Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Growth in this sector is largely fueled by the rapid pace of digital transformation, particularly the widespread migration to cloud environments, and the growing requirement for stringent regulatory compliance regarding data privacy. Additionally, the continuous rise in security breaches forces businesses to prioritize identity governance to safeguard sensitive resources. As reported by the Identity Defined Security Alliance in 2024, 90% of organizations encountered at least one identity-related incident within the previous year, highlighting the urgent need for strong security measures.

However, the market faces significant hurdles due to the intricacies involved in deploying and integrating IAM solutions across varied IT infrastructures. Companies often grapple with issues like identity sprawl and the high level of technical proficiency needed to configure these systems for both legacy and modern platforms. This operational complexity, combined with significant implementation costs, often places a heavy burden on smaller enterprises, potentially slowing the wider acceptance of comprehensive identity management frameworks.

Market Drivers

The rising frequency of cyberattacks and data breaches serves as the main driver for the Global Identity & Access Management (IAM) Market, forcing organizations to fundamentally reassess their security boundaries. Attackers have largely moved away from traditional software vulnerabilities, opting instead for sophisticated identity-based intrusions where stolen credentials allow them to mimic legitimate users.According to the '2025 Global Threat Report' by CrowdStrike in August 2025, 79% of detected cyberattacks in 2024 were malware-free, indicating a clear market trend toward using compromised identities rather than exploits to penetrate networks. This increase in credential-based threats requires robust IAM systems capable of real-time user verification. Reflecting the urgency to modernize security, Zscaler reported in 2025 that 81% of organizations are shifting to implement zero trust strategies by 2026, emphasizing the vital adoption of identity-centric security models globally.

At the same time, the rapid expansion of cloud services and digital transformation efforts is broadening the attack surface, introducing complex challenges in managing access for both human and non-human entities. As businesses move toward hybrid and multi-cloud environments, the number of silicon-based identities requiring authentication has surged, making manual identity governance ineffective. According to CyberArk's '2025 Identity Security Landscape' report from April 2025, machine identities now exceed human identities by a ratio of 82 to 1, highlighting the critical issue of unmanaged access points in modern infrastructure. This massive increase in machine identities - spanning from bots to serverless functions - fuels the demand for automated IAM solutions capable of securing diverse digital assets without hindering operational speed or scalability.

Market Challenges

The operational difficulties linked to deploying and integrating Identity and Access Management (IAM) solutions across varied IT infrastructures serve as a significant constraint on market growth. As enterprises navigate hybrid environments that include both legacy applications and modern cloud services, the technical challenge of unifying these distinct systems generates considerable friction. This integration process requires specialized knowledge and extensive configuration, resulting in high implementation costs that frequently surpass the budgets of small and medium-sized businesses. As a result, prospective buyers often postpone or reduce the scope of their identity modernization initiatives to prevent business interruptions and resource depletion.This obstacle is underscored by recent industry statistics illustrating the scale of the problem. According to the Cloud Security Alliance in 2024, 65% of organizations pinpointed the management of access controls and policy enforcement across fragmented identity systems as a major operational issue. These integration barriers directly impede market expansion by extending sales cycles and lowering adoption rates among organizations with limited resources, effectively limiting the revenue opportunities for IAM vendors in the current market landscape.

Market Trends

The broad acceptance of passwordless authentication technologies is reshaping the IAM sector by substituting vulnerable static credentials with cryptographic proofs and biometric verification. Companies are actively moving toward FIDO2 standards and WebAuthn protocols to remove the friction and security dangers linked to traditional passwords, such as phishing and credential stuffing. This transition extends beyond user convenience, representing a vital strengthening of the authentication layer against interception attacks. Demonstrating this swift shift, the '2025 Businesses at Work' report by Okta in March 2025 noted that the year-over-year growth of the passwordless Okta Verify FastPass solution hit 69% among Fortune 500 clients, indicating a clear move away from legacy login methods.Simultaneously, the incorporation of AI and machine learning for adaptive risk analysis is evolving access control from static, rule-based frameworks to dynamic, behavior-focused systems. Contemporary IAM platforms leverage these technologies to analyze vast telemetry streams in real-time, enabling continuous evaluation of user risk scores based on anomalies in location, device status, and access behaviors. This functionality facilitates automated threat response, drastically narrowing the exposure window for identity-related breaches. Highlighting the operational value of these intelligent defenses, the '2025 Cost of a Data Breach Report' by IBM in August 2025 revealed that organizations using extensive security AI and automation reduced their breach lifecycles by 80 days compared to those without such capabilities, emphasizing the importance of automated risk engines in modern security architectures.

Key Players Profiled in the Identity & Access Management (IAM) Market

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- CA Technologies Inc.

- Dell Technologies Inc.

- Centrify Corporation

- Hewlett-Packard Company

- Hitachi ID Systems Inc.

- NetIQ Corporation

- Okta, Inc.

Report Scope

In this report, the Global Identity & Access Management (IAM) Market has been segmented into the following categories:Identity & Access Management (IAM) Market, by Solution:

- Provisioning

- Password Management

- Directory Service

- Advanced Authentication

- Single Sign-On (SSO)

- Audit

- Compliance

- Governance

Identity & Access Management (IAM) Market, by Deployment:

- On-premises

- Cloud

Identity & Access Management (IAM) Market, by Organization Size:

- SME

- Large Organization

Identity & Access Management (IAM) Market, by End Use Industry:

- BFSI

- IT & Telecom

- Education

- Retail

- Healthcare

- Others

Identity & Access Management (IAM) Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Identity & Access Management (IAM) Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Identity & Access Management (IAM) market report include:- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- CA Technologies Inc.

- Dell Technologies Inc.

- Centrify Corporation

- Hewlett-Packard Company

- Hitachi ID Systems Inc.

- NetIQ Corporation

- Okta, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

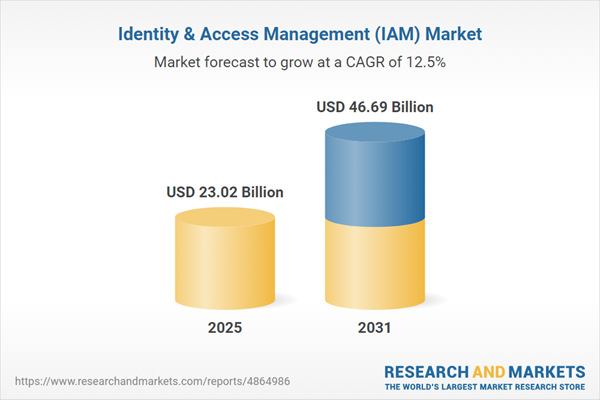

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 23.02 Billion |

| Forecasted Market Value ( USD | $ 46.69 Billion |

| Compound Annual Growth Rate | 12.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |