The rise of influencer marketing is impelling the market growth in North America. It assists in linking brands with highly engaged niche audiences. Brands team up with influencers across social media platforms to promote products in more authentic and relatable ways. These people, whether they are celebrities or micro-influencers, generate content that connects with their audience, resulting in increased interaction and reliance. Because individuals tend to trust influencer recommendations over traditional ads, this type of marketing has become more effective. With influencers’ ability to target specific demographics and build personal associations, brands can reach their ideal customers in a manner that feels less like advertising and more like genuine content.

The growing demand for personalization and hyper-targeting is offering a favorable North America advertising market outlook. As people expect more relevant and tailored experiences, advertisers employ data analytics, machine learning (ML), and artificial intelligence (AI) to develop ads that are specific to individual preferences and behaviors. With tools that track browsing history, past purchases, and social media activity, brands can deliver highly personalized ads that resonate with users on a deeper level. This level of targeting improves ad performance and increases return on investment (ROI) because ads are shown to people who are most likely to engage. Social media platforms allow advertisers to customize their campaigns to reach precise demographics, locations, and interests.

North America Advertising Market Trends:

Growing adoption of digital skills

The increasing adoption of digital skills across the region is enabling businesses to create more efficient and engaging campaigns. As more professionals gain digital marketing expertise, companies can leverage instruments, such as social media analysis, search engine optimization (SEO), programmatic advertising, and data analytics to reach specific audiences. This allows advertisers to optimize their campaigns in real time, improving ROI. Additionally, digital skills help to enhance content creation, user engagement, and overall ad effectiveness. Moreover, government agencies wager on the incorporation of digital skills, thereby driving the demand for advertising in the area. In January 2025, the National Telecommunications and Information Administration (NTIA) of the Department of Commerce proposed awarding over USD 369 Million to 41 entities to aid digital skills and inclusion initiatives in communities nationwide.Expansion of retail and e-commerce platforms

The expansion of retail and e-commerce platforms is fueling the North America advertising market growth. This helps in giving brands more ways to reach users. According to the data published on the official website of the Statistics Canada, the retail trade e-commerce sales reached USD 4,113,782 in November 2024. As more people shop online, retailers are turning to digital ads to get their products in front of the right audience. Social media platforms have become key advertising channels, allowing brands to run targeted ads and sell directly through the channels. E-commerce sites employ consumer data to create relevant ads, which increases the chances of conversion. Additionally, the rise of omnichannel retail, where businesses integrate both physical and online shopping, also means brands need to advertise across multiple forms, ranging from websites to in-store promotions. This broadening creates the requirement for innovations in ad formats, encouraging brands to find creative ways to engage with people.Rise of streaming services and over-the-top (OTT) platforms

The increasing number of streaming services and OTT platforms is impelling the market growth. As more people shift to OTT portals, advertisers are tapping into these spaces to run targeted ads. OTT platforms provide detailed viewer data, which allows brands to target specific audiences based on interests, demographics, and viewing habits. Besides this, ad-supported streaming services provide brands a chance to reach viewers with fewer distractions, unlike traditional TV. With video content being more engaging, advertisers can create immersive and high-quality ads that feel less intrusive. The flexibility of these OTT platforms, along with their high popularity, is enabling improvements in ad formats, making streaming a major player in the regional market. This shift reflects how users’ usage habits of OTT channels are influencing ad strategies. According to the report, the United States OTT market is set to attain USD 371.9 Billion by 2032.North America Advertising Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the North America advertising market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on segment.Analysis by Segment:

- Television Advertising

- Print Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Mobile Advertising

- Cinema Advertising

Regional Analysis:

- United States

- Canada

Competitive Landscape:

Key players in the market work on developing services and products to meet the high North America advertising market demand. Big companies wager on highly targeted ads based on user data. Traditional media outlets, such as TV networks and print publications, play an important role, especially in reaching mass audiences. Advertising agencies work with brands to come up with engaging, new, and creative campaigns across platforms, encouraging innovations in Internet, social, and television advertising. In addition, influencers and celebrities help brands to connect with younger audiences on social media platforms. Apart from this, the competition among these key players enables them to continuously improve, making advertising more personalized, interactive, and effective. As they adapt to changing user behaviors and new technologies, they are essential in keeping the market dynamic and evolving. For instance, in May 2024, Netflix, a prominent media company, developed a new advertising technology platform, as it almost doubled its user base for ad-supported services. The firm will start its testing in Canada later in 2024 and aims to introduce its service in the US by the conclusion of the second quarter of 2025. By teaming up with top advertising technology organizations, it seeks to provide advertisers with enhanced features and more accurate targeting alternatives.The report provides a comprehensive analysis of the competitive landscape in the North America advertising market with detailed profiles of all major companies.

Key Questions Answered in This Report

1. How big is the advertising market in North America?2. What factors are driving the growth of the North America advertising market?

3. What is the forecast for the North America advertising market in the region?

4. Which segment accounted for the largest North America advertising segment market share?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Advertising Market

5.1 Market Performance

5.2 Market Breakup by Segment

5.3 Market Breakup by Region

5.4 Market Forecast

6 North America Advertising Market

6.1 Market Performance

6.2 Impact of COVID-19

6.3 Market Forecast

7 North America Advertising Market: Breakup by Segment

7.1 Television Advertising

7.2 Print Advertising

7.3 Radio Advertising

7.4 Outdoor Advertising

7.5 Internet Advertising

7.6 Mobile Advertising

7.7 Cinema Advertising

8 North America Advertising Market: Breakup by Region

8.1 United States

8.1.1 Historical Market Trends

8.1.2 Market Breakup by Segment

8.1.3 Market Forecast

8.2 Canada

8.2.1 Historical Market Trends

8.2.2 Market Breakup by Segment

8.2.3 Market Forecast

9 SWOT Analysis

9.1 Overview

9.2 Strengths

9.3 Weaknesses

9.4 Opportunities

9.5 Threats

10 Value Chain Analysis

10.1 Overview

10.2 Research

10.3 Content Development

10.4 Advertising Agency

10.5 Advertising Media

10.6 Audience

11 Porter’s Five Forces Analysis

11.1 Overview

11.2 Bargaining Power of Buyers

11.3 Bargaining Power of Suppliers

11.4 Degree of Rivalry

11.5 Threat of New Entrants

11.6 Threat of Substitutes

12 Competitive Landscape

12.1 Market Structure

12.2 Key Players

12.3 Profiles of Key Players

List of Figures

Figure 1: North America: Advertising Market: Major Drivers and Challenges

Figure 2: Global: Advertising Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Advertising Market: Breakup by Segment (in %), 2024

Figure 4: Global: Advertising Market: Breakup by Region (in %), 2024

Figure 5: Global: Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6: North America: Advertising Market: Sales Value (in Billion USD), 2019-2024

Figure 7: North America: Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: North America: Advertising Market: Breakup by Segment (in %), 2024

Figure 9: North America: Advertising (Television) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 10: North America: Advertising (Television) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 11: North America: Advertising (Print) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 12: North America: Advertising (Print) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 13: North America: Advertising (Radio) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 14: North America: Advertising (Radio) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 15: North America: Advertising (Outdoor) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 16: North America: Advertising (Outdoor) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 17: North America: Advertising (Internet) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 18: North America: Advertising (Internet) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 19: North America: Advertising (Mobile) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 20: North America: Advertising (Mobile) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 21: North America: Advertising (Cinema) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 22: North America: Advertising (Cinema) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 23: North America: Advertising Market: Breakup by Country (in %), 2024

Figure 24: United States: Advertising Market: Sales Value (in Billion USD), 2019-2024

Figure 25: United States: Advertising Market: Breakup by Segment (in %), 2024

Figure 26: United States: Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 27: Canada: Advertising Market: Sales Value (in Billion USD), 2019-2024

Figure 28: Canada: Advertising Market: Breakup by Segment (in %), 2024

Figure 29: Canada: Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 30: North America: Advertising Industry: SWOT Analysis

Figure 31: North America: Advertising Industry: Value Chain Analysis

Figure 32: North America: Advertising Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: North America: Advertising Market: Key Industry Highlights, 2024 and 2033

Table 2: North America: Advertising Market Forecast: Breakup by Segment (in Billion USD), 2025-2033

Table 3: North America: Advertising Market Forecast: Breakup by Country (in Billion USD), 2025-2033

Table 4: North America: Advertising Market: Competitive Structure

Table 5: North America: Advertising Market: Key Players

Table Information

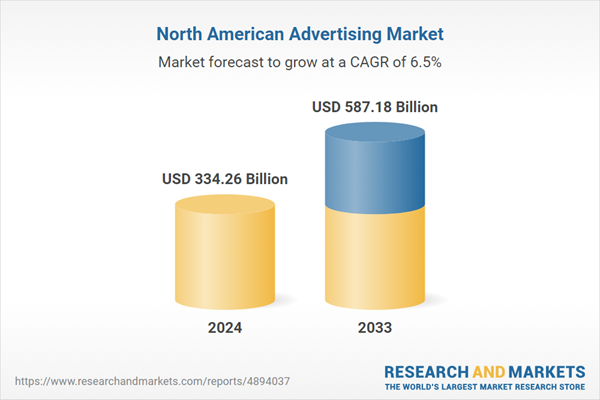

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 334.26 Billion |

| Forecasted Market Value ( USD | $ 587.18 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | North America |