The COVID-19 pandemic impacted the market significantly, and the market faced considerable losses during the early pandemic. Long lockdown restrictions and restrictions to control the spread of the virus hampered the market's growth. For instance, according to an article published by the Journal of Clinical Pathology in January 2021, there has been a significant impact on the provision of small biopsy procedures due to the COVID-19 pandemic in Northern Ireland. However, as the pandemic has subsided currently, normal biopsy procedures are being carried out as usual; hence the studied market is expected to have stable growth during the forecast period of the study.

Endoscopic ultrasound needles are used for both therapeutic and diagnostic purposes. The major growth driver in the endoscopic ultrasound needles market is the increasing geriatric population and the growing prevalence of gastrointestinal cancers. There has been a rising prevalence of chronic diseases, like pancreatic, liver, hepatobiliary, lung, and gastrointestinal cancers, with patients increasingly preferring minimally invasive surgical procedures. Growing technological advancements related to endoscopic ultrasound needles are likely to fuel the expansion of the endoscopic ultrasound needles market in the coming years.

According to an article published by PubMed in June 2021, when 800 patients were randomized for 18 months, 771 were analyzed to check the benefit of rapid on-site evaluation (ROSE) on the diagnostic accuracy of endoscopic ultrasound-guided fine-needle biopsy (EUS-FNB). Among the 385 with rapid on-site evaluation (ROSE) analysis, a 96.4% accuracy result was obtained. The remaining 386 without ROSE was 97.4%, with an absolute risk difference of 1.0%. The study concluded that endoscopic ultrasound-guided fine-needle biopsy (EUS-FNB) demonstrated high accuracy in solid pancreatic lesions (SPLs). Solid Pancreatic Lesions primarily include adenocarcinoma, neuroendocrine tumors, cystic pancreatic neoplasms with solid components, solid pseudopapillary tumor, pancreatoblastoma, pancreatic lymphoma, and pancreatic metastasis. Hence, ongoing research and studies leading to new research and developments in the cancer segment inspire key market players to take strategic steps that can propel the growth of the studied market.

The rising prevalence of cancer is a major factor driving the growth of the market. For instance, according to the data published by ICMR-National Centre for Disease Informatics and Research in 2021, Leukemia accounted for nearly half of all childhood cancers in both genders in the 0-14 years age group in India; it had a prevalence of 46.4% in boys and 44.3% in girls in 2021. The other common childhood cancer in boys was found to be lymphoma (16.4%), while in girls, it was a malignant bone tumor (8.9%).

Furthermore, increasing product launches by market players in the region are also expected to enhance market growth. For instance, in October 2021, Micro-Tech Endoscopy launched an enhanced version of the company's endoscopic ultrasound needles named Areus FNA Needle and Trident FNB Needle.

Thus, due to the aforementioned factors, such as the rising prevalence of cancer, growing research studies for cancer diagnosis and treatment, and increasing product launches by key market players, the studied market is expected to experience growth during the forecast period of the study. However, the lack of professionals with expertise in operating with endoscopic ultrasound needles is restraining the market's growth.

Endoscopic Ultrasound Needles Market Trends

Biopsy Needles Expected to Hold a Significant Share in the Market Over the Forecast Period

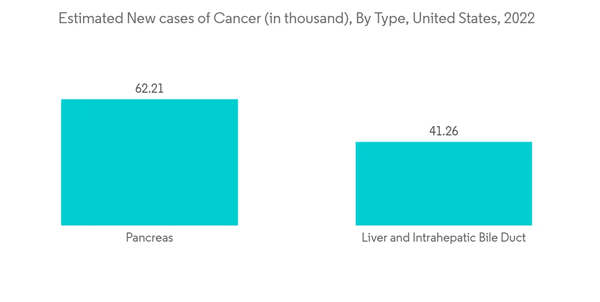

The biopsy needles (EUS-FNB) segment is likely to dominate the market in the upcoming years due to increased product usage for the endoscopic ultrasound of different non-pancreatic lesions, such as submucosal lesions, lymphoma, autoimmune pancreatitis, etc.Among all the cancer studies and research, pancreatic cancer research has been adaptive due to the increasing incidence of pancreatic cancer cases. As per the American Cancer Society's data review in January 2022, nearly 25% of pancreatic cancers are estimated to be caused by cigarette smoking, 20% due to overweight, and inherited genetic syndromes contributing to 10% of the total pancreatic cancer cases, where people with diabetes are more prone to have pancreatic cancer. Another data from the American Society of Clinical Oncology (ASCO) in 2021 estimated that 60,430 adults (31,950 men and 28,480 women) in the United States were diagnosed with pancreatic cancer. The growing number of cases of pancreatic cancers has been increasing the demand for biopsy needles.

As per the article published by PubMed in November 2021, the recent developments in Endoscopic Ultrasound (EUS)-Guided fine-needle biopsy (FNB) allow to associate with improved diagnostic accuracy based on preserving the tissue architecture, which is necessary to detect the typical histological features of Autoimmune Pancreatitis, which, if kept untreated, can become chronic and cause pancreatic cancer.

Furthermore, product launches by key market players are also enhancing segment growth. For instance, NeoDynamics AB announced that the Company had been granted a United States patent for its biopsy needle design employed in the NeoNavia FlexiPulse probe. The front-loaded, open-tip sampling needle has been designed to enable maximum tissue yield with minimal patient trauma.

Hence, due to factors such as increased product usage for the endoscopic ultrasound of different non-pancreatic lesions, such as submucosal lesions, lymphoma, autoimmune pancreatitis, and product launches by key market players, the segment is expected to experience growth during the forecast period of the study.

North America Expected to Hold a Significant Share in the Endoscopic Ultrasound Needles Market

The North American endoscopic ultrasound needles market has dominated globally. This is due to the growing use of advanced diagnostic procedures in pulmonology, oncology, and gastroenterology in Canada and the United States and the presence of major market players in the region.According to the data published by the American Cancer Society in 2022, it is estimated that there will be around 343,040 new cases of digestive system cancer in the United States in 2022; it is also estimated that there will be 395,600 new cases of genital system cancer. The presence of such a high incidence rate creates a demand for procedures to diagnose and treat such diseases. This has thus helped the endoscopic ultrasound needles market grow. Moreover, there is a growing use of advanced diagnostic procedures in pulmonology, oncology, and gastroenterology in North American countries of Canada and the United States.

Furthermore, according to the data from the Canadian Cancer Society in November 2022, it is estimated that 233,900 people will be diagnosed with cancer in 2022, and this growth in incidence is largely due to Canada's growing and aging population and emphasizes the importance of cancer prevention.

The presence of most of the global players in the endoscopic ultrasound needles market is also contributing to the growth of the studied market in this region with access to a number of products. For instance, in May 2021, Cook Ireland Ltd received marketing authorization from the United States FDA for its EchoTip Ultra Endoscopic Ultrasound Needle, EchoTip ProCore HD Ultrasound Biopsy Needle, according to data provided by the Department of Health and Human Sciences (US FDA).

These factors mentioned above, such as the rising prevalence of cancer, and increasing product launches, are expected to influence the growth of the endoscopic ultrasound needles market in North America.

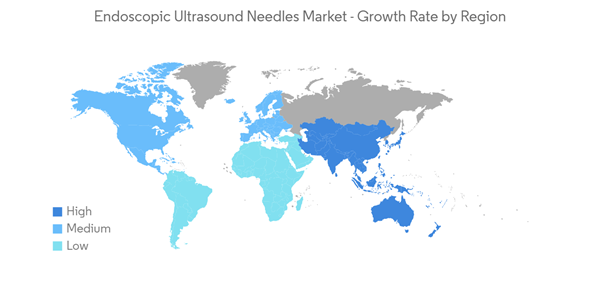

Endoscopic Ultrasound Needles Industry Overview

The endoscopic ultrasound needles market is moderately consolidated in nature. The global key players are manufacturing the majority of endoscopic ultrasound needles. Market leaders with more funds for research and a better distribution system have an established position. Moreover, Asia-Pacific is witnessing the emergence of some small players due to a rise in awareness, helping the market grow. Some of the major players in the market include ACE Medical Devices Pvt. Ltd, Boston Scientific Corporation, CONMED Corporation, Cook Group Incorporated, ENDO-FLEX GmbH, Medi-Globe Corporation, Medtronic PLC, Micro-Tech Endoscopy, and Olympus Corporation, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACE Medical Devices Pvt. Ltd

- Boston Scientific Corporation

- CONMED Corporation

- Cook Group Incorporated

- ENDO-FLEX GmbH

- Medi-Globe Corporation

- Medtronic PLC

- Micro-Tech Endoscopy

- Olympus Corporation