The use of RWS grew over the recent past, particularly driven by the growth in asymmetric warfare. Non-state actors started employing the techniques and tactics of asymmetric warfare. Conventional forces require new capabilities to become successful in modern combat situations and post-conlict scenarios. In this regard, the use of remote weapon systems is becoming widespread in several anti-terrorist and counter-insurgency operations.

There were several advancements in RWS and unmanned turrets in recent years, ranging from the protection of the systems and lethality to the support of larger calibers. Such developments are expected to help the growth in the procurement of new weapon systems and upgrades of the existing platforms in the years to come. Though RWS acts as a viable option for providing defensive firepower to the armed forces, certain installation and operational challenges are influencing the global militaries to prefer manned turrets over remote weapons. However, it is expected that these operational limitations will be addressed in the future through the extensive R&D being conducted towards the integration of advanced technologies into the RWS.

Remote Weapon Systems Market Trends

The Land Segment is Projected to Register the Highest CAGR During the Forecast Period

The land segment is anticipated to show the highest CAGR during the forecast period. The land segment encompasses the RWS that is stationary and mounted on land vehicles. The increase in attacks on military bases and outposts in the recent past increased the demand for remotely operated stationary weapon stations for protecting vulnerable areas.Despite the land segment being expected to dominate the market during the forecast period, currently, the airborne segment had the largest share in the RWS market in 2023. While many countries include dedicated attack helicopters that possess a wide range of armaments, including the RWS, the weapon systems are also attached to utility and transport helicopters. Customization of aircraft to include the RWS as a retrofit is being widely adopted by the countries that lack the funds for procuring dedicated attack helicopters, making the segment grab the highest market share currently. For instance, in November 2022, Kongsberg Defence & Aerospace teamed up forces with Thales UK to support the Protector Remote Weapon Systems (RWS) program of the British armed forces. The firms will collaborate on numerous capacities for the weapon system's maturity in the UK military and foreign markets under the terms of the agreement. The Protector RWS is promoted globally by Kongsberg and Thales, with around 1,000 of the weapon systems being integrated into British defense.

Stationary Land RWS, especially sentry guns, are also being used to guard the borders of some countries. In addition, the growth in the procurement of armored vehicles and unmanned ground vehicles necessitated the demand for the RWS installed on these ground vehicles. With the increasing adoption of unmanned land vehicles, high adoption of these systems is expected during the forecast period. All these factors are contributing to the growth of the land segment currently.

North America Dominated Market Share

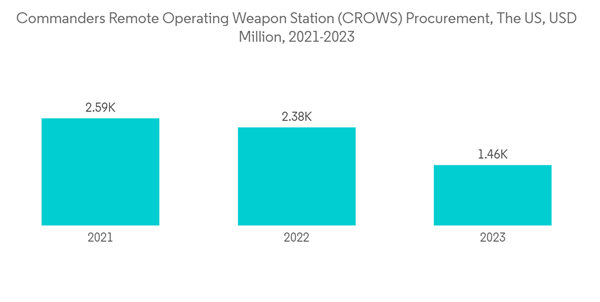

The United States and Canada are avid users of remote weapon systems in North America. They are currently focusing on upgrading their existing vehicle fleet and their corresponding capabilities.The need for upgrading the capabilities of the existing fleet to counter emerging threats resulted in a flurry of contracts being awarded to cater to the diversified needs of the armed forces. For instance, in November 2022, the US Army awarded a USD 1.5 billion contract to Kongsberg Defence & Aerospace to continue its supply of Common Remotely Operated Weapon Stations (CROWS). CROWS are armored mounts that can perform on-the-move target acquisition and fire-burst strikes while being shielded inside armored vehicles. The company will deliver its Kongsberg Protector remote weapon station family, which is also used by NATO and ally forces, under the five-year arrangement. Likewise, in January 2023, Rheinmetall Systems and Kongsberg Defence & Aerospace signed a framework agreement to produce subsystems for the US Army's Common Remotely Operated Weapon Station (CROWS) program. The five-year framework deal covers the provision of high-definition image-stabilized EO sensors (day cameras), weapon mounts, and other assemblies.

Such procurement programs, along with other upgrade programs, are anticipated to be initiated in the upcoming period and are envisioned to enhance the business prospects of the North American remote weapon systems market during the forecast period.

Remote Weapon Systems Industry Overview

The remote weapon systems market is fragmented due to the presence of many global as well as regional defense manufacturers and suppliers that cater to the requirements of remote weapon systems of armed forces around the world. About 13 players in the market account for approximately 50% of the market share. THALES, BAE Systems plc, Rheinmetall AG, Leonardo S.p.A., and ASELSAN A.S. are the dominant players in the market. Some of the other prominent players in the local and regional markets are China Ordnance Industries Group Corporation Limited, Rostec State Corporation, L3Harris Technologies Inc., Israel Aerospace Industries Ltd., Patria Group, and KMW+Nexter Defense Systems, among others. With the growing demand for remote-control weapon systems, the innovation of new systems with advanced sensor systems and optronic equipment in fire control systems to target, track, and hit the target is anticipated to increase. It is thereby helping the companies expand their geographical presence in emerging markets.For instance, in March 2023, General Dynamics European Land Systems (GDELS) awarded Elmet International SRL (a subsidiary of Elbit Systems) a follow-on contract worth USD 120 million to supply unmanned turrets, Remote Controlled Weapon Stations (RCWS), and mortar systems for the Romanian Armed Forces 'Piranha V' Armored Personnel Carrier (APC).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Kongsberg Gruppen ASA

- Elbit Systems Ltd

- Rafael Advanced Defense Systems Ltd

- Raytheon Company

- Saab AB

- Leonardo SpA

- Electro Optic Systems Pty Ltd

- ASELSAN AS

- General Dynamics Corporation

- BAE Systems PLC

- China Ordnance Industries Group Corporation Limited

- Thales Group

- Rostec State Corporation

- FN Herstal

- Rheinetall AG

- Hanwha Corp

- Singapore Technologies Engineering Ltd