COVID-19 is expected to impact the short bowel syndrome up to a certain level due to the complexity of the disease. For instance, according to a study published in the Journal of Parenteral and Enteral Nutrition in August 2022, short bowel syndrome (SBS) has been considered a risk factor in COVID-19 patients due to the complexity of the short bowel syndrome disease, the need for interdisciplinary treatment, and the frequency of caregiver contacts. This might have impacted the market growth due to the increased adoption of SBS drugs. During the initial phase of the pandemic, the market has seen a lack of pace due to supply chain restrictions. Furthermore, the market is expected to take until mid of 2023 to reach pre-COVID demand. Until then, the production facilities are expected to recover with a skewed production schedule, which may fluctuate based on demand.

The major factors attributing to the growth of the SBS market are the increased prevalence of GI disorders such as volvulus, Inflammatory bowel disease (IBD), Crohn’s disease (CD), and mesenteric ischemia, rising awareness by non-profit organizations, and rising initiatives from the key players in the launch of key products, among others.

According to the study published in Surgery Today in January 2021, SBS is expected to occur in 24.5 out of every 100,000 live births and a comprehensive assessment is necessary before choosing among the available nutritional, medicinal, and surgical therapy. Therefore, the high prevalence of SBS is expected to drive market growth due to the adoption of therapies to combat the syndrome.

Furthermore, the rising initiatives from the market players in the development of therapies for SBS are expected to drive market growth over the forecast period. For instance, in June 2022, 9 Meters Biopharma, a clinical-stage company released positive preliminary topline results from the phase II study of VurolenatIde for SBS. Therefore, the rising research activities by the market players will lead to the development of novel therapies for SBS, thereby leading to increased adoption, and driving market growth.

Therefore, the rising prevalence of GI disorders and increasing launches of therapies for SBS is expected to drive market growth. However, the lack of availability of approved drugs in developing countries and lethal adverse complications like colonic cancer, and polyps along with common side effects associated with the medication are the factors expected to hinder the market growth.

Key Market Trends

GLP-2 Drug Therapy is Expected to Hold a Significant Market Share Over the Forecast Period

Glucagon-like peptide-2 (GLP-2) is a potent intestinotrophic growth factor with therapeutic potential for the prevention or treatment of short bowel syndrome (SBS). GLP-2 drugs regulate gastric motility, gastric acid secretion, and intestinal hexose transport and increase the barrier function of the gut epithelium.The factors driving the segment's growth include the effectiveness of GLP-2 drugs in SBS, and the rising research for GLP-2 drugs for SBS, among others.

The rising research on GLP-2 drugs is expected to boost the growth of the market significantly over the forecast period. For instance, in September 2022, Zealand Pharma released positive results from a phase 3 study of Glepaglutide (a GLP-2 agonist) in patients with SBS. The treatment was assessed as safe and well-tolerated in the trial. Such initiatives of rising research are therefore expected to propel market growth due to increased development and approval of therapies,

Furthermore, according to the study published in the Journal of International Medical Research in March 2022, with the help of nutritional intestinal hormones, particularly glucagon-like peptide-2 analogs, intestinal rehabilitation in SBS patients has advanced significantly and provided strong support for the formulation of treatment guidelines for patients with SBS. Such studies are anticipated to drive segment growth over the forecast period due to the increased adoption of GLP-2 therapies in the management of SBS.

In addition, rising funding from the NIH for Crohn's disease is further expected to drive the segment growth. For instance, as per the NIH funding data in May 2022, the estimated funding for Crohn''s disease in United States in 2021 and 2022 were USD 88 million and USD 92 million respectively. Therefore the rising funding for Crohn's disease may drive the SBS market, as people with digestive disorders such as Crohn's disease are unable to use significant amounts of their small intestine and may develop short bowel syndrome (SBS).

Therefore, the factors such as the high importance of GLP-2 therapies and the research advancements in GLP-2 therapies are expected to drive the segment growth.

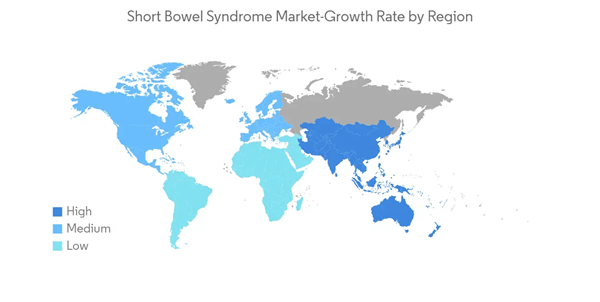

North America Holds a Major Share in the Market Studied and Expected to do Same Over the Forecast Period

North America is expected to hold a significant share in the overall Short Bowel Syndrome Market throughout the forecast period due to the rising prevalence of SBS, the increased sedentary lifestyle, increased healthcare infrastructure, and rising funding from the government on the research of Crohn's disease, among others.According to the study published in UpToDate in November 2021, in the United States, there are about 120 cases of home parenteral nutrition per million people each year, with SBS accounting for about 25% of cases. Such a high prevalence of SBS in the United States is expected to drive the growth of the market due to the increased adoption of treatment for SBS in the region.

Rising grants from the government of the United States are expected to drive market growth in the region. For instance, in October 2021, funding of USD 1.9 million to examine SBS has been given to a researcher at Saint Louis University School of Medicine (SBS). With the help of this NIH grant, he will assess the effects of novel compounds he has been developing in preclinical models to see how well they can reduce multisystem injury in SBS.

Furthermore, the rising grants for inflammatory bowel syndrome in Canada are also expected to drive the market studied. For instance, in November 2022, the Canadian Inflammatory Bowel Disease Research Consortium (CIRC) awarded the inaugural CAD 1 million (USD 0.8 million) grant from Takeda Canada Inc. support of high-quality and impactful clinical research to improve patient outcomes and quality of life for people living with inflammatory bowel disease (IBD) in Canada. This will lead to increased research on IBD and therefore lead to the development of therapies for SBS, as IBD is among the primary contributors to SBS. Such grants help in the development of novel molecules for SBS, thereby leading to increased approvals and adoption, driving the market growth.

Therefore, the increased funding for the research on IBD and SBS, and the rising prevalence of SBS are expected to drive market growth in the region.

Competitive Landscape

The short bowel syndrome market is moderately competitive and consists of several prominent industry players. Prominent players in the market are making partnerships and acquiring the products in the market, and other companies are expanding their market position globally. Some of the companies in the market include TAKEDA Inc, VectivBio AG, OxThera Inc, Nutricia, Ardelyx, and Zealand Pharma, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Takeda Pharmaceutical Company Limited

- OxThera Inc.

- VectivBio AG

- Nutrinia

- Merck KGaA

- Ardelyx

- Zealand Pharma

- Nestle Health Science

- Hanmi Pharm.Co., Ltd

- Sancilio&Company Inc

- 9 Meters Biopharma

- OPKO Health, Inc.