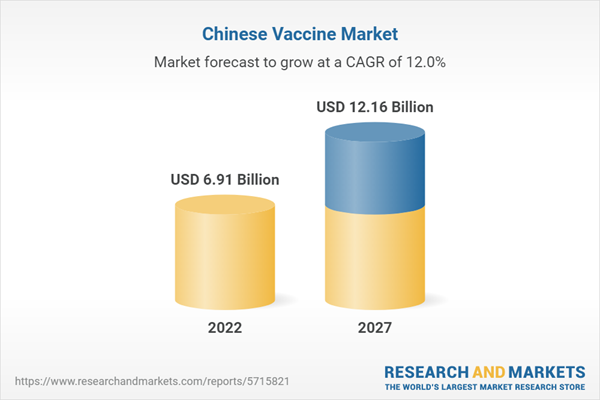

China Vaccine Market will surpass US$ 12.16 Billion by 2027 at a CAGR of 11.97 Percent according to the publisher. Annually in China, approx. 700 million vaccine doses are produced; China is one of the world's largest producers of vaccines. As a result, China has drawn significant attention to the vaccine industry to play a representative role. In addition, it is a closed market with a solid local vaccine industry, access to which is challenging for Western players.China Vaccine market was US$ 6.91 Billion in 2022

Category 1 & 2 Vaccines in China

In China, Vaccines are available through the government's Expanded Program on Immunization (EPI) at no charge for aged 14 years of children. These government-purchased vaccines are called Category 1 under the Regulations on the Administration of Vaccines and Vaccination. In contrast, private-sector also known as Category 2 vaccines, such as rabies vaccine, influenza vaccine (InfV), and Haemophilus influenza type b vaccine (Hib), are available but are usually paid for out-of-pocket, as they are included in neither the EPI system nor government health insurance. According to our research findings, the China Vaccine market was US$ 6.91 Billion in 2022.Disease Type: Pneumococcal, Meningococcal Meningitis, and DTP Vaccines Controls Significant Portion of China Vaccines Industry

Meningococcal Meningitis, Pneumococcal, and DTP Vaccine market are expected to control a significant portion of China's vaccine market. The vaccine market in China is segmented into Meningococcal meningitis, Pneumococcal, DTP, Ebola, Rabies & Others. In Aug 2021, China formally revised its laws to allow parents to have up to three children to boost the birth rate. In part, thanks to the loosening of the second-child policy in China, the number is expected to increase. China’s vaccine industry has always been more petite and less mature than it’s US, European, or Indian counterparts. However, over the past decades, it has rapidly grown to become one of the only developing countries able to manufacture and supply most vaccines used in its domestic immunization program.Product Insight: PCV13 has Highest Share in the Chinese Vaccine Industry

In terms of products, the Products included in this report are as follows: MCV4, MPSV4, MCV2-Hib, MCV2, MPSV2 and Men A, PCV13, and PPV23. PCV13 holds the maximum share of the China vaccine market. Therefore, it is predicted that PCV13 will also maintain its top place during the forecasting period. In addition, China is the most prominent vaccine consumer in the world. As a result, Chinese residents have become much more aware of preventive health care due to its impact, which has also driven the vaccination rate.Key Company Insights

The major players covered in the report are Sinopharm Group, Hualan Biological Engineering Inc, Chongqing Zhifei Biological Products Co Ltd, Walvax Biotechnology Co Ltd, Beijing Tiantan Biological Products Corp Ltd, Sinovac Biotech, and Shenzhen Kangtai Biological Products Co Ltd. In addition, the R&D, clinical, and commercialization experience accumulated by the COVID-19 vaccine would help a group of outstanding domestic Chinese vaccine company’s snowball. Against this backdrop, the Chinese vaccine industry is expected to usher in a golden period. The next decade will be for China's biopharmaceuticals to move from catching up to surpassing a 'golden decade' for the Chinese vaccine industry.May 2022, Walvax Biotechnology Co., Ltd. announced the results for the immunogenicity and safety profile of PCV13, the 13-valent Pneumococcal Polysaccharide Conjugate Vaccine, administered as an infant series at 3, 4, and 5 months of age and a booster dose at 12-15 months of age in Chinese infants as part of the randomized, multi-center, double-blind, and positive-controlled phase 3 clinical trial in China to demonstrate the non-inferior immune responses and safety of PCV13 as compared to Pneumococcal 7-valent Conjugate Vaccine [Diphtheria CRM197 Protein] ('PCV7').

The report titled “China Vaccine Market & Doses Forecast By Sector (Private, Public), Disease Type (Meningococcal Meningitis, Pneumococcal, DTP, Ebola, Rabies, Others), Products (MCV4, MPSV4, MCV2-Hib, MCV2, MPSV2 and Men A, PCV13, PPV23, Others), Company (Sinopharm Group, Hualan Biological Engineering Inc, Chongqing Zhifei Biological Products Co Ltd, Walvax Biotechnology Co Ltd, Beijing Tiantan Biological Products Corp Ltd, Sinovac Biotech, and Shenzhen Kangtai Biological Products Co Ltd.)” provides a complete analysis of China Vaccine Market.

Sectors - Vaccine Market & Doses in China

- Public

- Private

Diseases -

1. Meningococcal Meningitis2. Pneumococcal

3. DTP

4. Ebola

5. Rabies

6. Others

Products -

1. MCV42. MPSV4

3. MCV2-Hib

4. MCV2

5. MPSV2 and Men A

6. PCV13

7. PPV23

All the companies covered in the report has been covered from the following points

- Overview

- Recent Development

- Vaccine Pipeline

- Revenue Analysis

Key Company Covered

1. Sinopharm Group (China National Biotec Group Company Limited)2. Hualan Biological Engineering Inc

3. Chongqing Zhifei Biological Products Co Ltd

4. Walvax Biotechnology Co Ltd

5. Beijing Tiantan Biological Products Corp Ltd

6. Sinovac Biotech

7. Shenzhen Kangtai Biological Products Co Ltd

Table of Contents

1. Introduction2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. China Vaccine Market

5.1 Public

5.2 Private

6. China Vaccine Doses

6.1 Public

6.2 Private

7. China Vaccine Share Analysis

7.1 By Sectors Market Share

7.2 By Sectors Vaccine Doses Share

7.3 By Products Type Market Share

7.4 By Disease Type Market Share

8. Meningococcal Meningitis Vaccine Market & Doses Analysis

8.1 Meningococcal Meningitis Vaccine

8.1.1 Public

8.1.2 Private

8.2 Meningococcal Meningitis Doses

8.2.1 Public

8.2.2 Private

9. Pneumococcal Vaccines Market & Doses Analysis

9.1 Pneumococcal Vaccines

9.2 Pneumococcal Vaccines Doses

10. DTP Vaccine Market & Doses Analysis

10.1 DTP Vaccine Market

10.1.1 DTaP

10.1.2 DTcP

10.2 DTP Vaccine Doses

10.2.1 Public

10.2.2 Private

11. Rabies Vaccine Market

12. Ebola Vaccine Market

13. Product - China Vaccine Market

13.1 MCV4

13.2 MPSV4

13.3 MCV2-Hib

13.4 MCV2

13.5 MPSV2 and Men A

13.6 PCV13

13.7 PPV23

13.8 Others

14. The Vaccine Regulatory Authority of China

15. Required and Recommended Vaccinations for China Travel

16. Mergers & Acquisitions

17. Company Sales

17.1 Sinopharm Group (China National Biotec Group Company Limited)

17.1.1 Overview

17.1.2 Recent Initiatives

17.1.3 Net Sales

17.2 Hualan Biological Engineering Inc

17.2.1 Overview

17.2.2 Recent Initiatives

17.2.3 Net Sales

17.3 Chongqing Zhifei Biological Products Co Ltd

17.3.1 Overview

17.3.2 Recent Initiatives

17.3.3 Net Sales

17.4 Walvax Biotechnology Co Ltd

17.4.1 Overview

17.4.2 Recent Initiatives

17.4.3 Net Sales

17.5 Beijing Tiantan Biological Products Corp Ltd

17.5.1 Overview

17.5.2 Recent Initiatives

17.5.3 Net Sales

17.6 Sinovac Biotech

17.6.1 Overview

17.6.2 Recent Initiatives

17.6.3 Net Sales

17.7 Shenzhen Kangtai Biological Products Co Ltd

17.7.1 Overview

17.7.2 Recent Initiatives

17.7.3 Net Sales

List of Figures:

Figure 01: China - Public Vaccine Market (Million US$), 2017 - 2022

Figure 02: China - Forecast for Public Vaccine Market (Million US$), 2023 - 2027

Figure 03: China - Private Vaccine Market (Million US$), 2017 - 2022

Figure 04: China - Forecast for Private Vaccine Market (Million US$), 2023 - 2027

Figure 05: China - Public Vaccine Doses (Million), 2017 - 2022

Figure 06: China - Forecast for Public Vaccine Doses (Million), 2023 - 2027

Figure 07: China - Private Vaccine Doses (Million), 2017 - 2022

Figure 08: China - Forecast for Private Vaccine Doses (Million), 2023 - 2027

Figure 09: Public - Meningococcal Meningitis Vaccine Market (Million US$), 2017 - 2022

Figure 10: Public - Forecast for Meningococcal Meningitis Vaccine Market (Million US$), 2023 - 2027

Figure 11: Private - Meningococcal Meningitis Vaccine Market (Million US$), 2017 - 2022

Figure 12: Private - Forecast for Meningococcal Meningitis Vaccine Market (Million US$), 2023 - 2027

Figure 13: Public - Meningococcal Meningitis Vaccine Doses (Million), 2017 - 2022

Figure 14: Public - Forecast for Meningococcal Meningitis Vaccine Doses (Million), 2023 - 2027

Figure 15: Private - Meningococcal Meningitis Vaccine Doses (Million), 2017 - 2022

Figure 16: Private - Forecast for Meningococcal Meningitis Vaccine Doses (Million), 2023 - 2027

Figure 17: China - Pneumococcal Vaccines Market (Million US$), 2017 - 2022

Figure 18: China - Forecast for Pneumococcal Vaccines Market (Million US$), 2023 - 2027

Figure 19: China - Pneumococcal Vaccines Doses Doses (Million), 2017 - 2022

Figure 20: China - Forecast for Pneumococcal Vaccines Doses Doses (Million), 2023 - 2027

Figure 21: China - DTP Vaccine Market (Million US$), 2017 - 2022

Figure 22: China - Forecast for DTP Vaccine Market (Million US$), 2023 - 2027

Figure 23: China - DTaP Vaccine Market Market (Million US$), 2017 - 2022

Figure 24: China - Forecast for DTaP Vaccine Market Market (Million US$), 2023 - 2027

Figure 25: China - DTcP Vaccine Market Market (Million US$), 2017 - 2022

Figure 26: China - Forecast for DTcP Vaccine Market Market (Million US$), 2023 - 2027

Figure 27: DTP - Public Vaccine Doses (Million), 2017 - 2022

Figure 28: DTP - Forecast for Public Vaccine Doses (Million), 2023 - 2027

Figure 29: DTP - Private Vaccine Doses (Million), 2017 - 2022

Figure 30: DTP - Forecast for Private Vaccine Doses (Million), 2023 - 2027

Figure 31: China - Rabies Vaccine Market (Million US$), 2017 - 2022

Figure 32: China - Forecast for Rabies Vaccine Market (Million US$), 2023 - 2027

Figure 33: China - Ebola Vaccine Market (Million US$), 2018 - 2022

Figure 34: China - Forecast for Ebola Vaccine Market (Million US$), 2023 - 2027

Figure 35: Product - MCV4 Vaccine Market (Million US$), 2020 - 2022

Figure 36: Product - Forecast for MCV4 Vaccine Market (Million US$), 2023 - 2027

Figure 37: Product - MPSV4 Vaccine Market (Million US$), 2017 - 2022

Figure 38: Product - Forecast for MPSV4 Vaccine Market (Million US$), 2023 - 2027

Figure 39: Product - MCV2-Hib Vaccine Market (Million US$), 2017 - 2022

Figure 40: Product - Forecast for MCV2-Hib Vaccine Market (Million US$), 2023 - 2027

Figure 41: Product - MCV2 Vaccine Market (Million US$), 2017 - 2022

Figure 42: Product - Forecast for MCV2 Vaccine Market (Million US$), 2023 - 2027

Figure 43: Product - MPSV2 and Men A Vaccine Market (Million US$), 2017 - 2022

Figure 44: Product - Forecast for MPSV2 and Men A Vaccine Market (Million US$), 2023 - 2027

Figure 45: Product - PCV13 Vaccine Market (Million US$), 2017 - 2022

Figure 46: Product - Forecast for PCV13 Vaccine Market (Million US$), 2023 - 2027

Figure 47: Product - PPV23 Vaccine Market (Million US$), 2017 - 2022

Figure 48: Product - Forecast for PPV23 Vaccine Market (Million US$), 2023 - 2027

Figure 49: Product - Others Vaccine Market (Million US$), 2017 - 2022

Figure 50: Product - Forecast for Others Vaccine Market (Million US$), 2023 - 2027

Figure 51: Sinopharm Group (China National Biotec Group Company Limited) - Global Revenue (Billion US$), 2017 - 2022

Figure 52: Sinopharm Group (China National Biotec Group Company Limited) - Forecast for Global Revenue (Billion US$), 2023 - 2027

Figure 53: Hualan Biological Engineering Inc - Global Revenue (Million US$), 2017 - 2022

Figure 54: Hualan Biological Engineering Inc - Forecast for Global Revenue (Million US$), 2023 - 2027

Figure 55: Chongqing Zhifei Biological Products Co Ltd - Global Revenue (Million US$), 2017 - 2022

Figure 56: Chongqing Zhifei Biological Products Co Ltd - Forecast for Global Revenue (Million US$), 2023 - 2027

Figure 57: Walvax Biotechnology Co Ltd - Global Revenue (Million US$), 2017 - 2022

Figure 58: Walvax Biotechnology Co Ltd - Forecast for Global Revenue (Million US$), 2023 - 2027

Figure 59: Beijing Tiantan Biological Products Corp Ltd - Global Revenue (Million US$), 2017 - 2022

Figure 60: Beijing Tiantan Biological Products Corp Ltd - Forecast for Global Revenue (Million US$), 2023 - 2027

Figure 61: Sinovac Biotech - Global Revenue (Million US$), 2017 - 2022

Figure 62: Sinovac Biotech - Forecast for Global Revenue (Million US$), 2023 - 2027

Figure 63: Shenzhen Kangtai Biological Products Co Ltd - Global Revenue (Million US$), 2017 - 2022

Figure 64: Shenzhen Kangtai Biological Products Co Ltd - Forecast for Global Revenue (Million US$), 2023 - 2027

List of Tables:

Table 01: China - Vaccine Market Share by Sectors (Percent), 2017 - 2021

Table 02: China - Forecast for Vaccine Market Share by Sectors (Percent), 2022 - 2027

Table 03: China - Vaccine Doses Share by Sectors (Percent), 2017 - 2021

Table 04: China - Forecast for Vaccine Doses Share by Sectors (Percent), 2022 - 2027

Table 05: China - Vaccine Market Share by Products Type (Percent), 2017 - 2021

Table 06: China - Forecast for Vaccine Market Share by Products Type (Percent), 2022 - 2027

Table 07: China - Vaccine Market Share by Disease Type (Percent), 2017 - 2021

Table 08: China - Forecast for Vaccine Market Share by Disease Type (Percent), 2022 - 2027

Companies Mentioned

- Sinopharm Group (China National Biotec Group Company Limited)

- Hualan Biological Engineering Inc

- Chongqing Zhifei Biological Products Co Ltd

- Walvax Biotechnology Co Ltd

- Beijing Tiantan Biological Products Corp Ltd

- Sinovac Biotech

- Shenzhen Kangtai Biological Products Co Ltd

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | January 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 6.91 Billion |

| Forecasted Market Value ( USD | $ 12.16 Billion |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | China |

| No. of Companies Mentioned | 7 |