Ready-to-drink tea and coffee refer to packaged beverages that are pre-made and require no additional preparation. These convenient and on-the-go options have gained immense popularity in recent years, catering to the fast-paced lifestyles of consumers. Ready-to-drink teas are usually brewed and bottled with various flavors, including black, green, white, or herbal, offering a refreshing and thirst-quenching experience. On the other hand, ready-to-drink coffee comes in different forms, such as cold brews, iced coffees, and lattes, providing a quick caffeine fix without the need for brewing or barista skills. They offer convenience, making them a go-to choice for busy individuals seeking a delicious pick-me-up during work or travel. Moreover, they often come in single-serving containers, maintaining freshness and reducing waste.

The increasing purchasing power of individuals is driving the global market. Furthermore, commercial spaces, such as cafeterias, coffee shops, cafes, restaurants, quick-service restaurant (QSR) chains, and hotels, are playing a crucial role in fuelling the market as these establishments are partnering with tea and coffee brands to launch endorsement programs, which further augments the market. Additionally, the installation of RTD tea and coffee vending machines in various places, such as airports, hospitals, shopping malls, school canteens, railways, and petrol stations, is supporting the market. Moreover, manufacturers are continuously innovating by introducing new and exciting flavors such as matcha, hazelnut, mint, hibiscus, Thai iced tea, caramel, peanut butter, passion fruit, kiwi green tea, mango, and melon, which are gaining prominence among the masses. Besides, promotional strategies, including celebrity endorsements and social media campaigns, are creating a positive market outlook. Additionally, the market is benefiting from the rising popularity of home delivery services through online retail channels, providing convenience, a wide product selection, fast shipping options, discounted deals, and various payment methods.

Ready to Drink Tea and Coffee Market Trends/Drivers:

The Rising Trend for Convenience and On-The-Go Lifestyles

The increasing demand for ready-to-drink tea and coffee can be attributed significantly to the modern consumer's fast-paced lifestyle and the desire for convenience. Presently, individuals are constantly on the move, juggling work, family, and social commitments, leaving little time for traditional brewing or coffee shop visits. Ready-to-drink beverages offer a quick and hassle-free solution, as they come pre-packaged and ready for immediate consumption. Whether it's a bottled iced tea for a refreshing pick-me-up during a hectic workday or a canned cold brew coffee for a boost of energy before hitting the gym, these beverages fit seamlessly into the fast-paced routines of consumers, eliminating the need for preparation without compromising on taste or quality.Escalating Health and Wellness Trends

The growing focus on health and wellness among consumers is catalyzing the market for ready to drink tea and coffee. As individuals are becoming more health-conscious and are seeking ways to make better dietary choices, they are turning away from sugary sodas and carbonated drinks. Ready-to-drink tea and coffee products have capitalized on this trend by offering healthier alternatives, such as low-calorie, low-sugar, and natural ingredient-based options. Moreover, green tea, herbal infusions, and organic coffee varieties have gained popularity due to their perceived health benefits and antioxidant properties. Additionally, manufacturers are incorporating functional ingredients, including vitamins, minerals, and adaptogens into their products to appeal to health-conscious consumers seeking beverages that offer more than just a caffeine boost.Diverse Flavor Profiles and Premiumization

The ready-to-drink tea and coffee market is supported by the availability of various flavors. Manufacturers are continuously innovating with a wide range of flavors, appealing to various taste preferences and cultural preferences. From traditional black tea and classic coffee to exotic fruit-infused teas and indulgent mocha coffee blends, the options are ever-expanding. This extensive flavor variety not only attracts new consumers but also encourages existing customers to explore and experiment with different offerings. Moreover, the trend towards premiumization has elevated the perception of ready-to-drink tea and coffee from a mere convenience product to a sophisticated and upscale beverage choice. Artisanal cold brews, single-origin coffee blends, and handcrafted tea concoctions have garnered a dedicated following among connoisseurs willing to pay a premium for high-quality and exclusive taste experiences.Ready to Drink Tea and Coffee Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global ready to drink tea and coffee market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on product, additives, packaging, price segment and distribution channel.Breakup by Product:

- RTD Tea

- Black Tea

- Fruit & Herbal Based Tea

- Oolong Tea

- Green Tea

- RTD Coffee

- Ginseng

- Vitamin B

- Taurine

- Guarana

- Yerba Mate

- Acai Berry

RTD tea dominates the market

The report has provided a detailed breakup and analysis of the market based on the product. This includes RTD tea (black tea, fruit and herbal based tea, oolong tea, and green tea) and RTD coffee (ginseng, vitamin B, taurine, guarana, yerba mate, and acai berry). According to the report, RTD tea represented the largest segment.RTD tea stands out as the largest product segment as it has long been a widely consumed beverage globally, with a rich cultural history and tradition in many regions. As such, the concept of bottled or canned RTD tea resonates well with consumers who seek the convenience of enjoying their favorite tea flavors on-the-go. Additionally, the health-conscious trend among consumers has fueled the demand for RTD tea, as it is often perceived as a healthier alternative to sugary carbonated drinks. Furthermore, the availability of diverse and refreshing RTD tea flavors, including green tea, herbal infusions, and fruit-infused blends, has broadened the appeal to a wide range of consumers. Moreover, effective marketing and branding strategies have played a significant role in promoting RTD tea as a trendy and appealing beverage choice. Companies have leveraged social media, influencers, and eye-catching packaging designs to attract young consumers and create a strong brand presence. This modern and aspirational approach has contributed to RTD tea's dominance in the market, especially among millennials and gen Z consumers.

Breakup by Additives:

- Flavors

- Artificial Sweeteners

- Acidulants

- Nutraceuticals

- Preservatives

- Others

Consumer palates are constantly seeking novel and enticing taste experiences, and flavored RTD beverages cater to this demand. Beverage manufacturers are continuously innovating and developing a wide array of flavors, ranging from classic favorites, including lemon, raspberry, and peach to more exotic options, including lychee, passion fruit, and coconut. The availability of diverse and exciting flavors not only attracts new consumers but also encourages repeat purchases and brand loyalty. Additionally, flavors allow beverage companies to tap into various demographics and cultural preferences, ensuring a broader market appeal.

On the other hand, with increasing concerns about sugar consumption and its impact on health, consumers are actively seeking healthier alternatives to traditional sugary beverages. Artificial sweeteners offer the advantage of providing sweetness without the added calories and are widely used to formulate low-calorie or sugar-free RTD beverages.

Breakup by Packaging:

- Glass Bottle

- Canned

- PET Bottle

- Aseptic

- Others

PET bottle dominates the market

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes glass bottle, canned, PET bottle, aseptic, and others. According to the report, PET bottle represented the largest segment.PET bottles offer a perfect balance between functionality, convenience, and sustainability, making them a popular choice for both manufacturers and consumers. Their lightweight nature makes them easy to transport and handle, enhancing the overall convenience for consumers, especially those on the go. Additionally, PET bottles are known for their excellent transparency, allowing consumers to visually assess the product's quality and freshness before making a purchase. Moreover, PET is recyclable, aligning with the growing consumer demand for eco-friendly and sustainable packaging options. The recyclability of PET bottles reflects positively on the brand's image, attracting environmentally conscious consumers. As a result of these advantages, beverage companies widely adopt PET bottles for their RTD products, making it the largest packaging segment and an integral part of the thriving RTD beverage industry.

Breakup by Price Segment:

- Premium

- Regular

- Popular Priced

- Fountain

- Super Premium

When analyzing the price segments in the market for ready-to-drink (RTD) beverages, premium and regular products emerge as the largest price segment. The premium segment targets consumers who seek a higher quality, exclusive, and indulgent experience. These RTD beverages often feature premium ingredients, unique flavors, and sophisticated packaging, positioning them as a more luxurious choice. The premium category appeals to consumers who are willing to pay a premium price for a distinctive and superior product.

On the other hand, the regular segment encompasses products that are more affordable and accessible to a broader consumer base. These offerings focus on providing a satisfactory taste experience at a reasonable price, making them suitable for everyday consumption. The regular segment's affordability and availability make it a popular choice among budget-conscious consumers and those seeking a familiar, consistent RTD beverage option.

Breakup by Distribution Channel:

- Off-Trade

- Independent Retailers

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

- On-Trade

- Food Service

- Vending

Off-trade channel holds the largest share in the market

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes off-trade (independent retailers, supermarkets and hypermarkets, convenience stores, and others) and on-trade (food service and vending). According to the report, off-trade accounted for the largest market share.The popularity of the off-trade segment can be attributed to its widespread accessibility and convenience for consumers. These retail outlets are easily accessible in both urban and rural areas, ensuring a broad reach for RTD beverage brands. Moreover, consumers appreciate the convenience of being able to purchase their favorite RTD beverages along with their regular groceries or other shopping needs. The off-trade distribution also allows beverage companies to tap into a vast consumer base and leverage retail visibility to promote their products through attractive displays and promotional campaigns. Off-trade retailers frequently engage in cross-promotional activities and brand partnerships with RTD beverage companies. Collaborations between retailers and brands, such as co-branded promotions or exclusive product launches, generate excitement among consumers and enhance the appeal of RTD tea and coffee products, further solidifying the dominance of off-trade channels in the market.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Asia Pacific exhibits a clear dominance, accounting for the largest ready to drink tea and coffee market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share.Asia Pacific holds a significant position in the market. Due to rapid urbanization, coupled with the adoption of Western lifestyles and preferences, has accelerated the consumption of convenience-oriented products, such as RTD beverages among the masses. Moreover, the diverse and vibrant culinary cultures of the Asia Pacific have influenced the proliferation of a wide array of unique and innovative RTD beverage flavors, appealing to a broad range of tastes. Additionally, the rising disposable incomes in several countries within the region have led to an increased willingness among consumers to explore and indulge in premium and high-quality RTD offerings. Furthermore, the dynamic growth of modern retail channels and the widespread presence of convenience stores and supermarkets have facilitated easy access to RTD beverages, accelerating their popularity.

Competitive Landscape:

Companies have been continuously innovating their RTD tea and coffee offerings by introducing new and unique flavors, blends, and formulations. They aim to cater to diverse consumer preferences and stay ahead in the market. Moreover, with the growing trend of health-conscious consumers, several companies are developing healthier versions of RTD tea and coffee. This includes products with reduced sugar content, natural ingredients, and added functional benefits, such as antioxidants or vitamins. Furthermore, environmental concerns have prompted companies to adopt more sustainable practices. They are exploring eco-friendly packaging options, implementing recycling programs, and sourcing ingredients responsibly to appeal to eco-conscious consumers. Besides, leading players are investing in marketing campaigns and branding strategies to create stronger brand identities and connect with their target audience. This includes celebrity endorsements, social media promotions, and interactive campaigns.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Asahi Breweries

- Dr Pepper Snapple Group

- Starbucks

- Pepsico

- The Coca Cola Company

- Ajinomoto General Foods Inc.

- Ting Hsin International Group

- Uni-President Enterprises Corporation

- Nestlé

- Dunkin' Brands

- Ferolito Vultaggio & Sons

- Keurig Dr Pepper

- Hangzhou Wahaha Group

- Lotte Chilsung

- Monster Beverage

- Acqua Minerale San Benedetto

- Kirin Holdings Company

- Unilever

- Arizona Beverage Company

- Suntory

Key Questions Answered in This Report

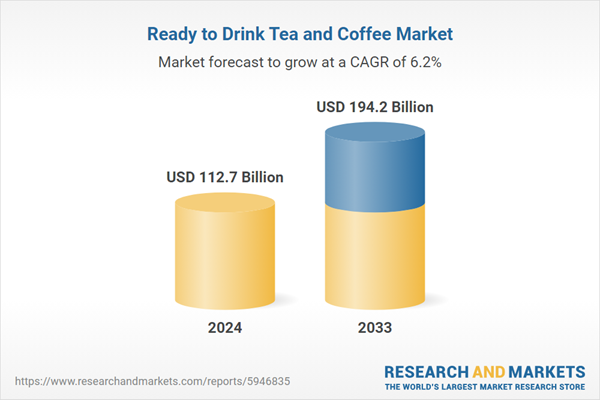

- What is the size of the global ready to drink tea and coffee market in 2024?

- What is the expected growth rate of the global ready to drink tea and coffee market during 2025-2033?

- What are the key factors driving the global ready to drink tea and coffee market?

- What has been the impact of COVID-19 on the global ready to drink tea and coffee market?

- What is the breakup of the global ready to drink tea and coffee market based on the product?

- What is the breakup of the global ready to drink tea and coffee market based on the packaging?

- What is the breakup of the global ready to drink tea and coffee market based on the distribution channel?

- What are the key regions in the global ready to drink tea and coffee market?

- Who are the key players/companies in the global ready to drink tea and coffee market?

Table of Contents

Companies Mentioned

- Asahi Breweries

- Dr Pepper Snapple Group

- Starbucks

- Pepsico

- The Coca Cola Company

- Ajinomoto General Foods Inc.

- Ting Hsin International Group

- Uni-President Enterprises Corporation

- Nestlé

- Dunkin' Brands

- Ferolito Vultaggio & Sons

- Keurig Dr Pepper

- Hangzhou Wahaha Group

- Lotte Chilsung

- Monster Beverage

- Acqua Minerale San Benedetto

- Kirin Holdings Company

- Unilever

- Arizona Beverage Company

- Suntory

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 112.7 Billion |

| Forecasted Market Value ( USD | $ 194.2 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |