Speak directly to the analyst to clarify any post sales queries you may have.

As polybutadiene becomes increasingly integral to elastomer innovation, senior executives in chemical production and manufacturing are challenged to anticipate shifting demand, navigate sourcing complexities, and align investment strategies with evolving regulatory requirements.

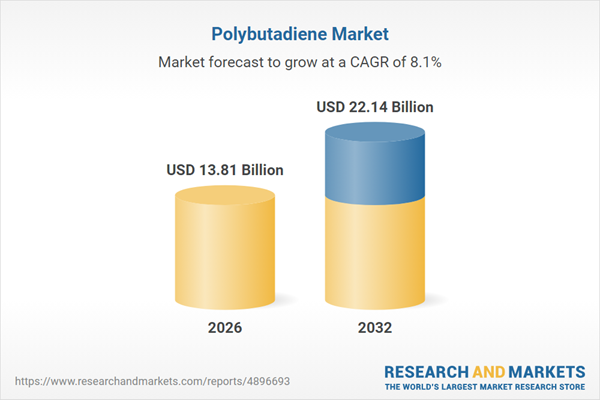

Market Snapshot: Polybutadiene Market Size and Growth Dynamics

The polybutadiene market presents substantial growth potential, projected to rise from USD 12.85 billion in 2025 to USD 13.81 billion by 2026, reaching an estimated USD 22.14 billion in 2032. This progression reflects a compound annual growth rate (CAGR) of 8.07%, driven by polybutadiene’s adaptability across diverse applications where performance demands are consistently rising. Automotive, industrial, and consumer businesses are recalibrating their product portfolios and supply strategies to leverage polybutadiene’s strength, resilience, and efficiency advantages. Market expansion is bolstered by innovation in polymer chemistry and evolving preferences among end users, positioning polybutadiene at the center of material strategies worldwide.

Scope & Segmentation

- Applications: Segmented into adhesives and sealants, footwear, hoses and belts, and tires. Each segment places distinct emphasis on performance enhancements such as adhesion for adhesives, wear resistance in footwear, flexibility for hoses and belts, and durability in tire manufacturing.

- End-Use Industries: Encompasses automotive, consumer goods, and industrial goods. Automotive focuses on material lifecycle, consumer markets seek efficiency and safety, while industrial uses demand robust performance in intensive conditions.

- Types: Employs emulsion and solution polymerization, both producing variants such as cis, trans, and vinyl structures. Technology selection influences qualities like tensile strength, abrasion resistance, and adaptability, supporting producers in customizing grades to exacting client requirements.

- Regions: Includes the Americas, Europe, Middle East & Africa, and Asia-Pacific. Regional dynamics are shaped by manufacturing capabilities, regulatory landscapes, and the efficiency of cross-border logistics, each influencing sourcing and competitive positioning.

Key Takeaways

- Polybutadiene grades are increasingly customized through advanced polymerization processes to address rising performance expectations across sectors.

- Regulatory and environmental mandates are accelerating transitions in process technology, feedstock selection, and circular economy integration, reshaping both manufacturing and procurement strategies.

- Supply-chain strategies are under review as companies seek to minimize exposure to geopolitical and transportation risks, with a notable trend toward regional sourcing and nearshoring for more secure supply scenarios.

- Market demand is shifting toward specialized, application-driven grades, with tire manufacturers and adhesives producers emphasizing differentiated performance features aligned with industry-specific priorities.

- Customer retention and satisfaction increasingly hinge on robust technical support, collaborative product development, and efficient product qualification, ensuring continued alignment with evolving client requirements across regions.

Tariff Impact: 2025 Policy Effects on Procurement and Sourcing

New tariff policies introduced in 2025 have heightened sourcing challenges, prompting manufacturers to reassess procurement tactics and diversify supply options. Larger industry participants are capitalizing on their buying power with long-term contractual agreements, while smaller operations differentiate through technical product improvements. The market is also seeing greater interest in vertical integration and strategic partnerships for feedstock security and improved risk management, as organizations seek stability and flexibility amid complex tariff environments.

Methodology & Data Sources

This report utilizes a mixed-methods approach, drawing on comprehensive interviews with polymer specialists, procurement executives, and supply-chain leaders. Supplementary validation is sourced from technical publications, peer-reviewed research, and an in-depth review of international trade and customs data to ensure accurate, actionable findings for decision-makers.

Why This Report Matters

- Enables senior executives to establish clear benchmarks and frameworks for responding to regulatory, technological, and market-driven changes in the polybutadiene market.

- Supports strategic planning across sourcing, technology investments, and sustainability initiatives for robust alignment with industry and regulatory standards.

- Provides actionable insights to optimize client engagement and service delivery models, encouraging long-term partnerships and sustained value creation within core application sectors.

Conclusion

The outlook for polybutadiene relies on a balanced approach to technology adoption, sustainability, and resilient supply chains. Organizations aligning their growth strategies with these imperatives are positioned to capture future opportunities and maintain competitive progression as the market environment develops.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Polybutadiene Market

Companies Mentioned

The key companies profiled in this Polybutadiene market report include:- ARLANXEO GmbH

- Asahi Kasei Corporation

- Braskem S.A.

- China Petroleum & Chemical Corporation

- Eneos Materials Corporation

- Evonik Industries AG

- Indian Oil Corporation Ltd.

- JSR Corporation

- JX Nippon Oil & Energy Corporation

- Kumho Petrochemical Co., Ltd.

- Kuraray Co., Ltd.

- LG Chem Ltd.

- LyondellBasell Industries Holdings B.V.

- Reliance Industries Limited

- SABIC

- Sinopec

- Sumitomo Chemical Co., Ltd.

- The Goodyear Tire & Rubber Company

- UBE Corporation

- Versalis S.p.A.

- Zeon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 13.81 Billion |

| Forecasted Market Value ( USD | $ 22.14 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |