Speak directly to the analyst to clarify any post sales queries you may have.

An incisive introduction that frames current strategic pressures on gas turbines including decarbonization, fuel transition, grid flexibility, and supply resilience

This executive introduction situates the gas turbines sector at the nexus of long-cycle infrastructure renewal and rapid technology transition. The industry continues to confront a set of converging forces: elevated policy attention on decarbonization, an accelerating shift in fuel mixes toward low-carbon alternatives, evolving grid requirements driven by renewables penetration, and persistent supply chain resilience concerns. These dynamics are reshaping investment priorities across operators, original equipment manufacturers, and aftermarket service providers, and they necessitate a clearer articulation of strategic priorities.Against this backdrop, stakeholders are recalibrating procurement and asset management practices. Capital allocation increasingly favors flexible assets that can operate with blended fuels and provide fast ramping capabilities to balance intermittent generation. Meanwhile, advances in materials science, combustion technology, and digital monitoring continue to extend component life and improve operational efficiency. As the sector navigates these shifts, operators must balance near-term operational reliability with medium-term transitions to hydrogen blending and novel cooling architectures.

The introduction underscores the imperative for an integrated response that combines technological modernization, adaptive commercial models, and strengthened domestic supply capacity. By framing the conversation around resilience, emissions trajectory, and operational flexibility, this document aims to equip senior decision-makers with a strategic lens to prioritize investments, partnerships, and regulatory engagement that will determine competitiveness in the next decade.

A comprehensive analysis of transformative shifts reshaping gas turbine development, aftermarket services, digitalization, and supply chain strategies in a decarbonizing world

The gas turbines landscape is undergoing transformative shifts that are altering product development priorities, procurement strategies, and aftermarket service models. First, the drive toward lower-carbon power generation has elevated hydrogen readiness from theoretical engineering to a practical design requirement. Manufacturers and integrators are investing in combustion system modifications, material upgrades, and control system adaptability to enable higher hydrogen blends without compromising safety or durability. Consequently, retrofit pathways and modular upgrade kits are emerging as commercially viable options that extend the operational lifespan of existing fleets and reduce capital intensity for operators.Concurrently, digitalization and predictive maintenance are moving from pilot projects to operational norms. Advanced sensor suites, edge analytics, and machine learning models are improving fault detection and reducing unplanned outages, thereby optimizing maintenance intervals and inventory holdings. This shift enhances uptime and supports performance-based contracting, where payments are increasingly tied to availability and efficiency metrics rather than traditional time-and-materials arrangements. As a result, aftermarket players are reorganizing their service offerings to provide outcome-oriented warranties and remote monitoring capabilities.

At the same time, supply chain geopolitics and materials availability are prompting a re-evaluation of sourcing strategies. Firms are diversifying suppliers, investing in domestic machining and coating capabilities, and exploring collaborative manufacturing consortia to mitigate exposure to single-source risks. These structural changes are accompanied by an intensified focus on lifecycle emissions accounting and regulatory alignment, which together are driving demand for transparency in component provenance and end-of-life recycling. Taken together, these transformative shifts are redefining competitiveness across the value chain and creating space for new entrants that can combine technical depth with agile commercial propositions.

A nuanced assessment of how cumulative tariff measures through 2025 reshaped supply chains, sourcing strategies, contractual risk allocation, and domestic capacity decisions

The cumulative effects of the United States tariff measures implemented through 2025 have created a palpable ripple across global supply chains, procurement behaviors, and investment decisions within the gas turbines ecosystem. Tariff-induced cost escalation for certain imported components and raw materials has prompted original equipment manufacturers and independent suppliers to reassess sourcing footprints. In response, some firms accelerated nearshoring efforts and reconfigured their vendor networks to prioritize suppliers within tariff-favored jurisdictions or domestic capacity. This recalibration has implications for lead times, engineering collaboration, and quality assurance processes.Beyond procurement, tariffs influenced contractual arrangements and risk allocation in supply agreements. Buyers sought more robust supplier guarantees and flexible delivery terms to manage potential price volatility and customs delays. Consequently, many procurement teams adopted longer-term framework agreements and diversified multi-supplier strategies to secure key inputs. These contractual shifts were accompanied by heightened attention to inventory strategies; some operators increased critical spares holdings to hedge against unpredictable cross-border flows, while others invested in predictive inventory planning enabled by digital forecasting tools.

Moreover, tariffs impacted innovation pathways by altering the relative economics of local manufacturing versus importation. For certain advanced components, the incremental cost of establishing domestic production was offset by predictable supply and reduced tariff exposure, leading to strategic investments in machining centers and specialized coatings facilities. However, for highly specialized OEMs dependent on global scale, tariffs elevated transaction costs and compelled a closer dialogue with policymakers and industry associations to seek clarifications, exemptions, or mitigation measures. Looking forward, the legacy of these tariff actions will likely be seen in a more regionally balanced manufacturing topology and a stronger emphasis on supply-chain transparency and contractual resilience.

Segment-focused insights that integrate product classes, component priorities, power rating distinctions, cooling architectures, technology choices, and diverse end-user needs

Segment-level dynamics reveal differentiated opportunity and risk profiles across product types, components, power classes, technologies, cooling approaches, and end-user sectors. Product segmentation delineates contrasting performance and market roles between aero-derivative gas turbines and heavy-duty machines; aero-derivative units are prized for rapid start-up and mobile applications, while heavy-duty platforms deliver sustained baseload duty and higher thermal efficiencies. These distinctions inform procurement priorities, with some operators prioritizing fleet flexibility and others optimizing for large-block generation efficiency.Component-level considerations further refine strategic focus. Key assemblies such as combustors, compressors, control systems, exhaust systems, shafts, and turbine blades each drive distinct maintenance cycles, materials requirements, and upgrade pathways. For example, advances in blade coatings and cooling passage design materially influence time-between-overhauls and fuel flexibility, while digital control system upgrades can unlock performance improvements across multiple hardware generations without requiring full machine replacement.

Power rating classifications-ranging from below 40 MW, through 41-120 MW and 121-250 MW bands, to units above 250 MW-shape deployment contexts and competitive positioning. Smaller units often target distributed generation and rapid-response applications, whereas mid- and large-capacity plants anchor utility-scale and industrial power portfolios. Technology splits between combined cycle and open cycle configurations determine thermodynamic efficiency profiles and integration complexity with heat recovery systems, with combined cycle installations typically favored where baseload efficiency and lower heat rate are primary objectives.

Cooling system choices, whether air-cooled or liquid-cooled, introduce trade-offs in capital expenditure, site water usage, and ambient performance sensitivity; air-cooled systems reduce water dependency but face larger efficiency penalties in hot climates, whereas liquid-cooled designs can sustain higher output but entail additional water management considerations. Finally, end-user segmentation across commercial, defense, industrial, and utilities contexts dictates performance priorities and contracting norms. Commercial operators often emphasize uptime and lifecycle costs, defense buyers prioritize ruggedization and autonomy, industrial customers focus on integration with processes and combined heat and power opportunities, and utilities prioritize grid services and long-term reliability. Together, these segmentation lenses enable more granular product strategies, tailored aftermarket offerings, and precise regulatory engagement plans.

Regional intelligence highlighting nuanced differences in regulatory drivers, infrastructure priorities, and commercial models across the Americas, Europe Middle East Africa, and Asia-Pacific

Regional dynamics underscore the importance of tailoring strategies to jurisdictional policy, infrastructure maturity, and commercial norms. In the Americas, a combination of policy incentives for low-carbon technology adoption and a large installed base of aging thermal assets creates fertile ground for retrofits, hydrogen-blend trials, and performance-driven service contracts. North American utilities and industrial customers increasingly seek modular upgrades and financing models that align capital spend with operational savings, while supply chain localization trends are enhancing domestic manufacturing and service capacity.Europe, the Middle East & Africa present a heterogeneous tableau of regulatory stringency, fuel availability, and investment tempo. Western Europe emphasizes emissions reductions and stringent compliance frameworks that favor high-efficiency combined cycle deployments and accelerated hydrogen integration. The Middle East continues to leverage gas-fired capacity for reliability while experimenting with mixed-fuel strategies and large-scale combined cycle projects that maximize thermal efficiency. Across Africa, growth in off-grid and distributed generation use cases drives demand for resilient, easily serviceable units and partnerships that include long-term service guarantees and capacity-building components.

Asia-Pacific remains a critical growth and innovation theater, characterized by a wide variance in market maturity, rapid urbanization, and substantial industrial electrification. Several countries in the region are balancing continued gas-fired capacity additions with aggressive renewables deployment, creating opportunities for flexible gas turbines that can operate in hybrid configurations. In many economies, policy support for local content and manufacturing incentives is shaping procurement decisions, prompting suppliers to establish regional production and service footprints. Collectively, these regional nuances require differentiated commercial models, localized technical support, and adaptive product roadmaps to meet diverse operational and regulatory needs.

Competitive and collaborative company-level insights revealing how incumbents, specialists, and new service providers are reshaping value capture through technology and aftermarket strategies

Competitive dynamics in the gas turbines space are defined by a blend of legacy incumbency, technology leadership, and emergent service-oriented competitors. Established original equipment manufacturers retain advantages rooted in proven machine families, engineering depth, and extensive aftermarket networks, which underwrite long-term service agreements and spare parts ecosystems. At the same time, specialist suppliers focused on materials, advanced coatings, and digital control systems are capturing incremental value by offering retrofit kits and performance-enhancing modules that integrate with legacy frames.New entrants and independent service providers are reshaping aftermarket economics by delivering outcome-based contracts, rapid component exchange programs, and cloud-enabled monitoring suites. Their ability to combine digital diagnostics with flexible contracting is compelling many operators to reassess traditional OEM lock-in models. Partnerships and consortiums are increasingly common, as firms seek to combine mechanical expertise with software analytics, additive manufacturing capabilities, and localized manufacturing to meet demand for rapid response and customization.

Strategic moves such as joint ventures, licensing of proprietary repair technologies, and targeted acquisitions are recurrent themes, reflecting a desire to broaden service portfolios and shorten innovation cycles. Additionally, intellectual property around hydrogen combustion, blade cooling, and digital prognostics has become a differentiator. In response, many organizations are investing in in-house R&D while selectively partnering to accelerate time-to-market for critical upgrades. Collectively, these shifts signal a more modular ecosystem in which value is captured through a combination of OEM credentials, aftermarket agility, and cross-disciplinary collaboration.

Actionable strategic recommendations for leaders to enhance resilience, accelerate low-carbon readiness, and monetize aftermarket services through partnerships and digitalization

Industry leaders seeking durable advantage must adopt a portfolio of actions that reinforce resilience, flexibility, and low-carbon readiness. First, prioritize modular design and retrofitability in product roadmaps to ensure that existing fleet investments can transition toward higher hydrogen blends and accommodate digital control upgrades. This reduces long-term capital strain and enables phased integration of emergent technologies while preserving operational continuity.Second, strengthen supply chain resilience by diversifying vetted suppliers, investing in selective nearshoring for critical components, and adopting transparent provenance tracking for high-value parts. These steps will mitigate tariff exposure and logistics disruption while supporting compliance requirements and lifecycle emissions reporting. Third, accelerate deployment of predictive maintenance and remote monitoring platforms that connect operational performance to outcome-based commercial models. By linking analytics to service contracts, firms can offer differentiated guarantees that align incentives and reduce total cost of ownership for customers.

Fourth, cultivate targeted partnerships with material science innovators and additive manufacturing specialists to shorten lead times for complex spare parts and enable on-demand fabrication at regional service hubs. Fifth, engage proactively with regulators and grid operators to shape frameworks for hydrogen blending, start-stop cycles, and ancillary service compensation, ensuring that asset capabilities are recognized and rewarded. Finally, embed sustainability metrics into product valuation and warranty design so that ecological performance becomes a selling point rather than a compliance cost. Taken together, these recommendations create an integrated roadmap for leaders to navigate technological, regulatory, and commercial inflection points effectively.

A rigorous triangulated research approach combining primary stakeholder interviews, technical literature review, and case study validation to underpin strategic insights and confidence levels

This research synthesis draws upon a triangulated methodology that combines qualitative expertise, primary stakeholder engagement, and secondary technical analysis to ensure robust and defensible insights. Primary inputs include structured interviews with operators, OEM executives, aftermarket managers, and policy influencers, providing frontline perspectives on operational constraints, procurement priorities, and regulatory expectations. These practices help contextualize technology readiness and adoption barriers across different deployment environments.Secondary analysis incorporates technical literature, publicly available engineering publications, and regulatory documents to validate performance characteristics, emissions pathways, and compliance frameworks. Historical project case studies and de-identified procurement records were reviewed to illuminate contracting trends, retrofit outcomes, and service delivery models. Where appropriate, comparative material science and combustion studies were examined to assess the relative maturity of hydrogen-compatible designs and advanced cooling techniques.

Analytical rigor was maintained through cross-validation of sources and sensitivity checks, ensuring that conclusions are grounded in convergent evidence rather than single-source assumptions. The methodology emphasizes transparency in assumptions, the traceability of technical assertions, and documented limitations where data gaps persist. This approach provides decision-makers with a clear view of confidence levels associated with key findings and the contextual factors that could alter strategic choices over the medium term.

A conclusive synthesis that integrates technology, commercial models, and policy imperatives to guide strategic decision-making for resilient and lower-carbon turbine operations

In conclusion, the gas turbines sector stands at an inflection point where technological possibility, regulatory ambition, and commercial pragmatism intersect. Operators and suppliers who align product design with hydrogen readiness, invest in digital prognostics, and shore up regional supply capabilities will be better positioned to capture value in a landscape that rewards flexibility and emissions performance. At the same time, policy shifts and tariff legacies underscore the importance of contractual resilience and supply chain transparency as prerequisites for operational stability.Moving forward, success will hinge on an integrated approach that blends engineering innovation, adaptive commercial models, and proactive regulatory engagement. Firms that adopt modular upgrade strategies, embrace outcome-based contracts, and forge targeted partnerships across materials, manufacturing, and analytics will reduce risk and accelerate time-to-benefit. In essence, the most competitive organizations will be those that treat transition not as a discrete project but as a continuous capability built into product architectures and service offerings.

This summary aims to equip executive teams with the strategic framing necessary to prioritize investments, shape supplier relationships, and engage constructively with policymakers and grid operators. By synthesizing operational realities with technology trajectories, stakeholders can design pathways that preserve reliability today while progressively unlocking lower-carbon operations tomorrow.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Gas Turbines Market

Companies Mentioned

The key companies profiled in this Gas Turbines market report include:- ABB Ltd.

- Ansaldo Energia S.p.A.

- Bharat Heavy Electricals Limited

- Capstone Green Energy Corporation

- Centrax Ltd.

- Danfoss A/S

- Destinus OPRA B.V.

- Doosan Enerbility Co., Ltd.

- Fuji Industries Co., Ltd.

- General Electric Company

- GKN PLC

- Harbin Electric Corporation

- Heinzmann Australia Pty Ltd

- Honeywell International Inc.

- IHI Corporation

- Kawasaki Heavy Industries, Ltd.

- MAN Energy Solutions

- MAPNA Group

- Mitsubishi Heavy Industries, Ltd.

- MTU Aero Engines AG

- Nidec Corporation

- Power Machines

- Rolls-Royce PLC

- Siemens AG

- Solar Turbines Incorporated

- Sumitomo Heavy Industries, Ltd.

- TECO-Westinghouse

- Toshiba Corporation

- Vericor Power Systems

- Wärtsilä Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | January 2026 |

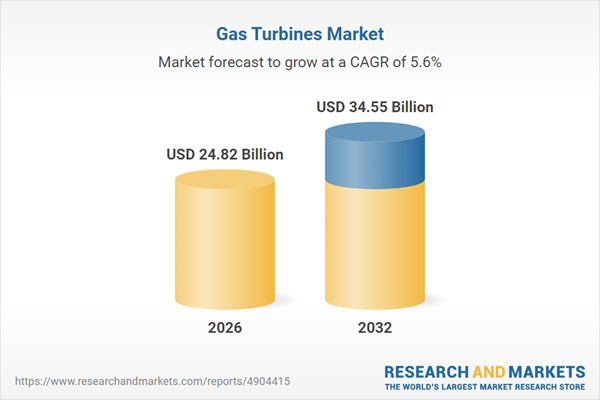

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 24.82 Billion |

| Forecasted Market Value ( USD | $ 34.55 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |