1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

Figure 1 Market Segmentation

1.3.1 Inclusions and Exclusions

1.3.2 Regions Covered

1.3.3 Years Considered

1.4 Currency Considered

Table 1 USD Exchange Rates Considered, 2018-2023

1.5 Units Considered

1.6 Stakeholders

1.7 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 2 Pet Food Ingredients Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Primary Insights

2.2 Market Size Estimation

2.2.1 Approach One-Bottom-Up

Figure 3 Pet Food Ingredients Market Size Estimation: Bottom-Up Approach

2.2.2 Approach Two-Top-Down

Figure 4 Pet Food Ingredients Market Size Estimation: Top-Down Approach

2.2.3 Pet Food Ingredients Market Size Estimation: Supply Side

Figure 5 Pet Food Ingredients Market Size Estimation: Supply-Side Analysis

2.2.4 Pet Food Ingredients Market Size Estimation: Demand Side

Figure 6 Pet Food Ingredients Market Size Estimation: Demand-Side Analysis

2.3 Data Triangulation

Figure 7 Data Triangulation Methodology

2.4 Research Assumptions

2.5 Research Limitations & Associated Risks

2.6 Recession Impact on Pet Food Ingredients Market

2.6.1 Macro Indicators of Recession

Figure 8 Indicators of Recession

Figure 9 World Inflation Rate, 2011-2021

Figure 10 Global GDP, 2011-2021 (USD Trillion)

Figure 11 Recession Indicators and Their Impact on Pet Food Ingredients Market

Figure 12 Global Pet Food Ingredients Market: Earlier Forecast vs. Recession Forecast

3 Executive Summary

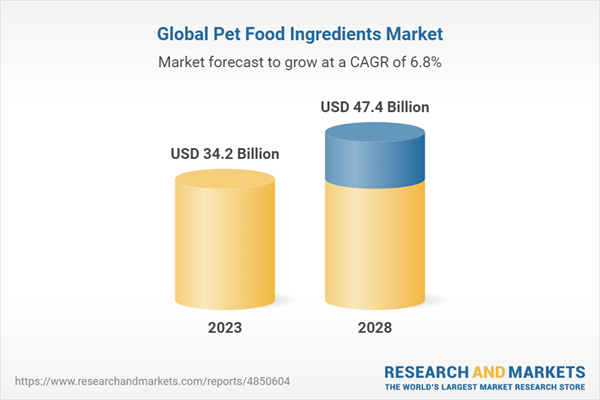

Table 2 Pet Food Ingredients Market Snapshot, 2023 vs. 2028

Figure 13 Pet Food Ingredients Market, by Ingredient, 2023 vs. 2028 (USD Million)

Figure 14 Pet Food Ingredients Market, by Pet, 2023 vs. 2028 (USD Million)

Figure 15 Pet Food Ingredients Market, by Form, 2023 vs. 2028

Figure 16 Pet Food Ingredients Market, by Source, 2023 vs. 2028 (USD Million)

Figure 17 Pet Food Ingredients Market: Regional Snapshot

4 Premium Insights

4.1 Attractive Opportunities for Key Players in Pet Food Ingredients Market

Figure 18 Increasing Adoption of Pets and Rising Pet Humanization Trend to Propel Growth

4.2 North America: Pet Food Ingredients Market, by Key Country and Source

Figure 19 US and Animal-based Source Accounted for Largest Shares in North American Market in 2022

4.3 Pet Food Ingredients Market, by Pet

Figure 20 Dogs Pet Segment to Lead During Forecast Period

4.4 Pet Food Ingredients Market, by Ingredient

Figure 21 Meat & Meat Products Ingredients to Lead During Forecast Period

4.5 Pet Food Ingredients Market, by Form

Figure 22 Dry Form Segment to Lead During Forecast Period

4.6 Pet Food Ingredients Market, by Source

Figure 23 Animal-based Source Segment to Lead During Forecast Period

Figure 24 Markets in China, Mexico, and Argentina to Grow at Highest Rates During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Macroeconomic Factors

5.2.1 Increase in Pet Adoption Among Urban Population

5.2.2 Increasing Trend of Humanization of Pets to Drive Demand for Premium Pet Products

Figure 25 Percentage of Pet Owners Giving Treats to Their Pets, by Pet Type, 2018-2022

5.3 Market Dynamics

Figure 26 Pet Food Ingredients: Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Pet Expenditure Along with a Substantial Rise in Pet Food Expenditure

Figure 27 US Pet Industry Expenditure, 2018-2022 (USD Billion)

Figure 28 Global Population vs. Animal Protein Production, 1990-2030

5.3.1.2 Preference for Organic Pet Food Ingredients

5.3.1.3 Acceptance of Insect-based Protein and Oil by Pet Owners

5.3.2 Restraints

5.3.2.1 Non-Uniformity of Regulations Hindering International Trade

5.3.2.2 Limited Availability of Ingredients and Price Sensitivity

5.3.3 Opportunities

5.3.3.1 Increase in Pet Humanization Trend

Figure 29 Attitude Toward Pets, Percentage of US Population as of May 2022

5.3.3.2 Technological Advancements to Enhance Product Development

5.3.3.3 Shift in Focus Toward Natural and Grain-Free Products

Figure 30 Sales Growth of Pet Supplements in US, 2022

Figure 31 Major Buying Factors for Pet Food, Percentage of Population in China as of April 2021

5.3.4 Challenges

5.3.4.1 Capital Investments for Equipment

5.3.4.2 Threat from Counterfeit Products

5.3.4.3 Oxidation in Pet Food Palatability

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research and Product Development

6.2.2 Raw Material Sourcing

6.2.3 Production and Processing

6.2.4 Distribution

6.2.5 Marketing & Sales

Figure 32 Value Chain Analysis of Pet Food Ingredients Market

6.3 Supply Chain Analysis

Figure 33 Pet Food Ingredients Market: Supply Chain

6.4 Technology Analysis

6.4.1 Next-Generation Protein for Pet Food Ingredients

6.5 Price Analysis: Pet Food Ingredients Market

6.5.1 Average Selling Price, by Type

Figure 34 Average Selling Price, by Ingredient, 2020-2022 (USD/Ton)

Table 3 Meat & Meat Products: Average Selling Price (ASP), by Region, 2020-2022 (USD/Ton)

Table 4 Cereals: Average Selling Price (ASP), by Region, 2020-2022 (USD/Ton)

Table 5 Vegetables & Fruits: Average Selling Price (ASP), by Region, 2020-2022 (USD/Ton)

Table 6 Fats: Average Selling Price, by Region, 2020-2022 (USD/Ton)

Table 7 Additives: Average Selling Price, by Region, 2020-2022 (USD/Ton)

6.6 Market Mapping and Ecosystem of Pet Food Ingredients Market

6.6.1 Demand Side

6.6.2 Supply Side

Figure 35 Pet Food Ingredients: Market Map

Figure 36 Pet Food Ingredients Ecosystem Mapping

Table 8 Pet Food Ingredients Market: Supply Chain (Ecosystem)

6.7 Trends/Disruptions Impacting Customer Business

Figure 37 Revenue Shift for Pet Food Ingredients Market

6.8 Pet Food Ingredients Market: Patent Analysis

Figure 38 Patents Granted: Pet Food Ingredients Market, 2012-2022

Figure 39 Regional Analysis of Patents Granted: Pet Food Ingredients Market, 2012-2022

Table 9 Patents Pertaining to Pet Food Ingredients, 2020-2022

6.9 Trade Data: Pet Food Ingredients Market

Table 10 Import Data of Dog or Cat Food, by Key Country, 2022 (Value and Volume)

Table 11 Export Data of Dog or Cat Food, by Key Country, 2022 (Value and Volume)

6.10 Porter's Five Forces Analysis

Table 12 Pet Food Ingredients Market: Porter's Five Forces Analysis

6.10.1 Intensity of Competitive Rivalry

6.10.2 Bargaining Power of Suppliers

6.10.3 Bargaining Power of Buyers

6.10.4 Threat of Substitutes

6.10.5 Threat of New Entrants

6.11 Case Studies

6.11.1 Adm: Pet Food Ingredients for Dogs and Cats

6.11.2 Gillco Ingredients: Enhancing Emulsification and Water-Holding in Dog Food Kibble Topper with Citri-Fi Citrus Fiber

6.12 Key Conferences and Events

Table 13 Key Conferences and Events in Pet Food Ingredients Market, 2023-2024

6.13 Tariff and Regulatory Landscape

Table 14 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 16 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

6.13.1 North America

6.13.1.1 United States (US)

6.13.1.2 Association of American Feed Control Officials (Aafco)

6.13.2 European Union

6.13.3 Asia-Pacific

6.13.3.1 China

6.13.3.2 Japan

Table 17 Permitted Level of Substances in Pet Food

Table 18 Standards for Pet Food Manufacturers

6.13.3.3 India

6.13.4 South Africa

6.13.5 International Feed Industry Federation

6.14 Key Stakeholders and Buying Criteria

Figure 40 Influence of Stakeholders on Buying Process for Top Three Ingredients

6.14.1 Key Stakeholders in Buying Process

Table 19 Influence of Stakeholders on Buying Process for Top Three Ingredients

6.14.2 Buying Criteria

Table 20 Key Criteria for Selecting Suppliers/Vendors

Figure 41 Key Criteria for Selecting Suppliers/Vendors

7 Pet Food Ingredients Market, by Ingredient

7.1 Introduction

Figure 42 Pet Food Ingredients Market, by Ingredient, 2023 vs. 2028

Table 21 Pet Food Ingredients Market, by Ingredient, 2019-2022 (USD Million)

Table 22 Pet Food Ingredients Market, by Ingredient, 2023-2028 (USD Million)

Table 23 Pet Food Ingredients Market, by Ingredient, 2019-2022 (Kt)

Table 24 Pet Food Ingredients Market, by Ingredient, 2023-2028 (Kt)

7.2 Meat & Meat Products

7.2.1 Health Benefits and Multifunctionality to Drive Market

Table 25 Meat & Meat Products: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 26 Meat & Meat Products: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

Table 27 Meat & Meat Products: Pet Food Ingredients Market, by Region, 2019-2022 (Kt)

Table 28 Meat & Meat Products: Pet Food Ingredients Market, by Region, 2023-2028 (Kt)

Table 29 Meat & Meat Products: Pet Food Ingredients Market, by Subtype, 2019-2022 (USD Million)

Table 30 Meat & Meat Products: Pet Food Ingredients Market, by Subtype, 2023-2028 (USD Million)

7.2.2 Deboned Meat

Table 31 Deboned Meat: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 32 Deboned Meat: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.2.3 Meat Meal

Table 33 Meat Meal: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 34 Meat Meal: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.2.4 By-Product Meal

Table 35 By-Product Meal: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 36 By-Product Meal: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.2.5 Animal Digest

Table 37 Animal Digest: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 38 Animal Digest: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.3 Cereals

7.3.1 Rich Carbohydrate Content and Energy-Boosting Properties to Drive Market

Figure 43 Share of Cereals Allocated to Food, Feed, or Processing, by Country, 2020

Table 39 Cereals: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 40 Cereals: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

Table 41 Cereals: Pet Food Ingredients Market, by Region, 2019-2022 (Kt)

Table 42 Cereals: Pet Food Ingredients Market, by Region, 2023-2028 (Kt)

Table 43 Cereals: Pet Food Ingredients Market, by Type, 2019-2022 (USD Million)

Table 44 Cereals: Pet Food Ingredients Market, by Type, 2023-2028 (USD Million)

7.3.2 Corn & Cornmeal

Table 45 Corn & Corn Meal: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 46 Corn & Corn Meal: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.3.3 Wheat & Wheatmeal

Table 47 Wheat & Wheat Meal: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 48 Wheat & Wheat Meal: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.3.4 Barley

Table 49 Barley: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 50 Barley: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.3.5 Rice

Table 51 Rice: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 52 Rice: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.3.6 Other Cereals

Table 53 Other Cereals: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 54 Other Cereals: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.4 Vegetables & Fruits

7.4.1 Benefits to Digestive Health and Assurance of Optimal Nutrition to Drive Market

Table 55 Vegetables & Fruits: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 56 Vegetables & Fruits: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

Table 57 Vegetables & Fruits: Pet Food Ingredients Market, by Region, 2019-2022 (Kt)

Table 58 Vegetables & Fruits: Pet Food Ingredients Market, by Region, 2023-2028 (Kt)

Table 59 Vegetables & Fruits: Pet Food Ingredients Market, by Subtype, 2019-2022 (USD Million)

Table 60 Vegetables & Fruits: Pet Food Ingredients Market, by Subtype, 2023-2028 (USD Million)

7.4.2 Fruits

Table 61 Fruits: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 62 Fruits: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.4.3 Potatoes

Table 63 Potatoes: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 64 Potatoes: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.4.4 Carrots

Table 65 Carrots: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 66 Carrots: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.4.5 Soy & Soy Meal

Table 67 Soy & Soy Meal: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 68 Soy & Soy Meal: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.4.6 Pea

Table 69 Pea: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 70 Pea: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.5 Fats

7.5.1 Rich Omega-3 Fatty Acid Content and Properties of Boosting Immunity and Skin Health in Pets to Drive Market

Table 71 Fats: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 72 Fats: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

Table 73 Fats: Pet Food Ingredients Market, by Region, 2019-2022 (Kt)

Table 74 Fats: Pet Food Ingredients Market, by Region, 2023-2028 (Kt)

Table 75 Fats: Pet Food Ingredients Market, by Subtype, 2019-2022 (USD Million)

Table 76 Fats: Pet Food Ingredients Market, by Subtype, 2023-2028 (USD Million)

7.5.2 Fish Oil

Table 77 Fish Oil: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 78 Fish Oil: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.5.3 Tallow

Table 79 Tallow: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 80 Tallow: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.5.4 Lard

Table 81 Lard: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 82 Lard: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.5.5 Poultry Fat

Table 83 Poultry Fat: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 84 Poultry Fat: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.5.6 Vegetable Oil

Table 85 Vegetable Oil: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 86 Vegetable Oil: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.6 Additives

7.6.1 Rising Focus on Pet Wellness and Health Benefits to Drive Market

Table 87 Additives: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 88 Additives: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

Table 89 Additives: Pet Food Ingredients Market, by Region, 2019-2022 (Kt)

Table 90 Additives: Pet Food Ingredients Market, by Region, 2023-2028 (Kt)

Table 91 Additives: Pet Food Ingredients Market, by Subtype, 2019-2022 (USD Million)

Table 92 Additives: Pet Food Ingredients Market, by Subtype, 2023-2028 (USD Million)

7.6.2 Vitamins & Minerals

Table 93 Vitamins & Minerals: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 94 Vitamins & Minerals: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.6.3 Enzymes

Table 95 Enzymes: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 96 Enzymes: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

7.6.4 Other Additives

Table 97 Other Additives: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 98 Other Additives: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

8 Pet Food Ingredients Market, by Pet

8.1 Introduction

Figure 44 Number of US Households That Own a Pet (2023-2024)

Figure 45 Pet Food Ingredients Market, by Pet, 2023 vs. 2028

Table 99 Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 100 Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

8.2 Dogs

8.2.1 High Adoption Rate to Present Attractive Market for Players

Table 101 Dogs: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 102 Dogs: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

8.3 Cats

8.3.1 Higher Nutritional Requirements of Cats to Drive Market

Table 103 List of Vitamins and Their Relevance

Table 104 Cats: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 105 Cats: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

8.4 Fish

8.4.1 Lower Maintenance Cost and High Adoption Rate to Drive Market

Table 106 Fish: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 107 Fish: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

8.5 Other Pets

Table 108 Other Pets: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 109 Other Pets: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

9 Pet Food Ingredients Market, by Source

9.1 Introduction

Figure 46 Pet Food Ingredients Market, by Source, 2023 vs. 2028

Table 110 Pet Food Ingredients Market, by Source, 2019-2022 (USD Million)

Table 111 Pet Food Ingredients Market, by Source, 2023-2028 (USD Million)

9.2 Animal-based

9.2.1 Health Advantages, Higher Feed Intake, and Greater Acceptance Among Pets to Boost Demand

Table 112 Animal-based: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 113 Animal-based: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

9.3 Plant Derivatives

9.3.1 Rising Trend of Veganism and Surging Popularity of Vegan Pet Food Products to Drive Market

Table 114 Plant Derivatives: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 115 Plant Derivatives: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

9.4 Synthetic

9.4.1 Multifunctionality of Synthetic Pet Food Ingredients and Rising Focus on Health & Wellness to Drive Market

Table 116 Synthetic: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 117 Synthetic: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

10 Pet Food Ingredients Market, by Form

10.1 Introduction

Figure 47 Pet Food Ingredients Market, by Form, 2023 vs. 2028

Table 118 Pet Food Ingredients Market, by Form, 2019-2022 (USD Million)

Table 119 Pet Food Ingredients Market, by Form, 2023-2028 (USD Million)

10.2 Dry

10.2.1 Cost-Effectiveness and High Nutrient Content to Boost Market

Table 120 Dry Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 121 Dry Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

10.3 Wet

10.3.1 Higher Acceptability Among Pet Owners to Drive Market

Table 122 Wet Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 123 Wet Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

11 Pet Food Ingredients Market, by Nature

11.1 Introduction

11.2 Organic

11.2.1 Benefits Associated with Organic Pet Food Ingredients and Government Policies to Fuel Demand

11.3 Inorganic

11.3.1 Rising Demand for Inorganic Pet Food Products to Drive Market

12 Pet Food Ingredients Market, by Region

12.1 Introduction

Figure 48 China to Record Fastest Growth in Global Pet Food Ingredients Market

Table 124 Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 125 Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

Table 126 Pet Food Ingredients Market, by Region, 2019-2022 (Kt)

Table 127 Pet Food Ingredients Market, by Region, 2023-2028 (Kt)

12.2 North America

12.2.1 North America: Recession Impact

Figure 49 North America: Inflation Rates, by Key Country, 2017-2022

Figure 50 North America: Recession Impact Analysis, 2023

Figure 51 North America: Pet Food Ingredients Market Snapshot

Table 128 North America: Pet Food Ingredients Market, by Country, 2019-2022 (USD Million)

Table 129 North America: Pet Food Ingredients Market, by Country, 2023-2028 (USD Million)

Table 130 North America: Pet Food Ingredients Market, by Form, 2019-2022 (USD Million)

Table 131 North America: Pet Food Ingredients Market, by Form, 2023-2028 (USD Million)

Table 132 North America: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 133 North America: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

Table 134 North America: Pet Food Ingredients Market, by Ingredient, 2019-2022 (USD Million)

Table 135 North America: Pet Food Ingredients Market, by Ingredient, 2023-2028 (USD Million)

Table 136 North America: Pet Food Ingredients Market, by Ingredient, 2019-2022 (Kt)

Table 137 North America: Pet Food Ingredients Market, by Ingredient, 2023-2028 (Kt)

Table 138 North America: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2019-2022 (USD Million)

Table 139 North America: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2023-2028 (USD Million)

Table 140 North America: Pet Food Ingredients Market for Cereals, by Subtype, 2019-2022 (USD Million)

Table 141 North America: Pet Food Ingredients Market for Cereals, by Subtype, 2023-2028 (USD Million)

Table 142 North America: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2019-2022 (USD Million)

Table 143 North America: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2023-2028 (USD Million)

Table 144 North America: Pet Food Ingredients Market for Fats, by Subtype, 2019-2022 (USD Million)

Table 145 North America: Pet Food Ingredients Market for Fats, by Subtype, 2023-2028 (USD Million)

Table 146 North America: Pet Food Ingredients Market for Additives, by Subtype, 2019-2022 (USD Million)

Table 147 North America: Pet Food Ingredients Market for Additives, by Subtype, 2023-2028 (USD Million)

Table 148 North America: Pet Food Ingredients Market, by Source, 2019-2022 (USD Million)

Table 149 North America: Pet Food Ingredients Market, by Source, 2023-2028 (USD Million)

12.2.2 US

12.2.2.1 Rising Pet Adoption Rate to Present Significant Business Opportunities for Pet Food Ingredient Manufacturers

Figure 52 Number of US Households That Own a Pet (In Millions), 2023

Figure 53 Total US Pet Industry Expenditure, 2018-2022

Table 150 US: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 151 US: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.2.3 Canada

12.2.3.1 Increased Spending on Health-Focused Pet Products to Drive Market

Figure 54 Canadian Domestic Exports of Pet Food (USD Million): Top 10 Markets in 2022

Table 152 Canada: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 153 Canada: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.2.4 Mexico

12.2.4.1 Rising Awareness About Healthier Nutritional Alternatives for Pets, Coupled with Key Player Investments in Pet Food, to Drive Market

Table 154 Mexico: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 155 Mexico: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.3 Asia-Pacific

Figure 55 Asia-Pacific: Pet Food Ingredients Market Snapshot

12.3.1 Asia-Pacific: Recession Impact

Figure 56 Asia-Pacific: Inflation Rates, by Key Country, 2017-2022

Figure 57 Asia-Pacific: Recession Impact Analysis, 2022 vs. 2023

Table 156 Asia-Pacific: Pet Food Ingredients Market, by Country, 2019-2022 (USD Million)

Table 157 Asia-Pacific: Pet Food Ingredients Market, by Country, 2023-2028 (USD Million)

Table 158 Asia-Pacific: Pet Food Ingredients Market, by Form, 2019-2022 (USD Million)

Table 159 Asia-Pacific: Pet Food Ingredients Market, by Form, 2023-2028 (USD Million)

Table 160 Asia-Pacific: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 161 Asia-Pacific: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

Table 162 Asia-Pacific: Pet Food Ingredients Market, by Ingredient, 2019-2022 (USD Million)

Table 163 Asia-Pacific: Pet Food Ingredients Market, by Ingredient, 2023-2028 (USD Million)

Table 164 Asia-Pacific: Pet Food Ingredients Market, by Ingredient, 2019-2022 (Kt)

Table 165 Asia-Pacific: Pet Food Ingredients Market, by Ingredient, 2023-2028 (Kt)

Table 166 Asia-Pacific: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2019-2022 (USD Million)

Table 167 Asia-Pacific: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2023-2028 (USD Million)

Table 168 Asia-Pacific: Pet Food Ingredients Market for Cereals, by Subtype, 2019-2022 (USD Million)

Table 169 Asia-Pacific: Pet Food Ingredients Market for Cereals, by Subtype, 2023-2028 (USD Million)

Table 170 Asia-Pacific: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2019-2022 (USD Million)

Table 171 Asia-Pacific: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2023-2028 (USD Million)

Table 172 Asia-Pacific: Pet Food Ingredients Market for Fats, by Subtype, 2019-2022 (USD Million)

Table 173 Asia-Pacific: Pet Food Ingredients Market for Fats, by Subtype, 2023-2028 (USD Million)

Table 174 Asia-Pacific: Pet Food Ingredients Market for Additives, by Subtype, 2019-2022 (USD Million)

Table 175 Asia-Pacific: Pet Food Ingredients Market for Additives, by Subtype, 2023-2028 (USD Million)

Table 176 Asia-Pacific: Pet Food Ingredients Market, by Source, 2019-2022 (USD Million)

Table 177 Asia-Pacific: Pet Food Ingredients Market, by Source, 2023-2028 (USD Million)

12.3.2 China

12.3.2.1 Increasing Spending on Pet Nutrition and Health to Drive Market

Figure 58 China's Import of Pet Food, by Value, 2017-2021 and 2022 (January-November)

Figure 59 Pet Population in China, 2016-2022

Table 178 China: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 179 China: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.3.3 Japan

12.3.3.1 Rising Focus on Protein-Rich Ingredients and Health and Nutrition of Pet Animals to Drive Market

Table 180 Japan: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 181 Japan: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.3.4 India

12.3.4.1 Emerging Middle-Class Population and Improving Economic Conditions to Boost Market

Table 182 India: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 183 India: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.3.5 Australia & New Zealand

12.3.5.1 Rising Spending on Pets to Drive Pet Food Ingredients Market

Figure 60 Expenses on Pets in Australia, 2022

Table 184 Australia & New Zealand: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 185 Australia & New Zealand: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.3.6 Rest of Asia-Pacific

Table 186 Rest of Asia-Pacific: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 187 Rest of Asia-Pacific: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.4 Europe

12.4.1 Europe: Recession Impact

Figure 61 Europe: Inflation Rates, by Key Country, 2017-2022

Figure 62 Europe: Recession Impact Analysis, 2023

Table 188 Europe: Pet Food Ingredients Market, by Country, 2019-2022 (USD Million)

Table 189 Europe: Pet Food Ingredients Market, by Country, 2023-2028 (USD Million)

Table 190 Europe: Pet Food Ingredients Market, by Form, 2019-2022 (USD Million)

Table 191 Europe: Pet Food Ingredients Market, by Form, 2023-2028 (USD Million)

Table 192 Europe: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 193 Europe: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

Table 194 Europe: Pet Food Ingredients Market, by Ingredient, 2019-2022 (USD Million)

Table 195 Europe: Pet Food Ingredients Market, by Ingredient, 2023-2028 (USD Million)

Table 196 Europe: Pet Food Ingredients Market, by Ingredient, 2019-2022 (Kt)

Table 197 Europe: Pet Food Ingredients Market, by Ingredient, 2023-2028 (Kt)

Table 198 Europe: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2019-2022 (USD Million)

Table 199 Europe: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2023-2028 (USD Million)

Table 200 Europe: Pet Food Ingredients Market for Cereals, by Subtype, 2019-2022 (USD Million)

Table 201 Europe: Pet Food Ingredients Market for Cereals, by Subtype, 2023-2028 (USD Million)

Table 202 Europe: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2019-2022 (USD Million)

Table 203 Europe: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2023-2028 (USD Million)

Table 204 Europe: Pet Food Ingredients Market for Fats, by Subtype, 2019-2022 (USD Million)

Table 205 Europe: Pet Food Ingredients Market for Fats, by Subtype, 2023-2028 (USD Million)

Table 206 Europe: Pet Food Ingredients Market for Additives, by Subtype, 2019-2022 (USD Million)

Table 207 Europe: Pet Food Ingredients Market for Additives, by Subtype, 2023-2028 (USD Million)

Table 208 Europe: Pet Food Ingredients Market, by Source, 2019-2022 (USD Million)

Table 209 Europe: Pet Food Ingredients Market, by Source, 2023-2028 (USD Million)

12.4.2 Germany

12.4.2.1 Rising Ownership due to Pet Humanization and Emotional Support to Drive Market

Table 210 Germany: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 211 Germany: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.4.3 Russia

12.4.3.1 Rising Demand for Industrially Prepared Pet Food to Boost Market

Table 212 Russia: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 213 Russia: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.4.4 UK

12.4.4.1 Strategic Developments of Companies to Drive Market

Figure 63 Top 10 Pets in UK 2023

Figure 64 Survey of Pet Owners: 48% of UK Population Treats Pet as Family Member, 2021

Table 214 UK: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 215 UK: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.4.5 France

12.4.5.1 Rising Demand for Premium and Health-Oriented Pet Products to Drive Market

Table 216 France: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 217 France: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.4.6 Italy

12.4.6.1 Large Number of Investments and Expansions to Drive Market

Table 218 Italy: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 219 Italy: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.4.7 Rest of Europe

Table 220 Rest of Europe: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 221 Rest of Europe: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.5 South America

12.5.1 South America: Recession Impact

Figure 65 South America: Inflation Rates, by Key Country, 2017-2022

Figure 66 South America: Recession Impact Analysis

Table 222 South America: Pet Food Ingredients Market, by Country, 2019-2022 (USD Million)

Table 223 South America: Pet Food Ingredients Market, by Country, 2023-2028 (USD Million)

Table 224 South America: Pet Food Ingredients Market, by Form, 2019-2022 (USD Million)

Table 225 South America: Pet Food Ingredients Market, by Form, 2023-2028 (USD Million)

Table 226 South America: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 227 South America: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

Table 228 South America: Pet Food Ingredients Market, by Ingredient, 2019-2022 (USD Million)

Table 229 South America: Pet Food Ingredients Market, by Ingredient, 2023-2028 (USD Million)

Table 230 South America: Pet Food Ingredients Market, by Ingredient, 2019-2022 (Kt)

Table 231 South America: Pet Food Ingredients Market, by Ingredient, 2023-2028 (Kt)

Table 232 South America: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2019-2022 (USD Million)

Table 233 South America: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2023-2028 (USD Million)

Table 234 South America: Pet Food Ingredients Market for Cereals, by Subtype, 2019-2022 (USD Million)

Table 235 South America: Pet Food Ingredients Market for Cereals, by Subtype, 2023-2028 (USD Million)

Table 236 South America: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2019-2022 (USD Million)

Table 237 South America: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2023-2028 (USD Million)

Table 238 South America: Pet Food Ingredients Market for Fats, by Subtype, 2019-2022 (USD Million)

Table 239 South America: Pet Food Ingredients Market for Fats, by Subtype, 2023-2028 (USD Million)

Table 240 South America: Pet Food Ingredients Market for Additives, by Subtype, 2019-2022 (USD Million)

Table 241 South America: Pet Food Ingredients Market for Additives, by Subtype, 2023-2028 (USD Million)

Table 242 South America: Pet Food Ingredients Market, by Source, 2019-2022 (USD Million)

Table 243 South America: Pet Food Ingredients Market, by Source, 2023-2028 (USD Million)

12.5.2 Brazil

12.5.2.1 Rising Spending on Premium Pet Food Products to Boost Market

Figure 67 Pet Industry Expenditure in Brazil, 2022

Table 244 Brazil: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 245 Brazil: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.5.3 Argentina

12.5.3.1 Improved Economic Conditions and Large Pet Dog Population to Drive Market

Table 246 Argentina: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 247 Argentina: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.5.4 Rest of South America

Table 248 Rest of South America: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 249 Rest of South America: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.6 Rest of the World

12.6.1 Rest of the World: Recession Impact

Figure 68 Rest of the World: Inflation Rates, by Key Country, 2017-2022

Figure 69 Rest of the World: Recession Impact Analysis

Table 250 Rest of the World: Pet Food Ingredients Market, by Region, 2019-2022 (USD Million)

Table 251 Rest of the World: Pet Food Ingredients Market, by Region, 2023-2028 (USD Million)

Table 252 Rest of the World: Pet Food Ingredients Market, by Form, 2019-2022 (USD Million)

Table 253 Rest of the World: Pet Food Ingredients Market, by Form, 2023-2028 (USD Million)

Table 254 Rest of the World: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 255 Rest of the World: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

Table 256 Rest of the World: Pet Food Ingredients Market, by Ingredient, 2019-2022 (USD Million)

Table 257 Rest of the World: Pet Food Ingredients Market, by Ingredient, 2023-2028 (USD Million)

Table 258 Rest of the World: Pet Food Ingredients Market, by Ingredient, 2019-2022 (Kt)

Table 259 Rest of the World: Pet Food Ingredients Market, by Ingredient, 2023-2028 (Kt)

Table 260 Rest of the World: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2019-2022 (USD Million)

Table 261 Rest of the World: Pet Food Ingredients Market for Meat & Meat Products, by Subtype, 2023-2028 (USD Million)

Table 262 Rest of the World: Pet Food Ingredients Market for Cereals, by Subtype, 2019-2022 (USD Million)

Table 263 Rest of the World: Pet Food Ingredients Market for Cereals, by Subtype, 2023-2028 (USD Million)

Table 264 Rest of the World: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2019-2022 (USD Million)

Table 265 Rest of the World: Pet Food Ingredients Market for Vegetables & Fruits, by Subtype, 2023-2028 (USD Million)

Table 266 Rest of the World: Pet Food Ingredients Market for Fats, by Subtype, 2019-2022 (USD Million)

Table 267 Rest of the World: Pet Food Ingredients Market for Fats, by Subtype, 2023-2028 (USD Million)

Table 268 Rest of the World: Pet Food Ingredients Market for Additives, by Subtype, 2019-2022 (USD Million)

Table 269 Rest of the World: Pet Food Ingredients Market for Additives, by Subtype, 2023-2028 (USD Million)

Table 270 Rest of the World: Pet Food Ingredients Market, by Source, 2019-2022 (USD Million)

Table 271 Rest of the World: Pet Food Ingredients Market, by Source, 2023-2028 (USD Million)

12.6.2 Middle East

12.6.2.1 Rising Pet Humanization Trend Among Growing Middle-Class Population to Drive Market

Table 272 Middle East: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 273 Middle East: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

12.6.3 Africa

12.6.3.1 Large Pet Population and Rising Demand for Premium Pet Food Products to Drive Market

Table 274 Africa: Pet Food Ingredients Market, by Pet, 2019-2022 (USD Million)

Table 275 Africa: Pet Food Ingredients Market, by Pet, 2023-2028 (USD Million)

13 Competitive Landscape

13.1 Key Player Strategies/Right to Win

13.2 Market Share Analysis, 2022

Table 276 Pet Food Ingredients Market: Degree of Competition, 2022

Table 277 Overview of Strategies Adopted by Key Players

13.3 Revenue Analysis

Figure 70 Revenue Analysis of Key Players, 2020-2022 (USD Billion)

13.4 Company Evaluation Matrix (Key Players), 2022

13.4.1 Stars

13.4.2 Emerging Leaders

13.4.3 Pervasive Players

13.4.4 Participants

Figure 71 Pet Food Ingredients Market: Company Evaluation Matrix, 2022

13.4.5 Pet Food Ingredients Market: Product Footprint (Key Players)

Table 278 Company Footprint, by Form (Key Players)

Table 279 Company Footprint, by Pet (Key Players)

Table 280 Company Footprint, by Region (Key Players)

Table 281 Overall Company Footprint (Key Players)

13.5 Startup/Small and Medium-Sized Enterprise (SME) Evaluation Matrix, 2022

13.5.1 Progressive Companies

13.5.2 Responsive Companies

13.5.3 Dynamic Companies

13.5.4 Starting Blocks

Figure 72 Pet Food Ingredients Market: SME Evaluation Matrix, 2022 (Other Players)

13.5.5 Competitive Benchmarking

Table 282 Pet Food Ingredients Market: Competitive Benchmarking of Other Players

13.6 Competitive Scenario

13.6.1 Product Launches

Table 283 Pet Food Ingredients Market: Product Launches, 2019?-2023

13.6.2 Deals

Table 284 Pet Food Ingredients Market: Deals, 2019-2023

13.6.3 Other Developments

Table 285 Pet Food Ingredients Market: Other Developments, 2019-2023

14 Company Profiles

(Business Overview, Products/Services/Solutions Offered, Recent Developments & Analyst's View)*

14.1 Key Players

14.1.1 BASF SE

Table 286 BASF SE: Business Overview

Figure 73 BASF SE: Company Snapshot

Table 287 BASF SE: Products/Solutions/Services Offered

Table 288 BASF SE: Deals

Table 289 BASF SE: Other Developments

14.1.2 Darling Ingredients Inc

Table 290 Darling Ingredients Inc.: Business Overview

Figure 74 Darling Ingredients Inc.: Company Snapshot

Table 291 Darling Ingredients Inc.: Products/Solutions/Services Offered

Table 292 Darling Ingredients Inc.: Deals

14.1.3 Cargill, Incorporated

Table 293 Cargill, Incorporated: Business Overview

Figure 75 Cargill, Incorporated: Company Snapshot

Table 294 Cargill, Incorporated: Products/Solutions/Services Offered

Table 295 Cargill, Incorporated: Product Launches

Table 296 Cargill, Incorporated: Other Developments

14.1.4 Ingredion

Table 297 Ingredion: Business Overview

Figure 76 Ingredion: Company Snapshot

Table 298 Ingredion: Products/Solutions/Services Offered

Table 299 Ingredion: Other Developments

14.1.5 DSM

Table 300 DSM: Business Overview

Figure 77 DSM: Company Snapshot

Table 301 DSM: Products/Solutions/Services Offered

Table 302 DSM: Deals

Table 303 DSM: Other Developments

14.1.6 Omega Protein Corporation

Table 304 Omega Protein Corporation: Business Overview

Table 305 Omega Protein Corporation: Products/Solutions/Services Offered

14.1.7 Adm

Table 306 Adm: Business Overview

Figure 78 Adm: Company Snapshot

Table 307 Adm: Products/Solutions/Services Offered

Table 308 Adm: Deals

Table 309 Adm: Other Developments

14.1.8 Kemin Industries, Inc

Table 310 Kemin Industries, Inc.: Business Overview

Table 311 Kemin Industries, Inc.: Products/Solutions/Services Offered

Table 312 Kemin Industries, Inc.: Deals

Table 313 Kemin Industries, Inc.: Other Developments

14.1.9 Chr. Hansen Holding A/S

Table 314 Chr. Hansen Holding A/S: Business Overview

Figure 79 Chr. Hansen Holding A/S: Company Snapshot

Table 315 Chr. Hansen Holding A/S: Products/Solutions/Services Offered

Table 316 Chr. Hansen Holding A/S: Product Launches

14.1.10 Roquette Frères

Table 317 Roquette Frères: Business Overview

Table 318 Roquette Frères: Products/Solutions/Services Offered

Table 319 Roquette Frères: Deals

14.1.11 The Scoular Company

Table 320 The Scoular Company: Business Overview

Table 321 The Scoular Company: Products/Solutions/Services Offered

Table 322 The Scoular Company: Deals

Table 323 The Scoular Company: Other Developments

14.1.12 Symrise

Table 324 Symrise: Business Overview

Figure 80 Symrise: Company Snapshot

Table 325 Symrise: Products/Solutions/Services Offered

Table 326 Symrise: Deals

Table 327 Symrise: Other Developments

14.1.13 Mowi

Table 328 Mowi: Business Overview

Figure 81 Mowi: Company Snapshot

Table 329 Mowi: Products/Solutions/Services Offered

14.1.14 Lallemand Inc

Table 330 Lallemand Inc.: Business Overview

Table 331 Lallemand Inc.: Products/Solutions/Services Offered

Table 332 Lallemand Inc.: Product Launches

Table 333 Lallemand Inc.: Deals

Table 334 Lallemand Inc.: Other Developments

14.1.15 Phileo by Lesaffre

Table 335 Phileo by Lesaffre: Business Overview

Table 336 Phileo by Lesaffre: Products/Solutions/Services Offered

Table 337 Phileo by Lesaffre: Deals

14.2 Other Players

14.2.1 3D Corporate Solutions

Table 338 3D Corporate Solutions: Business Overview

Table 339 3D Corporate Solutions: Products/Solutions/Services Offered

Table 340 3D Corporate Solutions: Deals

14.2.2 Hydrite Chemical

Table 341 Hydrite Chemical: Business Overview

Table 342 Hydrite Chemical: Products/Solutions/Services Offered

Table 343 Hydrite Chemical: Product Launches

14.2.3 Afb International

Table 344 Afb International: Business Overview

Table 345 Afb International: Products/Solutions/Services Offered

Table 346 Afb International: Other Developments

14.2.4 Gillco Ingredients

Table 347 Gillco Ingredients: Business Overview

Table 348 Gillco Ingredients: Products/Solutions/Services Offered

Table 349 Gillco Ingredients: Deals

14.2.5 Saria International GmbH

Table 350 Saria International GmbH: Business Overview

Table 351 Saria International GmbH: Products/Solutions/Services Offered

14.2.6 Green Source Organics

Table 352 Green Source Organics: Business Overview

14.2.7 Biorigin

Table 353 Biorigin: Business Overview

14.2.8 Zinpro

Table 354 Zinpro: Business Overview

14.2.9 Aps Phoenix LLC

Table 355 Aps Phoenix LLC: Business Overview

14.2.10 Labudde Group, Inc

Table 356 Labudde Group, Inc.: Business Overview

*Details on Business Overview, Products/Services/Solutions Offered, Recent Developments & Analyst's View Might Not be Captured in Case of Unlisted Companies

15 Adjacent and Related Markets

15.1 Introduction

Table 357 Adjacent Markets to Pet Food Ingredients Market

15.2 Limitations

15.3 Wet Pet Food Market

15.3.1 Market Definition

15.3.2 Market Overview

Table 358 Wet Pet Food Market, by Pet, 2019-2022 (USD Million)

Table 359 Wet Pet Food Market, by Pet, 2023-2028 (USD Million)

15.4 Probiotics in Animal Feed Market

15.4.1 Market Definition

15.4.2 Market Overview

Table 360 Probiotics in Animal Feed Market, by Source, 2019-2022 (USD Million)

Table 361 Probiotics in Animal Feed Market, by Source, 2023-2028 (USD Million)

16 Appendix

16.1 Discussion Guide

16.2 Knowledgestore: The Subscription Portal

16.3 Customization Options