Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative orientation to how product, process, and consumer trends converge to redefine food coating priorities for manufacturers and ingredient suppliers

The food coating sector sits at the intersection of culinary tradition and industrial innovation, serving as a vital enabler of texture, preservation, and sensory appeal across a broad range of food products. Demand drivers include evolving consumer preferences for crispness and mouthfeel, stronger emphasis on clean-label formulations, and broader adoption of convenience formats across retail and foodservice. Equally important are operational pressures from processors and co-packers who seek consistent performance, longer shelf life, and formulations that withstand automated handling and high-throughput frying or baking operations.Given these forces, stakeholders from ingredient suppliers to large-scale processors are rethinking formulation strategies, production processes, and supplier relationships. Ingredient innovation now coexists with regulatory scrutiny and sustainability expectations, which in turn shapes procurement, R&D prioritization, and go-to-market activities. As a result, understanding the interplay between consumer trends, manufacturing constraints, and distribution dynamics is essential for leaders seeking to maintain product differentiation while controlling cost and complexity.

How simultaneous pressures from clean-label demand, sustainability mandates, and advanced processing technologies are fundamentally reworking supply chain and product strategies

Recent years have produced transformative shifts that are reshaping value chains and competitive positioning across the food coating landscape. First, clean-label and transparency expectations have pushed formulators toward simpler ingredient decks and plant-based alternatives, challenging manufacturers to retain sensory performance while removing synthetic additives. Second, sustainability pressures have influenced both primary inputs and packaging choices, prompting innovation in edible films and biodegradable carrier systems that reduce environmental footprints while preserving product quality.Concurrently, automation and advanced processing technologies have altered scale economics and reproducibility. Processors increasingly demand coatings that perform predictably across high-speed conveyors, variable frying equipment, and diverse freezing profiles. These operational expectations favor suppliers who invest in application testing and technical support. Lastly, the convergence of retail convenience and foodservice experimentation has created opportunities for novel formats such as pre-seasoned mixes, marinades formulated for industrial brining, and multi-functional coatings that deliver flavor, color, and barrier properties in a single solution. As these shifts accelerate, strategic agility in formulation, certification, and distribution becomes a differentiator for leading firms.

The practical and strategic ramifications of 2025 tariff adjustments on sourcing, formulation choices, and supplier strategies across the food coating value chain

The imposition of tariffs and trade adjustments in 2025 presents tangible operational and strategic consequences for companies sourcing raw materials and exporting finished coating products. Tariff changes alter landed costs for imported ingredients such as specialty flours, glazing agents, and certain waxes, and they can create incentive structures that shift procurement toward domestic suppliers or alternative feedstocks. In response, many organizations will reassess supplier contracts, renegotiate terms, and accelerate qualification of secondary vendors to avoid single-source exposure.Beyond immediate cost effects, tariffs drive longer-term sourcing realignments. Manufacturers with integrated sourcing capabilities may leverage scale to absorb price shocks, whereas smaller processors are likely to seek collaborative purchasing arrangements or cooperative sourcing to preserve margin. Tariffs also influence product strategy: formulations that rely heavily on tariff-affected inputs will invite reformulation to maintain price competitiveness. Furthermore, regulatory-induced supply shifts can create short-term availability constraints, encouraging inventory hedging or nearshoring of critical inputs. Companies that combine scenario planning with agile procurement processes will manage disruption more effectively and protect customer relationships during periods of elevated trade friction.

A layered segmentation framework that clarifies how type, form, application, end use, and distribution interlock to shape R&D and commercial priorities

A precise understanding of segmentation is essential to translate product innovation into commercial outcomes. Based on Type, market is studied across Batter, Breading, Coating Mixes, and Edible Film. The Breading is further studied across Dry Breading, Pre Dust, and Re Breading. The Coating Mixes is further studied across Flour Mix, Marinade, and Seasoned Mix. The Edible Film is further studied across Carnauba Wax and Shellac. These distinctions matter because each subcategory carries distinct formulation constraints, application requirements, and regulatory considerations that influence production workflows and supplier specialization.Based on Form, market is studied across Emulsion, Liquid, and Powder. The Emulsion is further studied across Oil In Water and Water In Oil. Emulsion stability, rheological behavior, and phase inversion risks determine which processors adopt pumped or batch application systems, and they also drive R&D investments in emulsifiers and stabilizers. Powder formats, by contrast, emphasize flowability and dust control in industrial environments, while liquids prioritize dosing accuracy and thermal stability.

Based on Application, market is studied across Bakery & Confectionery, Fruits & Vegetables, Meat & Poultry, and Seafood. The Bakery & Confectionery is further studied across Bread, Confectionery, and Pastry. The Fruits & Vegetables is further studied across Fresh Produce and Frozen Produce. The Meat & Poultry is further studied across Chicken, Red Meat, and Turkey & Others. The Seafood is further studied across Fish and Shellfish. Application-driven requirements determine parameters such as adhesion, frying tolerance, and moisture barrier performance, and they also influence labeling and processing temperature windows.

Based on End Use, market is studied across Food Service, Household, and Industrial. The Food Service is further studied across Catering and Restaurants. The Industrial is further studied across Bakery Plants and Meat Processing. End-use segmentation captures distinctions in batch size, quality consistency, and traceability expectations that shape customer support models and service-level agreements. Finally, based on Distribution Channel, market is studied across Offline and Online, which affects packaging sizes, promotional strategies, and logistics models. Integrating these segmentation lenses enables product teams to prioritize development pathways, align technical support with customer workflows, and refine commercial propositions for distinct buyer cohorts.

How regional regulatory regimes, supply chain endowments, and consumer preferences converge to create distinct commercial priorities across major global territories

Regional dynamics exert a powerful influence on ingredient sourcing, regulatory compliance, and consumer expectations. In the Americas, proximity to major agricultural hubs and established processing infrastructure supports rapid innovation cycles and broad availability of commodity inputs, while regional consumer preferences emphasize convenience and protein-centric applications that drive demand for durable coatings. Trade policy shifts and logistics considerations also play a defining role for suppliers serving cross-border customers within this region.Within Europe, Middle East & Africa, regulatory frameworks and label expectations vary substantially across markets, prompting suppliers to develop modular formulations that can be certified and adapted to local requirements. This region displays a strong orientation toward sustainability claims and clean-label formulations, which encourages investment in renewable sourcing and transparent supply chains. In addition, diverse food cultures across the region create pockets of specialty demand, from traditional bakery coatings to seafood-specific solutions.

Across Asia-Pacific, rapid urbanization and growing foodservice networks create heightened demand for convenience-oriented formats and prolific innovation in flavor-forward coatings. The region also serves as a major manufacturing base for both upstream ingredients and finished products, making it a focal point for scale-driven suppliers. Taken together, these regional signatures require market participants to calibrate product portfolios, compliance strategies, and go-to-market models to local commercial rhythms and regulatory environments.

Strategic profiles and capability imperatives that determine which suppliers win customer trials and scale long-term adoption across diverse processing contexts

Competitive positioning within the food coating space increasingly depends on a combination of formulation expertise, application support, and channel reach. Leading companies are investing in application labs and co-development partnerships with processors to accelerate product adoption and reduce time-to-market. These investments typically include pilot-scale testing, sensory panels, and performance validation under customer-specific processing conditions. Strategic acquisitions and targeted partnerships are also common, enabling firms to extend ingredient portfolios, acquire niche capabilities such as edible film technologies, or access regional distribution networks.At the same time, some firms concentrate on premiumization and claims-based differentiation, leveraging certifications, provenance narratives, and sustainability metrics to command price premiums. Others focus on cost leadership through manufacturing scale, optimized supply chains, and contractual raw material sourcing. Technology-enabled services such as digital formulation libraries and application simulation tools are emerging as adjuncts to traditional product offerings, allowing suppliers to deliver higher-value consultative services and strengthen account retention. For companies seeking to expand, aligning sales incentives, technical service offerings, and logistics capabilities is essential to convert innovation into repeatable commercial outcomes.

Actionable and prioritized operational and commercial measures that leaders can implement to accelerate adoption, manage input volatility, and protect margins under evolving trade and regulatory conditions

Industry leaders should pursue a coordinated strategy that balances technical excellence with commercial agility. First, prioritize application-led R&D by embedding pilot-scale validation within product development so that new coatings demonstrate performance across the full range of customer equipment and operating conditions. Second, develop reformulation playbooks that enable rapid substitution of tariff-exposed or sustainability-sensitive inputs without compromising sensory attributes. These playbooks should include pre-qualified alternative suppliers and validated process parameters to minimize qualification timelines.Third, align go-to-market models with end-use segmentation by tailoring technical support and packaging to the needs of industrial processors, foodservice operators, and retail consumers respectively. Fourth, invest in sustainability and traceability initiatives that support credible claims while reducing exposure to regulatory shifts; these investments should be measurable and communicable through standardized reporting. Fifth, strengthen commercial resilience by diversifying distribution channels and adopting flexible pricing structures that account for raw material volatility. By executing these actions in parallel, companies will improve their capacity to capture growth opportunities while mitigating operational risk.

A transparent mixed-methods research approach integrating primary interviews, secondary standards review, and triangulated synthesis to validate sector conclusions and limitations

The research methodology underpinning this analysis combines structured primary inquiry with rigorous secondary synthesis and triangulation to ensure robustness and relevance. Primary research activities include in-depth interviews with formulation scientists, operations managers, and procurement leads across food processors, as well as consultations with certification bodies and application specialists. These conversations provide firsthand insight into performance expectations, pain points in scale-up, and the practical constraints encountered in industrial environments.Secondary research draws on publicly available regulatory documentation, technical standards, and product literature, which are cross-checked against primary inputs to validate assumptions. Data synthesis follows a layered approach: first mapping segmentation definitions and product attributes; then correlating those attributes with processing requirements and distribution models; and finally identifying strategic implications for R&D and commercial teams. Limitations are acknowledged, including the potential for rapid regulatory change and regional variability in ingredient availability, and sensitivity analyses are used to test key conclusions against plausible operational scenarios.

A concise synthesis emphasizing why technical validation, sourcing agility, and customer-tailored commercial models are decisive for long-term leadership in food coatings

The food coating landscape is evolving under the combined influence of consumer preferences, regulatory pressures, and operational demands. Formulators must simultaneously deliver sensory excellence, production robustness, and credible sustainability credentials, while procurement teams navigate shifting trade dynamics and input availability. Companies that invest in application validation, diversify sourcing, and align product offerings to segmented customer needs will be better positioned to convert technological advances into durable commercial advantage.In summary, the ability to integrate technical know-how with adaptive commercial models will differentiate winners from followers. Leaders should view current disruptions as catalysts for strategic renewal rather than episodic challenges, using them to redesign product roadmaps, strengthen supplier ecosystems, and enhance customer intimacy. These responses will both mitigate near-term volatility and create the foundation for sustained growth as consumer preferences and processing technologies continue to evolve.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Food Coating Market

Companies Mentioned

The key companies profiled in this Food Coating market report include:- AGRANA Beteiligungs-AG

- Apeel Sciences

- Archer-Daniels-Midland Company

- Ashland Inc

- Associated British Foods plc

- Bunge Limited

- Cargill Incorporated

- Corbion N V

- DuPont de Nemours Inc

- Döhler GmbH

- Givaudan S A

- Ingredion Incorporated

- International Flavors & Fragrances Inc

- Kerry Group plc

- Koninklijke DSM N V

- Newly Weds Foods

- PGP International Inc

- Puratos Group N V

- Roquette Frères S A

- RPM International Inc Mantrose-Haeuser Co Inc

- Sensient Technologies Corporation

- Solina

- Sufresca

- Sumitomo Chemical Co Ltd

- Tate & Lyle PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

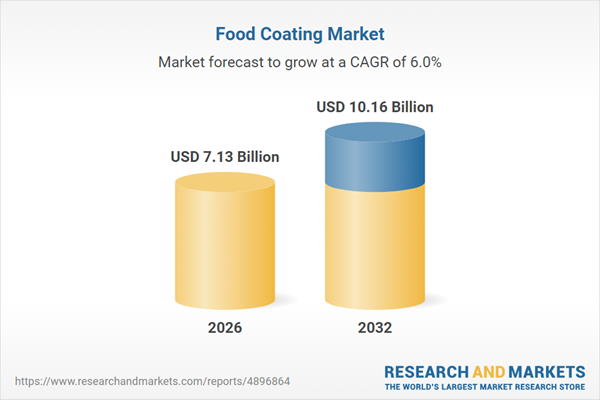

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 7.13 Billion |

| Forecasted Market Value ( USD | $ 10.16 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |