Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this positive trajectory, the industry encounters significant hurdles regarding the enforcement of strict environmental sustainability protocols and plastic reduction strategies. Manufacturers are compelled to navigate a complex regulatory environment that necessitates the adoption of tethered caps or the inclusion of high proportions of recycled materials, requirements that demand costly modifications to established production facilities. This pressure from regulatory bodies, compounded by the unpredictable nature of raw material pricing, serves as a substantial impediment to achieving seamless capacity growth and maintaining operational efficiency within the sector.

Market Drivers

The robust expansion of the healthcare and pharmaceutical sectors serves as a major engine for market value, creating a need for high-precision closures utilized in drug delivery systems, injectables, and ophthalmic solutions. Unlike standard sealing applications, this segment necessitates strict adherence to safety protocols and functional engineering, including child-resistant and tamper-evident mechanisms. Consequently, manufacturers are heavily investing in proprietary technologies to satisfy these intricate medical requirements, strategically pivoting from volume-centric manufacturing to value-added packaging. This shift is reflected in financial results; as noted by AptarGroup in February 2025 regarding their 'Fourth Quarter and Annual 2024 Results', their Pharma segment achieved an 8% increase in net sales for the full year 2024, fueled by strong demand for specialized drug delivery systems.Concurrently, the escalating insistence on sustainable and recyclable packaging is transforming product design and material procurement throughout the sector. As regulations mandate tethered caps and circular economy practices, corporations are expediting the adoption of post-consumer recycled content and lightweight structures. This transition demands considerable innovation to preserve seal integrity while reducing reliance on virgin plastics. Evidencing this trend, Berry Global stated in their '2024 Sustainability Report' from March 2025 that the company raised its acquisition of post-consumer resin by 43% compared to the previous year. This pursuit of circularity occurs alongside consistent consumption; The Coca-Cola Company reported in 2025 that global unit case volume rose by 1% for the full year 2024, highlighting the continuous necessity for sustainable closure solutions at a mass scale.

Market Challenges

The strict enforcement of plastic reduction policies and environmental sustainability mandates represents a significant obstacle to the advancement of the Global Plastic Caps and Closures Market. Producers are forced to undertake costly retooling of their manufacturing lines to support new designs, such as tethered caps, and to incorporate substantial amounts of recycled materials. This mandatory capital expenditure redirects essential financial resources away from innovation and capacity expansion, while the rarity of high-grade post-consumer resin generates a supply-demand disparity that severely increases operational expenses.This operational inefficiency is fundamentally caused by the restricted availability of feedstock needed to satisfy these legal requirements. Data from The Recycling Partnership in 2024 indicates that roughly 83% of plastic packaging capable of curbside recycling was not successfully recovered in the recycling stream. This inadequate recovery rate critically limits the supply of essential recycled materials, compelling manufacturers to operate within a volatile and costly raw material market. As a result, the industry faces difficulties in scaling production effectively while complying with the rigorous regulatory environment, which directly impedes overall market development.

Market Trends

The rise of innovations in dispensing and sports caps is transforming market dynamics, moving the focus from basic sealing to functional convenience, especially within the food and beverage industries. Brands are increasingly implementing sophisticated closure systems that provide hygiene, precise dosage, and on-the-go utility to distinguish their products in a competitive retail landscape. This trend favors value-added designs over standard commodity caps, stimulating volume growth in higher-margin segments as consumers seek improved usability. This pivot toward specialized functionality is reflected in recent industry performance; Silgan Holdings reported in their '2024 Annual Report' released in February 2025 that they achieved double-digit volume growth in dispensing products for three consecutive quarters during the fiscal year, highlighting the strong adoption of these convenient solutions.At the same time, the evolution of short-neck and lightweight designs is advancing beyond simple resin reduction toward fundamental material restructuring to optimize efficiency. Manufacturers are developing mono-material solutions, such as all-PET closures, which substantially lower package weight compared to conventional polypropylene assemblies and remove the necessity for material separation during recycling. This technical advancement facilitates lighter transportation loads and establishes a seamless circular loop for bottle-to-cap reprocessing. Illustrating the commercial potential of this structural innovation, Origin Materials announced in a September 2024 press release titled 'Origin Materials Announces Organizational Streamlining' that it had signed a memorandum of understanding with a client to purchase over $100 million worth of their proprietary lightweight PET caps.

Key Players Profiled in the Plastic Caps and Closures Market

- Silgan Holdings Inc.

- Amcor Ltd.

- Crown Holdings Inc.

- Aptar Group Inc.

- Berry Global, Inc.

- Albea S.A.

- Ball Corporation

- Evergreen Packaging Inc.

- Closure Systems International

- Guala Closures Group

Report Scope

In this report, the Global Plastic Caps and Closures Market has been segmented into the following categories:Plastic Caps and Closures Market, by Product Type:

- Screw-on caps

- Dispensing caps

- Others

Plastic Caps and Closures Market, by Container Type:

- Plastic

- Glass

Plastic Caps and Closures Market, by Raw Material:

- PP

- HDPE

- LDPE

- Others

Plastic Caps and Closures Market, by Technology:

- Post-Mold Te Band

- Compression Molding

- Injection Molding

Plastic Caps and Closures Market, by End-Use Sector:

- Beverage

- Pharmaceutical

- Food

- Personal & homecare

- Others

Plastic Caps and Closures Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Plastic Caps and Closures Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Plastic Caps and Closures market report include:- Silgan Holdings Inc.

- Amcor Ltd

- Crown Holdings Inc.

- Aptar Group Inc.

- Berry Global, Inc.

- Albea S.A.

- Ball Corporation

- Evergreen Packaging Inc.

- Closure Systems International

- Guala Closures Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

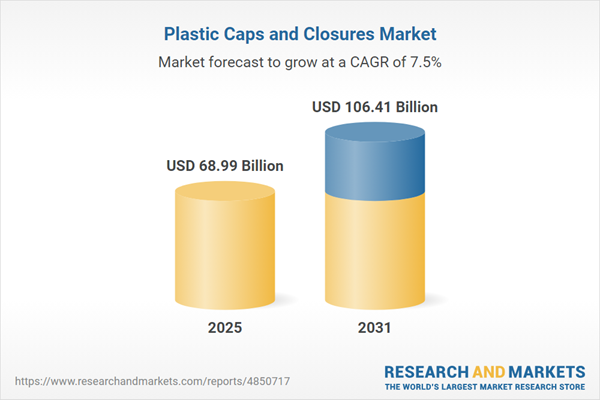

| Estimated Market Value ( USD | $ 68.99 Billion |

| Forecasted Market Value ( USD | $ 106.41 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |