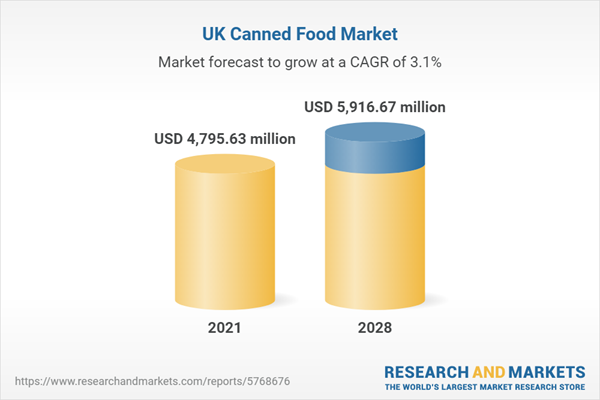

The UK canned food market was valued at US$4,795.626 million in 2021 and is expected to grow at a CAGR of 3.05% over the forecast period to reach a market size of US$5,916.673 million by 2028.

Food is prepared and sealed in an airtight container such as tin and steel cans as part of the process of canning. The shelf life of canned goods is normally one to five years, although, under some conditions, it may be longer. The desire for nutritious foods high in protein, useful fiber, vitamins, and omega-3 fatty acids, as well as the growing urban population's preference for quick and simple meals, are the key market drivers in this country. The low cost associated with canned food is also augmenting the growth of the market in Britain during the projection period. Moreover, the expansion of food retail outlets and supermarkets, increased urbanization, investments in R&D, and marketing tactics employed by market participants are all predicted to have a favorable impact on the total revenue of the UK canned food industry.However, rising concerns regarding the negative impact of canned goods on the environment and the negative perception associated with canned food among consumers are limiting the growth of the UK canned food market during the anticipated period.

The UK canned food market is driven by low cost associated with canned foods.

With a rise in demand for canned goods, consumers are continuing to alter their eating patterns in the aftermath of the cost-of-living issue. According to the official data, since February 2022, the increase in canned products has outpaced that of the rest of the supermarket industry. Sales volumes of products in the UK, such as tomatoes and canned soup, are at their highest comparative levels since 2018. Due to reduced prices and longer shelf lives, flexibility to store products in the cupboard, value for money and reducing food waste as important buying factors for canned foods in the UK. A recent survey of more than 1,000 UK consumers, aged 18 to 56, conducted by the food and drink group Princes in 2022 found that nearly a third or 31 per cent of British consumers plan to increase their purchases of canned goods over the upcoming year. The data for the same survey also shows that respondents are more likely to purchase canned beans (40%) and canned tomatoes (35%), to save money amid the cost-of-living crisis. British customers are seeking ways to save money when heating and eating, and think that cooking canned or similarly packaged supermarket items is the least expensive option.Various leading supermarket chains in the country are also advising consumers to buy more canned goods to reduce costs. For instance, to prevent food wastage and help household finances, UK retail chain Waitrose has urged customers to prepare at least one meal each week using canned goods.

Key developments.

- In August 2022, Waitrose, a UK grocery giant, urged customers to prepare at least one canned meal every week to prevent food wastage and help household budgets, as it announced intentions to remove 'best before' dates from fresh goods.

Based on distribution channels, the UK canned food market is expected to witness positive growth in offline sector, especially through supermarkets and hypermarkets.

According to a recent survey commissioned by Princes Group, more Britain people are buying canned food in their weekly shop during the cost-of-living crisis, with statistics suggesting that tinned products have been surpassing the rest of the grocery industry. In the middle of the UK's 42-year-high inflation rate, it was discovered that a canned food renaissance is on the way. According to the findings, customers purchased more canned food from supermarkets between May and August 2022 than they did at the same time in 2020 (during peak lockdown). In a very competitive industry, supermarkets are responding by extending their own-label offerings to demonstrate that they recognize the issues consumers face and provide the greatest value. Discounters have also seen huge sales rises in recent months, drawing in an increasing number of clients as the burden of rising expenses mounts.Based on type, the UK canned food market is expected to witness demand for canned meat products.

The innovative product launches along with the focus on convenience good is projected to drive the demand for canned meat products in the UK. Waitrose & Partners is a British supermarket brand that was created in 1904 by Waite, Rose & Taylor, which was eventually reduced to Waitrose. According to their corporate report released in 2022, canned meat sales increased by 36%, while fish heads sales increased by 34%. Furthermore, sales of lesser pieces of meat such as cow shin increased by 23%, while sales of ox cheek and lamb neck increased by 9% and 4%, respectively. Additionally, sales of canned pork and ham have increased by 36%. Therefore, due to such a rise in the number of sales for canned meat products in the UK, the market for this segment is anticipated to rise during the projected period.Moreover, Princes is one of the UK’s leading food and beverage brands that offers a wide range of canned meat products. The company has expanded its ambient canned meat collection in the UK, continuing its innovation binge. To target the lucrative midday market and compete with chilled lines, the UK food and drink corporation produces Princes Chicken Deli Fillers to attract a younger audience. There are four flavors in the product line namely, Chicken and Bacon, Sweet Chilli Flavoured Chicken, Coronation Chicken, and Chicken & Sweetcorn. As a result of such market developments, the segment for canned meat products in the UK is anticipated to rise in the next five years.

Market Segmentation:

By Type

- Canned Fish/Seafood

- Canned Meat Products

- Canned Fruits

- Canned Vegetables

- Others Canned Foods

By Enterprise Size

- Small

- Medium

- Large

By Distribution Channel

- Online

- Offline

- Supermarket/Hypermarket

- Convenience Stores

- Others

Table of Contents

1. INTRODUCTION1.1. Market Overview

1.2. Market Definition

1.3. Scope of the Study

1.4. Market Segmentation

1.5. Currency

1.6. Assumptions

1.7. Base, and Forecast Years Timeline

2. RESEARCH METHODOLOGY

2.1. Research Data

2.2. Research Design

3. EXECUTIVE SUMMARY

3.1. Research Highlights

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter’s Five Force Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. UK CANNED FOOD MARKET BY TYPE

5.1. Introduction

5.2. Canned Fish/Seafood

5.3. Canned Meat Products

5.4. Canned Fruits

5.5. Canned Vegetables

5.6. Others Canned Foods

6. UK CANNED FOOD MARKET BY ENTERPRISE SIZE

6.1. Introduction

6.2. Small

6.3. Medium

6.4. Large

7. UK CANNED FOOD MARKET BY DISTRIBUTION CHANNELS

7.1. Introduction

7.2. Online

7.3. Offline

7.3.1. Supermarket/Hypermarket

7.3.2. Convenience Stores

7.3.3. Others

8. COMPETITIVE ENVIRONMENT AND ANALYSIS

8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrativeness

8.3. Mergers, Acquisition, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. COMPANY PROFILES

9.1. Del Monte (UK) Limited,

9.2. WA Baxter & Sons (Holdings) Limited,

9.3. Kraft heinz,

9.4. John West,

9.5. Princes Foods

9.6. Campbell Foods UK Ltd

Companies Mentioned

- Del Monte (UK) Limited,

- WA Baxter & Sons (Holdings) Limited,

- Kraft heinz,

- John West,

- Princes Foods

- Campbell Foods UK Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | March 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 4795.63 million |

| Forecasted Market Value ( USD | $ 5916.67 million |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 6 |