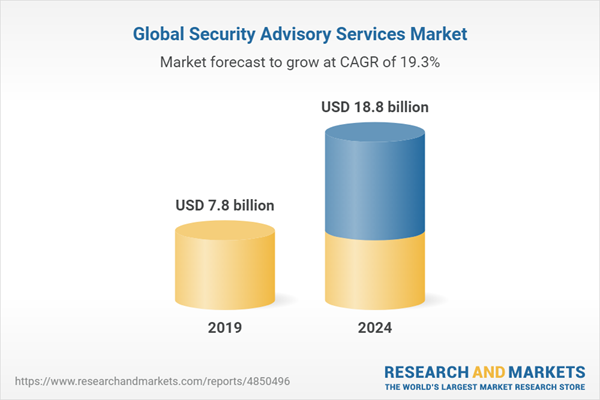

The security advisory services market is expected to grow at a CAGR of 19.3% during the forecast period due to the push from regulatory bodies across the globe and increase in adoption of hybrid network environment

The SMEs segment is expected to grow with a higher CAGR during the forecast period

The SME segment is expected to grow at a higher CAGR during the forecast period. Vendors of security advisory services help SMEs secure their valuable business applications from the more sophisticated cyber-attack vectors and vulnerabilities. The security advisory services are gaining popularity among the SMEs, as they help SMEs to save their money, time, and resources. The adoption of security advisory services among the SMEs were low in the past. There were several factors, such as low levels of awareness, budget constraints, and lack of technical skills, which we're all responsible for this slow adoption. SMEs are said to be rapidly adopting security advisory services to protect their applications from vulnerabilities and attacks.

Incident response segment is expected to have a significant growth in the security advisory services market during the forecast period

Amoung the service type, the incident response segment is expected t grow with the highest CAGR during the forecast period. Incident response services help organizations to significantly strengthen the security defense mechanics. Moreover, it helps organizations in minimizing the impact of cyber threats by quickly identifying unauthorized and malicious activities across IT infrastructure. The incident response services allow organizations to avoid unnecessary regulatory fines. Therefore, SMEs and large organizations around the world are expected to increase their investments in the adoption of incident response services during the forecast period.

North America expected to have the largest market size during the forecast period

North America is the most mature market in terms of security advisory services adoption. North America is likely to account for a substantial share of the global security advisory services market during the forecast period. The market growth in this region is driven primarily by the presence of large IT companies/users and rapid technological advancements, such as digitalization in the US and Canada. The presence of key players in the security advisory services market in the region is expected to be a significant factor driving the market growth in North America. Key players, such as Cisco, DXC Technology, Rapid7, ePlus, and Verizon along with several startups in the region, are offering enhanced security advisory services solutions, to cater to the needs of customers.

In the process of determining and verifying the market size of several segments and subsegments gathered through secondary research, extensive primary interviews were conducted with key people.

The breakup of the profiles of the primary participants is as follows:

- By Company: Tier 1 – 42%, Tier 2 – 36%, and Tier 3 – 22%

- By Designation: C-Level – 40%, Director Level – 35%, and Others – 25%

- By Region: North America – 45%, Europe – 30%, APAC – 15%, RoW – 10%

The security advisory services market includes various major vendors such as Cisco (US), DXC Technologies (US), KPMG (UK), Deloitte (US), PwC (UK), TCS (India), EY (UK), Verizon (US), eSentire (Canada), Rapid7 (US), Dimension Data (South Africa), Kudelski Security (Switzerland), NTT Security (Japan), Sumeru (India), ePlus (US), Coalfire (US), Novacoast (US), Security Compass (Canada), Sage Data Security (US) and Avalon Cyber (US).

Research Coverage:

The report includes an in-depth competitive analysis of the key players in the security advisory services market along with their company profiles, recent developments, and key market strategies. The report segments the security advisory services market by service type, organization size, vertical, and region.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in the security advisory services market in the following ways:

- The overall security advisory services market revenue stream has been estimated based on the revenues generated by vendors, offering security advisory services. The report provides the closest approximations of the revenue numbers for the overall market and the subsegments. The market numbers are split further into regions namely, North America, Europe, APAC, MEA, and Latin America.

- The report helps the stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

- The report will help the stakeholders understand the competitors and gain more insights to better their market position. The competitive landscape section includes the competitor ecosystem, new product developments, partnerships, and mergers and acquisitions.

Table of Contents

Companies Mentioned

- Avalon Cyber

- Cisco

- Coalfire

- Deloitte

- Dimension Data

- DXC Technology

- ePlus

- eSentire

- EY

- KPMG

- Kudelski Security

- Mitkat Advisory Services

- Novacoast

- NTT Security

- PwC

- Rapid7

- Sage Data Security

- Security Compass

- Stickman

- Sumeru Software Solutions

- TCS

- Veritas

- Verizon

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 164 |

| Published | October 2019 |

| Forecast Period | 2019 - 2024 |

| Estimated Market Value ( USD | $ 7.8 billion |

| Forecasted Market Value ( USD | $ 18.8 billion |

| Compound Annual Growth Rate | 19.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |