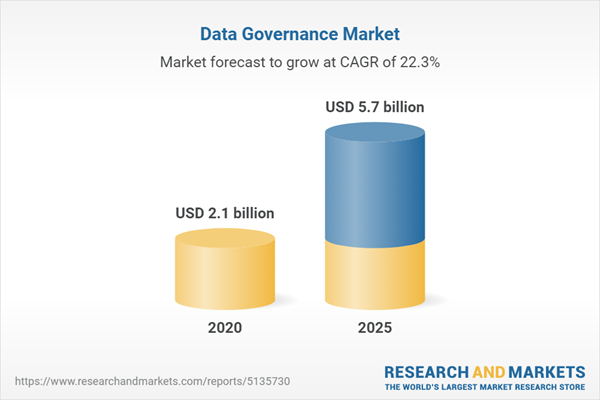

The data governance market size is estimated to be USD 2.1 billion in 2020 and is expected to reach USD 5.7 billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of 22.3% during the forecast period. The rapidly increasing growth in data volumes, rising regulatory and compliance mandates, and enhancing strategic risk management and decision-making with the increasing business collaborations are expected to propel the growth of the data governance market.

Compliance management application segment to grow at a higher CAGR during the forecast period.

Among various applications, the compliance management application segment is expected to grow at the fastest rate, due to the fact that compliance management applications enable organizations to test, remediate, attest, and manage their corporate structure. Compliance management applications enable organizations to implement, manage, monitor, and measure the effectiveness of their governance and compliance strategies. In addition to this, cloud-based compliance management applications provide organizations with all the necessary tools for creating an effective internal management system. The collaborative workspace helps process managers in determining organizations’ compliance levels.

The retail and consumer goods industry vertical to grow at the highest CAGR during the forecast period.

The retail and consumer goods industry vertical is expected to grow at the highest CAGR during the forecast period, as it is creating large volumes of data which is ultimately driving the need for efficient data governance solutions in this industry vertical. The ongoing transformations in the retail and consumer goods vertical are creating large volumes of data every year, which ultimately drives the need for efficient data governance solutions.

North America to hold the highest market share during the forecast period.

North America is expected to dominate the data governance market throughout the forecast period, owing to the early adoption of technologies and the presence of a large number of data governance solution providers. AsiaPacific (APAC) is expected to grow at the highest CAGR during the forecast period. The increasing digitalization and investment in infrastructure upgrades have resulted in the higher adoption of data governance and data management solutions. APAC is witnessing the increasing demand for cloud-based solutions, owing to the growing size of SMEs. Companies operating in this region provide different solutions based on organization size and their requirements.

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the data governance market

- By Company: Tier I: 55%, Tier II: 20%, and Tier III: 25%

- By Designation: C-Level Executives: 40%, Directors: 35%, and Others: 25%

- By Region: North America: 40%, Asia Pacific (APAC): 20%, Europe: 30%, Middle East and Africa (MEA): 8%, and Latin America: 2%

The report includes the study of the key players offering data governance solutions and services. It profiles major vendors in the global social media analytics market. The major vendors are IBM (US), Oracle (US), SAP (Germany), SAS (US), Collibra (US), Informatica (US), Talend (US), TopQuadrant (US), Information Builders (US), Alation (US), TIBCO (US), Varonis (US), erwin (US), Data Advantage Group (US), Syncsort (US), Infogix (US), Magnitude Software (US), Ataccama (US), Reltio (US), Global Data Excellence (Switzerland), Global IDs (US), Innovative Routines International (US), Denodo (US), Adaptive (US), Microsoft (US), Zaloni (US), Alex Solutions (Australia), Microfocus (UK) and Mindtree(US). It further includes an in-depth competitive analysis of key players in the social media analytics market, along with their company profiles, business overviews, product offerings, recent developments, and market strategies.

Research Coverage

The market study covers the data governance market across segments. It aims at estimating the market size and the growth potential of this market, across different segments, such as component, deployment model, organization size, application, industry verticals, and region.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall data governance and its subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report further helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Introduction to Covid-19

1.2 Covid-19 Health Assessment

Figure 1 Covid-19: the Global Propagation

Figure 2 Covid-19 Propagation: Select Countries

1.3 Covid-19 Economic Assessment

Figure 3 Revised Gross Domestic Product Forecasts for Select G20 Countries in 2020

1.3.1 Covid-19 Economic Impact - Scenario Assessment

Figure 4 Criteria Impacting the Global Economy

Figure 5 Scenarios in Terms of Recovery of the Global Economy

1.4 Objectives of the Study

1.5 Market Definition

1.6 Market Scope

1.6.1 Inclusions and Exclusions

1.6.2 Market Segmentation

1.6.3 Regions Covered

1.6.4 Years Considered for the Study

1.7 Currency Considered

Table 1 United States Dollar Exchange Rate, 2017-2019

1.8 Stakeholders

1.9 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 6 Data Governance Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

Table 2 Primary Interviews

2.1.2.1 Breakup of Primary Profiles

Figure 7 Breakup of Primary Interviews: by Company, Designation, and Region

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

Figure 8 Market Size Estimation Methodology - Approach 1 (Supply Side): Revenue of Products/Solutions/Services of Market

Figure 9 Market Size Estimation Methodology - Approach 1 - Bottom-Up (Supply Side): Collective Revenue of All Products/Solutions/ Services of Market

Figure 10 Market Size Estimation Methodology - Approach 2 - Bottom-Up (Demand Side): Products/Solutions/Services Sold and Their Average Selling Price

Figure 11 Data Governance Market: Top-Down and Bottom-Up Approaches

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

Table 3 Factor Analysis

2.5 Assumptions for the Study

2.6 Limitations of the Study

2.7 Competitive Leadership Mapping Research Methodology

Table 4 Evaluation Criteria

2.7.1 Vendor Inclusion Criteria

3 Executive Summary

Table 5 Global Data Governance Market Size and Growth Rate, 2014-2019 (USD Million, Y-O-Y %)

Table 6 Global Market Size and Growth Rate, 2019-2025 (USD Million, Y-O-Y %)

Figure 12 Market Snapshot, by Component

Figure 13 Market Snapshot, by Service

Figure 14 Market Snapshot, by Deployment Model

Figure 15 Market Snapshot, by Organization Size

Figure 16 Market Snapshot, by Application

Figure 17 Market Snapshot, by Vertical

Figure 18 Market Snapshot, by Region

4 Premium Insights

4.1 Attractive Market Opportunities in the Data Governance Market

Figure 19 Efficient Data Governance Enhances the Quality of Data by Establishing Data Quality Metrics to Identify Quality Issues and Remediation Plans

4.2 Market: Top 3 Applications

Figure 20 Risk Management Segment to Grow at the Highest CAGR During the Forecast Period

4.3 Market: by Region

Figure 21 North America Accounted for the Largest Market Share in 2019

4.4 Market in North America, by Application and Industry Vertical

Figure 22 Risk Management and Bfsi Segments to Account for Largest Market Shares in the North American Market in 2020

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

Figure 23 Drivers, Restraints, Opportunities, and Challenges: Data Governance Market

5.2.1 Drivers

5.2.1.1 Growing Regulatory Compliance and Privacy Concerns for Data Security

5.2.1.2 Increasing Demand to Ensure High Data Quality and Lineage Throughout An Organization’S Data Life Cycle

5.2.1.3 Improving Bi and Analytics to Decrease Customer Risks

5.2.2 Restraints

5.2.2.1 Integration of Data from Data Silos

5.2.3 Opportunities

5.2.3.1 Growing Applications of Ai in Data Governance

5.2.3.2 Adoption of Devops Across All Company Software

5.2.4 Challenges

5.2.4.1 Complexities in Governing Security Across Byod and Cloud Platforms

5.2.4.2 Increased Risk Due to the Lack of Controlled Governance with An End-To-End View in the Time of Covid-19

5.2.4.3 Data Governance Problems Resulting from the Covid-19 Pandemic

5.2.5 Cumulative Growth Analysis

5.3 Adjacent Markets

Table 7 Adjacent Markets to the Data Governance Market

5.4 Use Cases

5.4.1 Use Case: Scenario 1

5.4.2 Use Case: Scenario 2

5.4.3 Use Case: Scenario 3

5.4.4 Use Case: Scenario 4

5.4.5 Use Case: Scenario 5

5.4.6 Use Case: Scenario 6

5.5 Regulatory Implications

5.5.1 General Data Protection Regulation

5.5.2 California Consumer Privacy Act

5.5.3 Health Insurance Portability and Accountability Act of 1996

5.5.4 Health Information Technology for Economic and Clinical Health Act

5.5.5 European Market Infrastructure Regulation

5.5.6 Basel Committee on Banking Supervision 239 Compliance

5.5.7 Sarbanes-Oxley Act of 2002

5.5.8 Personal Data Protection Act

6 Data Governance Market: Covid-19 Impact

Figure 24 Market to Witness a Minor Decline Between 2020 and 2021

7 Data Governance Market, by Application

7.1 Introduction

7.1.1 Application: Covid-19 Impact

Figure 25 Compliance Management Segment to Grow at the Highest CAGR During the Forecast Period

Table 8 Market Size, by Application, 2014-2019 (USD Million)

Table 9 Market Size, by Application, 2019-2025 (USD Million)

7.2 Incident Management

7.2.1 Incident Management: Market Drivers

Table 10 Incident Management: Market Size, by Region, 2014-2019 (USD Million)

Table 11 Incident Management: Market Size, by Region, 2019-2025 (USD Million)

7.3 Process Management

7.3.1 Process Management: Market Drivers

Table 12 Process Management: Market Size, by Region, 2014-2019 (USD Million)

Table 13 Process Management: Data Governance Market Size, by Region, 2019-2025 (USD Million)

7.4 Compliance Management

7.4.1 Compliance Management: Market Drivers

Table 14 Compliance Management: Market Size, by Region, 2014-2019 (USD Million)

Table 15 Compliance Management: Market Size, by Region, 2019-2025 (USD Million)

7.5 Risk Management

7.5.1 Risk Management: Market Drivers

Table 16 Risk Management: Market Size, by Region, 2014-2019 (USD Million)

Table 17 Risk Management: Market Size, by Region, 2019-2025 (USD Million)

7.6 Audit Management

7.6.1 Audit Management: Market Drivers

Table 18 Audit Management: Market Size, by Region, 2014-2019 (USD Million)

Table 19 Audit Management: Market Size, by Region, 2019-2025 (USD Million)

7.7 Data Quality and Security Management

7.7.1 Data Quality and Security Management: Data Governance Market Drivers

Table 20 Data Quality and Security Management: Market Size, by Region, 2014-2019 (USD Million)

Table 21 Data Quality and Security Management: Market Size, by Region, 2019-2025 (USD Million)

7.8 Others

Table 22 Other Applications: Market Size, by Region, 2014-2019 (USD Million)

Table 23 Other Applications: Market Size, by Region, 2019-2025 (USD Million)

8 Data Governance Market, by Component

8.1 Introduction

8.1.1 Component: Covid-19 Impact

Figure 26 Services Segment to Grow at a Higher CAGR During the Forecast Period

Table 24 Market Size, by Component, 2014-2019 (USD Million)

Table 25 Market Size, by Component, 2019-2025 (USD Million)

8.2 Solutions

8.2.1 Solutions: Market Drivers

Table 26 Solutions: Market Size, by Region, 2014-2019 (USD Million)

Table 27 Solutions: Market Size, by Region, 2019-2025 (USD Million)

8.3 Services

8.3.1 Services: Market Drivers

Figure 27 Professional Services Segment to Grow at a Higher CAGR During the Forecast Period

Table 28 Services: Data Governance Market Size, by Region, 2014-2019 (USD Million)

Table 29 Services: Market Size, by Region, 2019-2025 (USD Million)

Table 30 Services: Market Size, by Type, 2014-2019 (USD Million)

Table 31 Services: Market Size, by Type, 2019-2025 (USD Million)

8.3.2 Managed Services

Table 32 Managed Services Market Size, by Region, 2014-2019 (USD Million)

Table 33 Managed Services Market Size, by Region, 2019-2025 (USD Million)

8.3.3 Professional Services

Figure 28 Deployment and Integration Services Segment to Grow at a Higher CAGR During the Forecast Period

Table 34 Market Size, by Professional Service, 2014-2019 (USD Million)

Table 35 Data Governance Market Size, by Professional Service, 2019-2025 (USD Million)

Table 36 Professional Services Market Size, by Region, 2014-2019 (USD Million)

Table 37 Professional Services Market Size, by Region, 2019-2025 (USD Million)

8.3.3.1 Consulting Services

Table 38 Consulting Services Market Size, by Region, 2014-2019 (USD Million)

Table 39 Consulting Services Market Size, by Region, 2019-2025 (USD Million)

8.3.3.2 Support and Maintenance

Table 40 Support and Maintenance Services Market Size, by Region, 2014-2019 (USD Million)

Table 41 Support and Maintenance Services Market Size, by Region, 2019-2025 (USD Million)

8.3.3.3 Deployment and Integration

Table 42 Deployment and Integration Services Market Size, by Region, 2014-2019 (USD Million)

Table 43 Deployment and Integration Services Market Size, by Region, 2019-2025 (USD Million)

9 Data Governance Market, by Deployment Model

9.1 Introduction

9.1.1 Deployment Model: Covid-19 Impact

Figure 29 On-Premises Segment to Register a Higher CAGR During the Forecast Period

Table 44 Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 45 Market Size, by Deployment Model, 2019-2025 (USD Million)

9.2 On-Premises

9.2.1 On-Premises: Market Drivers

Table 46 On-Premises: Market Size, by Region, 2014-2019 (USD Million)

Table 47 On-Premises: Market Size, by Region, 2019-2025 (USD Million)

9.3 Cloud

9.3.1 Cloud: Market Drivers

Table 48 Cloud: Market Size, by Region, 2014-2019 (USD Million)

Table 49 Cloud: Market Size, by Region, 2019-2025 (USD Million)

10 Data Governance Market, by Organization Size

10.1 Introduction

10.1.1 Organization Size: Covid-19 Impact

Figure 30 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Table 50 Market Size, by Organization Size, 2014-2019 (USD Million)

Table 51 Market Size, by Organization Size, 2019-2025 (USD Million)

10.2 Small and Medium-Sized Enetrprises

10.2.1 Small and Medium-Sized Enterprises: Market Drivers

Table 52 Small and Medium-Sized Enterprises: Market Size, by Region, 2014-2019 (USD Million)

Table 53 Small and Medium-Sized Enterprises: Market Size, by Region, 2019-2025 (USD Million)

10.3 Large Enterprises

10.3.1 Large Enterprises: Market Drivers

Table 54 Large Enterprises: Market Size, by Region, 2014-2019 (USD Million)

Table 55 Large Enterprises: Market Size, by Region, 2019-2025 (USD Million)

11 Data Governance Market, by Vertical

11.1 Introduction

11.1.1 Industry Vertical: Covid-19 Impact

Figure 31 Telecom and It Vertical to Grow at the Highest CAGR During the Forecast Period

Table 56 Market Size, by Vertical, 2014-2019 (USD Million)

Table 57 Market Size, by Vertical, 2019-2025 (USD Million)

11.2 Banking, Financial Services and Insurance

11.2.1 Banking, Financial Services and Insurance: Market Drivers

Table 58 Banking, Financial Services and Insurance: Market Size, by Region, 2014-2019 (USD Million)

Table 59 Banking, Financial Services and Insurance: Market Size, by Region, 2019-2025 (USD Million)

11.3 Retail and Consumer Goods

11.3.1 Retail and Consumer Goods: Market Drivers

Table 60 Retail and Consumer Goods: Market Size, by Region, 2014-2019 (USD Million)

Table 61 Retail and Consumer Goods: Market Size, by Region, 2019-2025 (USD Million)

11.4 Government

11.4.1 Government: Data Governance Market Drivers

Table 62 Government: Market Size, by Region, 2014-2019 (USD Million)

Table 63 Government: Market Size, by Region, 2019-2025 (USD Million)

11.5 Healthcare

11.5.1 Healthcare: Market Drivers

Table 64 Healthcare: Market Size, by Region, 2014-2019 (USD Million)

Table 65 Healthcare: Market Size, by Region, 2019-2025 (USD Million)

11.6 Manufacturing

11.6.1 Manufacturing: Market Drivers

Table 66 Manufacturing: Market Size, by Region, 2014-2019 (USD Million)

Table 67 Manufacturing: Market Size, by Region, 2019-2025 (USD Million)

11.7 Telecom and It

11.7.1 Telecom and It: Market Drivers

Table 68 Telecom and It: Data Governance Market Size, by Region, 2014-2019 (USD Million)

Table 69 Telecom and It: Market Size, by Region, 2019-2025 (USD Million)

11.8 Energy and Utilities

11.8.1 Energy and Utilities: Market Drivers

Table 70 Energy and Utilities: Market Size, by Region, 2014-2019 (USD Million)

Table 71 Energy and Utilities: Market Size, by Region, 2019-2025 (USD Million)

11.9 Transportation and Logistics

11.9.1 Transportation and Logistics: Market Drivers

Table 72 Transportation and Logistics: Market Size, by Region, 2014-2019 (USD Million)

Table 73 Transportation and Logistics: Market Size, by Region, 2019-2025 (USD Million)

11.10 Others

Table 74 Other Verticals: Market Size, by Region, 2014-2019 (USD Million)

Table 75 Other Verticals: Market Size, by Region, 2019-2025 (USD Million)

12 Data Governance Market, by Region

12.1 Introduction

Figure 32 Asia Pacific to Have the Highest CAGR in the Market During the Forecast Period

Figure 33 India to Have the Highest CAGR in the Market During the Forecast Period

Figure 34 North America to Hold the Largest Share During the Forecast Period

Table 76 Market Size, by Region, 2014-2019 (USD Million)

Table 77 Market Size, by Region, 2019-2025 (USD Million)

12.2 North America

12.2.1 North America: Data Governance Market Drivers

12.2.2 North America: Covid-19 Impact

Figure 35 North America: Market Snapshot

Table 78 North America: Market Size, by Component, 2014-2019 (USD Million)

Table 79 North America: Market Size, by Component, 2019-2025 (USD Million)

Table 80 North America: Market Size, by Service, 2014-2019 (USD Million)

Table 81 North America: Market Size, by Service, 2019-2025 (USD Million)

Table 82 North America: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 83 North America: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 84 North America: Market Size, by Application, 2014-2019 (USD Million)

Table 85 North America: Market Size, by Application, 2019-2025 (USD Million)

Table 86 North America: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 87 North America: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 88 North America: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 89 North America: Market Size, by Organization Size, 2019-2025 (USD Million)

Table 90 North America: Market Size, by Vertical, 2014-2019 (USD Million)

Table 91 North America: Market Size, by Vertical, 2019-2025 (USD Million)

Table 92 North America: Market Size, by Country, 2014-2019 (USD Million)

Table 93 North America: Market Size, by Country, 2019-2025 (USD Million)

12.2.3 United States

Table 94 Us: Data Governance Market Size, by Component, 2014-2019 (USD Million)

Table 95 Us: Market Size, by Component, 2019-2025 (USD Million)

Table 96 Us: Market Size, by Service, 2014-2019 (USD Million)

Table 97 Us: Market Size, by Service, 2019-2025 (USD Million)

Table 98 Us: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 99 Us: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 100 Us: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 101 Us: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 102 Us: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 103 Us: Market Size, by Organization Size, 2019-2025 (USD Million)

12.2.4 Canada

Table 104 Canada: Data Governance Market Size, by Component, 2014-2019 (USD Million)

Table 105 Canada: Market Size, by Component, 2019-2025 (USD Million)

Table 106 Canada: Market Size, by Service, 2014-2019 (USD Million)

Table 107 Canada: Market Size, by Service, 2019-2025 (USD Million)

Table 108 Canada: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 109 Canada: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 110 Canada: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 111 Canada: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 112 Canada: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 113 Canada: Market Size, by Organization Size, 2019-2025 (USD Million)

12.3 Europe

12.3.1 Europe: Data Governance Market Drivers

12.3.2 Europe: Covid-19 Impact

Table 114 Europe: Market Size, by Component, 2014-2019 (USD Million)

Table 115 Europe: Market Size, by Component, 2019-2025 (USD Million)

Table 116 Europe: Market Size, by Service, 2014-2019 (USD Million)

Table 117 Europe: Market Size, by Service, 2019-2025 (USD Million)

Table 118 Europe: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 119 Europe: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 120 Europe: Market Size, by Application, 2014-2019 (USD Million)

Table 121 Europe: Market Size, by Application, 2019-2025 (USD Million)

Table 122 Europe: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 123 Europe: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 124 Europe: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 125 Europe: Market Size, by Organization Size, 2019-2025 (USD Million)

Table 126 Europe: Market Size, by Vertical, 2014-2019 (USD Million)

Table 127 Europe: Market Size, by Vertical, 2019-2025 (USD Million)

Table 128 Europe: Market Size, by Country, 2014-2019 (USD Million)

Table 129 Europe: Market Size, by Country, 2019-2025 (USD Million)

12.3.3 United Kingdom

Table 130 Uk: Data Governance Market Size, by Component, 2014-2019 (USD Million)

Table 131 Uk: Market Size, by Component, 2019-2025 (USD Million)

Table 132 Uk: Market Size, by Service, 2014-2019 (USD Million)

Table 133 Uk: Market Size, by Service, 2019-2025 (USD Million)

Table 134 Uk: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 135 Uk: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 136 Uk: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 137 Uk: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 138 Uk: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 139 Uk: Market Size, by Organization Size, 2019-2025 (USD Million)

12.3.4 France

Table 140 France: Data Governance Market Size, by Component, 2014-2019 (USD Million)

Table 141 France: Market Size, by Component, 2019-2025 (USD Million)

Table 142 France: Market Size, by Service, 2014-2019 (USD Million)

Table 143 France: Market Size, by Service, 2019-2025 (USD Million)

Table 144 France: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 145 France: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 146 France: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 147 France: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 148 France: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 149 France: Market Size, by Organization Size, 2019-2025 (USD Million)

12.3.5 Germany

Table 150 Germany: Data Governance Market Size, by Component, 2014-2019 (USD Million)

Table 151 Germany: Market Size, by Component, 2019-2025 (USD Million)

Table 152 Germany: Market Size, by Service, 2014-2019 (USD Million)

Table 153 Germany: Market Size, by Service, 2019-2025 (USD Million)

Table 154 Germany: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 155 Germany: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 156 Germany: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 157 Germany: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 158 Germany: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 159 Germany: Market Size, by Organization Size, 2019-2025 (USD Million)

12.3.6 Rest of Europe

12.4 Asia Pacific

12.4.1 Asia Pacific: Data Governance Market Drivers

12.4.2 Asia Pacific: Covid-19 Impact

Figure 36 Asia Pacific: Market Snapshot

Table 160 Asia Pacific: Market Size, by Component, 2014-2019 (USD Million)

Table 161 Asia Pacific: Market Size, by Component, 2019-2025 (USD Million)

Table 162 Asia Pacific: Market Size, by Service, 2014-2019 (USD Million)

Table 163 Asia Pacific: Market Size, by Service, 2019-2025 (USD Million)

Table 164 Asia Pacific: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 165 Asia Pacific: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 166 Asia Pacific: Market Size, by Application, 2014-2019 (USD Million)

Table 167 Asia Pacific: Market Size, by Application, 2019-2025 (USD Million)

Table 168 Asia Pacific: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 169 Asia Pacific: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 170 Asia Pacific: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 171 Asia Pacific: Market Size, by Organization Size, 2019-2025 (USD Million)

Table 172 Asia Pacific: Market Size, by Vertical, 2014-2019 (USD Million)

Table 173 Asia Pacific: Market Size, by Vertical, 2019-2025 (USD Million)

Table 174 Asia Pacific: Market Size, by Country, 2014-2019 (USD Million)

Table 175 Asia Pacific: Market Size, by Country, 2019-2025 (USD Million)

12.4.3 China

Table 176 China: Data Governance Market Size, by Component, 2014-2019 (USD Million)

Table 177 China: Market Size, by Component, 2019-2025 (USD Million)

Table 178 China: Market Size, by Service, 2014-2019 (USD Million)

Table 179 China: Market Size, by Service, 2019-2025 (USD Million)

Table 180 China: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 181 China: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 182 China: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 183 China: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 184 China: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 185 China: Market Size, by Organization Size, 2019-2025 (USD Million)

12.4.4 India

Table 186 India: Data Governance Market Size, by Component, 2014-2019 (USD Million)

Table 187 India: Market Size, by Component, 2019-2025 (USD Million)

Table 188 India: Market Size, by Service, 2014-2019 (USD Million)

Table 189 India: Market Size, by Service, 2019-2025 (USD Million)

Table 190 India: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 191 India: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 192 India: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 193 India: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 194 India: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 195 India: Market Size, by Organization Size, 2019-2025 (USD Million)

12.4.5 Japan

Table 196 Japan: Data Governance Market Size, by Component, 2014-2019 (USD Million)

Table 197 Japan: Market Size, by Component, 2019-2025 (USD Million)

Table 198 Japan: Market Size, by Service, 2014-2019 (USD Million)

Table 199 Japan: Market Size, by Service, 2019-2025 (USD Million)

Table 200 Japan: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 201 Japan: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 202 Japan: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 203 Japan: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 204 Japan: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 205 Japan: Market Size, by Organization Size, 2019-2025 (USD Million)

12.4.6 Rest of Asia Pacific

12.5 Latin America

12.5.1 Latin America: Data Governance Market Drivers

12.5.2 Latin America: Covid-19 Impact

Table 206 Latin America: Market Size, by Component, 2014-2019 (USD Million)

Table 207 Latin America: Market Size, by Component, 2019-2025 (USD Million)

Table 208 Latin America: Market Size, by Service, 2014-2019 (USD Million)

Table 209 Latin America: Market Size, by Service, 2019-2025 (USD Million)

Table 210 Latin America: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 211 Latin America: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 212 Latin America: Market Size, by Application, 2014-2019 (USD Million)

Table 213 Latin America: Market Size, by Application, 2019-2025 (USD Million)

Table 214 Latin America: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 215 Latin America: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 216 Latin America: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 217 Latin America: Market Size, by Organization Size, 2019-2025 (USD Million)

Table 218 Latin America: Market Size, by Vertical, 2014-2019 (USD Million)

Table 219 Latin America: Market Size, by Vertical, 2019-2025 (USD Million)

12.5.3 Brazil

12.5.4 Mexico

12.5.5 Rest of Latin America

12.6 Middle East and Africa

12.6.1 Middle East and Africa: Data Governance Market Drivers

12.6.2 Middle East and Africa: Covid-19 Impact

Table 220 Middle East and Africa: Market Size, by Component, 2014-2019 (USD Million)

Table 221 Middle East and Africa: Market Size, by Component, 2019-2025 (USD Million)

Table 222 Middle East and Africa: Market Size, by Service, 2014-2019 (USD Million)

Table 223 Middle East and Africa: Market Size, by Service, 2019-2025 (USD Million)

Table 224 Middle East and Africa: Market Size, by Professional Service, 2014-2019 (USD Million)

Table 225 Middle East and Africa: Market Size, by Professional Service, 2019-2025 (USD Million)

Table 226 Middle East and Africa: Market Size, by Application, 2014-2019 (USD Million)

Table 227 Middle East and Africa: Market Size, by Application, 2019-2025 (USD Million)

Table 228 Middle East and Africa: Market Size, by Deployment Model, 2014-2019 (USD Million)

Table 229 Middle East and Africa: Market Size, by Deployment Model, 2019-2025 (USD Million)

Table 230 Middle East and Africa: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 231 Middle East and Africa: Market Size, by Organization Size, 2019-2025 (USD Million)

Table 232 Middle East and Africa: Market Size, by Industry Vertical, 2014-2019 (USD Million)

Table 233 Middle East and Africa: Market Size, by Industry Vertical, 2019-2025 (USD Million)

12.6.3 Middle East

12.6.4 Africa

13 Competitive Landscape

13.1 Competitive Leadership Mapping

13.1.1 Visionary Leaders

13.1.2 Innovators

13.1.3 Dynamic Differentiators

13.1.4 Emerging Companies

Figure 37 Data Governance Market (Global), Competitive Leadership Mapping, 2019

13.2 Strength of Product Portfolio

Figure 38 Product Portfolio Analysis of Top Players in the Market

13.3 Business Strategy Excellence

Figure 39 Business Strategy Excellence of Top Players in the Market

14 Company Profiles

14.1 Introduction

14.2 IBM

Figure 40 IBM: Company Snapshot

Figure 41 IBM: Swot Analysis

14.3 Oracle

Figure 42 Oracle: Company Snapshot

Figure 43 Oracle: Swot Analysis

14.4 Sap

Figure 44 Sap: Company Snapshot

Figure 45 Sap: Swot Analysis

14.5 Sas

Figure 46 Sas: Company Snapshot

Figure 47 Sas: Swot Analysis

14.6 Collibra

Figure 48 Collibra: Swot Analysis

14.7 Informatica

14.8 Talend

Figure 49 Talend: Company Snapshot

14.9 Topquadrant

14.10 Information Builders

14.11 Alation

14.12 Tibco

14.13 Varonis

Figure 50 Varonis: Company Snapshot

14.14 Erwin

14.15 Data Advantage Group

14.16 Syncsort

14.17 Infogix

14.18 Magnitude Software

14.19 Ataccama

14.20 Reltio

14.21 Global Data Excellence

14.22 Global Ids

14.23 Innovative Routines International

14.24 Denodo

14.25 Adaptive

14.26 Microsoft

14.27 Zaloni

14.28 Alex Solutions

14.29 Aws

14.30 Micro Focus

14.31 Mindtree

14.32 Right-To-Win

15 Appendix

15.1 Adjacent Markets

15.1.1 Master Data Management Market

15.1.1.1 Introduction

Table 234 Master Data Management Market Size, by Component, 2019-2025 (USD Million)

Table 235 Master Data Management Market Size, by Deployment Type, 2019-2025 (USD Million)

Table 236 Master Data Management Market Size, by Organization Size, 2019-2025 (USD Million)

Table 237 Master Data Management Market Size, by Vertical, 2019-2025 (USD Million)

Table 238 Master Data Management Market, by Region, 2019-2025 (USD Million)

Table 239 North America: Master Data Management Market Size, by Country, 2019-2025 (USD Million)

Table 240 Europe: Master Data Management Market Size, by Country, 2019-2025 (USD Million)

Table 241 Asia Pacific: Master Data Management Market Size, by Country, 2019-2025 (USD Million)

Table 242 Middle East and Africa: Master Data Management Market Size, by Country, 2019-2025 (USD Million)

Table 243 Latin America: Master Data Management Market Size, by Country, 2019-2025 (USD Million)

15.1.2 Data Quality Tools

15.1.2.1 Introduction

Table 244 Data Quality Tools Market Size, by Data Type, 2016-2022 (USD Million)

Table 245 Data Quality Tools Market Size, by Business Function, 2016-2022 (USD Million)

Table 246 Data Quality Tools Market Size, by Component, 2016-2022 (USD Million)

Table 247 Data Quality Tools Market Size, by Service, 2016-2022 (USD Million)

Table 248 Data Quality Tools Market Size, by Professional Service, 2016-2022 (USD Million)

Table 249 Data Quality Tools Market Size, by Organization Size, 2016-2022 (USD Million)

Table 250 Data Quality Tools Market Size, by Vertical, 2016-2022 (USD Million)

15.1.3 Enterprise Data Management Market

15.1.3.1 Introduction

Table 251 Enterprise Data Management Market Size, by Region, 2018-2025 (USD Million)

Table 252 Enterprise Data Management Market Size, by Vertical, 2018-2025 (USD Million)

Table 253 Enterprise Data Management Market Size, by Component, 2018-2025 (USD Million)

Table 254 Enterprise Data Management Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 255 Enterprise Data Management Market Size, by Organization Size, 2018-2025 (USD Million)

Table 256 North America: Enterprise Data Management Market Size, by Vertical, 2018-2025 (USD Million)

Table 257 North America: Enterprise Data Management Market Size, by Component, 2018-2025 (USD Million)

Table 258 North America: Enterprise Data Management Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 259 North America: Enterprise Data Management Market Size, by Organization Size, 2018-2025 (USD Million)

Table 260 North America: Enterprise Data Management Market Size, by Country, 2018-2025 (USD Million)

Table 261 Europe: Enterprise Data Management Market Size, by Industry Vertical, 2018-2025 (USD Million)

Table 262 Europe: Enterprise Data Management Market Size, by Component, 2018-2025 (USD Million)

Table 263 Europe: Enterprise Data Management Market Size, by Organization Size, 2018-2025 (USD Million)

Table 264 Europe: Enterprise Data Management Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 265 Europe: Enterprise Data Management Market Size, by Country, 2018-2025 (USD Million)

Table 266 Asia Pacific: Enterprise Data Management Market Size, by Industry Vertical, 2018-2025 (USD Million)

Table 267 Asia Pacific: Enterprise Data Management Market Size, by Component, 2018-2025 (USD Million)

Table 268 Asia Pacific: Enterprise Data Management Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 269 Asia Pacific: Enterprise Data Management Market Size, by Organization Size, 2018-2025 (USD Million)

Table 270 Asia Pacific: Enterprise Data Management Market Size, by Country, 2018-2025 (USD Million)

Table 271 Middle East and Africa: Enterprise Data Management Market Size, by Industry Vertical, 2018-2025 (USD Million)

Table 272 Middle East and Africa: Enterprise Data Management Market Size, by Component, 2018-2025 (USD Million)

Table 273 Middle East and Africa: Enterprise Data Management Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 274 Middle East and Africa: Enterprise Data Management Market Size, by Organization Size, 2018-2025 (USD Million)

Table 275 Middle East and Africa: Enterprise Data Management Market Size, by Country, 2018-2025 (USD Million)

Table 276 Latin America: Enterprise Data Management Market Size, by Industry Vertical, 2018-2025 (USD Million)

Table 277 Latin America: Enterprise Data Management Market Size, by Component, 2018-2025 (USD Million)

Table 278 Latin America: Enterprise Data Management Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 279 Latin America: Enterprise Data Management Market Size, by Organization Size, 2018-2025 (USD Million)

Table 280 Latin America: Enterprise Data Management Market Size, by Country, 2018-2025 (USD Million)

15.1.4 Big Data Market

15.1.4.1 Introduction

Table 281 Big Data Market Size, by Region, 2018-2025 (USD Million)

Table 282 Big Data Market Size, by Industry Vertical, 2018-2025 (USD Million)

Table 283 Big Data Market Size, by Component, 2018-2025 (USD Million)

Table 284 Big Data Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 285 Big Data Market Size, by Organization Size, 2018-2025 (USD Million)

Table 286 Big Data Market Size, by Business Function, 2018-2025 (USD Million)

Table 287 North America: Big Data Market Size, by Industry Vertical, 2018-2025 (USD Million)

Table 288 North America: Big Data Market Size, by Component, 2018-2025 (USD Million)

Table 289 North America: Big Data Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 290 North America: Big Data Market Size, by Organization Size, 2018-2025 (USD Million)

Table 291 North America: Big Data Market Size, by Business Function, 2018-2025 (USD Million)

Table 292 North America: Big Data Market Size, by Country, 2018-2025 (USD Million)

Table 293 Europe: Big Data Market Size, by Industry Vertical, 2018-2025 (USD Million)

Table 294 Europe: Big Data Market Size, by Component, 2018-2025 (USD Million)

Table 295 Europe: Big Data Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 296 Europe: Big Data Market Size, by Organization Size, 2018-2025 (USD Million)

Table 297 Europe: Big Data Market Size, by Business Function, 2018-2025 (USD Million)

Table 298 Europe: Big Data Market Size, by Country, 2018-2025 (USD Million)

Table 299 Asia Pacific: Big Data Market Size, by Industry Vertical, 2018-2025 (USD Million)

Table 300 Asia Pacific: Big Data Market Size, by Component, 2018-2025 (USD Million)

Table 301 Asia Pacific: Big Data Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 302 Asia Pacific: Big Data Market Size, by Organization Size, 2018-2025 (USD Million)

Table 303 Asia Pacific: Big Data Market Size, by Business Function, 2018-2025 (USD Million)

Table 304 Asia Pacific: Big Data Market Size, by Country, 2018-2025 (USD Million)

Table 305 Middle East and Africa: Big Data Market Size, by Industry Vertical, 2018-2025 (USD Million)

Table 306 Middle East and Africa: Big Data Market Size, by Component, 2018-2025 (USD Million)

Table 307 Middle East and Africa: Big Data Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 308 Middle East and Africa: Big Data Market Size, by Organization Size, 2018-2025 (USD Million)

Table 309 Middle East and Africa: Big Data Market Size, by Business Function, 2018-2025 (USD Million)

Table 310 Middle East and Africa: Big Data Market Size, by Country, 2018-2025 (USD Million)

Table 311 Latin America: Big Data Market Size, by Vertical, 2018-2025 (USD Million)

Table 312 Latin America: Big Data Market Size, by Component, 2018-2025 (USD Million)

Table 313 Latin America: Big Data Market Size, by Deployment Mode, 2018-2025 (USD Million)

Table 314 Latin America: Big Data Market Size, by Organization Size, 2018-2025 (USD Million)

Table 315 Latin America: Big Data Market Size, by Business Function, 2018-2025 (USD Million)

Table 316 Latin America: Big Data Market Size, by Country, 2018-2025 (USD Million)

15.2 Discussion Guide

15.3 Knowledge Store: Subscription Portal

15.4 Available Customization

15.5 Related Reports

15.6 Author Details

Companies Mentioned

- Adaptive

- Alation

- Alex Solutions

- Ataccama

- AWS

- Collibra

- Data Advantage Group

- Denodo

- Erwin

- Global Data Excellence

- Global IDS

- IBM

- Infogix

- Informatica

- Information Builders

- Innovative Routines International

- Magnitude Software

- Micro Focus

- Microsoft

- Mindtree

- Oracle

- Reltio

- SAP

- SAS

- Syncsort

- Talend

- Tibco

- Topquadrant

- Varonis

- Zaloni

Table Information

| Report Attribute | Details |

|---|---|

| Published | July 2020 |

| Forecast Period | 2020 - 2025 |

| Estimated Market Value ( USD | $ 2.1 billion |

| Forecasted Market Value ( USD | $ 5.7 billion |

| Compound Annual Growth Rate | 22.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |