin (Apao) Adhesives

8.4.6.1 Properties

8.4.6.2 Applications

8.4.7 Others

8.4.7.1 Polyamides

8.4.7.2 Polyurethane (Pur)

8.4.7.3 Other Resin Types

8.5 Reactive & Others

8.5.1 Fastest-Growing Adhesive Technology During Forecast Period

8.5.2 Polyurethane-based Adhesives

8.5.2.1 Liquid

8.5.2.1.1 One-Component

8.5.2.1.2 Two-Component

8.5.3 Epoxy-based Adhesives

8.5.4 Others

8.5.4.1 Polysulfide Adhesives

8.5.4.2 Modified Acrylate & Methyl Methacrylate (Mma) Adhesives

8.5.4.3 Cyanoacrylate Adhesives

8.5.4.4 Anaerobic Adhesives

8.5.4.5 Formaldehyde-based (Reactive-based) Adhesives

8.5.4.6 Silicone

8.5.4.7 Polyester

8.5.4.8 Resorcinol

8.5.4.9 Phenolic

8.5.4.10 Natural and Bio-based Adhesives

8.2 Water-based Adhesives

8.2.1 Asia-Pacific to be Fastest-Growing Market for Water-based Adhesives

8.2.2 Pva Emulsion Adhesives

8.2.3 Acrylic Polymer Emulsion Adhesives

8.2.4 Vae Emulsion Adhesives

8.2.5 Sbc Latex Adhesives

8.2.6 Others

8.2.6.1 Polyurethane Dispersion Adhesives

8.2.6.2 Water-based Rubber Adhesives

8.3 Solvent-based Adhesives

8.3.1 Stringent Government Regulations to Restrict Use of Solvent-based Adhesives

8.3.2 Polyurethane Adhesives

8.3.3 Acrylic Adhesives

8.3.4 Chloroprene Rubber (Cr) Adhesives

8.3.5 Polyvinyl Acetate (Pva) Adhesives

8.3.6 Polyamide Adhesives

8.3.7 Synthesized Rubber Adhesives

8.3.8 Other Resin Types

8.4 Hot-Melt Adhesives

8.4.1 Fast-Setting Speed and Relatively Lower Cost Driving Demand for Hot-Melt Adhesives

8.4.2 Ethylene-Vinyl Acetate (Eva) Adhesives

8.4.3 Styrenic Block Copolymer (Sbc) Adhesives

8.4.4 Metallocene Polyolefin (Mpo) Adhesives

8.4.5 Polyolefin Adhesives

8.4.6 Amorphous Poly-Alphaolefin (Apao) Adhesives

8.4.6.1 Properties

8.4.6.2 Applications

8.4.7 Others

8.4.7.1 Polyamides

8.4.7.2 Polyurethane (Pur)

8.4.7.3 Other Resin Types

8.5 Reactive & Others

8.5.1 Fastest-Growing Adhesive Technology During Forecast Period

8.5.2 Polyurethane-based Adhesives

8.5.2.1 Liquid

8.5.2.1.1 One-Component

8.5.2.1.2 Two-Component

8.5.3 Epoxy-based Adhesives

8.5.4 Others

8.5.4.1 Polysulfide Adhesives

8.5.4.2 Modified Acrylate & Methyl Methacrylate (Mma) Adhesives

8.5.4.3 Cyanoacrylate Adhesives

8.5.4.4 Anaerobic Adhesives

8.5.4.5 Formaldehyde-based (Reactive-based) Adhesives

8.5.4.6 Silicone

8.5.4.7 Polyester

8.5.4.8 Resorcinol

8.5.4.9 Phenolic

8.5.4.10 Natural and Bio-based Adhesives

9 Adhesives Market, by Application

9.1 Introduction

9.2 Paper & Packaging

9.2.1 High Demand for Flexible Packaging to Drive Market

9.3 Building & Construction

9.3.1 Development of Smart Cities and Megaprojects to Drive Growth

9.4 Woodworking

9.4.1 Growth of Furniture Industry to Drive Market

9.5 Automotive & Transportation

9.5.1 Advancements in Electric Vehicles to Fuel Demand for Adhesives

9.6 Consumer & DIY

9.6.1 Increasing Demand for Low-Strength and Durable Adhesives to Drive Market

9.7 Leather & Footwear

9.7.1 Rising Demand for Athletic Footwear to Drive Market

9.8 Assembly

9.8.1 Wide Use of Adhesives in Manufacturing Sector to Boost Market

9.9 Electronics

9.9.1 New Trends and Technological Innovations to Fuel Market

9.10 Medical

9.10.1 Growing Use of Silicone Adhesives to Drive Market

9.11 Other Applications

9.2 Paper & Packaging

9.2.1 High Demand for Flexible Packaging to Drive Market

9.3 Building & Construction

9.3.1 Development of Smart Cities and Megaprojects to Drive Growth

9.4 Woodworking

9.4.1 Growth of Furniture Industry to Drive Market

9.5 Automotive & Transportation

9.5.1 Advancements in Electric Vehicles to Fuel Demand for Adhesives

9.6 Consumer & DIY

9.6.1 Increasing Demand for Low-Strength and Durable Adhesives to Drive Market

9.7 Leather & Footwear

9.7.1 Rising Demand for Athletic Footwear to Drive Market

9.8 Assembly

9.8.1 Wide Use of Adhesives in Manufacturing Sector to Boost Market

9.9 Electronics

9.9.1 New Trends and Technological Innovations to Fuel Market

9.10 Medical

9.10.1 Growing Use of Silicone Adhesives to Drive Market

9.11 Other Applications

10 Sealants Market, by Resin Type

10.1 Introduction

10.2 Silicone

10.2.1 Better Flexibility and Longer Shelf Life to Drive Demand

10.3 Polyurethane

10.3.1 High Demand in Automotive Applications to Drive Market

10.4 Plastisol

10.4.1 Increasing Application in Automobiles to Drive Market

10.5 Emulsion

10.5.1 Growing Use in Construction Sector to Drive Market

10.6 Polysulfide

10.6.1 Increasing Demand for Insulating Glass Sealants to Drive Market

10.7 Butyl

10.7.1 Higher Stability Against Oxidation to Fuel Demand

10.8 Other Resin Types

10.2 Silicone

10.2.1 Better Flexibility and Longer Shelf Life to Drive Demand

10.3 Polyurethane

10.3.1 High Demand in Automotive Applications to Drive Market

10.4 Plastisol

10.4.1 Increasing Application in Automobiles to Drive Market

10.5 Emulsion

10.5.1 Growing Use in Construction Sector to Drive Market

10.6 Polysulfide

10.6.1 Increasing Demand for Insulating Glass Sealants to Drive Market

10.7 Butyl

10.7.1 Higher Stability Against Oxidation to Fuel Demand

10.8 Other Resin Types

11 Sealants Market, by Application

11.1 Introduction

11.2 Building & Construction

11.2.1 Investments in New Construction and Infrastructure to Drive Market

11.3 Automotive & Transportation

11.3.1 Wide Use in Radiators and Automotive Components to Drive Demand for Sealants

11.4 Consumer

11.4.1 Rising Demand for Sealants for Household Use to Drive Market

11.5 Other Applications

11.2 Building & Construction

11.2.1 Investments in New Construction and Infrastructure to Drive Market

11.3 Automotive & Transportation

11.3.1 Wide Use in Radiators and Automotive Components to Drive Demand for Sealants

11.4 Consumer

11.4.1 Rising Demand for Sealants for Household Use to Drive Market

11.5 Other Applications

12 Adhesives & Sealants Market, by Region

12.1 Introduction

12.2 North America

12.2.1 US

12.2.1.1 Increasing Private and Residential Construction to Drive Market

12.2.2 Canada

12.2.2.1 Surge in Construction Projects to Foster Market Growth

12.2.3 Mexico

12.2.3.1 New Constructions in Residential Segment to Drive Market

12.3 Europe

12.3.1 Germany

12.3.1.1 Electric Mobility Revolution to Increase Demand for Adhesives & Sealants in Automotive Industry

12.3.2 UK

12.3.2.1 Growth of Construction Sector to Drive Market

12.3.3 France

12.3.3.1 Development of Affordable Houses and Renewable Energy Infrastructure to Foster Market Growth

12.3.4 Italy

12.3.4.1 Developments in Medical Industry to Support Market Growth

12.3.5 Spain

12.3.5.1 Recovery of Construction and Automotive Industries to Drive Market

12.3.6 Turkey

12.3.6.1 Rapid Urbanization and Increasing Purchasing Power to Boost Market

12.3.7 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.1.1 Foreign Investments to Drive Market

12.4.2 India

12.4.2.1 Government Initiatives for Economic Growth to Boost Market

12.4.3 Japan

12.4.3.1 Growth of Tourism Sector to Boost Market

12.4.4 South Korea

12.4.4.1 Growth in Automotive and Building Construction Industries to Fuel Demand

12.4.5 Thailand

12.4.5.1 Economic Stability and Rising Establishment of End-use Industries to Fuel Market

12.4.6 Indonesia

12.4.6.1 Rise in Automobile Manufacturers to Drive Market

12.4.7 Rest of Asia-Pacific

12.5 South America

12.5.1 Brazil

12.5.1.1 Rising Investment from Government to Drive Market

12.5.2 Argentina

12.5.2.1 Increase in Population and Improved Economic Conditions to Drive Demand

12.5.3 Rest of South America

12.6 Middle East & Africa

12.6.1 GCC Countries

12.6.1.1 Saudi Arabia

12.6.1.1.1 Mega Housing Projects to Increase Demand for Adhesives

12.6.1.2 UAE

12.6.1.2.1 Growing Industrial Activity to Impact Market Growth

12.6.1.3 Rest of GCC Countries

12.6.2 Rest of Middle East & Africa

12.2 North America

12.2.1 US

12.2.1.1 Increasing Private and Residential Construction to Drive Market

12.2.2 Canada

12.2.2.1 Surge in Construction Projects to Foster Market Growth

12.2.3 Mexico

12.2.3.1 New Constructions in Residential Segment to Drive Market

12.3 Europe

12.3.1 Germany

12.3.1.1 Electric Mobility Revolution to Increase Demand for Adhesives & Sealants in Automotive Industry

12.3.2 UK

12.3.2.1 Growth of Construction Sector to Drive Market

12.3.3 France

12.3.3.1 Development of Affordable Houses and Renewable Energy Infrastructure to Foster Market Growth

12.3.4 Italy

12.3.4.1 Developments in Medical Industry to Support Market Growth

12.3.5 Spain

12.3.5.1 Recovery of Construction and Automotive Industries to Drive Market

12.3.6 Turkey

12.3.6.1 Rapid Urbanization and Increasing Purchasing Power to Boost Market

12.3.7 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.1.1 Foreign Investments to Drive Market

12.4.2 India

12.4.2.1 Government Initiatives for Economic Growth to Boost Market

12.4.3 Japan

12.4.3.1 Growth of Tourism Sector to Boost Market

12.4.4 South Korea

12.4.4.1 Growth in Automotive and Building Construction Industries to Fuel Demand

12.4.5 Thailand

12.4.5.1 Economic Stability and Rising Establishment of End-use Industries to Fuel Market

12.4.6 Indonesia

12.4.6.1 Rise in Automobile Manufacturers to Drive Market

12.4.7 Rest of Asia-Pacific

12.5 South America

12.5.1 Brazil

12.5.1.1 Rising Investment from Government to Drive Market

12.5.2 Argentina

12.5.2.1 Increase in Population and Improved Economic Conditions to Drive Demand

12.5.3 Rest of South America

12.6 Middle East & Africa

12.6.1 GCC Countries

12.6.1.1 Saudi Arabia

12.6.1.1.1 Mega Housing Projects to Increase Demand for Adhesives

12.6.1.2 UAE

12.6.1.2.1 Growing Industrial Activity to Impact Market Growth

12.6.1.3 Rest of GCC Countries

12.6.2 Rest of Middle East & Africa

13 Competitive Landscape

13.1 Introduction

13.2 Key Player Strategies/Right to Win

13.3 Market Share Analysis, 2024

13.4 Revenue Analysis

13.5 Company Evaluation Matrix: Key Players, 2024

13.5.1 Stars

13.5.2 Emerging Leaders

13.5.3 Pervasive Players

13.5.4 Participants

13.5.5 Company Footprint: Key Players, 2024

13.5.5.1 Company Footprint

13.5.5.2 Region Footprint

13.5.5.3 Application Footprint

13.6 Company Evaluation Matrix: Startups/SMEs, 2024

13.6.1 Progressive Companies

13.6.2 Responsive Companies

13.6.3 Dynamic Companies

13.6.4 Starting Blocks

13.6.5 Competitive Benchmarking: Startups/SMEs, 2024

13.6.5.1 Detailed List of Key Startups/SMEs

13.6.5.2 Competitive Benchmarking of Key Startups/SMEs

13.7 Product Comparison Analysis

13.8 Company Valuation and Financial Metrics

13.9 Competitive Scenario

13.9.1 Product Launches

13.9.2 Deals

13.9.3 Expansions

13.2 Key Player Strategies/Right to Win

13.3 Market Share Analysis, 2024

13.4 Revenue Analysis

13.5 Company Evaluation Matrix: Key Players, 2024

13.5.1 Stars

13.5.2 Emerging Leaders

13.5.3 Pervasive Players

13.5.4 Participants

13.5.5 Company Footprint: Key Players, 2024

13.5.5.1 Company Footprint

13.5.5.2 Region Footprint

13.5.5.3 Application Footprint

13.6 Company Evaluation Matrix: Startups/SMEs, 2024

13.6.1 Progressive Companies

13.6.2 Responsive Companies

13.6.3 Dynamic Companies

13.6.4 Starting Blocks

13.6.5 Competitive Benchmarking: Startups/SMEs, 2024

13.6.5.1 Detailed List of Key Startups/SMEs

13.6.5.2 Competitive Benchmarking of Key Startups/SMEs

13.7 Product Comparison Analysis

13.8 Company Valuation and Financial Metrics

13.9 Competitive Scenario

13.9.1 Product Launches

13.9.2 Deals

13.9.3 Expansions

14 Company Profiles

14.1 Key Players

14.1.1 Henkel AG & Co. KGaA

14.1.1.1 Business Overview

14.1.1.2 Products Offered

14.1.1.3 Recent Developments

14.1.1.3.1 Product Launches

14.1.1.3.2 Deals

14.1.1.3.3 Expansions

14.1.1.4 Analyst's View

14.1.1.4.1 Right to Win

14.1.1.4.2 Strategic Choices

14.1.1.4.3 Weaknesses and Competitive Threats

14.1.2 H.B. Fuller Company

14.1.2.1 Business Overview

14.1.2.2 Products Offered

14.1.2.3 Recent Developments

14.1.2.3.1 Product Launches

14.1.2.3.2 Deals

14.1.2.3.3 Expansions

14.1.2.4 Analyst's View

14.1.2.4.1 Right to Win

14.1.2.4.2 Strategic Choices

14.1.2.4.3 Weaknesses and Competitive Threats

14.1.3 Sika AG

14.1.3.1 Business Overview

14.1.3.2 Products Offered

14.1.3.3 Recent Developments

14.1.3.3.1 Deals

14.1.3.3.2 Expansions

14.1.3.4 Analyst's View

14.1.3.4.1 Right to Win

14.1.3.4.2 Strategic Choices

14.1.3.4.3 Weaknesses and Competitive Threats

14.1.4 Arkema

14.1.4.1 Business Overview

14.1.4.2 Products Offered

14.1.4.3 Recent Developments

14.1.4.3.1 Product Launches

14.1.4.3.2 Deals

14.1.4.4 Analyst's View

14.1.4.4.1 Right to Win

14.1.4.4.2 Strategic Choices

14.1.4.4.3 Weaknesses and Competitive Threats

14.1.5 3M Company

14.1.5.1 Business Overview

14.1.5.2 Products Offered

14.1.5.3 Recent Developments

14.1.5.3.1 Product Launches

14.1.5.4 Analyst's View

14.1.5.4.1 Right to Win

14.1.5.4.2 Strategic Choices

14.1.5.4.3 Weaknesses and Competitive Threats

14.1.6 Huntsman Corporation

14.1.6.1 Business Overview

14.1.6.2 Products Offered

14.1.6.3 Recent Developments

14.1.6.3.1 Product Launches

14.1.6.3.2 Deals

14.1.6.3.3 Expansions

14.1.7 Dow Inc.

14.1.7.1 Business Overview

14.1.7.2 Products Offered

14.1.7.3 Recent Developments

14.1.7.3.1 Product Launches

14.1.7.3.2 Expansions

14.1.8 Avery Dennison Corporation

14.1.8.1 Business Overview

14.1.8.2 Products Offered

14.1.8.3 Recent Developments

14.1.8.3.1 Product Launches

14.1.8.3.2 Expansions

14.1.9 Wacker Chemie AG

14.1.9.1 Business Overview

14.1.9.2 Products/Solutions/Services Offered

14.1.9.3 Recent Developments

14.1.9.3.1 Product Launches

14.1.9.3.2 Expansions

14.1.10 Illinois Tool Works Inc.

14.1.10.1 Business Overview

14.1.10.2 Products Offered

14.1.10.3 Recent Developments

14.1.10.3.1 Product Launches

14.1.10.3.2 Deals

14.2 Other Players

14.2.1 AkzoNobel N.V.

14.2.2 Ppg Industries, Inc.

14.2.3 Parker Hannifin Corp

14.2.4 Adhesives Research, Inc.

14.2.5 Delo Industrie Klebstoffe GmbH & Co. KGaA

14.2.6 Dymax

14.2.7 Mapei S.P.A.

14.2.8 Meridian Adhesives Group

14.2.9 Master Bond Inc.

14.2.10 Soudal Group

14.2.11 Pidilite Industries Ltd.

14.2.12 Jowat SE

14.2.13 Franklin International

14.2.14 Astral Adhesives

14.2.15 Dic Corporation

14.1.1 Henkel AG & Co. KGaA

14.1.1.1 Business Overview

14.1.1.2 Products Offered

14.1.1.3 Recent Developments

14.1.1.3.1 Product Launches

14.1.1.3.2 Deals

14.1.1.3.3 Expansions

14.1.1.4 Analyst's View

14.1.1.4.1 Right to Win

14.1.1.4.2 Strategic Choices

14.1.1.4.3 Weaknesses and Competitive Threats

14.1.2 H.B. Fuller Company

14.1.2.1 Business Overview

14.1.2.2 Products Offered

14.1.2.3 Recent Developments

14.1.2.3.1 Product Launches

14.1.2.3.2 Deals

14.1.2.3.3 Expansions

14.1.2.4 Analyst's View

14.1.2.4.1 Right to Win

14.1.2.4.2 Strategic Choices

14.1.2.4.3 Weaknesses and Competitive Threats

14.1.3 Sika AG

14.1.3.1 Business Overview

14.1.3.2 Products Offered

14.1.3.3 Recent Developments

14.1.3.3.1 Deals

14.1.3.3.2 Expansions

14.1.3.4 Analyst's View

14.1.3.4.1 Right to Win

14.1.3.4.2 Strategic Choices

14.1.3.4.3 Weaknesses and Competitive Threats

14.1.4 Arkema

14.1.4.1 Business Overview

14.1.4.2 Products Offered

14.1.4.3 Recent Developments

14.1.4.3.1 Product Launches

14.1.4.3.2 Deals

14.1.4.4 Analyst's View

14.1.4.4.1 Right to Win

14.1.4.4.2 Strategic Choices

14.1.4.4.3 Weaknesses and Competitive Threats

14.1.5 3M Company

14.1.5.1 Business Overview

14.1.5.2 Products Offered

14.1.5.3 Recent Developments

14.1.5.3.1 Product Launches

14.1.5.4 Analyst's View

14.1.5.4.1 Right to Win

14.1.5.4.2 Strategic Choices

14.1.5.4.3 Weaknesses and Competitive Threats

14.1.6 Huntsman Corporation

14.1.6.1 Business Overview

14.1.6.2 Products Offered

14.1.6.3 Recent Developments

14.1.6.3.1 Product Launches

14.1.6.3.2 Deals

14.1.6.3.3 Expansions

14.1.7 Dow Inc.

14.1.7.1 Business Overview

14.1.7.2 Products Offered

14.1.7.3 Recent Developments

14.1.7.3.1 Product Launches

14.1.7.3.2 Expansions

14.1.8 Avery Dennison Corporation

14.1.8.1 Business Overview

14.1.8.2 Products Offered

14.1.8.3 Recent Developments

14.1.8.3.1 Product Launches

14.1.8.3.2 Expansions

14.1.9 Wacker Chemie AG

14.1.9.1 Business Overview

14.1.9.2 Products/Solutions/Services Offered

14.1.9.3 Recent Developments

14.1.9.3.1 Product Launches

14.1.9.3.2 Expansions

14.1.10 Illinois Tool Works Inc.

14.1.10.1 Business Overview

14.1.10.2 Products Offered

14.1.10.3 Recent Developments

14.1.10.3.1 Product Launches

14.1.10.3.2 Deals

14.2 Other Players

14.2.1 AkzoNobel N.V.

14.2.2 Ppg Industries, Inc.

14.2.3 Parker Hannifin Corp

14.2.4 Adhesives Research, Inc.

14.2.5 Delo Industrie Klebstoffe GmbH & Co. KGaA

14.2.6 Dymax

14.2.7 Mapei S.P.A.

14.2.8 Meridian Adhesives Group

14.2.9 Master Bond Inc.

14.2.10 Soudal Group

14.2.11 Pidilite Industries Ltd.

14.2.12 Jowat SE

14.2.13 Franklin International

14.2.14 Astral Adhesives

14.2.15 Dic Corporation

15 Adjacent & Related Markets

15.1 Limitations

15.2 Construction Sealants Market

15.2.1 Market Definition

15.3 Market Overview

15.4 Construction Sealants Market, by Resin Type

15.4.1 Silicone

15.4.2 Polyurethane

15.4.3 Polysulfide

15.4.4 Others

15.5 Construction Sealants Market, by Application

15.5.1 Glazing

15.5.2 Flooring & Joining

15.5.3 Sanitary & Kitchen

15.5.4 Other Applications

15.6 Construction Sealants Market, by End-use Industry

15.6.1 Residential

15.6.2 Nonresidential

15.6.3 Commercial & Infrastructure

15.7 Construction Sealants Market, by Region

15.7.1 Asia-Pacific

15.7.2 North America

15.7.3 Europe

15.7.4 South America

15.7.5 Middle East & Africa

15.2 Construction Sealants Market

15.2.1 Market Definition

15.3 Market Overview

15.4 Construction Sealants Market, by Resin Type

15.4.1 Silicone

15.4.2 Polyurethane

15.4.3 Polysulfide

15.4.4 Others

15.5 Construction Sealants Market, by Application

15.5.1 Glazing

15.5.2 Flooring & Joining

15.5.3 Sanitary & Kitchen

15.5.4 Other Applications

15.6 Construction Sealants Market, by End-use Industry

15.6.1 Residential

15.6.2 Nonresidential

15.6.3 Commercial & Infrastructure

15.7 Construction Sealants Market, by Region

15.7.1 Asia-Pacific

15.7.2 North America

15.7.3 Europe

15.7.4 South America

15.7.5 Middle East & Africa

16 Appendix

16.1 Discussion Guide

16.2 Knowledgestore: The Subscription Portal

16.3 Customization Options

16.2 Knowledgestore: The Subscription Portal

16.3 Customization Options

List of Tables

Table 1 Adhesives & Sealants Market: Risk Assessment

Table 2 Adhesives & Sealants Market: Porter's Five Forces Analysis

Table 3 GDP Trends and Forecast of Major Economies, 2021-2030 (USD Billion)

Table 4 Construction Industry Spending of Top Economies, 2020-2024 (USD Billion)

Table 5 Adhesives & Sealants Market: Role in Ecosystem

Table 6 Investment and Funding Scenario

Table 7 Influence of Stakeholders on Buying Process for Top 3 Applications (%)

Table 8 Key Buying Criteria for Adhesives & Sealants

Table 9 Pricing Range of Adhesives for Top Applications, by Key Player, 2024 (USD/KG)

Table 10 Pricing Range of Sealants for Top Applications, by Key Player, 2024 (USD/KG)

Table 11 Pricing Trend of Adhesives, by Region, 2022-2030 (USD/KG)

Table 12 Pricing Trend of Sealants, by Region, 2022-2030 (USD/KG)

Table 13 Import Data Related to Adhesives & Sealants, by Region, 2020-2024 (USD Million)

Table 14 Export Data Related to Adhesives & Sealants, by Region, 2020-2024 (USD Million)

Table 15 Leeds Standards for Architectural Applications

Table 16 Leeds Standards for Specialty Applications

Table 17 Leeds Standards for Substrate-Specific Applications

Table 18 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 19 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 20 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 21 Adhesives & Sealants Market: Detailed List of Conferences & Events

Table 22 Patent Status: Patent Applications, Limited Patents, and Granted Patents, 2014-2024

Table 23 List of Major Patents Related to Polyurethane Adhesives, 2014-2024

Table 24 Patents by Mitsui Chemicals Inc

Table 25 US Adjusted Reciprocal Tariff Rates

Table 26 Adhesives & Sealants Market, by Type, 2020-2024 (USD Million)

Table 27 Adhesives & Sealants Market, by Type, 2025-2030 (USD Million)

Table 28 Adhesives & Sealants Market, by Type, 2020-2024 (Kiloton)

Table 29 Adhesives & Sealants Market, by Type, 2025-2030 (Kiloton)

Table 30 Adhesives Market, by Region, 2020-2024 (USD Million)

Table 31 Adhesives Market, by Region, 2025-2030 (USD Million)

Table 32 Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 33 Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 34 Sealants Market, by Region, 2020-2024 (USD Million)

Table 35 Sealants Market, by Region, 2025-2030 (USD Million)

Table 36 Sealants Market, by Region, 2020-2024 (Kiloton)

Table 37 Sealants Market, by Region, 2025-2030 (Kiloton)

Table 38 Adhesives Market, by Technology, 2020-2024 (USD Million)

Table 39 Adhesives Market, by Technology, 2025-2030 (USD Million)

Table 40 Adhesives Market, by Technology, 2020-2024 (Kiloton)

Table 41 Adhesives Market, by Technology, 2025-2030 (Kiloton)

Table 42 Water-based: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 43 Water-based: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 44 Water-based: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 45 Water-based: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 46 Water-based: Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 47 Water-based: Adhesives Market T, by Resin Type, 2025-2030 (USD Million)

Table 48 Water-based: Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 49 Water-based: Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 50 Pva Emulsion: Water-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 51 Pva Emulsion: Water-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 52 Pva Emulsion: Water-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 53 Pva Emulsion: Water-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 54 Acrylic Polymer Emulsion: Water-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 55 Acrylic Polymer Emulsion: Water-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 56 Acrylic Polymer Emulsion: Water-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 57 Acrylic Polymer Emulsion: Water-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 58 Vae Emulsion: Water-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 59 Vae Emulsion: Water-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 60 Vae Emulsion: Water-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 61 Vae Emulsion: Water-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 62 Sbc Latex: Water-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 63 Sbc Latex: Water-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 64 Sbc Latex: Water-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 65 Sbc Latex: Water-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 66 Other Resin Types: Water-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 67 Other Resin Types: Water-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 68 Other Resin Types: Water-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 69 Other Resin Types: Water-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 70 Solvent-based: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 71 Solvent-based: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 72 Solvent-based: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 73 Solvent-based: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 74 Solvent-based: Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 75 Solvent-based: Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 76 Solvent-based: Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 77 Solvent-based: Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 78 Polyurethane: Solvent-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 79 Polyurethane: Solvent-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 80 Polyurethane: Solvent-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 81 Polyurethane: Solvent-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 82 Acrylic: Solvent-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 83 Acrylic: Solvent-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 84 Acrylic: Solvent-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 85 Acrylic: Solvent-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 86 Chloroprene Rubber: Solvent-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 87 Chloroprene Rubber: Solvent-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 88 Chloroprene Rubber: Solvent-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 89 Chloroprene Rubber: Solvent-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 90 Polyvinyl Acetate: Solvent-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 91 Polyvinyl Acetate: Solvent-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 92 Polyvinyl Acetate: Solvent-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 93 Polyvinyl Acetate: Solvent-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 94 Polyamide: Solvent-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 95 Polyamide: Solvent-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 96 Polyamide: Solvent-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 97 Polyamide: Solvent-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 98 Synthesized Rubber: Solvent-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 99 Synthesized Rubber: Solvent-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 100 Synthesized Rubber: Solvent-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 101 Synthesized Rubber: Solvent-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 102 Other Resin Types: Solvent-based Adhesives Market, by Region, 2020-2024 (USD Million)

Table 103 Other Resin Types: Solvent-based Adhesives Market, by Region, 2025-2030 (USD Million)

Table 104 Other Resin Types: Solvent-based Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 105 Other Resin Types: Solvent-based Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 106 Hot-Melt: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 107 Hot-Melt: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 108 Hot-Melt: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 109 Hot-Melt: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 110 Hot-Melt: Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 111 Hot-Melt: Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 112 Hot-Melt: Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 113 Hot-Melt: Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 114 Ethylene-Vinyl Acetate: Holt-Melt Adhesives Market, by Region, 2020-2024 (USD Million)

Table 115 Ethylene-Vinyl Acetate: Holt-Melt Adhesives Market, by Region, 2025-2030 (USD Million)

Table 116 Ethylene-Vinyl Acetate: Holt-Melt Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 117 Ethylene-Vinyl Acetate: Holt-Melt Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 118 Styrenic Block Copolymer: Hot-Melt Adhesives Market, by Region, 2020-2024 (USD Million)

Table 119 Styrenic Block Copolymer: Hot-Melt Adhesives Market, by Region, 2025-2030 (USD Million)

Table 120 Styrenic Block Copolymer: Hot-Melt Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 121 Styrenic Block Copolymer: Hot-Melt Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 122 Metallocene Polyolefin: Hot-Melt Adhesives Market, by Region, 2020-2024 (USD Million)

Table 123 Metallocene Polyolefin: Hot-Melt Adhesives Market, by Region, 2025-2030 (USD Million)

Table 124 Metallocene Polyolefin: Hot-Melt Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 125 Metallocene Polyolefin: Hot-Melt Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 126 Polyolefin: Hot-Melt Adhesives Market, by Region, 2020-2024 (USD Million)

Table 127 Polyolefin: Hot-Melt Adhesives Market, by Region, 2025-2030 (USD Million)

Table 128 Polyolefin: Hot-Melt Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 129 Polyolefin: Hot-Melt Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 130 Amorphous Poly-Alphaolefin: Hot-Melt Adhesives Market, by Region, 2020-2024 (USD Million)

Table 131 Amorphous Poly-Alphaolefin: Hot-Melt Adhesives Market, by Region, 2025-2030 (USD Million)

Table 132 Amorphous Poly-Alphaolefin: Hot-Melt Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 133 Amorphous Poly-Alphaolefin: Hot-Melt Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 134 Other Resin Types: Hot-Melt Adhesives Market, by Region, 2020-2024 (USD Million)

Table 135 Other Resin Types: Hot-Melt Adhesives Market, by Region, 2025-2030 (USD Million)

Table 136 Other Resin Type: Hot-Melt Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 137 Other Resin Type: Hot-Melt Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 138 Reactive & Others: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 139 Reactive & Others: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 140 Reactive & Others: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 141 Reactive & Others: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 142 Reactive & Others: Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 143 Reactive & Others: Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 144 Reactive & Others: Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 145 Reactive & Others: Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 146 Polyurethane: Reactive & Other Adhesives Market, by Region, 2020-2024 (USD Million)

Table 147 Polyurethane: Reactive & Other Adhesives Market, by Region, 2025-2030 (USD Million)

Table 148 Polyurethane: Reactive & Other Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 149 Polyurethane: Reactive & Other Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 150 Epoxy: Reactive & Other Adhesives Market, by Region, 2020-2024 (USD Million)

Table 151 Epoxy: Reactive & Other Adhesives Market, by Region, 2025-2030 (USD Million)

Table 152 Epoxy: Reactive & Other Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 153 Epoxy: Reactive & Other Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 154 Applications of Cyanoacrylate Adhesives

Table 155 Applications of Anaerobic Adhesives

Table 156 Applications of Phenolic Resins in Various Adhesive Mixes

Table 157 Other Resin Types: Reactive & Other Adhesives Market, by Region, 2020-2024 (USD Million)

Table 158 Other Resin Types: Reactive & Other Adhesives Market, by Region, 2025-2030 (USD Million)

Table 159 Other Resin Types: Reactive & Other Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 160 Other Resin Types: Reactive & Other Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 161 Adhesives Market, by Application, 2020-2024 (USD Million)

Table 162 Adhesives Market, by Application, 2025-2030 (USD Million)

Table 163 Adhesives Market, by Application, 2020-2024 (Kiloton)

Table 164 Adhesives Market, by Application, 2025-2030 (Kiloton)

Table 165 Paper & Packaging: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 166 Paper & Packaging: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 167 Paper & Packaging: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 168 Paper & Packaging: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 169 Building & Construction: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 170 Building & Construction: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 171 Building & Construction: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 172 Building & Construction: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 173 Woodworking: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 174 Woodworking: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 175 Woodworking: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 176 Woodworking: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 177 Automotive & Transportation: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 178 Automotive & Transportation: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 179 Automotive & Transportation: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 180 Automotive & Transportation: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 181 Consumer & DIY: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 182 Consumer & DIY: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 183 Consumer & DIY: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 184 Consumer & DIY: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 185 Leather & Footwear: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 186 Leather & Footwear: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 187 Leather & Footwear: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 188 Leather & Footwear: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 189 Assembly: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 190 Assembly: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 191 Assembly: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 192 Assembly: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 193 Electronics: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 194 Electronics: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 195 Electronics: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 196 Electronics: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 197 Medical: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 198 Medical: Adhesives & Sealants Market, by Region, 2025-2030 (USD Million)

Table 199 Medical: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 200 Medical: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 201 Other Applications: Adhesives Market, by Region, 2020-2024 (USD Million)

Table 202 Other Applications: Adhesives Market, by Region, 2025-2030 (USD Million)

Table 203 Other Applications: Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 204 Other Applications: Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 205 Sealants Market, by Resin Type, 2020-2024 (USD Million)

Table 206 Sealants Market, by Resin Type, 2025-2030 (USD Million)

Table 207 Sealants Market, by Resin Type, 2020-2024 (Kiloton)

Table 208 Sealants Market, by Resin Type, 2025-2030 (Kiloton)

Table 209 Silicone: Sealants Market, by Region, 2020-2024 (USD Million)

Table 210 Silicone: Sealants Market, by Region, 2025-2030 (USD Million)

Table 211 Silicone: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 212 Silicone: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 213 Polyurethane: Sealants Market, by Region, 2020-2024 (USD Million)

Table 214 Polyurethane: Sealants Market, by Region, 2025-2030 (USD Million)

Table 215 Polyurethane: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 216 Polyurethane: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 217 Plastisol: Sealants Market, by Region, 2020-2024 (USD Million)

Table 218 Plastisol: Sealants Market, by Region, 2025-2030 (USD Million)

Table 219 Plastisol: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 220 Plastisol: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 221 Emulsion: Sealants Market, by Region, 2020-2024 (USD Million)

Table 222 Emulsion: Sealants Market, by Region, 2025-2030 (USD Million)

Table 223 Emulsion: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 224 Emulsion: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 225 Polysulfide: Sealants Market, by Region, 2020-2024 (USD Million)

Table 226 Polysulfide: Sealants Market, by Region, 2025-2030 (USD Million)

Table 227 Polysulfide: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 228 Polysulfide: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 229 Butyl: Sealants Market, by Region, 2020-2024 (USD Million)

Table 230 Butyl: Sealants Market, by Region, 2025-2030 (USD Million)

Table 231 Butyl: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 232 Butyl: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 233 Other Resin Types: Sealants Market, by Region, 2020-2024 (USD Million)

Table 234 Other Resin Types: Sealants Market, by Region, 2025-2030 (USD Million)

Table 235 Other Resin Types: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 236 Other Resin Types: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 237 Sealants Market, by Application, 2020-2024 (USD Million)

Table 238 Sealants Market, by Application, 2025-2030 (USD Million)

Table 239 Sealants Market, by Application, 2020-2024 (Kiloton)

Table 240 Sealants Market, by Application, 2025-2030 (Kiloton)

Table 241 Building & Construction: Sealants Market, by Region, 2020-2024 (USD Million)

Table 242 Building & Construction: Sealants Market, by Region, 2025-2030 (USD Million)

Table 243 Building & Construction: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 244 Building & Construction: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 245 Automotive & Transportation: Sealants Market, by Region, 2020-2024 (USD Million)

Table 246 Automotive & Transportation: Sealants Market, by Region, 2025-2030 (USD Million)

Table 247 Automotive & Transportation: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 248 Automotive & Transportation: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 249 Consumer: Sealants Market, by Region, 2020-2024 (USD Million)

Table 250 Consumer: Sealants Market, by Region, 2025-2030 (USD Million)

Table 251 Consumer: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 252 Consumer: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 253 Other Applications: Sealants Market, by Region, 2020-2024 (USD Million)

Table 254 Other Applications: Sealants Market, by Region, 2025-2030 (USD Million)

Table 255 Other Applications: Sealants Market, by Region, 2020-2024 (Kiloton)

Table 256 Other Applications: Sealants Market, by Region, 2025-2030 (Kiloton)

Table 257 Adhesives & Sealants Market, by Region, 2020-2024 (USD Million)

Table 258 Adhesives & Sealants Market, by Region, 2025-2030 (USD Million)

Table 259 Adhesives & Sealants Market, by Region, 2020-2024 (Kiloton)

Table 260 Adhesives & Sealants Market, by Region, 2025-2030 (Kiloton)

Table 261 Adhesives Market, by Region, 2020-2024 (USD Million)

Table 262 Adhesives Market, by Region, 2025-2030 (USD Million)

Table 263 Adhesives Market, by Region, 2020-2024 (Kiloton)

Table 264 Adhesives Market, by Region, 2025-2030 (Kiloton)

Table 265 Sealants Market, by Region, 2020-2024 (USD Million)

Table 266 Sealants Market, by Region, 2025-2030 (USD Million)

Table 267 Sealants Market, by Region, 2020-2024 (Kiloton)

Table 268 Sealants Market, by Region, 2025-2030 (Kiloton)

Table 269 North America: Adhesives & Sealants Market, by Type, 2020-2024 (USD Million)

Table 270 North America: Adhesives & Sealants Market, by Type, 2025-2030 (USD Million)

Table 271 North America: Adhesives & Sealants Market, by Type, 2020-2024 (Kiloton)

Table 272 North America: Adhesives & Sealants Market, by Type, 2025-2030 (Kiloton)

Table 273 North America: Adhesives Market, by Country, 2020-2024 (USD Million)

Table 274 North America: Adhesives Market, by Country, 2025-2030 (USD Million)

Table 275 North America: Adhesives Market, by Country, 2020-2024 (Kiloton)

Table 276 North America: Adhesives Market, by Country, 2025-2030 (Kiloton)

Table 277 North America: Sealants Market, by Country, 2020-2024 (USD Million)

Table 278 North America: Sealants Market, by Country, 2025-2030 (USD Million)

Table 279 North America: Sealants Market, by Country, 2020-2024 (Kiloton)

Table 280 North America: Sealants Market, by Country, 2025-2030 (Kiloton)

Table 281 North America: Adhesives Market, by Technology, 2020-2024 (USD Million)

Table 282 North America: Adhesives Market, by Technology, 2025-2030 (USD Million)

Table 283 North America: Adhesives Market, by Technology, 2020-2024 (Kiloton)

Table 284 North America: Adhesives Market, by Technology, 2025-2030 (Kiloton)

Table 285 North America: Water-based Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 286 North America: Water-based Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 287 North America: Water-based Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 288 North America: Water-based Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 289 North America: Solvent-based Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 290 North America: Solvent-based Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 291 North America: Solvent-based Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 292 North America: Solvent-based Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 293 North America: Hot-Melt Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 294 North America: Hot-Melt Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 295 North America: Hot-Melt Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 296 North America: Hot-Melt Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 297 North America: Reactive & Other Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 298 North America: Reactive & Other Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 299 North America: Reactive & Other Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 300 North America: Reactive & Other Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 301 North America: Adhesives Market, by Application, 2020-2024 (USD Million)

Table 302 North America: Adhesives Market, by Application, 2025-2030 (USD Million)

Table 303 North America: Adhesives Market, by Application, 2020-2024 (Kiloton)

Table 304 North America: Adhesives Market, by Application, 2025-2030 (Kiloton)

Table 305 North America: Sealants Market, by Resin Type, 2020-2024 (USD Million)

Table 306 North America: Sealants Market, by Resin Type, 2025-2030 (USD Million)

Table 307 North America: Sealants Market, by Resin Type, 2020-2024 (Kiloton)

Table 308 North America: Sealants Market, by Resin Type, 2025-2030 (Kiloton)

Table 309 North America: Sealants Market, by Application, 2020-2024 (USD Million)

Table 310 North America: Sealants Market, by Application, 2025-2030 (USD Million)

Table 311 North America: Sealants Market, by Application, 2020-2024 (Kiloton)

Table 312 North America: Sealants Market, by Application, 2025-2030 (Kiloton)

Table 313 Europe: Adhesives & Sealants Market, by Type, 2020-2024 (USD Million)

Table 314 Europe: Adhesives & Sealants Market, by Type, 2025-2030 (USD Million)

Table 315 Europe: Adhesives & Sealants Market, by Type, 2020-2024 (Kiloton)

Table 316 Europe: Adhesives & Sealants Market, by Type, 2025-2030 (Kiloton)

Table 317 Europe: Adhesives Market, by Country, 2020-2024 (USD Million)

Table 318 Europe: Adhesives Market, by Country, 2025-2030 (USD Million)

Table 319 Europe: Adhesives Market, by Country, 2020-2024 (Kiloton)

Table 320 Europe: Adhesives Market, by Country, 2025-2030 (Kiloton)

Table 321 Europe: Sealants Market, by Country, 2020-2024 (USD Million)

Table 322 Europe: Sealants Market, by Country, 2025-2030 (USD Million)

Table 323 Europe: Sealants Market, by Country, 2020-2024 (Kiloton)

Table 324 Europe: Sealants Market, by Country, 2025-2030 (Kiloton)

Table 325 Europe: Adhesives Market, by Technology, 2020-2024 (USD Million)

Table 326 Europe: Adhesives Market, by Technology, 2025-2030 (USD Million)

Table 327 Europe: Adhesives Market, by Technology, 2020-2024 (Kiloton)

Table 328 Europe: Adhesives Market, by Technology, 2025-2030 (Kiloton)

Table 329 Europe: Water-based Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 330 Europe: Water-based Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 331 Europe: Water-based Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 332 Europe: Water-based Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 333 Europe: Solvent-based Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 334 Europe: Solvent-based Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 335 Europe: Solvent-based Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 336 Europe: Solvent-based Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 337 Europe: Hot-Melt Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 338 Europe: Hot-Melt Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 339 Europe: Hot-Melt Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 340 Europe: Hot-Melt Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 341 Europe: Reactive & Other Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 342 Europe: Reactive & Other Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 343 Europe: Reactive & Other Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 344 Europe: Reactive & Other Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 345 Europe: Adhesives Market, by Application, 2020-2024 (USD Million)

Table 346 Europe: Adhesives Market, by Application, 2025-2030 (USD Million)

Table 347 Europe: Adhesives Market, by Application, 2020-2024 (Kiloton)

Table 348 Europe: Adhesives Market, by Application, 2025-2030 (Kiloton)

Table 349 Europe: Sealants Market, by Resin Type, 2020-2024 (USD Million)

Table 350 Europe: Sealants Market, by Resin Type, 2025-2030 (USD Million)

Table 351 Europe: Sealants Market, by Resin Type, 2020-2024 (Kiloton)

Table 352 Europe: Sealants Market, by Resin Type, 2025-2030 (Kiloton)

Table 353 Europe: Sealants Market, by Application, 2020-2024 (USD Million)

Table 354 Europe: Sealants Market, by Application, 2025-2030 (USD Million)

Table 355 Europe: Sealants Market, by Application, 2020-2024 (Kiloton)

Table 356 Europe: Sealants Market, by Application, 2025-2030 (Kiloton)

Table 357 Asia-Pacific: Adhesives & Sealants Market, by Type, 2020-2024 (USD Million)

Table 358 Asia-Pacific: Adhesives & Sealants Market, by Type, 2025-2030 (USD Million)

Table 359 Asia-Pacific: Adhesives & Sealants Market, by Type, 2020-2024 (Kiloton)

Table 360 Asia-Pacific: Adhesives & Sealants Market, by Type, 2025-2030 (Kiloton)

Table 361 Asia-Pacific: Adhesives Market, by Country, 2020-2024 (USD Million)

Table 362 Asia-Pacific: Adhesives Market, by Country, 2025-2030 (USD Million)

Table 363 Asia-Pacific: Adhesives Market, by Country, 2020-2024 (Kiloton)

Table 364 Asia-Pacific: Adhesives Market, by Country, 2025-2030 (Kiloton)

Table 365 Asia-Pacific: Sealants Market, by Country, 2020-2024 (USD Million)

Table 366 Asia-Pacific: Sealants Market, by Country, 2025-2030 (USD Million)

Table 367 Asia-Pacific: Sealants Market, by Country, 2020-2024 (Kiloton)

Table 368 Asia-Pacific: Sealants Market, by Country, 2025-2030 (Kiloton)

Table 369 Asia-Pacific: Adhesives Market, by Technology, 2020-2024 (USD Million)

Table 370 Asia-Pacific: Adhesives Market, by Technology, 2025-2030 (USD Million)

Table 371 Asia-Pacific: Adhesives Market, by Technology, 2020-2024 (Kiloton)

Table 372 Asia-Pacific: Adhesives Market, by Technology, 2025-2030 (Kiloton)

Table 373 Asia-Pacific: Water-based Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 374 Asia-Pacific: Water-based Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 375 Asia-Pacific: Water-based Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 376 Asia-Pacific: Water-based Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 377 Asia-Pacific: Solvent-based Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 378 Asia-Pacific: Solvent-based Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 379 Asia-Pacific: Solvent-based Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 380 Asia-Pacific: Solvent-based Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 381 Asia-Pacific: Hot-Melt Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 382 Asia-Pacific: Hot-Melt Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 383 Asia-Pacific: Hot-Melt Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 384 Asia-Pacific: Hot-Melt Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 385 Asia-Pacific: Reactive & Other Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 386 Asia-Pacific: Reactive & Other Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 387 Asia-Pacific: Reactive & Other Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 388 Asia-Pacific: Reactive & Other Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 389 Asia-Pacific: Adhesives Market, by Application, 2020-2024 (USD Million)

Table 390 Asia-Pacific: Adhesives Market, by Application, 2025-2030 (USD Million)

Table 391 Asia-Pacific: Adhesives Market, by Application, 2020-2024 (Kiloton)

Table 392 Asia-Pacific: Adhesives Market, by Application, 2025-2030 (Kiloton)

Table 393 Asia-Pacific: Sealants Market, by Resin Type, 2020-2024 (USD Million)

Table 394 Asia-Pacific: Sealants Market, by Resin Type, 2025-2030 (USD Million)

Table 395 Asia-Pacific: Sealants Market, by Resin Type, 2020-2024 (Kiloton)

Table 396 Asia-Pacific: Sealants Market, by Resin Type, 2025-2030 (Kiloton)

Table 397 Asia-Pacific: Sealants Market, by Application, 2020-2024 (USD Million)

Table 398 Asia-Pacific: Sealants Market, by Application, 2025-2030 (USD Million)

Table 399 Asia-Pacific: Sealants Market, by Application, 2020-2024 (Kiloton)

Table 400 Asia-Pacific: Sealants Market, by Application, 2025-2030 (Kiloton)

Table 401 South America: Adhesives & Sealants Market, by Type, 2020-2024 (USD Million)

Table 402 South America: Adhesives & Sealants Market, by Type, 2025-2030 (USD Million)

Table 403 South America: Adhesives & Sealants Market, by Type, 2020-2024 (Kiloton)

Table 404 South America: Adhesives & Sealants Market, by Type, 2025-2030 (Kiloton)

Table 405 South America: Adhesives Market, by Country, 2020-2024 (USD Million)

Table 406 South America: Adhesives Market, by Country, 2025-2030 (USD Million)

Table 407 South America: Adhesives Market, by Country, 2020-2024 (Kiloton)

Table 408 South America: Adhesives Market, by Country, 2025-2030 (Kiloton)

Table 409 South America: Sealants Market, by Country, 2020-2024 (USD Million)

Table 410 South America: Sealants Market, by Country, 2025-2030 (USD Million)

Table 411 South America: Sealants Market, by Country, 2020-2024 (Kiloton)

Table 412 South America: Sealants Market, by Country, 2025-2030 (Kiloton)

Table 413 South America: Adhesives Market, by Technology, 2020-2024 (USD Million)

Table 414 South America: Adhesives Market, by Technology, 2025-2030 (USD Million)

Table 415 South America: Adhesives Market, by Technology, 2020-2024 (Kiloton)

Table 416 South America: Adhesives Market, by Technology, 2025-2030 (Kiloton)

Table 417 South America: Water-based Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 418 South America: Water-based Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 419 South America: Water-based Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 420 South America: Water-based Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 421 South America: Solvent-based Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 422 South America: Solvent-based Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 423 South America: Solvent-based Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 424 South America: Solvent-based Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 425 South America: Hot-Melt Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 426 South America: Hot-Melt Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 427 South America: Hot-Melt Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 428 South America: Hot-Melt Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 429 South America: Reactive & Other Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 430 South America: Reactive & Other Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 431 South America: Reactive & Other Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 432 South America: Reactive & Other Adhesives Market, by Resin Type, 2025-2030 (Kiloton)

Table 433 South America: Adhesives Market, by Application, 2020-2024 (USD Million)

Table 434 South America: Adhesives Market, by Application, 2025-2030 (USD Million)

Table 435 South America: Adhesives Market, by Application, 2020-2024 (Kiloton)

Table 436 South America: Adhesives Market, by Application, 2025-2030 (Kiloton)

Table 437 South America: Sealants Market, by Resin Type, 2020-2024 (USD Million)

Table 438 South America: Sealants Market, by Resin Type, 2025-2030 (USD Million)

Table 439 South America: Sealants Market, by Resin Type, 2020-2024 (Kiloton)

Table 440 South America: Sealants Market, by Resin Type, 2025-2030 (Kiloton)

Table 441 South America: Sealants Market, by Application, 2020-2024 (USD Million)

Table 442 South America: Sealants Market, by Application, 2025-2030 (USD Million)

Table 443 South America: Sealants Market, by Application, 2020-2024 (Kiloton)

Table 444 South America: Sealants Market, by Application, 2025-2030 (Kiloton)

Table 445 Middle East & Africa: Adhesives & Sealants Market, by Type, 2020-2024 (USD Million)

Table 446 Middle East & Africa: Adhesives & Sealants Market, by Type, 2025-2030 (USD Million)

Table 447 Middle East & Africa: Adhesives & Sealants Market, by Type, 2020-2024 (Kiloton)

Table 448 Middle East & Africa: Adhesives & Sealants Market, by Type, 2025-2030 (Kiloton)

Table 449 Middle East & Africa: Adhesives Market, by Country, 2020-2024 (USD Million)

Table 450 Middle East & Africa: Adhesives Market, by Country, 2025-2030 (USD Million)

Table 451 Middle East & Africa: Adhesives Market, by Country, 2020-2024 (Kiloton)

Table 452 Middle East & Africa: Adhesives Market, by Country, 2025-2030 (Kiloton)

Table 453 Middle East & Africa: Sealants Market, by Country, 2020-2024 (USD Million)

Table 454 Middle East & Africa: Sealants Market, by Country, 2025-2030 (USD Million)

Table 455 Middle East & Africa: Sealants Market, by Country, 2020-2024 (Kiloton)

Table 456 Middle East & Africa: Sealants Market, by Country, 2025-2030 (Kiloton)

Table 457 Middle East & Africa: Adhesives Market, by Technology, 2020-2024 (USD Million)

Table 458 Middle East & Africa: Adhesives Market, by Technology, 2025-2030 (USD Million)

Table 459 Middle East & Africa: Adhesives Market, by Technology, 2020-2024 (Kiloton)

Table 460 Middle East & Africa: Adhesives Market, by Technology, 2025-2030 (Kiloton)

Table 461 Middle East & Africa: Water-based Adhesives Market, by Resin Type, 2020-2024 (USD Million)

Table 462 Middle East & Africa: Water-based Adhesives Market, by Resin Type, 2025-2030 (USD Million)

Table 463 Middle East & Africa: Water-based Adhesives Market, by Resin Type, 2020-2024 (Kiloton)

Table 464 Middle East & Africa: Water-based Adhesives Market, by Resin Type, 2025-2030 (Kiloton)