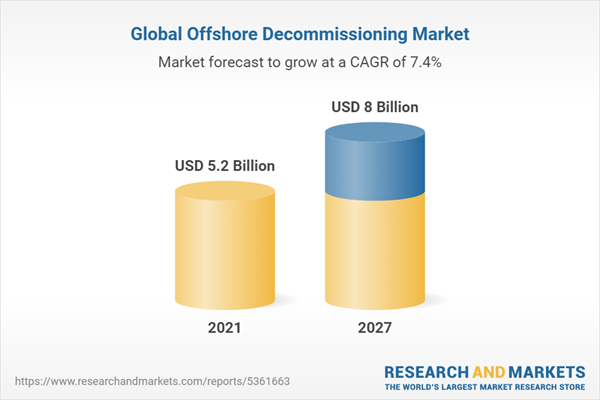

The global offshore decommissioning market is projected to reach USD 8 billion by 2027 from an estimated USD 5.2 billion in 2021, at a CAGR of 7.4% during the forecast period.

The factors driving the market include maturing oil & gas fields, low crude oil prices, and aging offshore infrastructure. Offshore decommissioning refers to ending oil & gas operations on offshore platforms and restoring marine life and seafloor to its pre-production conditions.

Well plugging & abandonment segment dominates the global market

The well plugging & abandonment segment is expected to be the largest market, by service type during the forecast period. This growth is evident owing to key activity to be performed regardless of decommissioning type; it ensures that oil wells do not have any type of leakage after the cessation of production. According to norms and regulations, wells that are matured and no longer productive need to be properly plugged & abandoned. It is essential to plug the wells before platform removal to prevent any kind of leakages, which can pollute the seafloor and damage the surrounding marine environment.

Complete removal dominate the global offshore decommissioning market

The complete removal segment of offshore decommissioning is estimated to be the largest market during the forecast period. Complete removal involves restoring the oilfield site to its natural or pre-commissioning state. It is an expensive decommissioning option for both operating companies and taxpayers. In the North Sea, a complete removal is currently required by the Convention for the Protection of the Marine Environment of the North-East Atlantic, or the ‘OSPAR’ agreement.

Europe to lead the global offshore decommissioning market in terms of growth rate

Europe is the largest market, by value, for offshore decommissioning, followed by North America. Owing to mature oil and gas fields, particularly in the UK and the North Sea. The impending cessation of production in major oil and gas fields would ensure that the European market would grow at the highest pace. Europe is estimated to witness the highest offshore decommissioning spending, with its well-developed regulatory framework compared to other regions.

Research Coverage

The report defines, describes, and forecasts the offshore decommissioning market, by service, structure, depth, removal, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include the analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the offshore decommissioning market.

The global offshore decommissioning market is dominated by leading players that have an extensive regional presence. The leading players in the offshore decommissioning industry are Heerema Marine Contractors (The Netherlands), Royal Boskalis Westminster N.V. (The Netherlands), Petrofac (Jersey), Oceaneering International (US), Baker Hughes Company (US), Halliburton (US), and Schlumberger (US).

Breakdown of Primaries

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects.

The distribution of primary interviews is as follows:

- By Company Type: Tier I - 55%, Tier II - 25%, and Tier III - 20%

- By Designation: C-Level - 35%, Director Level - 30%, and Others - 35%

- By Region: North America - 20%, Europe - 30%, Asia-Pacific - 25%, Middle East & Africa - 15%, and South America - 10%

Note: Others includes sales managers, marketing managers, product managers, and product engineers

The tier of the companies is defined on the basis of their total revenue as of 2017; Tier 1: USD 1 billion, Tier 2: from USD 1 billion to USD 500 million, and Tier 3: <USD 500 million.

Key Benefits of Buying the Report

- The report identifies and addresses the key markets for offshore decommissioning, which would help service providers review the growth in demand.

- The report helps service providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and help them in making better strategic decisions.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Definition

1.2.1 Offshore Decommissioning Market, by Depth: Inclusions & Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Geographical Scope

1.4 Years Considered

1.5 Currency

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 1 Offshore Decommissioning Market: Research Design

2.2 Market Breakdown & Data Triangulation

Figure 2 Data Triangulation Methodology

2.2.1 Secondary Data

2.2.2 Primary Data

2.2.2.1 Key Industry Insights

2.2.2.2 Breakdown of Primaries

Figure 3 Breakdown of Primary Interviews: by Company Type, Designation, & Region

2.3 Impact of COVID-19 on Oil & Gas Industry

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

2.4.2 Top-Down Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

2.5 Demand-Side Metrics

Figure 6 Main Metrics Considered while Constructing and Assessing Demand for Offshore Decommissioning

Table 1 Number of Decommissioning Approvals and Project Costs are Determining Factors for Global Offshore Decommissioning Market

Figure 7 Market Size Estimation: Demand-Side Metrics Approach

2.5.1 Research Assumptions for Demand-Side Metrics

2.6 Supply-Side Analysis

Figure 8 Key Steps Considered for Assessing Supply of Offshore Decommissioning Services

Figure 9 Offshore Decommissioning Market: Supply-Side Analysis, 2020

2.6.1 Calculations for Supply Side

2.6.2 Assumptions for Supply Side

2.6.2.1 Key Primary Insights for Supply Side

2.7 Forecast

3 Executive Summary

Table 2 Offshore Decommissioning Market Snapshot

Figure 10 Europe Dominated Offshore Decommissioning Market (by Value) in 2020

Figure 11 Well Plugging & Abandonment Segment is Expected to Hold Largest Share of Offshore Decommissioning Market, by Service, During Forecast Period

Figure 12 Topsides Segment is Expected to Hold Largest Share of Offshore Decommissioning Market, by Structure, During Forecast Period

Figure 13 Shallow Water Segment is Expected to Lead Offshore Decommissioning Market, by Depth, During Forecast Period

Figure 14 Complete Removal Segment is Expected to Lead Offshore Decommissioning Market, by Removal, During Forecast Period

4 Premium Insights

4.1 Attractive Opportunities in Offshore Decommissioning Market

Figure 15 Maturing Oil & Gas Fields, and Low Crude Oil Prices to Drive Growth of Offshore Decommissioning Market, 2021-2027

4.2 Offshore Decommissioning Market, by Region

Figure 16 Offshore Decommissioning Market in Asia-Pacific to Grow at Highest CAGR During Forecast Period

4.3 Offshore Decommissioning Market, by Service

Figure 17 Well Plugging & Abandonment Segment Dominated Offshore Decommissioning Market in 2020

4.4 Offshore Decommissioning Market, by Structure

Figure 18 Topsides Segment Dominated Offshore Decommissioning Market, by Structure, in 2020

4.5 Offshore Decommissioning Market, by Depth

Figure 19 Shallow Water Segment Dominated Offshore Decommissioning Market in 2020

4.6 Offshore Decommissioning Market, by Removal

Figure 20 Complete Removal Dominated Offshore Decommissioning Market, by Removal, in 2020

4.7 Offshore Decommissioning Market in Europe, by Structure & Country

Figure 21 Topsides and UK Were Largest Shareholders in Offshore Decommissioning Market in Europe, by Structure and Country, in 2020

5 Market Overview

5.1 Introduction

5.2 COVID-19 Health Assessment

Figure 22 COVID-19 Global Propagation

Figure 23 COVID-19 Propagation in Selected Countries

5.3 Road to Recovery

Figure 24 Recovery Road for 2020 & 2021

5.4 COVID-19 Economic Assessment

Figure 25 Revised GDP Forecasts for Select G20 Countries in 2020

5.5 Market Dynamics

Figure 26 Offshore Decommissioning Market: Drivers, Restraints, Opportunities, and Challenges

5.5.1 Drivers

5.5.1.1 Growing Number of Abandoned Wells and Presence of Large Mature Offshore Oilfields Worldwide

Figure 27 Well Decommissioning Activities in North Sea, 2020 to 2029

Figure 28 Decline Rates of Mature Non-OPEC Fields, 2000-2019

5.5.1.2 Fluctuations in Oil Prices Boost Offshore Decommissioning Activities

Figure 29 West Texas Intermediate (WTI) Crude Oil Prices, January 2018-March 2021

5.5.2 Restraints

5.5.2.1 High Cost Associated with Offshore Decommissioning Processes

5.5.2.2 Lack of Skilled Workers in Developing Countries

5.5.2.3 Environmental Concerns Associated with Offshore Decommissioning

5.5.3 Opportunities

5.5.3.1 Aging Offshore Infrastructures, Especially in North Sea and Gulf of Mexico

Figure 30 Annual Average Decommissioning Need for Offshore Oil and Gas Assets, by Region, 2000-2040

5.5.3.2 Deepwater Discovery and Development in Offshore Areas

5.5.4 Challenges

5.5.4.1 Growing Adoption of Technologies to Increase Production from Mature Fields

5.5.4.2 Impact of COVID-19 on Offshore Decommissioning Spending

5.6 Trends/Disruptions Impacting Customers’ Businesses

5.6.1 Revenue Shift and New Revenue Pockets in Offshore Decommissioning Market

Figure 31 Revenue Shift of Offshore Decommissioning Providers

5.7 Supply Chain Overview

Figure 32 Offshore Decommissioning Market: Supply Chain

Table 3 Offshore Decommissioning Market: Supply Chain/Ecosystem

5.7.1 Key Influencers

5.7.1.1 EPC Companies

5.7.1.2 Service Providers

5.7.1.3 Operators

5.8 Market Map

Figure 33 Offshore Decommissioning Market Map

5.9 Technology Analysis

5.10 Patent Analysis

5.10.1 List of Major Patents

5.11 Offshore Decommissioning Market: Regulations

Table 4 Regulatory Landscape

5.12 Porter's Five Forces Analysis

Figure 34 Porter's Five Forces Analysis for Offshore Decommissioning Market

Table 5 Offshore Decommissioning Market: Porter's Five Forces Analysis

5.12.1 Threat of Substitutes

5.12.2 Bargaining Power of Suppliers

5.12.3 Bargaining Power of Buyers

5.12.4 Threat of New Entrants

5.12.5 Intensity of Competitive Rivalry

5.13 Case Study Analysis

5.13.1 Oceaneering Provided Decommissioning Support for Field Redevelopment in Persian Gulf

6 Offshore Decommissioning Market, by Service Type

6.1 Introduction

Figure 35 Offshore Decommissioning Market, by Service, 2020

Table 6 Offshore Decommissioning Market, by Service Type, 2017-2019 (USD Million)

Table 7 Offshore Decommissioning Market, by Service Type, 2020-2027 (USD Million)

6.2 Project Management, Engineering, and Planning

6.2.1 Project Management, Engineering, and Planning Phase of Decommissioning Can Start as Early as 2-3 Years Prior to Cessation of Production

Table 8 Offshore Decommissioning Market for Project Management, Engineering, and Planning, by Region, 2017-2019 (USD Million)

Table 9 Offshore Decommissioning Market for Project Management, Engineering, and Planning, by Region, 2020-2027 (USD Million)

6.3 Permitting & Regulatory Compliance

6.3.1 Middle East & Africa is Among Fastest Markets in Following Regulatory Compliance

Table 10 Offshore Decommissioning Market for Permitting & Regulatory Compliance, by Region, 2017-2019 (USD Million)

Table 11 Offshore Decommissioning Market for Permitting & Regulatory Compliance, by Region, 2020-2027 (USD Million)

6.4 Platform Preparation

6.4.1 Platform Preparation Helps in Reducing Offshore Decommissioning Costs and Time

Table 12 Offshore Decommissioning Market for Platform Preparation, by Region, 2017-2019 (USD Million)

Table 13 Offshore Decommissioning Market for Platform Preparation, by Region, 2020-2027 (USD Million)

6.5 Well Plugging & Abandonment

6.5.1 Increasing Investments in Well Plugging & Abandonment are Driving Market

Table 14 Offshore Decommissioning Market for Well Plugging & Abandonment, by Region, 2017-2019 (USD Million)

Table 15 Offshore Decommissioning Market for Well Plugging & Abandonment, by Region, 2020-2027 (USD Million)

6.6 Conductor Removal

6.6.1 Growing Emphasis on Safety is Expected to Drive Market for Conductor Removal Segment During Forecast Period

Table 16 Offshore Decommissioning Market for Conductor Removal, by Region, 2017-2019 (USD Million)

Table 17 Offshore Decommissioning Market for Conductor Removal, by Region, 2020-2027 (USD Million)

6.7 Mobilization & Demobilization of Derrick Barges

6.7.1 Rising Need for Economical and Safe Transportation of Structures to Onshore Locations is Expected to Drive Market During Forecast Period 91

Table 18 Offshore Decommissioning Market for Mobilization & Demobilization of Derrick Barges, by Region, 2017-2019 (USD Million)

Table 19 Offshore Decommissioning Market for Mobilization & Demobilization of Derrick Barges, by Region, 2020-2027 (USD Million)

6.8 Platform Removal

6.8.1 North Sea and Gulf of Mexico are Home to Maximum Number of Platforms, Which are Ideal and Not Producing Any Type of Hydrocarbons and Eligible for Decommissioning

Table 20 Offshore Decommissioning Market for Platform Removal, by Region, 2017-2019 (USD Million)

Table 21 Offshore Decommissioning Market for Platform Removal, by Region, 2020-2027 (USD Million)

6.9 Pipeline & Power Cable Decommissioning

6.9.1 Ageing Offshore Infrastructures are Estimated to Drive Market for this Segment During Forecast Period

Table 22 Offshore Decommissioning Market for Pipeline & Power Cable Decommissioning, by Region, 2017-2019 (USD Million)

Table 23 Offshore Decommissioning Market for Pipeline & Power Cable Decommissioning, by Region, 2020-2027 (USD Million)

6.10 Material Disposal

6.10.1 Rising Need for Safe Disposal and Recycling of Structure is Expected to Propel Market Growth During Forecast Period

Table 24 Offshore Decommissioning Market for Material Disposal, by Region, 2017-2019 (USD Million)

Table 25 Offshore Decommissioning Market for Material Disposal, by Region, 2020-2027 (USD Million)

6.11 Site Clearance

6.11.1 Availability of Regulatory Framework Guides Operating Companies to Conduct Their Site Clearance in Environmentally Safe Manner

Table 26 Offshore Decommissioning Market for Site Clearance, by Region, 2017-2019 (USD Million)

Table 27 Offshore Decommissioning Market for Site Clearance, by Region, 2020-2027 (USD Million)

7 Offshore Decommissioning Market, by Structure

7.1 Introduction

Figure 36 Offshore Decommissioning Market, by Structure, 2020

Table 28 Offshore Decommissioning Market, by Structure, 2017-2019 (USD Million)

Table 29 Offshore Decommissioning Market, by Structure, 2020-2027 (USD Million)

7.2 Topsides

7.2.1 Growing Number of Projects & Investments for Topside Removal is Expected to Drive Market During Forecast Period

Table 30 Offshore Decommissioning Market for Topsides, by Region, 2017-2019 (USD Million)

Table 31 Offshore Decommissioning Market for Topsides, by Region, 2020-2027 (USD Million)

7.3 Substructure

7.3.1 Increasing Substructure Decommissioning Activities in North Sea are Driving Market During Forecast Period

Table 32 Offshore Decommissioning Market for Substructure, by Region, 2017-2019 (USD Million)

Table 33 Offshore Decommissioning Market for Substructure, by Region, 2020-2027 (USD Million)

7.4 Subsea Infrastructure

7.4.1 Aging Subsea Equipment and Infrastructure are Expected to Boost Market Growth

Table 34 Offshore Decommissioning Market for Subsea Infrastructure, by Region, 2017-2019 (USD Million)

Table 35 Offshore Decommissioning Market for Subsea Infrastructure, by Region, 2020-2027 (USD Million)

8 Offshore Decommissioning Market, by Depth

8.1 Introduction

Figure 37 Shallow Water Held Larger Share of Offshore Decommissioning Market, by Depth, in 2020

Table 36 Offshore Decommissioning Market Size, by Depth, 2017-2019 (USD Million)

Table 37 Offshore Decommissioning Market Size, by Depth, 2020-2027 (USD Million)

8.2 Shallow Water

8.2.1 Shallow Water Projects are 30-40 Years Old and Hence Need to be Decommissioned

Table 38 Offshore Decommissioning Market for Shallow Water, by Region, 2017-2019 (USD Million)

Table 39 Offshore Decommissioning Market for Shallow Water, by Region, 2020-2027 (USD Million)

8.3 Deepwater

8.3.1 Increasing Need to Decommission Abandoned Wells in Deepwater Areas is Driving Market

Table 40 Offshore Decommissioning Market for Deepwater, by Region, 2017-2019 (USD Million)

Table 41 Offshore Decommissioning Market for Deepwater, by Region, 2020-2027 (USD Million)

9 Offshore Decommissioning Market, by Removal

9.1 Introduction

Figure 38 Offshore Decommissioning Market, by Removal, 2020

Table 42 Offshore Decommissioning Market, by Removal, 2017-2019 (USD Million)

Table 43 Offshore Decommissioning Market, by Removal, 2020-2027 (USD Million)

9.2 Complete Removal

9.2.1 Safety Concerns Regarding Marine Life are Expected to Drive Market for Complete Removal Segment During Forecast Period

Table 44 Offshore Decommissioning Market for Complete Removal, by Region, 2017-2019 (USD Million)

Table 45 Offshore Decommissioning Market for Complete Removal, by Region, 2020-2027 (USD Million)

9.3 Partial Removal

9.3.1 Government Policies in US Gulf of Mexico are Driving Market for this Segment

Table 46 Partial Removal: Offshore Decommissioning Market, by Region, 2017-2019 (USD Million)

Table 47 Partial Removal: Offshore Decommissioning Market, by Region, 2020-2027 (USD Million)

9.4 Leave in Place

9.4.1 Leave in Place Removal Requires No Site Clearance and Provides Migratory Animal Habitat, Which is Estimated to Boost Market Growth for this Segment

Table 48 Offshore Decommissioning Market for Leave in Place, by Region, 2017-2019 (USD Million)

Table 49 Leave in Place: Offshore Decommissioning Market, by Region, 2020-2027 (USD Million)

10 Offshore Decommissioning Market, by Region

10.1 Introduction

Figure 39 Offshore Decommissioning Market in Asia-Pacific is Expected to Grow at Highest CAGR During Forecast Period

Figure 40 Europe Held Largest Share of Offshore Decommissioning Market, by Region, 2020

Table 50 Offshore Decommissioning Market, by Region, 2017-2019 (USD Million)

Table 51 Offshore Decommissioning Market, by Region, 2020-2027 (USD Million)

10.2 Europe

Figure 41 Europe: Regional Snapshot

10.2.1 By Service Type

Table 52 Offshore Decommissioning Market in Europe, by Service Type, 2017-2019 (USD Million)

Table 53 Offshore Decommissioning Market in Europe, by Service Type, 2020-2027 (USD Million)

10.2.2 By Structure

Table 54 Offshore Decommissioning Market in Europe, by Structure, 2017-2019 (USD Million)

Table 55 Offshore Decommissioning Market in Europe, by Structure, 2020-2027 (USD Million)

10.2.3 By Depth

Table 56 Offshore Decommissioning Market in Europe, by Depth, 2017-2019 (USD Million)

Table 57 Offshore Decommissioning Market in Europe, by Depth, 2020-2027 (USD Million)

10.2.4 By Removal

Table 58 Offshore Decommissioning Market in Europe, by Removal, 2017-2019 (USD Million)

Table 59 Offshore Decommissioning Market in Europe, by Removal, 2020-2027 (USD Million)

10.2.5 By Country

Table 60 Offshore Decommissioning Market in Europe, by Country, 2017-2019 (USD Million)

Table 61 Offshore Decommissioning Market in Europe, by Country, 2020-2027 (USD Million)

10.2.5.1 UK

10.2.5.1.1 Presence of Major Mature Offshore Oilfields and Government Policies such as Tax Refunds for Decommissioning of Its Oil & Gas Assets are Fostering Market Growth

Table 62 Offshore Decommissioning Market in UK, by Structure, 2017-2019 (USD Million)

Table 63 Offshore Decommissioning Market in UK, by Structure, 2020-2027 (USD Million)

Table 64 Offshore Decommissioning Market in UK, by Depth, 2017-2019 (USD Million)

Table 65 Offshore Decommissioning Market in UK, by Depth, 2020-2027 (USD Million)

Table 66 Offshore Decommissioning Market in UK, by Removal, 2017-2019 (USD Million)

Table 67 Offshore Decommissioning Market in UK, by Removal, 2020-2027 (USD Million)

10.2.5.2 Norway

10.2.5.2.1 Increasing Number of Mature Oilfields is Expected to Lead to Growth of Market

Table 68 Offshore Decommissioning Market in Norway, by Structure, 2017-2019 (USD Million)

Table 69 Offshore Decommissioning Market in Norway, by Structure, 2020-2027 (USD Million)

Table 70 Offshore Decommissioning Market in Norway, by Depth, 2017-2019 (USD Million)

Table 71 Offshore Decommissioning Market in Norway, by Depth, 2020-2027 (USD Million)

Table 72 Offshore Decommissioning Market in Norway, by Removal, 2017-2019 (USD Million)

Table 73 Offshore Decommissioning Market in Norway, by Removal, 2020-2027 (USD Million)

10.2.5.3 Netherlands

10.2.5.3.1 Most Old Structures and Platforms in Shallow Water Areas are Now Eligible for Decommissioning, Thereby Offering Opportunities for Market Growth

Table 74 Offshore Decommissioning Market in Netherlands, by Structure, 2017-2019 (USD Million)

Table 75 Offshore Decommissioning Market in Netherlands, by Structure, 2020-2027 (USD Million)

Table 76 Offshore Decommissioning Market in Netherlands, by Depth, 2017-2019 (USD Million)

Table 77 Offshore Decommissioning Market in Netherlands, by Depth, 2020-2027 (USD Million)

Table 78 Offshore Decommissioning Market in Netherlands, by Removal, 2017-2019 (USD Million)

Table 79 Offshore Decommissioning Market in Netherlands, by Removal, 2020-2027 (USD Million)

10.2.5.4 Rest of Europe

Table 80 Offshore Decommissioning Market in Rest of Europe, by Structure, 2017-2019 (USD Million)

Table 81 Offshore Decommissioning Market in Rest of Europe, by Structure, 2020-2027 (USD Million)

Table 82 Offshore Decommissioning Market in Rest of Europe, by Depth, 2017-2019 (USD Million)

Table 83 Offshore Decommissioning Market in Rest of Europe, by Depth, 2020-2027 (USD Million)

Table 84 Offshore Decommissioning Market in Rest of Europe, by Removal, 2017-2019 (USD Million)

Table 85 Offshore Decommissioning Market in Rest of Europe, by Removal, 2020-2027 (USD Million)

10.3 North America

Figure 42 North America: Regional Snapshot

10.3.1 By Service Type

Table 86 Offshore Decommissioning Market in North America, by Service Type, 2017-2019 (USD Million)

Table 87 Offshore Decommissioning Market in North America, by Service Type, 2020-2027 (USD Million)

10.3.2 By Structure

Table 88 Offshore Decommissioning Market in North America, by Structure, 2017-2019 (USD Million)

Table 89 Offshore Decommissioning Market in North America, by Structure, 2020-2027 (USD Million)

10.3.3 By Depth

Table 90 Offshore Decommissioning Market in North America, by Depth, 2017-2019 (USD Million)

Table 91 Offshore Decommissioning Market in North America, by Depth, 2020-2027 (USD Million)

10.3.4 By Removal

Table 92 Offshore Decommissioning Market in North America, by Removal, 2017-2019 (USD Million)

Table 93 Offshore Decommissioning Market in North America, by Removal, 2020-2027 (USD Million)

10.3.5 By Country

Table 94 Offshore Decommissioning Market in North America, by Country, 2017-2019 (USD Million)

Table 95 Offshore Decommissioning Market in North America, by Country, 2020-2027 (USD Million)

10.3.5.1 US

10.3.5.1.1 Presence of Large Number of Abandoned Wells, Which Need to be Decommissioned is Expected to Boost Market Growth

Table 96 Offshore Decommissioning Market in US, by Structure, 2017-2019 (USD Million)

Table 97 Offshore Decommissioning Market in US, by Structure, 2020-2027 (USD Million)

Table 98 Offshore Decommissioning Market in US, by Depth, 2017-2019 (USD Million)

Table 99 Offshore Decommissioning Market in US, by Depth, 2020-2027 (USD Million)

Table 100 Offshore Decommissioning Market in US, by Removal, 2017-2019 (USD Million)

Table 101 Offshore Decommissioning Market in US, by Removal, 2020-2027 (USD Million)

10.3.5.2 Canada

10.3.5.2.1 Support Polices for Offshore Decommissioning are Expected to Drive Market in Canada During Forecast Period

Table 102 Offshore Decommissioning Market in Canada, by Structure, 2017-2019 (USD Million)

Table 103 Offshore Decommissioning Market in Canada, by Structure, 2020-2027 (USD Million)

Table 104 Offshore Decommissioning Market in Canada, by Depth, 2017-2019 (USD Million)

Table 105 Offshore Decommissioning Market in Canada, by Depth, 2020-2027 (USD Million)

Table 106 Offshore Decommissioning Market in Canada, by Removal, 2017-2019 (USD Million)

Table 107 Offshore Decommissioning Market in Canada, by Removal, 2020-2027 (USD Million)

10.3.5.3 Mexico

10.3.5.3.1 Complete Removal of Aging Infrastructure Dominated Offshore Decommissioning Market in Mexico

Table 108 Offshore Decommissioning Market in Mexico, by Structure, 2017-2019 (USD Million)

Table 109 Offshore Decommissioning Market in Mexico, by Structure, 2020-2027 (USD Million)

Table 110 Offshore Decommissioning Market in Mexico, by Depth, 2017-2019 (USD Million)

Table 111 Offshore Decommissioning Market in Mexico, by Depth, 2020-2027 (USD Million)

Table 112 Offshore Decommissioning Market in Mexico, by Removal, 2017-2019 (USD Million)

Table 113 Offshore Decommissioning Market in Mexico, by Removal, 2020-2027 (USD Million)

10.4 South America

10.4.1 By Service Type

Table 114 Offshore Decommissioning Market in South America, by Service Type, 2017-2019 (USD Million)

Table 115 Offshore Decommissioning Market in South America, by Service Type, 2020-2027 (USD Million)

10.4.2 By Structure

Table 116 Offshore Decommissioning Market in South America, by Structure, 2017-2019 (USD Million)

Table 117 Offshore Decommissioning Market in South America, by Structure, 2020-2027 (USD Million)

10.4.3 By Depth

Table 118 Offshore Decommissioning Market in South America, by Depth, 2017-2019 (USD Million)

Table 119 Offshore Decommissioning Market in South America, by Depth, 2020-2027 (USD Million)

10.4.4 By Removal

Table 120 Offshore Decommissioning Market in South America, by Removal, 2017-2019 (USD Million)

Table 121 Offshore Decommissioning Market in South America, by Removal, 2020-2027 (USD Million)

10.4.5 By Country

Table 122 Offshore Decommissioning Market in South America, by Country, 2017-2019 (USD Million)

Table 123 Offshore Decommissioning Market in South America, by Country, 2020-2027 (USD Million)

10.4.5.1 Brazil

10.4.5.1.1 Increasing Investments and New Regulations are Driving Market in Brazil

Table 124 Offshore Decommissioning Market in Brazil, by Structure, 2017-2019 (USD Million)

Table 125 Offshore Decommissioning Market in Brazil, by Structure, 2020-2027 (USD Million)

Table 126 Offshore Decommissioning Market in Brazil, by Depth, 2017-2019 (USD Million)

Table 127 Offshore Decommissioning Market in Brazil, by Depth, 2020-2027 (USD Million)

Table 128 Offshore Decommissioning Market in Brazil, by Removal, 2017-2019 (USD Million)

Table 129 Offshore Decommissioning Market in Brazil, by Removal, 2020-2027 (USD Million)

10.4.5.2 Rest of South America

10.4.5.2.1 Low Crude Oil Prices Would Increase Demand for Offshore Decommissioning During Forecast Period

Table 130 Offshore Decommissioning Market in Rest of South America, by Structure, 2017-2019 (USD Million)

Table 131 Offshore Decommissioning Market in Rest of South America, by Structure, 2020-2027 (USD Million)

Table 132 Offshore Decommissioning Market in Rest of South America, by Depth, 2017-2019 (USD Million)

Table 133 Offshore Decommissioning Market in Rest of South America, by Depth, 2020-2027 (USD Million)

Table 134 Offshore Decommissioning Market in Rest of South America, by Removal, 2017-2019 (USD Million)

Table 135 Offshore Decommissioning Market in Rest of South America, by Removal, 2020-2027 (USD Million)

10.5 Middle East & Africa

10.5.1 By Service Type

Table 136 Offshore Decommissioning Market in Middle East & Africa, by Service Type, 2017-2019 (USD Million)

Table 137 Offshore Decommissioning Market in Middle East & Africa, by Service Type, 2020-2027 (USD Million)

10.5.2 By Structure

Table 138 Offshore Decommissioning Market in Middle East & Africa, by Structure, 2017-2019 (USD Million)

Table 139 Offshore Decommissioning Market in Middle East & Africa, by Structure, 2020-2027 (USD Million)

10.5.3 By Depth

Table 140 Offshore Decommissioning Market in Middle East & Africa, by Depth, 2017-2019 (USD Million)

Table 141 Offshore Decommissioning Market in Middle East & Africa, by Depth, 2020-2027 (USD Million)

10.5.4 By Removal

Table 142 Offshore Decommissioning Market in Middle East & Africa, by Removal, 2017-2019 (USD Million)

Table 143 Offshore Decommissioning Market in Middle East & Africa, by Removal, 2020-2027 (USD Million)

10.5.5 By Country

Table 144 Offshore Decommissioning Market in Middle East & Africa, by Country, 2017-2019 (USD Million)

Table 145 Offshore Decommissioning Market in Middle East & Africa, by Country, 2020-2027 (USD Million)

10.5.5.1 UAE

10.5.5.1.1 Increasing Number of Mature Oilfields in Shallow Water is Expected to Dominate Offshore Decommissioning Market in UAE

Table 146 Offshore Decommissioning Market in UAE, by Structure, 2017-2019 (USD Million)

Table 147 Offshore Decommissioning Market in UAE, by Structure, 2020-2027 (USD Million)

Table 148 Offshore Decommissioning Market in UAE, by Depth, 2017-2019 (USD Million)

Table 149 Offshore Decommissioning Market in UAE, by Depth, 2020-2027 (USD Million)

Table 150 Offshore Decommissioning Market in UAE, by Removal, 2017-2019 (USD Million)

Table 151 Offshore Decommissioning Market in UAE, by Removal, 2020-2027 (USD Million)

10.5.5.2 Angola

10.5.5.2.1 Implementation of New Regulations is Boosting Offshore Decommissioning Market in Angola

Table 152 Offshore Decommissioning Market in Angola, by Structure, 2017-2019 (USD Million)

Table 153 Offshore Decommissioning Market in Angola, by Structure, 2020-2027 (USD Million)

Table 154 Offshore Decommissioning Market in Angola, by Depth, 2017-2019 (USD Million)

Table 155 Offshore Decommissioning Market in Angola, by Depth, 2020-2027 (USD Million)

Table 156 Offshore Decommissioning Market in Angola, by Removal, 2017-2019 (USD Million)

Table 157 Offshore Decommissioning Market in Angola, by Removal, 2020-2027 (USD Million)

10.5.5.3 Saudi Arabia

10.5.5.3.1 Increasing Investments for Decommissioning Activities in Offshore Field

Table 158 Offshore Decommissioning Market in Saudi Arabia, by Structure, 2017-2019 (USD Million)

Table 159 Offshore Decommissioning Market in Saudi Arabia, by Structure, 2020-2027 (USD Million)

Table 160 Offshore Decommissioning Market in Saudi Arabia, by Depth, 2017-2019 (USD Million)

Table 161 Offshore Decommissioning Market in Saudi Arabia, by Depth, 2020-2027 (USD Million)

Table 162 Offshore Decommissioning Market in Saudi Arabia, by Removal, 2017-2019 (USD Million)

Table 163 Offshore Decommissioning Market in Saudi Arabia, by Removal, 2020-2027 (USD Million)

10.5.5.4 Rest of Middle East & Africa

Table 164 Offshore Decommissioning Market in Rest of Middle East & Africa, by Structure, 2017-2019 (USD Million)

Table 165 Offshore Decommissioning Market in Rest of Middle East & Africa, by Structure, 2020-2027 (USD Million)

Table 166 Offshore Decommissioning Market in Rest of Middle East & Africa, by Depth, 2017-2019 (USD Million)

Table 167 Offshore Decommissioning Market in Rest of Middle East & Africa, by Depth, 2020-2027 (USD Million)

Table 168 Offshore Decommissioning Market in Rest of Middle East & Africa, by Removal, 2017-2019 (USD Million)

Table 169 Offshore Decommissioning Market in Rest of Middle East & Africa, by Removal, 2020-2027 (USD Million)

10.6 Asia-Pacific

10.6.1 By Service Type

Table 170 Offshore Decommissioning Market in Asia-Pacific, by Service Type, 2017-2019 (USD Million)

Table 171 Offshore Decommissioning Market in Asia-Pacific, by Service Type, 2020-2027 (USD Million)

10.6.2 By Structure

Table 172 Offshore Decommissioning Market in Asia-Pacific, by Structure, 2017-2019 (USD Million)

Table 173 Offshore Decommissioning Market in Asia-Pacific, by Structure, 2020-2027 (USD Million)

10.6.3 By Depth

Table 174 Offshore Decommissioning Market in Asia-Pacific, by Depth, 2017-2019 (USD Million)

Table 175 Offshore Decommissioning Market in Asia-Pacific, by Depth, 2020-2027 (USD Million)

10.6.4 By Removal

Table 176 Offshore Decommissioning Market in Asia-Pacific, by Removal, 2017-2019 (USD Million)

Table 177 Offshore Decommissioning Market in Asia-Pacific, by Removal, 2020-2027 (USD Million)

10.6.5 By Country

Table 178 Offshore Decommissioning Market in Asia-Pacific, by Country, 2017-2019 (USD Million)

Table 179 Offshore Decommissioning Market in Asia-Pacific, by Country, 2020-2027 (USD Million)

10.6.5.1 China

10.6.5.1.1 Shallow Water Segment is Expected to Dominate Offshore Decommissioning Market in China

Table 180 Offshore Decommissioning Market in China, by Structure, 2017-2019 (USD Million)

Table 181 Offshore Decommissioning Market in China, by Structure, 2020-2027 (USD Million)

Table 182 Offshore Decommissioning Market in China, by Depth, 2017-2019 (USD Million)

Table 183 Offshore Decommissioning Market in China, by Depth, 2020-2027 (USD Million)

Table 184 Offshore Decommissioning Market in China, by Removal, 2017-2019 (USD Million)

Table 185 Offshore Decommissioning Market in China, by Removal, 2020-2027 (USD Million)

10.6.5.2 Indonesia

10.6.5.2.1 Declining Oil & Gas Production Over Past 10 Years from Aging Oilfields is Expected to Drive Market

Table 186 Offshore Decommissioning Market in Indonesia, by Structure, 2017-2019 (USD Million)

Table 187 Offshore Decommissioning Market in Indonesia, by Structure, 2020-2027 (USD Million)

Table 188 Offshore Decommissioning Market in Indonesia, by Depth, 2017-2019 (USD Million)

Table 189 Offshore Decommissioning Market in Indonesia, by Depth, 2020-2027 (USD Million)

Table 190 Offshore Decommissioning Market in Indonesia, by Removal, 2017-2019 (USD Million)

Table 191 Offshore Decommissioning Market in Indonesia, by Removal, 2020-2027 (USD Million)

10.6.5.3 Malaysia

10.6.5.3.1 Growing Number of Maturing Well and Decommissioning Activities in Malaysian Offshore Fields is Expected to Drive Market

Table 192 Offshore Decommissioning Market in Malaysia, by Structure, 2017-2019 (USD Million)

Table 193 Offshore Decommissioning Market in Malaysia, by Structure, 2020-2027 (USD Million)

Table 194 Offshore Decommissioning Market in Malaysia, by Depth, 2017-2019 (USD Million)

Table 195 Offshore Decommissioning Market in Malaysia, by Depth, 2020-2027 (USD Million)

Table 196 Offshore Decommissioning Market in Malaysia, by Removal, 2017-2019 (USD Million)

Table 197 Offshore Decommissioning Market in Malaysia, by Removal, 2020-2027 (USD Million)

10.6.5.4 Australia

10.6.5.4.1 Supporting Government Investments in Country are Expected to Drive Offshore Decommissioning Market During Forecast Period

Table 198 Offshore Decommissioning Market in Australia, by Structure, 2017-2019 (USD Million)

Table 199 Offshore Decommissioning Market in Australia, by Structure, 2020-2027 (USD Million)

Table 200 Offshore Decommissioning Market in Australia, by Depth, 2017-2019 (USD Million)

Table 201 Offshore Decommissioning Market in Australia, by Depth, 2020-2027 (USD Million)

Table 202 Offshore Decommissioning Market in Australia, by Removal, 2017-2019 (USD Million)

Table 203 Offshore Decommissioning Market in Australia, by Removal, 2020-2027 (USD Million)

10.6.5.5 Rest of Asia-Pacific

Table 204 Offshore Decommissioning Market in Rest of Asia-Pacific, by Structure, 2017-2019 (USD Million)

Table 205 Offshore Decommissioning Market in Rest of Asia-Pacific, by Structure, 2020-2027 (USD Million)

Table 206 Offshore Decommissioning Market in Rest of Asia-Pacific, by Depth, 2017-2019 (USD Million)

Table 207 Offshore Decommissioning Market in Rest of Asia-Pacific, by Depth, 2020-2027 (USD Million)

Table 208 Offshore Decommissioning Market in Rest of Asia-Pacific, by Removal, 2017-2019 (USD Million)

Table 209 Offshore Decommissioning Market in Rest of Asia-Pacific, by Removal, 2020-2027 (USD Million)

11 Competitive Landscape

11.1 Overview

Figure 43 Key Developments in Offshore Decommissioning Market, 2017 to 2021

11.2 Revenue Analysis of Top 6 Market Players

Figure 44 Top 6 Players Dominated Market in Last 5 Years

11.3 Share Analysis of Key Players, 2020

Table 210 Offshore Decommissioning Market: Degree of Competition

Figure 45 Share Analysis of Top Players in Offshore Decommissioning Market, 2020

11.4 Market Evaluation Framework

Table 211 Market Evaluation Framework, 2017-2021

11.5 Competitive Leadership Mapping

11.5.1 Star

11.5.2 Emerging Leader

11.5.3 Pervasive

11.5.4 Participant

Figure 46 Offshore Decommissioning Market: Competitive Leadership Mapping, 2020

11.6 Competitive Scenario and Trends

11.6.1 Deals

11.6.2 Offshore Decommissioning Market: Deals, 2017-2021

Table 212 Company Service Type Footprint

Table 213 Company Regional Footprint

12 Company Profiles

12.1 Key Companies

(Business Overview, Products Offered, Recent Developments, Analyst's View)*

12.1.1 Halliburton

Table 214 Halliburton: Business Overview

Figure 47 Halliburton: Company Snapshot

Table 215 Halliburton: Deals

12.1.2 Petrofac

Table 216 Petrofac: Business Overview

Figure 48 Petrofac: Company Snapshot

Table 217 Petrofac: Deals

12.1.3 Oceaneering International

Table 218 Oceaneering International: Business Overview

Figure 49 Oceaneering International: Company Snapshot

Table 219 Oceaneering International: Deals

Table 220 Oceaneering International: Others

12.1.4 Royal Boskalis Westminster N.V.

Table 221 Royal Boskalis Westminster N.V.: Business Overview

Figure 50 Royal Boskalis Westminster N.V.: Company Snapshot

Table 222 Royal Boskalis Westminster N.V.: Deals

12.1.5 Aker Solutions

Table 223 Aker Solutions: Business Overview

Figure 51 Aker Solutions: Company Snapshot

Table 224 Aker Solutions: Deals

Table 225 Aker Solutions: Others

12.1.6 Schlumberger

Table 226 Schlumberger: Business Overview

Figure 52 Schlumberger: Company Snapshot

Table 227 Schlumberger: Deals

12.1.7 Baker Hughes Company

Table 228 Baker Hughes Company: Business Overview

Figure 53 Baker Hughes Company: Company Snapshot

Table 229 Baker Hughes Company: Deals

12.1.8 TechnipFMC

Table 230 TechnipFMC: Business Overview

Figure 54 TechnipFMC: Company Snapshot

Table 231 TechnipFMC: Deals

12.1.9 Subsea 7

Table 232 Subsea 7: Business Overview

Figure 55 Subsea 7: Company Snapshot

Table 233 Subsea 7: Deals

12.1.10 Weatherford

Table 234 Weatherford: Business Overview

Figure 56 Weatherford: Company Snapshot

Table 235 Weatherford: Deals

12.1.11 Saipem

Table 236 Saipem: Business Overview

Figure 57 Saipem: Company Snapshot

Table 237 Saipem: Deals

12.1.12 John Wood Group plc

Table 238 John Wood Group plc: Business Overview

Figure 58 John Wood Group plc: Company Snapshot

Table 239 John Wood Group: Deals

12.1.13 AF Gruppen

Table 240 AF Gruppen: Business Overview

Figure 59 AF Gruppen: Company Snapshot

Table 241 AF Gruppen: Deals

12.1.14 Heerema Marine Contractors

Table 242 Heerema Marine Contractors: Business Overview

Table 243 Heerema Marine Contractors: Deals

12.1.15 Allseas Group

Table 244 Allseas Group: Business Overview

Table 245 Allseas Group: Deals

12.2 Other Companies

12.2.1 Deepocean Group

12.2.2 Acteon Group

12.2.3 Maersk Decom

12.2.4 Able UK

12.2.5 Mactech Offshore

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Analyst's View Might Not be Captured in Case of Unlisted Companies

13 Appendix

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: The Subscription Portal

13.4 Available Customizations

Companies Mentioned

- Able UK

- Acteon Group

- AF Gruppen

- Aker Solutions

- Allseas Group

- Baker Hughes Company

- Deepocean Group

- Halliburton

- Heerema Marine Contractors

- John Wood Group plc

- Mactech Offshore

- Maersk Decom

- Oceaneering International

- Petrofac

- Royal Boskalis Westminster N.V.

- Saipem

- Schlumberger

- Subsea 7

- TechnipFMC

- Weatherford

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | July 2021 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 8 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |