Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Shifting consumer preferences toward quality and durable tires, fueled by concerns regarding safety and vehicle performance, are steering the market toward premium offerings. Growth in cross-border transport and freight movement is further enhancing the demand for commercial vehicle tires. Technological integration in tire manufacturing is shaping the future of the industry. Innovations in rubber compounds, tread design, and manufacturing techniques are improving product lifespan, rolling resistance, and fuel efficiency. Sustainability is becoming a critical theme, with manufacturers exploring eco-friendly materials and recyclable tire solutions to reduce environmental impact.

The growing traction of electric vehicles is influencing the design and material requirements of tires, necessitating advanced adaptations to cater to heavier battery loads and instant torque delivery. These developments are leading to a broadening product portfolio in the market. Despite the growth potential, the sector faces challenges such as fluctuating raw material prices, regulatory pressures, and competition from low-cost imports. Local production constraints and dependency on tire imports impact pricing and availability. Counterfeit tire penetration presents risks to road safety and dents consumer trust. These issues, combined with dynamic policy shifts around emissions and transport standards, create a complex operating landscape. Nevertheless, ongoing investments in logistics infrastructure, expansion of retail tire networks, and consumer education programs present new avenues for sustained market expansion.

Market Drivers

Rising Vehicle Ownership

The growing urban population and improved access to credit have made vehicle ownership more accessible in South Africa. This increase in personal and commercial vehicle numbers is a core driver of tire sales. As the number of vehicles on the road continues to rise, replacement cycles are becoming more frequent, expanding the replacement segment. Fleet expansion in sectors such as ride-hailing, logistics, and public transport further reinforces consistent tire demand.Significant investments in the automotive sector are driving tire demand. For instance, Volkswagen announced a R4 billion investment in its Kariega plant to increase capacity, and BAIC invested R11 billion in a new plant in the Coega Special Economic Zone. These developments are expected to boost vehicle production and, consequently, tire requirements.Key Market Challenges

Volatility in Raw Material Prices

Fluctuations in the cost of key raw materials such as natural rubber, synthetic rubber, and carbon black significantly impact manufacturing expenses. These variations are often driven by international supply-demand dynamics, currency fluctuations, and geopolitical tensions. This volatility makes it challenging for tire producers to maintain stable pricing, affecting margins and consumer affordability. The South African market faces a steady inflow of inexpensive imported tires, many of which do not comply with safety or quality standards. These products attract budget-conscious consumers but pose safety hazards due to their reduced durability and performance. The prevalence of such imports creates unfair competition for quality-focused domestic players and erodes consumer trust.Key Market Trends

Growing Adoption of Electric Vehicles (EVs)

South Africa’s electric vehicle (EV) market is accelerating rapidly, with over 3,000 new energy vehicles sold in Q1 2024 almost 40% of all 2023 sales. This growth is driven by supportive government policies, including a 150% tax deduction on qualifying EV investments starting in 2026 and commitments from the Automotive Masterplan to promote EV production and infrastructure. As EV adoption rises, tire demands shift significantly. EVs are heavier due to batteries and require tires with higher load-bearing capacity, low rolling resistance for efficiency, and enhanced durability to handle torque. Tire manufacturers are responding by developing EV-specific tires with advanced compounds and tread designs that reduce energy consumption and road noise.Local manufacturers are increasing research and development efforts and collaborating with global suppliers to meet growing OEM and aftermarket demand. Additionally, tire retailers and service centers are upgrading capabilities for EV tire maintenance. With infrastructure expansions like Mercedes-Benz’s deployment of 127 charging stations across key provinces, the EV ecosystem in South Africa is strengthening. By 2025, EV tire sales are expected to grow substantially, especially in urban markets, making EV tire technology a key driver of innovation and market growth in the local tire industry.

Key Market Players

- Bridgestone South Africa (Pty) Ltd

- Sumitomo Rubber South Africa (Pty) Ltd

- Goodyear South Africa (Pty) Ltd

- Continental Tyre South Africa (Pty) Ltd

- Michelin Tyre Company South Africa (Pty) Ltd

- Pirelli Tyre (South Africa) (Pty) Ltd

- Trelleborg South Africa (Pty) Ltd

- Hankook Tire South Africa (Pty) Ltd

- Yokohama Rubber Company South Africa (Pty) Ltd

- Apollo Tyres South Africa (Pty) Ltd

Report Scope:

In this report, the South Africa Tire Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:South Africa Tire Market, By Vehicle Type:

- Passenger Car

- Light Commercial Vehicle (LCV)

- Medium & Heavy Commercial Vehicles (M&HCV)

- Off-the-Road Vehicles (OTR)

- Two-Wheeler

South Africa Tire Market, By Tire Construction Type:

- Radial

- Bias

South Africa Tire Market, By Demand Category:

- OEM

- Replacement

South Africa Tire Market, By Region:

- Gauteng

- Kwazulu-Natal

- Western Cape

- Eastern Cape

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the South Africa Tire Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bridgestone South Africa (Pty) Ltd

- Sumitomo Rubber South Africa (Pty) Ltd

- Goodyear South Africa (Pty) Ltd

- Continental Tyre South Africa (Pty) Ltd

- Michelin Tyre Company South Africa (Pty) Ltd

- Pirelli Tyre (South Africa) (Pty) Ltd

- Trelleborg South Africa (Pty) Ltd

- Hankook Tire South Africa (Pty) Ltd

- Yokohama Rubber Company South Africa (Pty) Ltd

- Apollo Tyres South Africa (Pty) Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

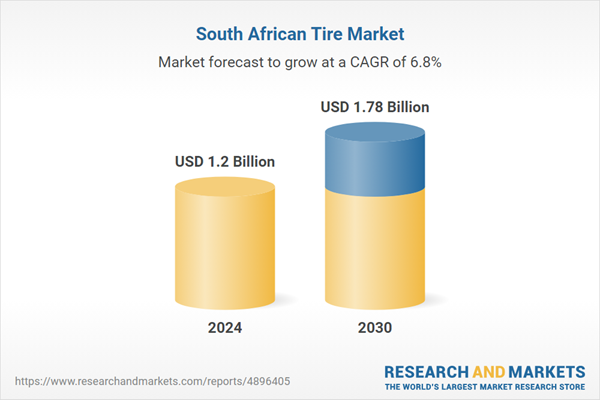

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.78 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | South Africa |

| No. of Companies Mentioned | 10 |