Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative introduction to the drivers, structural challenges, and strategic priorities shaping industrial hemp adoption across value chains and end markets

Industrial hemp has re-emerged as a strategic raw material across multiple industrial ecosystems owing to its versatility, low-input agronomy, and alignment with sustainability mandates. Over the past decade stakeholders have shifted from experimental pilot projects to concerted efforts to industrialize supply chains, develop higher-value processing capabilities, and validate performance attributes for applications ranging from textiles to advanced composites. This introduction synthesizes the core drivers that underpin commercial interest and highlights the structural challenges that decision-makers must navigate to realize durable opportunity.Regulatory reform, evolving consumer preferences toward sustainable and bio-based inputs, and technological advances in mechanical and chemical processing have collectively expanded the use cases for hemp-derived components. At the same time, heterogeneous policy frameworks, variability in feedstock quality, and limited large-scale processing capacity constrain rapid scale-up. Consequently, leadership teams must balance near-term commercialization with longer-term investments in processing infrastructure, quality assurance, and supply relationships. The result is a dynamic landscape where commercial traction will favor organizations that can align agronomy, processing, and application development into coherent value chains while proactively engaging with regulatory and standard-setting bodies.

A clear exposition of the regulatory liberalization, processing innovations, and supply chain realignments that are rapidly transforming industrial hemp economics and competitiveness

The industrial hemp landscape is undergoing transformative shifts that are redefining competitive advantage, cost structures, and end-use performance. Policy liberalization in multiple jurisdictions is reducing barriers to cultivation and processing, while accelerated R&D is unlocking new processing pathways that improve fiber quality, extract purity, and material consistency. These technological shifts are critical because they directly influence the scalability of applications in construction, automotive, textiles, and specialty chemicals.Concurrently, corporate sustainability commitments and procurement mandates are elevating hemp as a credible alternative to petroleum-derived inputs and resource-intensive crops. Investors and strategic buyers are prioritizing vertically integrated models that capture value across cultivation, primary processing, and downstream formulation. Supply chain resilience has also risen in importance, with firms diversifying sourcing footprints and investing in traceability technologies to mitigate regulatory or tariff-driven disruptions. Taken together, these changes are increasing the strategic calculus for incumbents and new entrants, and they favor entities that can rapidly translate processing innovations into reproducible product performance and validated supply security.

A focused analysis of how the 2025 tariff adjustments have reshaped supply chain strategies, compliance burdens, and domestic processing incentives in industrial hemp trade flows

The tariff environment introduced in 2025 has introduced multi-dimensional consequences for participants across the industrial hemp value chain. Trade policy shifts have altered the input cost calculus for manufacturers that previously relied on low-cost imported feedstock or intermediates, prompting rapid reassessment of supplier contracts and inventory strategies. Higher import duties have, in some instances, incentivized nearshoring of primary processing, accelerating interest in domestic decortication and degumming capacity to reduce exposure to cross-border tariff volatility.At the same time, export-oriented growers and processors have had to respond to shifting demand patterns as buyers re-route procurement toward tariff-favored jurisdictions or domestically produced alternatives. Compliance and administrative costs associated with tariff classification and customs procedures have also increased operational overheads for multiregional players. In response, many firms have prioritized value capture through vertical integration, long-term offtake agreements, and investment in efficiency-enhancing technologies that lower per-unit conversion costs. Overall, the tariff adjustments have reinforced the strategic importance of supply chain flexibility, contractual risk management, and targeted capital deployment to strengthen domestic processing capabilities.

High-resolution segmentation insights demonstrating how product streams, processing techniques, material fractions, sourcing choices, distribution channels, and end-user demands define value capture

Segmentation-driven strategy is central to understanding where value concentrates within the industrial hemp ecosystem. Based on Product Type, market attention is shifting across Fiber, Hurds, Oil, Seeds, and Shivs, with each product stream presenting distinct processing requirements and downstream applications; fiber commands interest for textiles and composites while oil and seeds are oriented toward nutraceutical and food use cases, and hurds and shivs feed construction and pulp applications. Based on Processing Technique, investment focus is clustering around Decortication, Degumming, and Pulping, where incremental improvements in throughput and fiber integrity materially affect product quality and conversion economics. Optimizing decortication flows and degumming chemistry, for example, can unlock higher-value textile-grade fibers and consistent feedstock for composite manufacturing.Based on Material Composition, differentiation centers on Cellulose, Hemicellulose, and Lignin fractions; cellulose extraction pathways are particularly consequential for high-performance applications that require mechanical strength and chemical purity. Based on Source, the contrast between Conventional and Organic supply streams influences certification needs, price premiums, and procurement routes, with organic designations becoming more relevant in food, personal care, and premium textile segments. Based on Sales Channel, the interplay between Offline and Online distribution affects customer acquisition, traceability expectations, and margin structures, with online platforms expanding serviceable geographies but requiring robust digital fulfillment. Based on End User, demand profiles span Automotive, Construction, Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, and Textiles, each with bespoke technical specifications, regulatory pathways, and certification expectations that determine value realization across the chain.

A comparative regional analysis detailing how regulatory regimes, processing infrastructure, and end-market priorities diverge across the Americas, EMEA, and Asia-Pacific

Regional dynamics are material to strategy because regulatory frameworks, processing capacity, and end-market demand differ significantly across geography. In the Americas, cultivation expansion and innovation in processing have been paired with strong downstream interest from construction and textile firms seeking sustainable inputs, while federal and state-level regulatory variation continues to shape cultivation strategies and compliance costs. This region exhibits a tendency toward vertical integration as firms seek to internalize risk and secure feedstock for manufacturing initiatives.In Europe, Middle East & Africa, regulatory stringency and certification regimes play a central role, encouraging investments in traceability and quality assurance. Europe, in particular, has seen an emphasis on high-value, certified-organic products and stringent material performance testing for construction and automotive applications. In contrast, some markets in the broader region prioritize import policies and tariff arrangements that influence trade flows and sourcing partnerships. Across Asia-Pacific, scale advantages in cultivation and processing capacity coexist with rapidly growing industrial demand for bio-based materials, driven by large manufacturing bases and government sustainability agendas. This region is also a focal point for processing innovation and cost-competitiveness, attracting inbound interest from global firms looking to diversify supply chains and leverage manufacturing ecosystems.

Strategic corporate behaviors and capability investments that are enabling firms to secure feedstock, build processing edge, and commercialize hemp-based solutions across conservative end markets

Corporate behavior in the industrial hemp space is converging around a set of tactical and strategic moves designed to secure feedstock, improve margin capture, and de-risk regulatory exposure. Leading players are investing in primary processing assets and forming strategic partnerships with growers to ensure consistent feedstock quality. Investment in quality assurance systems, third-party certifications, and digital traceability platforms has become a differentiator for suppliers competing for contracts with regulated end users such as pharmaceutical and food manufacturers.Moreover, R&D commitments are focused on processing yield improvements, formulation science to meet end-use specifications, and product standardization to expedite adoption by conservative industries like automotive and construction. Companies are also deploying commercialization playbooks that emphasize pilot partnerships with OEMs and building reference projects that validate performance claims. Where appropriate, strategic acquirers are seeking bolt-on assets that add processing throughput or proprietary extraction technologies, while commercial partnerships are being used to access distribution networks and accelerate product introduction. Collectively, these company-level approaches reflect a pragmatic balance between near-term revenue generation and long-term capability building.

Actionable recommendations for leaders to fortify processing capabilities, secure supply agreements, and institutionalize traceability while accelerating application validation

Industry leaders should adopt a dual-track approach that concurrently secures near-term commercial traction and builds long-term competitive advantages. First, prioritize investments in primary processing technologies such as decortication and degumming to improve feedstock quality and broaden application potential. This should be complemented by supplier partnerships and long-term purchasing arrangements with growers to stabilize input quality and reduce exposure to tariff-driven supply shocks. Second, implement robust traceability and quality assurance programs that align with regulatory expectations and support entry into pharmaceutical, food, and certified-organic channels.In parallel, focus on application-led commercialization by collaborating with OEMs and specification writers to validate performance claims in construction, automotive, and textile contexts. Invest selectively in R&D to lower conversion costs and enhance the functional properties of cellulose, hemicellulose, and lignin fractions. Expand distribution capabilities by balancing offline relationships with targeted online platforms that enable broader customer reach without sacrificing traceability. Finally, adopt proactive regulatory engagement to shape standards and classification frameworks, and build scenario-driven contingency plans that account for tariff fluctuations and trade policy changes.

A transparent explanation of the mixed-methods research approach combining primary interviews, technical validation, and multi-source triangulation to ensure robust industry intelligence

The research methodology integrates primary engagement, secondary synthesis, and technical validation to produce a balanced intelligence product. Primary inputs include structured interviews with growers, processors, end-user procurement leads, technology providers, and trade association representatives to capture operational realities, cost drivers, and adoption barriers. Secondary sources comprise peer-reviewed scientific literature, publicly available regulatory filings, government agricultural and trade publications, and industry association reports to ground findings in documented evidence and policy context. Data triangulation is used to reconcile discrepancies between interviews and publicly available information, and to validate technical claims relating to processing yields and material properties.Technical assessments involved site visits to processing facilities and review of laboratory reports where available, enabling direct observation of decortication, degumming, and pulping workflows. Quality assurance protocols and certification frameworks were mapped to identify gaps between supplier capabilities and end-user requirements. Throughout the exercise, limitations such as regional data heterogeneity and rapidly evolving regulatory landscapes were acknowledged and mitigated by cross-checking multiple independent sources and emphasizing corroborated trends over speculative assertions.

A decisive conclusion that synthesizes opportunities, structural constraints, and pragmatic pathways for converting industrial hemp potential into durable commercial outcomes

In sum, industrial hemp presents a portfolio of opportunities that are increasingly accessible to firms that can align technical capability with regulatory agility and supply chain resilience. Regulatory progress and processing innovation are expanding addressable applications, yet heterogeneity in feedstock quality, certification requirements, and tariff regimes continues to shape competitive advantage. Organizations that integrate upstream cultivation partnerships with investment in decortication and downstream application validation will be well positioned to move from pilot projects to repeatable commercial deployments.Strategic success will depend on deliberate choices: where to localize processing capacity, which product streams to prioritize based on end-user requirements, and how to structure commercial relationships to mitigate policy and trade risk. By emphasizing traceability, quality assurance, and targeted R&D, firms can accelerate adoption among conservative buyers and capture higher-value opportunities created by the sustainability transition. The essence of the conclusion is pragmatic: combine technical rigor with strategic partnerships and regulatory engagement to convert emerging promise into durable commercial outcomes.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Industrial Hemp Market

Companies Mentioned

The key companies profiled in this Industrial Hemp market report include:- Bast Fibre Technologies Inc.

- Boring Hemp Company

- CANAH INTERNATIONAL SRL

- Canopy Growth Corporation

- Colorado Hemp Works, LLC

- CV Sciences, Inc.

- Dun Agro Hemp Group

- Ecofibre Limited

- Elixinol Global Limited

- Fresh Hemp Foods Ltd.

- Hemp Depot

- Hemp Sense Inc.

- HempFlax Group B.V.

- HemPoland sp. z o.o.

- Isodiol International Inc.

- Kazmira LLC

- Konoplex LLC

- Lotus Hemp

- Medical Marijuana, Inc.

- Nutiva, Inc.

- SOUTH HEMP TECNO SRL

- The Hemp Cooperative of America

- Tilray, Inc.

- Valley Bio Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | January 2026 |

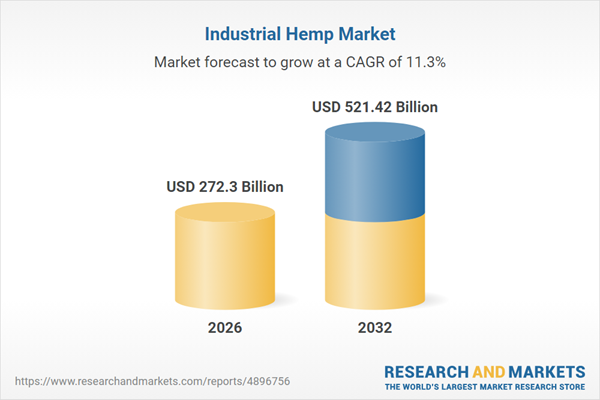

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 272.3 Billion |

| Forecasted Market Value ( USD | $ 521.42 Billion |

| Compound Annual Growth Rate | 11.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |