Speak directly to the analyst to clarify any post sales queries you may have.

A concise framing of current industry dynamics and operational priorities shaping gigabit passive optical network equipment deployment strategies

The gigabit passive optical network equipment landscape is experiencing rapid technological maturation and commercial momentum as fiber deepening, higher-capacity access demands, and next-generation service expectations converge. Network operators are balancing legacy GPON deployments with the imperative to adopt multi-gigabit-capable technologies that can carry evolving residential, enterprise, and wholesale traffic profiles. At the same time, equipment vendors are responding with more integrated optical line terminals, compact distribution architectures, and software-enabled management layers that reduce operational friction and accelerate service turn-up.Transitioning from concept to deployment requires decision-makers to reconcile technical trade-offs, supply chain realities, and deployment economics. Capital planners and network architects are increasingly focused on interoperability, migration strategies that protect existing investments, and the operational benefits of centralized orchestration. These priorities are amplified by the need to support symmetrical services, low-latency applications, and differentiated enterprise SLAs while keeping total cost of ownership manageable. As stakeholders assess vendor roadmaps and system architectures, they must also weigh software maturity, lifecycle support, and the flexibility to adopt emerging standards without disruptive rip-and-replace cycles.

This introduction frames the core dynamics shaping vendor strategies, operator priorities, and technology adoption pathways. It also establishes the analytical lens used throughout this report: a practical emphasis on deployment pragmatism, migration sequencing, and the interplay between hardware innovation and software-driven network operations. The result is a grounded perspective aimed at informing procurement decisions, technology partnerships, and deployment timelines in a rapidly evolving access-network ecosystem.

How converging technological advances and operational automation are reshaping access network architectures and vendor ecosystems for gigabit passive optical networks

The access network landscape is undergoing transformative shifts driven by both technological and market forces. First, there is a clear move from single-technology GPON-centric architectures toward multi-standard coexistence where GPON, XG-PON, XGS-PON, and NG-PON2 capabilities are architected to serve distinct service tiers and migration stages. Vendors are increasingly designing platforms that support field-level upgrades or modular card swaps, enabling operators to transition capacity and features incrementally. This modularity reduces initial capital strain while preserving the pathway to symmetrical multi-gigabit services.Second, software and automation are redefining operational expectations. Centralized management planes, containerized network functions, and intent-based provisioning simplify service activation and fault isolation. Operators adopting these paradigms are able to reduce mean time to repair and accelerate service velocity, which in turn supports new revenue streams and premium enterprise offerings. Third, physical topology choices are shifting as planners reconsider the trade-offs between passive distribution simplicity and resilience. Hybrid topologies that blend ring redundancy with tree distribution are gaining traction where service continuity and fiber efficiency must co-exist.

Finally, ecosystem dynamics are changing: interoperability testing, disaggregated optical components, and a broader supplier base are challenging vertically integrated assumptions. Open interfaces and standardized control APIs are fostering multi-vendor solutions, but they also raise governance and integration complexity. Therefore, operators are prioritizing rigorous lab validation and staged field trials before wide-scale rollouts. Collectively, these shifts are accelerating the evolution of access networks from static pipe-delivery systems to adaptable, software-defined platforms capable of supporting a diverse mix of consumer, enterprise, and wholesale services.

Practical procurement and supply chain implications stemming from the cumulative tariff measures introduced in the United States during 2025

The United States tariff interventions announced for 2025 have introduced layered supply chain and procurement implications that merit careful consideration by vendors, operators, and integrators. Tariff adjustments have increased the emphasis on supply-chain diversification, component sourcing strategies, and nearshoring options to mitigate cost exposure. Network planners must now integrate tariff risk into procurement timelines, specifying longer lead times where sourcing flexibility is limited and prioritizing components and subassemblies that can be qualified from multiple geographic sources.As a result of the tariff environment, some equipment vendors are accelerating localization of production and expanding regional partner networks to preserve price competitiveness. These moves often involve strategic investments in contract manufacturing, multi-sourcing agreements, and firmware portability to ensure functionality parity across supply chains. Procurement organizations are likewise revising contractual terms to include tariff pass-through clauses, indexed pricing mechanisms, and supply contingencies that protect delivery schedules and budget fidelity.

Beyond procurement mechanics, tariffs are influencing product design choices. Engineers are assessing the feasibility of greater subcomponent standardization to simplify qualification cycles for alternative suppliers. In some cases, vendors are prioritizing modular designs that permit replacement of tariff-impacted modules without redesigning the entire platform. For operators, the cumulative effect is a recalibration of procurement strategies, with an increased focus on long-term supplier relationships, rigorous qualification of regional manufacturers, and scenario planning that quantifies the operational impact of tariff-induced supply disruptions. Going forward, leaders will need to harmonize sourcing resilience with technical and commercial performance to sustain deployment momentum under a more complex trade regime.

Detailed segmentation-driven insights outlining how technology selection, topology choices, end-user requirements, and deployment approaches determine strategic network decisions

Segmentation analysis reveals differentiated technology pathways and deployment choices that influence vendor and operator strategies. Based on Technology, operators are juxtaposing legacy GPON deployments against higher-capacity alternatives such as NG-PON2, XG-PON, and XGS-PON to craft migration roadmaps that align service tiers with fiber plant longevity. This technology layering enables phased upgrades where GPON continues to serve mass-market residential segments while XGS-PON and XG-PON are allocated to business services and bandwidth-intensive residential customers, with NG-PON2 reserved for ultra-high capacity corridors and long-term scaling.Based on Network Topology, planners are re-evaluating pure tree architectures in favor of hybrid and ring topologies in environments where resiliency and service continuity are prioritized. Hybrid topology implementations combine the simplicity and low cost of tree distribution with selective ring segments to provide redundancy and simplified restoration. Ring topology remains attractive for dense urban deployments where fiber redundancy and rapid service restoration are critical, whereas tree topology remains a cost-effective solution for sparse suburban and rural builds.

Based on End User, the segmentation between Enterprise, Residential, and Wholesale Telecom customers informs procurement, SLA governance, and feature bundling. Enterprise customers often demand symmetrical bandwidth, low-latency paths, and managed service overlays, necessitating platforms with robust QoS, security, and service orchestration. Residential segments prioritize affordability and aggregated capacity, leading operators to balance cost-per-subscriber metrics against incremental revenue from premium tiers. Wholesale telecom customers value interoperability and clear demarcation points that enable efficient resale and service-level agreements between providers.

Based on Deployment, decisions between Brownfield Upgrade and Greenfield Deployment affect both technical choice and project execution. Brownfield upgrades emphasize backward-compatible solutions and minimal disruption to existing customers, fostering an incremental approach to capacity expansion. Greenfield deployments allow for fresh design choices favoring future-proof topologies and the incorporation of the latest hardware and software paradigms from the outset. Each deployment path requires tailored project governance, testing regimes, and change management practices to ensure successful rollouts and long-term operational stability.

How regional variations across the Americas, Europe Middle East & Africa, and Asia-Pacific are shaping differentiated deployment priorities and vendor strategies

Regional dynamics are shaping deployment patterns, vendor strategies, and investment priorities across distinct continents and economic blocs. In the Americas, network modernization is characterized by accelerated fiber extensions into urban and suburban footprints combined with targeted policy incentives that support broadband expansion. Operators in the region are balancing competitive pressure from alternative access technologies with regulatory programs that promote universal service, creating a dual focus on customer acquisition and rural coverage. This environment favors pragmatic migration strategies that blend cost-effective GPON installations with targeted XGS-PON upgrades in high-value corridors.In Europe, Middle East & Africa, heterogeneity is the dominant theme. Mature Western European markets emphasize high reliability, regulatory compliance, and rapid adoption of higher-capacity standards for enterprise and carrier-grade services, while many markets in the Middle East and Africa prioritize rapid greenfield deployment to meet rising connectivity demand. Regulatory frameworks and public-private partnerships are influential across the region, shaping funding models and rollout priorities. Vendors and integrators that can offer scalable solutions and flexible financing are well positioned to capture expansion opportunities across diverse national contexts.

Across Asia-Pacific, demand dynamics are driven by massive urbanization, dense subscriber concentrations, and aggressive national broadband initiatives. High-density metropolitan areas enable efficient fiber economics and justify investments in advanced technologies like NG-PON2 where future capacity needs justify the incremental cost. Elsewhere in the region, large-scale greenfield projects and public infrastructure programs are catalyzing rapid fiber build-outs, creating opportunities for both global suppliers and local manufacturers. Overall, regional strategies must account for regulatory nuances, partner ecosystems, and the granular balance between urban and rural deployment dynamics to optimize network rollout and service strategies.

Key company-level strategic behaviors and partnership trends that determine competitive advantage and deployment success in the gigabit PON equipment market

Company-level dynamics are influencing product roadmaps, partnership models, and go-to-market approaches within the gigabit passive optical network ecosystem. Leading vendors are prioritizing modular hardware designs and software-rich management platforms that reduce time-to-service and enable feature differentiation through software licensing. These strategic priorities are creating a competitive advantage for suppliers that can provide comprehensive validation, long-term support agreements, and a clear interoperability story across multi-vendor environments.Strategic alliances and channel partnerships are becoming more prominent as vendors seek to accelerate field deployments and reduce integration risk. Systems integrators and contract manufacturers play increasingly important roles in regional rollouts, bringing localized expertise and deployment capacity that global vendors may lack. At the same time, a subset of agile suppliers is focusing on niche product differentiation-such as ultra-compact distribution nodes, innovative power management, or enhanced security features-to capture specific vertical use cases.

Mergers, acquisitions, and joint development agreements are reshaping competitive positioning and accelerating access to complementary technologies. Companies that can combine strong component supply chains with robust software ecosystems are best positioned to meet operator demands for turnkey solutions. Equally important is the emphasis on lifecycle economics and predictable support models, which influence procurement decisions beyond initial purchase and into multi-year operational partnerships. Buyers are therefore looking for both technical capability and a demonstrated commitment to field support and continuous feature evolution.

Actionable and pragmatic strategic recommendations for operators and vendors to accelerate deployment, manage risk, and capture new revenue opportunities from gigabit PON networks

Industry leaders should pursue a set of pragmatic actions to convert technology potential into operational and commercial outcomes. First, accelerate modular migration strategies that protect legacy investments while enabling incremental upgrades to XG-PON, XGS-PON, and NG-PON2 where justified by service needs. Prioritizing backward-compatible platforms reduces customer churn risk and smooths capital allocation over multi-year deployment plans. Second, invest in software and automation capabilities that streamline provisioning, fault management, and capacity planning to reduce operational expenditures and improve service velocity.Third, embed supply-chain resilience into procurement practices by diversifying qualified suppliers, exploring nearshoring, and negotiating flexible contractual terms that reflect tariff and geopolitical risks. This approach should be complemented by rigorous component qualification procedures and contingency inventory planning. Fourth, tailor deployment strategies to topology and end-user segmentation: adopt hybrid topology approaches in environments that require resilience, reserve ring topologies for dense urban cores, and maintain cost-optimized tree deployments for lower-density areas. Fifth, cultivate regional partnerships and field services to ensure rapid time-to-revenue for greenfield projects and controlled upgrade paths for brownfield operations.

Finally, formalize a governance process for technology adoption that includes staged field trials, interoperability testing, and stakeholder alignment across procurement, network engineering, and commercial teams. By coupling sound technical evaluation with procurement discipline and operational readiness, industry leaders can accelerate rollouts, maintain service quality, and capture new revenue opportunities emerging from evolving consumer and enterprise demands.

A rigorous multi-method research methodology combining expert interviews, laboratory interoperability testing, and structured secondary source validation

The research approach combines qualitative expert interviews, technical lab validations, and structured secondary research to build a multifaceted view of the gigabit passive optical network equipment landscape. Primary research included discussions with network architects, procurement leads, systems integrators, and equipment engineers to capture real-world deployment considerations, technology trade-offs, and vendor performance observations. These interviews informed scenario analysis, including migration sequencing options and procurement contingencies relevant to contemporary supply-chain dynamics.Technical evaluations were based on laboratory interoperability testing and review of vendor documentation to assess upgrade pathways, modularity, and management-plane capabilities. This hands-on validation highlighted practical constraints around field upgrades, component interchangeability, and orchestration integration. Secondary research encompassed regulatory filings, vendor product literature, engineering white papers, and publicly available procurement specifications to triangulate findings and ensure factual accuracy.

Throughout the research process, emphasis was placed on corroborating claims across multiple sources, documenting assumptions, and clearly articulating the limits of inference where public data was constrained. The methodology balances technical rigor with market relevance, ensuring that conclusions are grounded in operational realities and validated by practitioners who manage deployment and support of access networks.

Concluding synthesis emphasizing the strategic imperatives for operators and vendors to balance innovation, operational readiness, and procurement resilience

The gigabit passive optical network equipment environment is at a strategic inflection point where technological maturity, operational automation, and evolving procurement dynamics converge to reshape deployment trajectories. Operators and vendors alike must navigate a complex interplay of technology choices, topology considerations, and regional variances while also integrating supply-chain resilience in response to tariff pressures and geopolitical uncertainty. The dominant themes are pragmatic modularity, software-enabled operations, and careful segmentation-driven deployment that aligns technical capability with end-user needs.Looking ahead, success will favor organizations that can execute disciplined migration strategies, validate multi-vendor interoperability, and sustain strong regional partnerships. By focusing on lifecycle support, automation, and contingency planning, stakeholders can convert technological opportunity into reliable service delivery and sustainable commercial outcomes. The conclusion underscores an imperative for deliberate, measured action that balances innovation with operational continuity and procurement prudence.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Gigabit Passive Optical Network Equipment Market

Companies Mentioned

The key companies profiled in this Gigabit Passive Optical Network Equipment market report include:- ADTRAN, Inc.

- Alcatel-Lucent Enterprise

- Allied Telesis Holdings K.K.

- Broadcom Inc.

- Calix, Inc.

- Cisco Systems, Inc.

- Dasan Zhone Solutions, Inc.

- ECI Telecom Ltd.

- Edgecore Networks Corporation

- Ericsson AB

- FiberHome Telecommunication Technologies Co., Ltd.

- Fujitsu Limited

- Genexis B.V.

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- Iskratel, d.o.o.

- Mitsubishi Electric Corporation

- NEC Corporation

- Nokia Corporation

- Sagemcom Broadband SAS

- Sumitomo Electric Industries, Ltd.

- Tellabs, Inc.

- TP-Link Corporation Limited

- UTStarcom Holdings Corp.

- ZTE Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

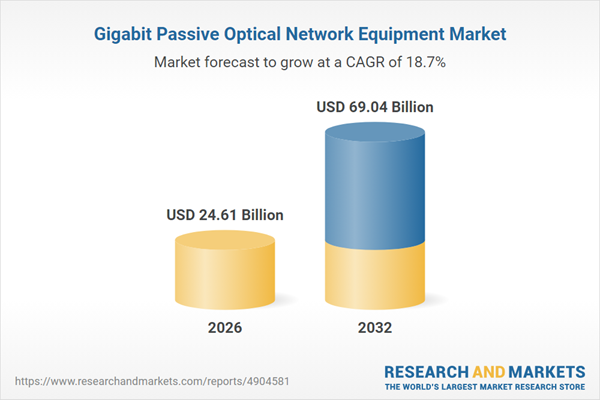

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 24.61 Billion |

| Forecasted Market Value ( USD | $ 69.04 Billion |

| Compound Annual Growth Rate | 18.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |