The specific characteristics of the COVID-19 pandemic made it challenging to identify whether and how people with heart disease could participate safely in cardiac rehabilitation and center-based exercise programs. According to the study published by the European Journal of Preventive Cardiology in August 2022, the pandemic had increased the demand for rehabilitation for COVID-19 patient groups who were critically ill with COVID-19 disease. Additionally, remote patient monitoring using implantable cardiac rehabilitation products was a safe alternative to in-person-only visits, which led to enhanced patient satisfaction and improved clinical outcomes. For instance, in February 2021, RhythMedix launched the next-generation cardiac monitor RhythmStar with built-in 4G cellular connectivity for arrhythmia detection. Therefore, there had been a greater need for cardiac rehabilitation, which was anticipated to have a beneficial impact on the market due to the COVID-19 pandemic. However, the market is returning to its pre-pandemic state due to decreased COVID-19 cases and the recovery of the healthcare sector with enhanced health access. The market will continue to rise steadily over the forecast period.

The cardiac rehabilitation market is primarily driven by increasing efforts to reduce heart diseases across the globe and the rising focus of the general population on health and fitness in developed countries. For instance, an article published by WHO in September 2022 called for a united effort to reduce mortality from cardiovascular diseases, a leading cause of death in the Southeast Asia Region, with 3.6 million lives lost every year. Through SEA HEARTS, the "WHO Southeast Asia HEARTS initiative," the WHO Southeast Asia Region intends to scale up and integrate ongoing activities in order to reduce mortality from cardiovascular diseases (CVDs) by one-third by 2030.

Additionally, according to the above source, representatives from Member countries, partners, academic institutions, and civil society organizations took part in the SEA HEARTS webinar, which examined strategies to speed up action against CVDs as part of a coordinated effort to promote cardiovascular health. Thus, such efforts are expected to reduce heart disease, leading to an increased demand for cardiac rehabilitation.

Furthermore, due to the demand for cardiac rehabilitation, market players are also focusing on product development and novel launches. For instance, in March 2022, MFine launched a Heart Rate Monitoring (HR) Tool on its app, which enables users to keep track of their heart rate without needing an additional device or any other app. Hence, as per the factors mentioned above, the cardiac rehabilitation market is anticipated to grow over the forecast period. However, a lack of knowledge in developing or underdeveloped nations is expected to impede market growth over the forecast period.

Cardiac Rehabilitation Market Trends

Treadmill Segment is Expected to Hold a Significant Market Share in the Cardiac Rehabilitation Market

The treadmill is one of the most popular activities to keep the body healthy and is frequently utilized. It is strongly advised for people with a history of heart failure. The treadmill's main function during cardiac rehab is choosing a target heart rate. Patients are usually given a heart rate goal to achieve during their exercise. It has been observed that treadmill exercise is one of the best rehabs for cardiac patients as it works out the heart and the overall body.For instance, according to the study published in the Journal of Clinical Medicine in January 2022, the effects of supervised treadmill exercise therapy on peripheral artery disease (PAD) patients' functional capacity and quality of life are favorable. Patients with PAD who get supervised treadmill exercise therapy have improved cardiorespiratory fitness, treadmill walking performance, and a lower mortality rate.

Product launches by the key market players support the market growth over the forest period. For instance, in August 2021, Peloton Interactive (PTON.O) launched its new treadmill with safety features in the United States. Treadmills have safety features, including a digital passcode to unlock the belt before a workout and a physical safety key that can help a runner come to a quick stop.

Thus, the above-mentioned factor is expected to boost the segment growth over the forecast period.

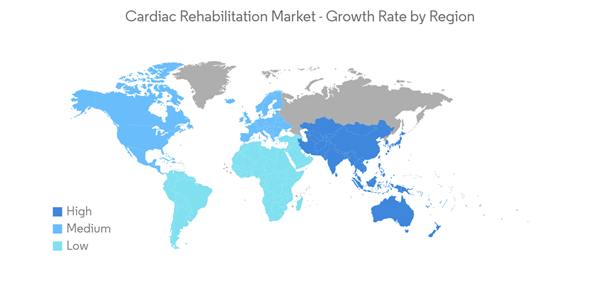

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is the most developed region in the world in terms of healthcare, primarily attributed to the higher adoption of the population to novel technologies and increasing focus on reducing the burden of heart disease. There is a growing demand for cardiac rehabilitation in the region, contributing to the growth of the market studied.For instance, in August 2022, the Million Hearts, a national initiative, was co-led by the CDC and the Centers for Medicare & Medicaid Services to prevent 1 million heart attacks and strokes in 5 years. The initiative focused on partner actions on a small set of priorities selected for their impact on heart disease, stroke, and related conditions. The goals of the initiative included 70% participation in cardiac rehabilitation among eligible patients, along with a 20% reduction in physical inactivity.

Similarly, the Canadian Government focused on numerous programs to cope with heart disease and reduce mortality. For instance, in August 2022, the Canadian Government provided more than USD 1.7 million to three organizations to fund initiatives aimed at improving seniors' physical activity as well as those in low-income areas and school communities across Canada. Thus, a growing focus on physical activity and cardiac rehabilitation is expected to boost the market in the region.

Furthermore, various market players use several strategies, such as merger and acquisition, fundraising, and product introduction. For instance, in March 2022, Recora, a provider of virtual cardiac healing through telehealth, reported a USD 20 million investment round. Additionally, its cardiac rehabilitation program was accessible to clinicians and health plans across the country.

Thus, all the above-mentioned factors are expected to boost the market growth over the forecast period in the North American region.

Cardiac Rehabilitation Industry Overview

The cardiac rehabilitation market is moderately concentrated in nature due to the presence of companies operating globally and regionally. The companies in the market include GE Healthcare, Koninklijke Philips N.V., Omron Corporation, Core Health & Fitness, LLC, and Technogym.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ball Dynamics International, LLC

- Core Health & Fitness, LLC

- Honeywell International, Inc.

- Omron Corporation

- Koninklijke Philips N.V. (BioTelemetry Inc)

- ICU Medical (Smiths Group)

- Halma plc

- Anta Sport (Amer Sports)

- GE Healthcare

- Technogym

- Baxter Medical