Rising Demand for Technologically Advanced Solutions

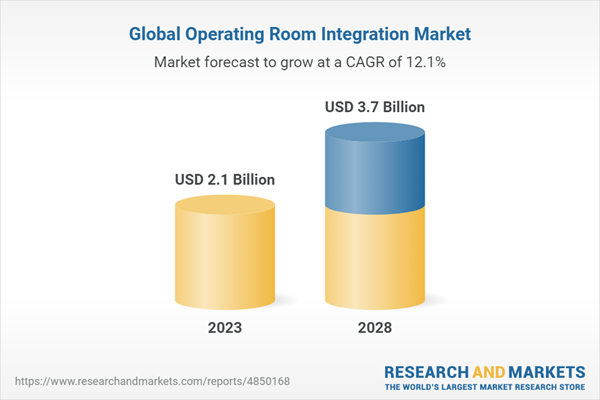

The global operating room integration in the healthcare market is projected to reach USD 3.7 Billion by 2028 from USD 2.1 Billion in 2023, at a high CAGR of 12.1% during the forecast period. OR integration systems are designed to streamline and optimize the surgical workflow. By integrating various devices and systems, these solutions eliminate the need for manual data entry, reduce equipment setup time, and enable seamless communication and coordination among surgical team members. Improved workflow efficiency leads to time savings, reduced errors, and enhanced overall productivity in the operating room. The gradual shift towards predictable outcomes and care quality has supported the greater implementation of various IT systems in healthcare organizations.

The Software segment registered the highest CAGR during the forecast period, by deployment

Software is projected to register at the highest growth rate in the operating room integration market in 2022. The advent of complex software and the increasing focus on healthcare system integration is expected to drive the demand for operating room integration services in the near future. Additionally, OR integration software offers many benefits, including workflow optimization, device integration, real-time data visualization, communication and collaboration, image and video management, documentation and reporting, Support for training and education, EHR integration, enhanced patient safety, and scalability. It improves efficiency, collaboration, and patient outcomes within the operating room environment

Ambulatory Surgical Centers & clinics is the fastest growing end-user segment in the operating room integration market in 2022

Based on the end user, the operating room integration market is into hospitals and ambulatory surgical centers & clinics. In 2022, the ambulatory surgical centers & clinics segment exhibited the fastest growth in the global operating room integration market. The growth of this segment can be attributed to factors such as potential cost reductions, the growing patient population, and the rising demand for better quality of care among patients.

APAC to witness the highest growth rate during the forecast period

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Market growth in the APAC region is mainly driven by factors such as the growing prevalence of chronic diseases, the rising adoption of advanced surgical treatment methodologies, the ongoing expansion of the healthcare infrastructure, and the growing market availability of advanced surgical technologies. While the level of OR integration varies across Asia-pacific countries, the overall trend is towards adopting and leveraging these systems to improve surgical practices and enhance patient care. The increasing focus on technology, patient safety, and quality improvement, combined with technological advancements in medical devices and government initiatives, continues to drive the adoption of OR integration in Asia

The break-down of primary participants is as mentioned below:

- By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation: C-level - 42%, Director-level - 31%, and Others - 27%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 26%, Middle East & Africa - 5%, Latin America - 5%

Key Players in the Operating room integration Market

The key players functioning in the operating room integration market include Stryker Corporation (US), STERIS Plc (US), KARL STORZ SE & Co. KG (Germany), Olympus Corporation (Japan), Getinge AB (Sweden), ALVO Medical (Poland), SKYTRON, LLC (US), Merivaara (Finland), Brainlab AG (Germany), TRILUX GmbH & Co. KG (a subsidiary of Mizuho OSI) (Germany), Caresyntax (Germany), Sony Group Corporation (Japan), Barco (Belgium), Arthrex, Inc. (US), Richard Wolf GmbH (Germany), FUJIFILM Holdings Corporation (Japan), Ditec Medical (Spain), Doricon Medical Systems (US), HILL-ROM HOLDINGS, Inc. (Baxter) (US), EIZO GmbH (Germany), OPExPARK, Inc. (Japan), ISIS-SURGIMEDIA (France), MEDITEK (Canada), Zimmer Biomet (US), and Dragerwerk AG & Co. KGaA (Germany).

Research Coverage:

The report analyzes the operating room integration Market. It aims to estimate the market size and future growth potential of various market segments based on components, device type, application, end-user, and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers (Rising demand for technologically advanced solutions, the growing number of surgical procedures worldwide, rising funding initiatives for the improvement of HCIT infrastructure, Increasing emphasis on cost control in hospitals), restraints (interoperability issues and high implementation costs), opportunities (technological advancements in hospitals, Growth opportunities in emerging economies), and challenges (Shortage of skilled surgeons in integrated operating rooms, consolidation of healthcare providers) influencing the growth of the operating room integration market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the operating room integration market.

- Market Development: Comprehensive information on the lucrative emerging markets, component, device type, application, end-user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the operating room integration market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the operating room integration market like Stryker Corporation (US), STERIS Plc (US), KARL STORZ SE & Co. KG (Germany), Olympus Corporation (Japan),

Table of Contents

Executive Summary

Companies Mentioned

- Alvo Medical

- Arthrex, Inc.

- Barco

- Brainlab Ag

- Caresyntax

- Ditec Medical

- Doricon Medical Systems

- Dragerwerk AG & Co. KGaA

- Eizo GmbH

- Fujifilm Holdings Corporation

- Getinge Ab

- Hill-Rom Holdings, Inc. (Baxter)

- Isis-Surgimedia

- Karl Storz Se & Co. Kg

- Meditek

- Merivaara

- Olympus Corporation

- Opexpark Inc.

- Richard Wolf GmbH

- Skytron, LLC

- Sony Corporation

- Steris plc

- Stryker Corporation

- Trilux Medical GmbH & Co. Kg (A Subsidiary of Mizuho Osi)

- Zimmer Biomet Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | June 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |