Technological advancements, increased auto manufacturing, and rising consumer desire for luxury and comfort in cars are different key factors projected to contribute to the connected car market's expansion. The development of improved suspension systems and the rise in demand for lightweight suspension systems, however, are anticipated to offer the market a greater potential for expansion.

There has been a significant change in the Indian automotive market away from well-known brands like the Fiat Padmini Premium, HM Ambassador, and Maruti 800 towards those produced by foreign OEMs. The Federation of Automobile Dealers Associations (FADA) estimates that Maruti Suzuki held a 39.17% share in the nation in 2022 and sold 98,318 units at retail, while Hyundai constituted for 15.96% market share in the same year with 40,056 units. Additionally, Tata Motors declared intentions to invest US$3.08 billion in its passenger car over the following five years in April 2022.

Collaborations and product innovation by manufacturers are propelling the market. For instance, Cisco and TELUS announced the launching of new 5G capabilities in North America to serve IoT use cases across industry verticals. The network would serve as a foundation to support drive testing by a major North American automotive manufacturer's 5G Connected Car in February 2024.

Additionally, HARMAN announced the launch of the HARMAN Ready Connect 5G Telematics Control Unit (TCU) in February 2024, leveraging state-of-the-art Snapdragon Digital Chassis connected car technologies from Qualcomm Technologies, Inc. Based on the Snapdragon Auto 5G Modem-RF Gen 2, HARMAN Ready Connect 5G TCU represented a significant advancement in automotive connectivity. Also, in February 2022, an Ultra Low-Latency Edge-Based Compute Platform for Turn-Key Connectivity, called HARMAN Savari MECWAVE, was introduced by HARMAN. Hazard alerts and other vehicle-to-everything (2X) communications, as well as high-throughput connection activities like interactive infotainment and video streaming, are deployed more quickly thanks to MECWAVE.

OEMs are creating software solutions for a more connected, individualized customer experience in addition to making cars. OEMs have the potential to develop new revenue streams and more continuing, direct interactions with their customers emerging from the auto industry's constant evolution.

Connected car market drivers

Growing adoption of ADAS features in cars

The increasing deConsumer interest in autonomous and connected cars is growing, and throughout the projected period, these technologies are expected to become more widely accepted. Consumer behavior is significantly impacted by ADAS features like collision warning, lane assistance, blind spot recognition, etc. These features are intended to improve the performance of automobiles by decreasing vehicle downtime by advising the owner of any problems with the vehicle. End customers are willing to spend more money on the newest technologies like automated driver assistance systems (ADAS) that improve driving experiences and raise driver and passenger safety as a result of the growing technical breakthroughs in the automobile sector.According to the Highway Loss Data Institute, by 2026, at least half of all registered vehicles will only have two ADAS systems. Around 71% of registered vehicles will have rear cameras by 2026, and 60% will have back parking sensors. However, just 17% of registered cars are projected to have adaptive cruise control with lane centering by 2026, and only 13% are likely to have adaptive lighting.

To overcome the challenges of creating advanced driver-assistance systems (ADAS), several technological firms are collaborating on the market. For instance, the cooperation between PATEO Corporation and Qualcomm Technologies, Inc. (Qualcomm) was expanded in June 2022 to include the development of solutions for vehicle intelligence, smart car connection, Service-Oriented Architecture (SOA), intelligent cockpits, and multi-domain fusion based on central controllers. Veoneer Inc., a leading provider of safety technology, will be acquired by Magna International Inc. in July 2021. To purchase Veoneer Inc., a major provider of automotive safety technologies, Magna International Inc. entered into a binding merger agreement with the firm. Magna sought to improve and expand its ADAS portfolio and sector position with this acquisition.

Connected car market geographical outlook

By geography, the connected car market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia-Pacific.The United States is the dominant market in the North American region. The rising adoption of Advanced Driver Assistance Systems (ADAS) comprising features like adaptive cruise control, lane departure warning, and collision avoidance systems has emerged as a significant driver of the demand for connected car technologies. These systems enhance safety, prompting the need for connectivity to support their functionality and facilitate real-time communication and data exchange between vehicles and infrastructure.

The development and deployment of 5G networks have introduced significant advancements in connectivity, offering faster speeds and enhanced reliability. This has led to real-time data exchange and improved communication between vehicles and infrastructure in the context of connected cars. With the United States emerging as a leader in 5G deployment. The region has a significant 59% population coverage of 5G, and the potential for leveraging this technology in the connected car market is substantial. The widespread availability of 5G services fuels the growth and implementation of advanced connected car technologies in the United States.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

Connected Car Market is analyzed into the following segments:

By Services

- Driver assistance

- Safety

- Vehicle and mobility management

- Others

By Application

- Safety

- Telematics

- Infotainment

- Navigation

By End-User

- OEM

- Aftermarket

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- Land Rover Limited

- HARMAN International

- Verizon

- Daimler AG

- AT&T

- Vodafone Group

- Telefónica S.A

- BMW AG

- Audi of America

Table Information

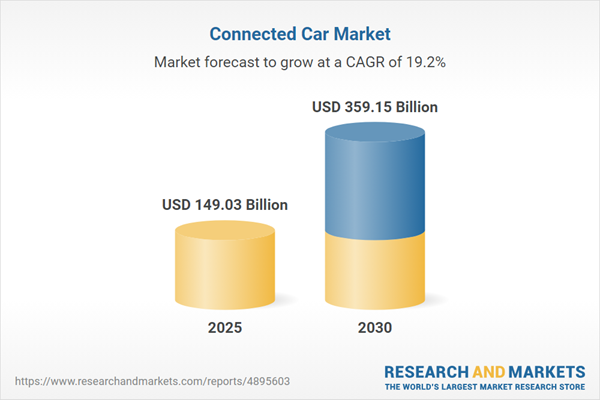

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | December 2024 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 149.03 Billion |

| Forecasted Market Value ( USD | $ 359.15 Billion |

| Compound Annual Growth Rate | 19.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |