The Youth sports market is poised to achieve significant growth as travel teams become more popular and families enjoy time together during a weekend sporting event.

Leagues purchase and distribute sports software, clothing, and equipment to teams and clubs. The leagues have created a large market out of what were previously disparate small businesses serving scholastic youth sports locally. The club and elite teams provide better coaching and better access for all youth, both boys and girls.

The availability of training by dedicated, professional coaches has made possible the evolution of hundreds of thousands of elite teams that together comprise a youth sports market in ordinary times. These are not ordinary times, unfortunately. Enormous market efficiency is being achieved as youth and recreational teams move to automated processes. Apps can be used to book hotels and make travel arrangements.

Youth sports facilities become part of a community development program for all ages Every team, and every sport has appeal and as there is more leisure, as the economy spins out more and more wealth at the top of the economic scale, there will be more spending on sports. Professional sports, betting, fantasy teams, semiprofessional teams, and teams just for fun will continue to look for venues and players.

According to the publisher, “Vendors are upgrading feature function packages. They are leveraging apps to improve communications and draw more people into programs. Software so it is able to provide a wide range of capabilities. Once a platform is in place, the organization of travel teams is facilitated.”

Market Leaders

- Nike

- Ameri Sports

- Wilson

- Adidas

- Under Armor

- InterContinental Hotels Group

- Marriott

- Bauer

- Stack Sports

- NBC Sports

- SportsEngine

Key Topics Covered:

- Club Management

- Flexible Payment Options

- League Software

- Recreational League

- Sports Software

- Sports Team Registration

- Sports Technology

- Sports Wearables

- Sports Websites

- Team Flexible Payment

- Team One Tap Payment

- Team Registration

- Team Roster Software

- Team Volunteer Management

- Travel Teams

- Volunteer Management

- Youth Development

- Youth Sports

- Youth Sports Coaching

- Youth Sports Team Communication

- Youth Travel Teams

Table of Contents

1. Youth Team, League, and Tournament Sports: Market Description and Market Dynamics

1.1 Youth League Sports Market Dynamics

1.2 Participation in Sports Develops Core Values in Youth

1.2.1 Professional Sports Embrace Youth Development Programs

1.2.2 Jr.NBA.com Emphasizes Fundamentals for Youth

1.3 Clothing and Apparel a Core Aspect of the Youth Sports Market

1.3.1 Little League Chose Dick's Team Sports HQ As Its Tech Provider

1.4 Hotels Leverage Vendor Positioning in Youth Sports Markets

1.5 Youth Sports League Software Is Highly Specialized

1.6 Barriers to Youth Sports Participation

1.6.1 Barriers to Youth Sports Participation

1.6.2 Aim to Ensure That All Kids Have the Chance to Grow Up Fit and Strong

1.6.3 Developing the Athletic and Human Potential of a Child

1.7 Youth Team Web Sites

1.7.1 Youth Sports Team Web Presence

1.8 Youth Sports Software Communications Functions

2. Youth Team, League, and Tournament Sports Market Shares and Forecasts

2.1 Youth Team, League, and Tournament Sports Market Driving Forces

2.1.1 Youth League Sports Market Dynamics

2.1.2 Innovation Is Core to the Market Growth of Youth Sports Organizations

2.2 Youth Sports Team, League, and Tournament Market Shares

2.2.1 Movement Toward Travel Teams

2.2.2 Linking to Team Sponsors

2.2.3 Youth League Sports Market Growth Development Programs

2.2.4 Youth League Sports Software Functions

2.2.5 Team Sports Financial Reporting

2.2.6 Youth Team Sports Acquisitions

2.2.7 Youth League Sports Apps Model Market Factors

2.2.8 Applications

2.3 Youth League Sports Market Forecasts

2.3.1 Youth Sports Team, League, and Tournament Market Segments, Dollars, Worldwide

2.4 Youth Team, League, and Tournament Facilities Market, Number Field Rentals

2.5 Youth League Sports Regional Market Analysis

2.5.1 U.S. Sports Profile

2.5.2 US Youth Sports Regional Analysis by MSA Region

2.5.3 Youth Team Sites Revenue Model

2.5.4 Canada

3 Youth League Sports Product Description

3.1 Vendors Build Brand with Significant, Targeted Upper Middle-Class Demographics

3.1.1 Vendors Address Needs of Different Types of Teams

3.1.2 Stack Sports GoalLine

3.1.3 Stack Sports Strengths

3.1.4 Stack Sports Challenges

4 Youth and Recreational League Sports Research and Technology

4.1 Payment Gateways

4.1.1 Payment Processing Solutions for a League

4.1.2 Recommended Merchant Broker Authorize.net Gateway

4.2 Responsive Web Design

4.2.1 Robust Website Structure

4.3 Tournament Types

4.3.1 Match Day Types

4.4 Season Registration & eSport Configuration

4.5 Venue

4.6 FE Management

4.6.1 Extra fields

4.7 Artificial Intelligence and Software

4.8 Nike Open-Source Software

5 Youth and Recreational League Sports Software Company Profiles

5.1 Adidas

5.2 Global Payments / Active Network

5.2.1 Active Network

5.2.2 Active Network Global Payments

5.2.3 Active Network / Active Sports

5.2.4 Active Sports Strengths

5.2.5 Active Sports Challenges

5.2.6 Active Sports Revenue Model

5.3 Agile Sports Technologies / Hudl

5.3.1 Hudl

5.3.2 Hudl Video

5.3.3 Hudl Acquisitions

5.3.4 Hudl Financing

5.3.5 Hudl Partnership with Nike

5.4 Amer Sports / Wilson

5.5 Aspen Institute

5.6 Athletrax / mysportsort

5.7 Bauer

5.8 Bear Dev

5.9 Catapult

5.9.1 Catapult Acquisitions

5.9.2 Catapult Customers

5.10 Coach Logic

5.11 Cogran

5.12 Comcast / NBC / Sport Engine

5.12.1 Comcast Business

5.12.2 NBC Sports Group

5.12.3 NBC Universal / SportsEngine

5.12.4 Sports Engine Culture

5.13 Dick's Sporting Goods

5.13.1 Dick's Sporting Goods Revenue

5.14 Engage Sports

5.15 FiXi Competition Management

5.15.1 FiXi Competition Management Revenue Model

5.15.2 FiXi Competition Management Features and Functions

5.15.3 FiXi Competition Management Customization and League Requirements

5.16 HorizonWebRef.com

5.16.1 HorizonWebRef.com Revenue Model

5.17 InterContinental Hotels Group IHG

5.17.1 IHG Strategic Priorities

5.17.2 InterContinental Hotels Group IHG's Holiday Inn Express

5.17.3 Holiday Inn Express

5.18 Jevin

5.19 Jonas Software / EZFacility

5.19.1 EZFacility Sports Facility & League Software

5.19.2 Advertising Revenue Model

5.19.3 EZFacility Features and Functions

5.19.4 EZFacility Target Market

5.20 JoomSport

5.20.1 JoomSport Revenue Model

5.20.2 JoomSport Target Market

5.20.3 JoomSport Features

5.21 LeagueApps

5.21.1 LeagueApps

5.21.2 LeagueApps Revenue Model

5.21.3 LeagueApps Features and Functions

5.21.4 LeagueApps Target Market

5.22 LeagueLobster

5.23 LeagueRepublic

5.23.1 LeagueRepublic Features

5.24 Marriott

5.25 NBC / SportsEngine

5.26 Nike

5.26.1 Nike Personal Analytics

5.26.2 Nike Partnership with Hudl

5.26.3 Nike Revenue - Impact of Covid-19

5.27 QSTC

5.28 RosterBot

5.29 SFA Sports Facilities Advisory & Sports Facilities Management

5.29.1 SFA Funding Services

5.30 Sideline Sports

5.30.1 Sideline Sports XPS Network

5.30.2 Sideline Sports Tools

5.31 SIP

5.32 Sixgill

5.33 Sportlyzer

5.33.1 Sportlyzer Team Management Software

5.34 SPay / Stack Sports

5.34.1 Stack Sports

5.34.2 Stack Sports partnership with USA Elite Sports Network (USA Elite)

5.34.3 Stack Sports

5.34.4 SPay

5.34.5 Stack Sports Brand

5.34.6 Stack Pay Payment Platform

5.34.7 Stack Sports Acquisitions

5.34.8 Stack Sports Built Functionality and User Base Through Acquisition

5.34.9 Stack Sports Soccer

5.34.10 Stack Sports Goalline

5.34.11 Stack Sports / Affinity Sports

5.34.12 Affinity Sports Concussion Protocols and Product Positioning

5.34.13 Stack Sports GamePlan System

5.35 Steel Sports

5.36 SwimTopia

5.36.1 SwimTopia Summer Swim Teams

5.36.2 SwimTopia Summer Swim Leagues

5.36.3 SwimTopia Revenue Model

5.37 Teamer

5.38 TeamSideline.com

5.38.1 TeamSideline Features

5.38.2 TeamSideline Team Sites

5.39 TeamSnap

5.40 Under Armour

5.41 Vista Equity Partners Fund IV and Vista Equity Partners Fund III / Lanyon

5.41.1 Vista Equity Partners / STATS

5.41.2 Vista Equity Partners Amisco Prozone ("Prozone")

5.41.3 Vista Equity Partners Automated Insights

5.41.4 Vista Equity Partners the Sports Network (TSN)

5.41.5 Vista Equity Partners Bloomberg Sports

5.42 VNN Sports

5.43 Wooter

5.44 YourTeamOnline

5.45 Zebra Technologies Sports Solutions

5.45.1 Zebra / NFL Partnership

5.46 Zuluru

5.46.1 Zuluru Revenue Model

5.47 Selected List of Youth Sports Software Companies

List of Figures

Figure 1. Market Growth Factors in High End Youth Sports

Figure 2. Youth League Sports Market Driving Forces

Figure 3. Market Growth in Youth Sports Driving Forces

Figure 4. Market Growth in Youth Sports Driving Factors

Figure 5. Driving Forces for Market Growth in Community Development Using Youth Sports

Figure 6. Youth Sports Driving Forces for Community Development

Figure 7. Youth Sports Product Offerings:

Figure 8. Barriers to Youth Sports Participation

Figure 9. Challenges to Youth Sports Participation

Figure 10. Aim to Ensure That All Kids Have the Chance to Grow Up Fit and Strong

Figure 11. Youth Team Sports Organization Aspects

Figure 12. Youth League Sports Software Market Driving Forces

Figure 13. Youth League Sports Software Development Mapping

Figure 14. Youth League Sports Market Factors

Figure 15. Youth League Sports Software Functions

Figure 16. Youth Sports Software Communications Functions

Figure 17. Market Growth Factors in High-End Youth Sports Schools and Facilities

Figure 18. Market Growth in Youth Sports Driving Forces

Figure 19. Market Growth in Youth Sports Driving Factors

Figure 20. Driving Forces for Market Growth in Community Development Using Youth Sports

Figure 21. Youth Sports Driving Forces for Community Development

Figure 22. Youth League Sports Market Driving Forces

Figure 23. Youth Sports Team, League, and Tournament Software, Hotel, and Shoes Spending Market Shares, Dollars, Worldwide, 2021

Figure 24. Youth Sports Team, League, and Tournament Software, Hotel, and Shoes Spending Market Shares, Dollars, Worldwide, 2021

Figure 25. Youth Sports Elite Teams, Club Teams

Figure 26. Youth League Sports Movement Toward Travel Teams

Figure 27. Youth League Sports Market Growth Development Programs

Figure 28. Youth League Sports Team Sponsors

Figure 29. Youth Sports Team, League, and Tournament Market Shares, Dollars, Worldwide, 2021

Figure 30. Youth Sports Team, League, and Tournament Software Market Shares, Dollars, Worldwide, 2021

Figure 31. Youth Sports Team, League, and Tournament Software Market Shares, Dollars, Worldwide, 2021

Figure 32. Youth League Sports Software Functions

Figure 33. Team Sports HQ Reporting Functions

Figure 34. Team Sports Payments and Order Tracking Functions

Figure 35. Youth League Sports Software Revenue Model Market Factors

Figure 36. Youth League Sports Software Market Demands

Figure 37. Youth Sports League Software Applications

Figure 38. Youth Team, League, and Tournament Sports Market Forecasts, Dollars, Worldwide, 2021-2028

Figure 39. Youth Team, League, and Tournament Sports Market Forecasts, Dollars, Worldwide, 2022-2028

Figure 40. Youth Sports Team, League, and Tournament Market Shares, Dollars, US, 2021-2028

Figure 41. Youth Sports Team, League, and Tournament Market Shares, Dollars, US, 2022-2028

Figure 42. Youth Team, League, and Tournament Sports Software, Hotel, Shoes, Apparel, Gear, Equipment and Travel Market Forecasts Dollars, Worldwide, 2022-2028

Figure 43. Youth Team, League, and Tournament Sports Software, Hotel, Shoes, Apparel, Gear, Equipment and Travel Market Forecasts, Percent, Worldwide, 2022-2028

Figure 44. Youth Team, League, and Tournament Facilities Market including Community Fields, Number Fields Used, US, 2021

Figure 45. Youth Team, League, and Tournament Participation, United States and Worldwide, Number of Players, 2021

Figure 46. Youth Team, League, and Tournament Software Markets by Sport, Units and Dollars, 2021

Figure 47. Aspects of Competition in Youth Sports Team, League, and Tournament Apparel and Equipment Markets

Figure 48. Youth Sports Team, League, and Tournament, Regional Market Segments, Dollars, 2021

Figure 49. Youth Sports Team, League, and Tournament, Regional Market Segments, Dollars, 2021

Figure 50. U.S. Census Bureau Regional Office Boundaries

Figure 51. US MSA Region Definitions

Figure 52. MSA Metropolitan Population, US 2022

Figure 53. Dollars Spent on Youth Sports by MSA Region

Figure 54. Canadian Youth Sports Market

Figure 95. Stack Sports GoalLine Customers

Figure 55. One-Stop Shop for Sports Registration, Payments and Management

Figure 56. Responsive Web Design (RWD) Illustrated

Figure 57. Robust Website Structure

Figure 58. Division of Tournament Types

Figure 59. Active Sports Partners

Figure 60. Active Network Metrics

Figure 61. Active Network Markets Served

Figure 62. Active Network Product Positioning

Figure 63. Active Network Solutions:

Figure 64. Active Network Management Software Solutions:

Figure 65. Active Network Platform Features

Figure 66. Active Network Customers

Figure 67. Aspen Institute Project Play Partners

Figure 68. Crowdfunding for Sports Teams

Figure 69. Catapult Customers

Figure 70. Coach Logic Video Analysis Tool Functions

Figure 71. Cogran Sports League Management Software Modules

Figure 72. Comcast Focus on Technology Initiatives:

Figure 73. NBC Sports SportsEngine Partners

Figure 74. Dick's Locations by State

Figure 75. Engage Sports Tools

Figure 76. FiXi Competition Management Target Markets

Figure 77. HorizonWebRef Pricing per Official

Figure 78. IHG Financials 2018

Figure 79. Selected IHG Brands

Figure 96. EZ Facility Key Features

Figure 80. EZFacility Target Markets

Figure 81. EZFacility Target Markets

Figure 82. ZoomSport professional edition license fees: $158.

Figure 83. JoomSport Target Market

Figure 84. LeagueRepublic Sports Software Functions

Figure 85. SFA Sports Facility Metrics

Figure 86. SFA Funding Services

Figure 87. Sideline Sports XPS Network Functions

Figure 88. Sideline Sports Clients by Category and Sport

Figure 89. Sportlyzer Monthly Recurring Revenue

Figure 90. Sportlyzer Total Registered Clubs

Figure 91. Sportlyzer Market Exit Strategy

Figure 92. Sportlyzer Sports Customers

Figure 93. Sportlyzer Sports Metrics

Figure 94. Stack Sports One-Stop Shop for Sports Registration, Payments and Management

Figure 95. Stack Sports 2021 Metrics

Figure 96. Stack Sports per Club Metrics

Figure 97. Stack Sports Client Base

Figure 98. Stack Sports Positioning

Figure 95. Stack Sports Target Markets

Figure 99. Stack Sports Brands

Figure 100. Stack Sports Customers

Figure 101. Stack Sports Software Competitive Advantage

Figure 102. Stack Sports Soccer

Figure 103. Affinity Sports Software Functions

Figure 104. Steel Sports Brand Relationships

Figure 105. TeamSnap League Management Metrics

Figure 106. TeamSnap Average Number User Touches per Month

Figure 107. TeamSnap Targets Coaches and Parents Easy-To-Use Tool for Organizing and Communicating Team Life

Figure 108. TeamSnap Coaching Platform Toolset Tasks

Figure 109. TeamSnap Platforms Supported

Figure 110. TeamSnap Target Market

Figure 111. TeamSnap Online Sports Team Management Application

Figure 112. TeamSnap Online Features

Figure 113. Teamsnap Benefits

Figure 114. TeamSnap Team Management Sports Targeted

Figure 115. TeamSnap Integration Features

Figure 116. TeamSnap Smartphone App Functions

Figure 117. Average # of TeamSnap Touches/User/Month

Figure 118. Zebra Technologies RFID Sports Positioning

Figure 119. Zebra Has One Million RFID Tags in Place

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Active Network

- Active Sports

- Adidas

- Affinity Sports

- Agile Sports Technologies

- Ameri Sports

- Aspen Institute

- Athletrax

- Bauer

- Bear Dev

- Catapult

- Coach Logic

- Cogran

- Comcast

- Dick's Sporting Goods

- Engage Sports

- EZFacility

- FiXi Competition Management

- Global Payments

- HorizonWebRef.com

- Hudl

- InterContinental Hotels Group

- Jevin

- Jonas Software

- JoomSport

- Lanyon

- LeagueApps

- LeagueLobster

- LeagueRepublic

- Marriott

- mysportsort

- NBC

- NFL

- Nike

- QSTC

- RosterBot

- SFA Sports

- Sideline Sports

- SIP

- Sixgill

- SPay

- Sportlyzer

- Sports Facilities Advisory

- SportsEngine

- Stack Sports

- STATS

- Steel Sports

- SwimTopia

- Teamer

- TeamSideline.com

- TeamSnap

- Under Armour

- Vista Equity Partners

- VNN Sports

- Wilson

- Wooter

- YourTeamOnline

- Zebra Technologies

- Zuluru

Table Information

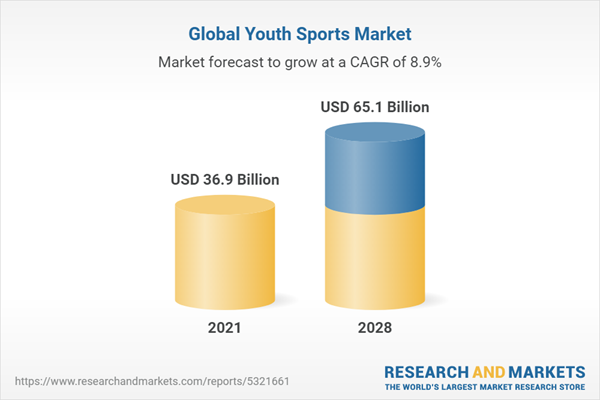

| Report Attribute | Details |

|---|---|

| No. of Pages | 270 |

| Published | November 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 36.9 Billion |

| Forecasted Market Value ( USD | $ 65.1 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |