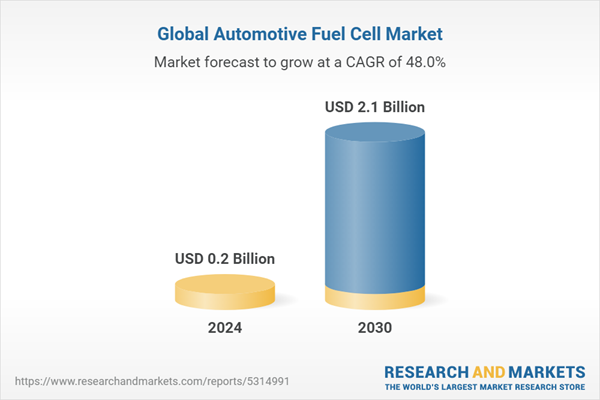

The global automotive fuel cell market is projected to grow from USD 0.2 billion in 2024 to USD 2.1 billion by 2030, at a CAGR of 48.0%. Parameters such as an increase in demand for low emission vehicles and an increase in demand for green mobility will drive the market. In addition, the advancements in hydrogen-powered technology, paired with government support for fuel cell technology, will create new opportunities for this market. Increasing demand for zero-emission vehicles in the market and strong government support has led to many top OEMs invest in the R&D of FCEVs. Hydrogen fuel cells have thus become a fast-growing technology in the past decades. Many new technological developments have taken place, which have increased the demand for automobile fuel cells in the market. Unlike traditional EVs, FCEVs can be used for much longer distances and are often used in long-distance EV commuting. Companies like Toyota, Hyundai, and Honda have been leading the development of this technology for the last two decades.

PEM fuel cells, commonly utilized for automotive purposes, are compatible with fuels like hydrogen, methanol, and ethanol. Hydrogen stands out as the cleanest fuel option for fuel cells in automotive applications. Despite the current limited demand for hydrogen fuel cell vehicles, primarily due to a constrained supply of green hydrogen and the use of fossil fuels in hydrogen production, countries worldwide are initiating green hydrogen projects for various applications. This initiative is expected to boost demand for hydrogen fuel cell vehicles as production scales up, accompanied by the establishment of hydrogen stations across countries. Storage poses a challenge hindering the widespread adoption of hydrogen as a fuel.

Due to its low density, hydrogen cannot be stored as easily as fossil fuels and requires compression and cooling before storage. Steam reforming remains the dominant method for hydrogen production in the United States, involving the high-temperature combination of steam with natural gas to extract hydrogen. Alternatively, hydrogen can be produced from water through electrolysis, a more energy-intensive process that offers the advantage of using renewable energy sources such as wind or solar, thereby mitigating harmful emissions associated with other energy production forms. This necessitates specific tanks for storage purposes, further contributing to the cost of using hydrogen fuel cells for automotive applications.

The goal is to facilitate the widespread adoption of hydrogen in Fuel Cell Electric Vehicles (FCEVs). Currently, light-duty FCEVs are gradually entering the consumer market in limited quantities, initially in specific regions both domestically and globally. Moreover, the hydrogen market is exhibiting promising growth in various sectors, including buses, material handling equipment (e.g., forklifts), ground support equipment, medium - and heavy-duty trucks, marine vessels, and stationary applications. While hydrogen production may generate emissions affecting air quality, it is crucial to note that the exhaust from an FCEV running on hydrogen comprises only water vapor and warm air, classifying it as a zero-emission vehicle. This has materialized in the introduction of light-duty vehicles to retail consumers and the initial deployment of medium - and heavy-duty buses and trucks in California, with plans for fleet availability expanding to northeastern states.

The United States is committed to decarbonizing its power sector by 2035, aiming for a 50-52% reduction in carbon emissions compared to 2005 levels and achieving net-zero emissions by 2050. Each fuel cell bus in operation in the US has the potential to annually reduce carbon emissions by 100 tons and eliminate the need for 9,000 gallons of fuel, resulting in significant cost savings of over USD 37,000 per vehicle compared to diesel-fueled buses. Recognizing the importance of fuel cell technology in its national energy strategy, the US government has proposed a USD 2 billion investment in technologies, including fuel cells, to reduce dependence on fossil fuels.

California, at the forefront of automotive legislation for emissions reduction, has established hydrogen refueling stations, and the H2USA project aims to advance hydrogen infrastructure, preparing for the widespread adoption of FCEVs. The US Department of Energy's investment of USD 52.5 million in 31 projects supports the advancement of clean hydrogen technologies and the Hydrogen Energy Earthshot initiative, targeting 700,000 jobs and $140 billion in revenue by 2030. However, the US goal of producing green hydrogen at $1 per kilogram by 2031 may be optimistic, with blue hydrogen and naturally extracted hydrogen gaining attention on political agendas worldwide.

Simultaneously, the California Air Resources Board (CARB) is championing zero-emissions vehicles, opening the door for more hydrogen fuel cell vehicles. North America's prowess in fuel cell technology innovation is attributed to government policies promoting low-emission technologies, business-friendly environments, lower taxes, and incentives for fuel cell vehicle users, fostering significant growth in the automotive fuel cell market.Canada is also taking steps to reduce carbon emissions, with the City of Toronto planning to convert 50% of its fleets to Electric Vehicles (EVs), including a substantial portion designated for long-distance travel using FCEVs. Provinces like BC and Quebec are incentivizing Zero-Emission Vehicle (ZEV) purchases, implementing regulations, and deploying hydrogen fueling infrastructure to promote the adoption of FCEVs.

In-depth interviews were conducted with CEOs, managers, and executives from various key organizations operating in this market.

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Hydrogen will be the most commonly used fuel in FCEVs

Hydrogen, naturally occurring in our environment and stored in various forms such as water (H2O), hydrocarbons (e.g., methane - CH4), and organic matter, presents a challenge in terms of efficiently extracting it for use as a fuel. Hydrogen is gaining prominence as a viable alternative fuel derived from diverse domestic resources. Although the hydrogen transportation market is in its early stages, joint efforts from both government and industry are concentrated on achieving clean, cost-effective, and secure hydrogen production and distribution. Hydrogen fuel cells harness the chemical energy of hydrogen to generate electricity, with water being the sole by-product of usage.PEM fuel cells, commonly utilized for automotive purposes, are compatible with fuels like hydrogen, methanol, and ethanol. Hydrogen stands out as the cleanest fuel option for fuel cells in automotive applications. Despite the current limited demand for hydrogen fuel cell vehicles, primarily due to a constrained supply of green hydrogen and the use of fossil fuels in hydrogen production, countries worldwide are initiating green hydrogen projects for various applications. This initiative is expected to boost demand for hydrogen fuel cell vehicles as production scales up, accompanied by the establishment of hydrogen stations across countries. Storage poses a challenge hindering the widespread adoption of hydrogen as a fuel.

Due to its low density, hydrogen cannot be stored as easily as fossil fuels and requires compression and cooling before storage. Steam reforming remains the dominant method for hydrogen production in the United States, involving the high-temperature combination of steam with natural gas to extract hydrogen. Alternatively, hydrogen can be produced from water through electrolysis, a more energy-intensive process that offers the advantage of using renewable energy sources such as wind or solar, thereby mitigating harmful emissions associated with other energy production forms. This necessitates specific tanks for storage purposes, further contributing to the cost of using hydrogen fuel cells for automotive applications.

The goal is to facilitate the widespread adoption of hydrogen in Fuel Cell Electric Vehicles (FCEVs). Currently, light-duty FCEVs are gradually entering the consumer market in limited quantities, initially in specific regions both domestically and globally. Moreover, the hydrogen market is exhibiting promising growth in various sectors, including buses, material handling equipment (e.g., forklifts), ground support equipment, medium - and heavy-duty trucks, marine vessels, and stationary applications. While hydrogen production may generate emissions affecting air quality, it is crucial to note that the exhaust from an FCEV running on hydrogen comprises only water vapor and warm air, classifying it as a zero-emission vehicle. This has materialized in the introduction of light-duty vehicles to retail consumers and the initial deployment of medium - and heavy-duty buses and trucks in California, with plans for fleet availability expanding to northeastern states.

North America to have rapid fuel cell demand growth during the forecast period

North America has emerged as one of the fastest growing market in fuel cell development, spearheaded by acclaimed companies like Ballard Power (Canada), Plug Power (LIS), and Fuel Cell Energy (US). The US and Canada are actively promoting the growth of Fuel Cell Electric Vehicles (FCEVs), particularly in the commercial vehicle sector. Government support includes performance testing for fuel cell Heavy Commercial Vehicles (HCVs) and buses, with key players like Ballard Power Systems, Hyster-Yale, Plug Power, Cummins, Advent Technologies Holdings, and BorgWarner contributing to the region's competitive market.The United States is committed to decarbonizing its power sector by 2035, aiming for a 50-52% reduction in carbon emissions compared to 2005 levels and achieving net-zero emissions by 2050. Each fuel cell bus in operation in the US has the potential to annually reduce carbon emissions by 100 tons and eliminate the need for 9,000 gallons of fuel, resulting in significant cost savings of over USD 37,000 per vehicle compared to diesel-fueled buses. Recognizing the importance of fuel cell technology in its national energy strategy, the US government has proposed a USD 2 billion investment in technologies, including fuel cells, to reduce dependence on fossil fuels.

California, at the forefront of automotive legislation for emissions reduction, has established hydrogen refueling stations, and the H2USA project aims to advance hydrogen infrastructure, preparing for the widespread adoption of FCEVs. The US Department of Energy's investment of USD 52.5 million in 31 projects supports the advancement of clean hydrogen technologies and the Hydrogen Energy Earthshot initiative, targeting 700,000 jobs and $140 billion in revenue by 2030. However, the US goal of producing green hydrogen at $1 per kilogram by 2031 may be optimistic, with blue hydrogen and naturally extracted hydrogen gaining attention on political agendas worldwide.

Simultaneously, the California Air Resources Board (CARB) is championing zero-emissions vehicles, opening the door for more hydrogen fuel cell vehicles. North America's prowess in fuel cell technology innovation is attributed to government policies promoting low-emission technologies, business-friendly environments, lower taxes, and incentives for fuel cell vehicle users, fostering significant growth in the automotive fuel cell market.Canada is also taking steps to reduce carbon emissions, with the City of Toronto planning to convert 50% of its fleets to Electric Vehicles (EVs), including a substantial portion designated for long-distance travel using FCEVs. Provinces like BC and Quebec are incentivizing Zero-Emission Vehicle (ZEV) purchases, implementing regulations, and deploying hydrogen fueling infrastructure to promote the adoption of FCEVs.

In-depth interviews were conducted with CEOs, managers, and executives from various key organizations operating in this market.

- By Respondent Type - OEMs - 24%, Tier I - 67%, Tier II & III - 9%

- By Designation - C - level Executives - 33%, Managers - 52%, Executives - 15%

- By Region - North America - 28%, Asia Oceania - 38%, Europe - 34%

Research Coverage

The report covers the automotive fuel cell market, in terms of vehicle type (Passenger Cars, LCV, Bus, Truck), Component (fuel cell stack, fuel processor, power conditioner, air compressor, humidifier), by specialised vehicle type (Material Handling Vehicle, Auxilary Power Unit or Refrigerated Truck), H2 fuel station (Asia Oceania, Europe, and North America), power output (< 150kW, 150-250 Kw, >250kw), operating miles (0-250 miles, 250-500 miles, and above 500 miles), propulsion (FCEV, FCHEV), fuel type (Methanol, Ethanol, and others), region (Asia Oceania, Europe, and North America). It covers the competitive landscape and company profiles of the major automotive fuel cell market ecosystem players.The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall automotive fuel cell market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of different automotive fuel cell systems based on their capacity.

The report provides insight on the following pointers:

- Analysis of key drivers (better fuel efficiency and increased driving range, rapid increase in investment and development for green hydrogen production, fast refuelling, reduced Oil dependency, lower emissions compared to other vehicles), restraints (highly flammable, hard to detect hydrogen leakage, high initial investment or hydrogen refuelling infrastructure, lower efficiency compared to BEV's and HEVs), challenges (rising demand for fuel cell vehicles in automotive and transportation sector, fuel cell vans to be an emerging opportunity for OEMs, government initiatives pertaining to hydrogen infrastructure), and opportunities (high vehicle costs, insufficient hydrogen infrastructure, fast growing demand for BEVS and HEVs), influencing the growth of the authentication and brand protection market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive fuel cell market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive fuel cell market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive fuel cell market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players Ballard Power Systems (Canada), Hyster-Yale (US), Plug Power(US) ITM Power(UK) and Cummins (US), among others in automotive fuel cell market.

Table of Contents

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

6 Automotive Fuel Cell Market, by Component

7 Automotive Fuel Cell Market, by Fuel Type

8 Automotive Fuel Cell Market, by Hydrogen Fuel Points

9 Automotive Fuel Cell Market, by Operating Miles

10 Automotive Fuel Cell Market, by Power Output

11 Automotive Fuel Cell Market, by Propulsion

12 Automotive Fuel Cell Market, by Specialized Vehicle Type

13 Automotive Fuel Cell Market, by Vehicle Type

14 Automotive Fuel Cell Market, by Region

15 Competitive Landscape

16 Company Profiles

17 Analyst's Recommendations

18 Appendix

Companies Mentioned

- Toyota Motor Corporation

- Hyundai Group

- Honda

- General Motors

- Stellantis

- Ballard Power Systems

- Hyster-Yale

- Plug Power

- Cummins

- Doosan Group

- Advent Technologies Holdings

- Itm Power

- Ceres Power

- Nedstack

- Proton Motor Power Systems

- Toshiba

- Powercell Ab

- Panasonic

- Toray Industries

- Sunrise Power Co. Ltd

- Bosch

- Intelligent Energy

- Symbio

- Elringklinger AG

- Swiss Hydrogen Power

- Dana Incorporated

- Fuel Cell System Manufacturing LLC

- Volkswagen AG

- Daimler

- Riversimple

- Saic Motors

- Van Hool

- Mebius Fuel Cell

- Hydra Energy Corporation

- Isuzu Motors

- Ford Motor Company

- Fuelcell Energy

- Bloom Energy

- Sunfire

- Ionomr Innovations

- Bramble Energy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 331 |

| Published | February 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.2 Billion |

| Forecasted Market Value ( USD | $ 2.1 Billion |

| Compound Annual Growth Rate | 48.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 41 |