Ammonia is an inorganic, colorless compound with an unpleasant pungent odor. It is naturally sourced from air, soil, water, plants and animals. The gaseous form of ammonia is compressed into liquid form, which dissolves in water to form ammonium hydroxide and is transported in steel cylinders. Ammonia is commonly used in the manufacturing of ammonium nitrate fertilizers, which discharge nitrogen in the soil to promote growth in farm crops and plants.

It is also used in the production of plastics, textiles, explosives, coloring agents, household cleaning products and pesticides. Ammonia can absorb heat from its surroundings and can filter and purify impurities from liquid mediums. As a result, it is widely used as a refrigerant in heating, ventilation and air conditioning (HVAC) systems and as a purifying agent in water treatment plants.

Ammonia Market Trends

Significant growth in the agriculture industry across India is one of the key factors creating a positive outlook for the market. With the rising population and decreasing arable lands for crop cultivation, there is an increasing demand for efficient nitrogen-rich ammonia-based fertilizers and agrochemicals to ensure optimal food production for the masses. Moreover, the widespread product adoption for the manufacturing of detergents and cleaning products is providing a thrust to the market growth. Ammonia is highly effective in breaking down household grime and removing stains of vegetable oils, fats, cooking grease and wine from tubs, sinks, toilets, countertops and tiles.It also evaporates quickly, thereby facilitating in cleaning glass without leaving any residual streak marks. In line with this, the increasing demand for ammonium nitrate for mining and explosive applications is also contributing to the growth of the market. Other factors, including various product innovations, such as the development of green ammonia through sustainable technologies, are anticipated to drive the market toward growth.

Key Market Segmentation

This report provides an analysis of the key trends in each sub-segment of the Indian ammonia market report, along with forecasts at the country and state level from 2023-2032. The report has categorized the market based on physical form and end-use.Breakup by Physical Form:

- Anhydrous Ammonia

- Aqueous Ammonia

Breakup by End-Use:

- Urea

- Ammonium Phosphate Fertilizers

- Industrial

- Others

Breakup by States:

- Gujarat

- Maharashtra

- Rajasthan

- Others

Competitive Landscape

The competitive landscape of the industry has also been examined with some of the key player being Chambal Fertilizers and Chemicals Ltd., GNFC (Gujarat Narmada Valley Fertilizers and Chemicals), IFFCO (Indian Farmers Fertilizer Cooperative Limited), KRIBHCO (Krishak Bharati Cooperative Limited), NFCL (Nagarjuna Fertilizers and Chemicals Limited), RCFL (Rashtriya Chemicals and Fertilizers Ltd) and Southern Petrochemicals Industries Limited (SPIC).Key Questions Answered in This Report

1. What is the size of ammonia market in India?2. What are the key factors driving the Indian ammonia market?

3. What has been the impact of COVID-19 on the Indian ammonia market?

4. What is the breakup of the Indian ammonia market based on the physical form?

5. What is the breakup of the Indian ammonia market based on the end-use?

6. What are the key regions in the Indian ammonia market?

7. Who are the key players/companies in the Indian ammonia market?

Table of Contents

Companies Mentioned

- Chambal Fertilizers and Chemicals Ltd.

- GNFC (Gujarat Narmada Valley Fertilizers and Chemicals)

- IFFCO (Indian Farmers Fertilizer Cooperative Limited)

- KRIBHCO (Krishak Bharati Cooperative Limited)

- NFCL (Nagarjuna Fertilizers and Chemicals Limited)

- RCFL (Rashtriya Chemicals

- Fertilizers Ltd) and Southern Petrochemicals Industries Limited (SPIC)

Table Information

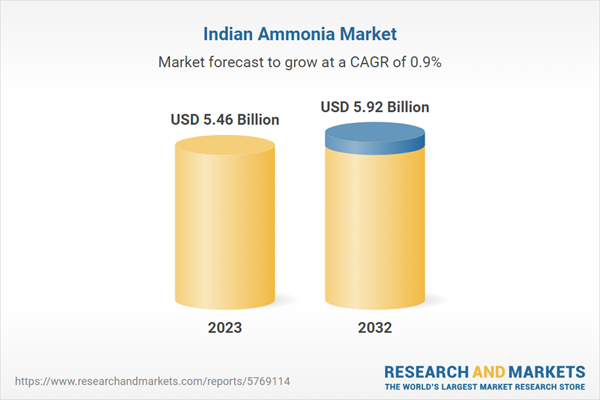

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | April 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 5.46 Billion |

| Forecasted Market Value ( USD | $ 5.92 Billion |

| Compound Annual Growth Rate | 0.9% |

| Regions Covered | India |

| No. of Companies Mentioned | 7 |