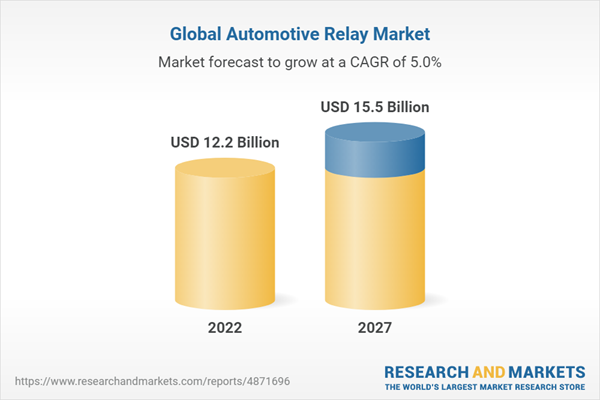

The automotive relay market is projected to grow from USD 12.2 billion in 2022 to USD 15.5 billion by 2027, at a CAGR of 5.0% for the same period. The key growth factor that drives the automotive relay demand is improving per capita income, especially in developing countries such as China, and India, which has shifted consumer preference from economy cars to mid-range cars. The mid-range vehicles are installed with more electronic components for advanced safety and comfort applications. Additionally, the demand for premium vehicles in European and North American countries contributes to the demand for automotive relays. On the other hand, an increase in electric and hybrid vehicle sales has spurred the demand for electric components such as electric compressors, batteries, tractor motors, electric motors, power electronics, and more. Also, the demand for a higher driving range and fast charging has made batteries and powerful motors an important aspect of electric vehicles. Many leading manufacturers offer high-voltage DC relays for electric vehicle applications. For instance, the Panasonic Corporation offers EV relays with a current range of 10A to 300A, available in various shapes with a switching capacity of around 2500A and 300V DC. Hongfa offers EV relays with a current range from 10A to 500A. Other key manufacturers invest heavily in research and development to develop EV relays for high-switching applications. Thus, the requirement of efficient relays with high power ratings and safety standards would become a critical element which is like to fuel the relay market from the electric and hybrid vehicles segment

PCB relays are speculated to drive the automotive relay market under the review period.

Printed circuit board (PCB) relays to lead the relay types in ICE vehicles globally. The benefits of PCB relays are compact, lower weight, and high power rating capacity, which aligns with the OEM requirement. PCB relays can switch current up to 200A; hence, these relays find applications for most automotive features where the relay needs to be small enough to fit in limited space. Some applications of PCB relays in vehicles are door locks, power windows, sunroofs, headlamps, and tail lights, among others. Hence, compact size, higher rating, and smaller package than plug-in relays make them preferable among all other types of relays, and with growing demand for applications mentioned above in the vehicles would further drive the demand for PCB relays in coming years.

Intelligent Park Assist is expected to be the rapidly growing automotive relay application during the forecast period.

The Intelligent Park Assist (IPA) is one of the premium comfort features aiding parking in modern vehicles. This technology has been introduced as vehicles on the road are constantly growing, limiting the availability of convenient parking spaces in congested urban areas. Hence, premium automakers are incorporating IPA to automatically and conveniently park their vehicles. Several manufacturers, such as Toyota, BMW, Lexus, Volkswagen, and Tesla, offer this system in their passenger car models. The relays are used for intelligent park assist, frequent switching operations, and signal communications. Hence, offering IPA technologies is currently limited to select premium models. With rising demand for mid- and premium vehicles, especially in Europe and North America, the adoption of intelligent park assist is expected to grow as simultaneously demand automotive relays in the future.

North America is anticipated to be the second-largest automotive relay market by 2027.

According to the publisher's analysis, North America is projected to be the second-largest market for automotive relays by 2027. The region has a higher demand for passenger vehicles, particularly for mid-range & premium SUVs and pickup trucks, due to strong buying power, high per capita income, improved standard of living, and consumers' interest in off-roading purposes. According to the publisher's analysis, production share of mid-range and premium passenger vehicles in North America, stood at more than 80% in 2021. These vehicles are installed with more electronic components for advanced safety and comfort features such as automatic air conditioning, start-stop, EPS, heated steering and seats, traction control, adaptive cruise control, and so on. With increasing premium car sales, the region's demand for automotive relays for various applications would also grow.

Further, increasing industrialization, growing logistic business, and e-commerce industry have created a significant demand for heavy truck production and sales in the US. This would subsequently create the demand for automotive relays for basic functions such as fuel pumps, headlights and tail lamps, steering, wiper, indicators, etc. In addition, electric and hybrid vehicles have also recently seen a considerable adoption rate in North America. All these factors are expected to drive the market of automotive relays in the North American region

In-depth interviews were conducted with CXOs, VPs, directors from business development, marketing, product development/innovation teams, independent consultants, and executives from various key organizations operating in this market.

- By Company Type: Tier 1 companies - 90%, Others - 10%

- By Designation: Director Level - 30%, C Level - 60%, and Others - 10%

- By Region: Asia Pacific - 45, North America - 30%, %, Europe - 20%, and Rest of the World - 5%

The automotive relay market is led by globally established players such as TE Connectivity (Switzerland), Omron Corporation (Japan), Panasonic Corporation (Japan), Hongfa Technologies Co. (China), Denso Corporation (and Fujitsu Component Limited (Japan).

Research Coverage:

The study segments the automotive relay market and forecasts the market size based on Relay Type (PCB Relays, Plug In Relays, High Voltage Relays, Protective Relays, Signal Relays, Time Relays), By Application (Door Lock, Power Windows, Sunroof, Power Seat, Electronic Power Steering (EPS), Lighting, Fuel Injection, Air Conditioner, Starter, Anti-Lock Braking System (ABS), Traction Control System (TCS), Cooling Fan, Engine Management Module, Adaptive Cruise Control, Intelligent Park Assist), By Ampere (5A-15A, 16A-35A, >35A), By Vehicle Type (Economy cars, Mid-range cars, Premium cars, Light Commercial Vehicle, Heavy Duty Vehicles), Electric Vehicle Relay Market, By Ampere (5A-15A, 16A-35A, >35A), Electric Vehicle Relay Market, By Relay Type (Main Relay, Precharge Relay, Quick Charge Relay, Normal Charge Relay, High Voltage Accessories Relay), Electric Vehicle Relay Market, By Vehicle Type (Battery Electric Vehicle, Fuel Cell Electric Vehicle, Plug In Hybrid Electric Vehicle) and Region (Asia Pacific, Europe, North America, And Rest of The World).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help the key market players operating in the automotive relay market with information on the closest approximations of the revenue numbers for the overall automotive relay market and the sub-segments. This report would also help stakeholders to understand fastest growing and largest market for automotive relay market at regional and global level for various sub-segments that are covered in the study. The report helps stakeholders to understand the competitive landscape, market share analysis and key growth opportunities, and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

Companies Mentioned

- ABB Group

- American Electronic Components

- American Zettler

- Cit Relay and Switch

- Coto Technologies

- Denso

- Fujitsu Component Limited

- Good Sky Electric Co. Ltd.

- Hella GmbH & Co KGaA

- Hongfa Technologies Co.

- Mitsuba Corporation

- Omron Industrial Automation

- Panasonic Corporation

- Picker

- Robert Bosch LLC

- Sanyou Corporation Limited

- Siemens

- Song Chuan Group Companies

- Te Connectivity

- Xiamen Level King Keep Electronics (Lkk)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | December 2022 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 12.2 Billion |

| Forecasted Market Value ( USD | $ 15.5 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |