Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction to needle-free diabetes care that synthesizes clinical potential, patient adherence benefits, and commercial adoption variables

Needle-free diabetes care is emerging from the margins of medical device innovation into a central conversation about how to make chronic disease management less invasive, more convenient, and better aligned with real-world patient behavior. New delivery platforms aim to reduce the procedural friction associated with subcutaneous injections, while simultaneously addressing adherence challenges that have long affected clinical outcomes across gestational diabetes, type 1 diabetes, and type 2 diabetes. Innovations in drug-device integration, materials science, and user-centered design are converging to create options that promise to reframe patient experience.Clinical stakeholders increasingly view needle-free options as enablers of broader therapeutic strategies, enabling combination approaches such as GLP-1 therapies alongside insulin delivery, and opening avenues for simplified regimens in vulnerable populations. Regulators and payers are showing heightened interest in evidence packages that demonstrate both safety and real-world effectiveness, which has moved device design considerations upstream into clinical trial planning. Consequently, technology developers are prioritizing human factors engineering alongside pharmacokinetic and pharmacodynamic performance.

From a commercial perspective, adoption pathways vary by end user: ambulatory care centers, hospitals and clinics, specialty clinics, and home care settings each present distinct procurement, training, and operational requirements. Distribution channels including hospital pharmacy, online pharmacy, and retail pharmacy introduce further complexity in how products are presented to prescribers and patients. As the field matures, the interplay between regulatory clarity, clinical utility, and supply chain readiness will shape which technologies gain traction and how they are integrated into standard care protocols.

An incisive overview of the transformational forces reshaping needle-free diabetes delivery technologies, regulatory expectations, and adoption dynamics

The landscape for needle-free diabetes care is undergoing transformative shifts driven by technological advancement, policy movement, and changing patient expectations. On the technological front, maturation of jet injectors, microneedle platforms-spanning coated, dissolvable, hollow, and solid variants-and patch pumps has expanded the palette of delivery mechanisms available to developers. These platforms differ not only in their physical mechanisms of action but also in their manufacturing complexity, cold-chain requirements, and integration options for biologics and combination therapies such as GLP-1 agents.Meanwhile, stakeholder expectations are shifting toward devices that prioritize ease of use and discrete administration, particularly for populations that face barriers to adherence. Age segmentation matters: adult populations pursue convenience and lifestyle compatibility, geriatric patients require simplified dosing and robust safety features, and pediatric use demands tolerability and clear caregiver interfaces. Additionally, end-user settings are evolving; the expansion of home care as a primary site of chronic care delivery increases the importance of devices designed for nonprofessional administration and remote monitoring compatibility.

Concurrently, regulatory and reimbursement frameworks are adapting to novel device categories. Regulatory authorities are clarifying pathways for combination drug-device products and expecting evidence that extends beyond conventional clinical endpoints to include user experience and real-world adherence metrics. Payers are similarly focused on value propositions that tie improved adherence and reduced complication rates to total cost of care outcomes. Taken together, these shifts are driving developers to align product design with lifecycle planning that spans clinical validation, reimbursement strategy, and distribution channel optimization.

An analytical examination of how U.S. tariff adjustments in 2025 reconfigured supply chains, sourcing decisions, and manufacturing strategies for medical device producers

Tariff policy changes and trade dynamics in the United States during 2025 have introduced new considerations for global supply chains and cost structures in the medical device sector. As manufacturers evaluate sourcing strategies, sensitivity to cross-border tariff adjustments has led many stakeholders to reassess component sourcing, manufacturing footprints, and distribution pathways. This recalibration affects not only upfront production costs but also strategic choices about where to locate final assembly, quality control, and regulatory testing capabilities.In response to tariff-related uncertainty, several suppliers intensified efforts to diversify supplier bases and to regionalize manufacturing closer to primary demand centers. This approach reduces exposure to import duties and mitigates the risk of supply disruptions. Moreover, manufacturers increasingly consider the implications of tariffs on packaging, electronic components, and materials that are critical to advanced delivery systems such as microneedle arrays and patch-based pumps, which rely on precision manufacturing and specialized substrates.

Policy shifts have also accentuated the importance of transparent supplier contracts and tariff forecasting within commercial planning cycles. Medical device companies are integrating trade-policy scenario planning into product launch strategies and contractual terms with distributors and healthcare system customers. In sum, the tariff environment in 2025 has not only influenced near-term procurement decisions but has also accelerated longer-term strategic moves toward supply chain resilience and regional manufacturing agility.

Comprehensive segmentation-driven insights that decode clinical priorities, device design trade-offs, and go-to-market imperatives across patient groups and delivery technologies

Segmentation analysis highlights critical differences in clinical requirements, user expectations, and commercialization pathways across application, product type, age group, end user, distribution channel, and technology. Based on application, devices designed for gestational diabetes must prioritize maternal-fetal safety profiles and ease of use during prenatal care visits, while type 1 diabetes applications demand precise dosing controls and rapid-onset delivery characteristics. Type 2 diabetes applications often emphasize long-term adherence and integration with lifestyle interventions.Based on product type, GLP-1 delivery systems require careful compatibility assessments between formulation stability and device materials, whereas insulin delivery systems present a bifurcation between prefilled devices that emphasize convenience and refillable devices that target cost efficiency and environmental considerations. Each approach shapes user training needs and supply chain logistics.

Based on age group, adult users typically focus on maneuverability and discretion; geriatric populations require simplified interfaces, clear dosing confirmation, and robust safety locks; pediatric use demands tolerability and caregiver-oriented design features. Based on end user, the supply chain and procurement complexity differs across ambulatory care centers, home care settings, hospitals and clinics, and specialty clinics, influencing educational outreach and integration with electronic health records.

Based on distribution channel, hospital pharmacy pathways prioritize formulary inclusion and institutional procurement processes, online pharmacy channels require digital patient support and logistics coordination, and retail pharmacy distribution hinges on point-of-care counseling and ease of dispense. Based on technology, jet injectors offer needle-free high-pressure delivery suited to certain formulations, microneedles provide minimally invasive transdermal access with variations across coated, dissolvable, hollow, and solid constructs, and patch pumps enable continuous or semi-continuous delivery modalities that align with lifestyle-focused therapies. These segmentation lenses collectively inform clinical trial design, human factors work, reimbursement strategy, and commercial prioritization.

Regional intelligence that deciphers how regulatory regimes, payer expectations, and manufacturing ecosystems shape adoption pathways across major global markets

Regional dynamics influence regulatory expectations, clinical adoption patterns, reimbursement models, and manufacturing strategies for needle-free diabetes technologies. In the Americas, healthcare systems vary widely from highly centralized public procurement to fragmented private payer landscapes, creating a mosaic of adoption pathways. Stakeholders in this region often emphasize rapid evidence generation in real-world settings and streamlined commercialization approaches that account for diverse payer environments.In Europe, Middle East & Africa, the regulatory environment is characterized by harmonization initiatives alongside region-specific requirements, which affects timing for multi-country rollouts. Reimbursement decision frameworks in this region frequently require health economics and outcomes research that addresses comparative effectiveness and long-term impact. In the Middle Eastern and African contexts, investment in local manufacturing capabilities and capacity building can accelerate access to innovative delivery options.

In Asia-Pacific, a combination of large patient populations, varying regulatory maturity, and strong domestic manufacturing ecosystems creates both opportunities and complexities. Many jurisdictions in this region emphasize cost-effectiveness and scalable production, while others focus on early adoption of patient-centric technologies. Across all regions, interoperability with digital health ecosystems, the availability of trained healthcare personnel, and cultural attitudes toward injection avoidance inform how needle-free devices are perceived and adopted by clinicians and patients alike.

Key competitive and operational insights demonstrating how leading firms align device innovation, evidence generation, and manufacturing flexibility to drive adoption

Leading companies in the needle-free diabetes space are converging around several strategic priorities: integration of drug-device functions, human factors-driven product development, and modular manufacturing approaches that allow for iterative improvements without disrupting supply chains. Companies that excel at aligning clinical evidence generation with reimbursement narratives tend to secure earlier formulary acceptance and stronger institutional partnerships.Partnerships between device innovators and pharmaceutical sponsors are becoming more strategic and longer-term, focusing on co-development pathways that address formulation-device compatibility from the outset. This collaboration model reduces downstream risks related to stability and performance, and better positions combination therapies for regulatory review. Additionally, some companies are investing in digital health adjuncts-remote monitoring, adherence coaching, and data analytics-that extend the value proposition beyond the physical device and into longitudinal care management.

From an operational standpoint, contract manufacturing organizations that can deliver precision fabrication for microneedle arrays, reliable electronic control systems for patch pumps, and validated assembly processes for jet injectors are critical partners. Companies that maintain flexible manufacturing footprints and robust quality systems can respond more nimbly to changes in demand, regulatory updates, and material sourcing challenges. Tactically, firms that prioritize clinician education and patient onboarding protocols increase the likelihood of sustained uptake in both institutional and home-care settings.

Actionable strategic recommendations for industry leaders to align human-centered design, regulatory planning, and supply chain resilience for successful commercialization

Industry leaders should commit to a series of strategic actions that bridge product innovation with scalable commercialization. First, prioritize human factors and real-world usability testing early in development to reduce barriers to adoption across adult, geriatric, and pediatric populations. Embedding iterative user feedback loops will inform engineering trade-offs and accelerate clinician and patient acceptance.Second, develop comprehensive regulatory strategies that integrate combination product pathways and allow for staged evidence generation. Early dialogue with regulators can clarify expectations for safety and performance testing, especially for novel microneedle constructs and combination GLP-1 delivery systems. Simultaneously, align reimbursement teams to build health economic models that meaningfully capture adherence-related benefits and downstream cost offsets, with narratives tailored to hospital pharmacies, online and retail pharmacy channels.

Third, strengthen supply chain resilience through regionalized manufacturing and diversified supplier networks to mitigate tariff-related and logistics risks. This includes validating contract manufacturing partners capable of precision micromanufacturing and ensuring alternative sourcing for critical electronic and substrate components. Fourth, pursue strategic partnerships between device developers and pharmaceutical sponsors to ensure formulation-device compatibility is addressed early, reducing late-stage technical risk.

Finally, commit to commercially oriented pilot programs that demonstrate clinical utility in real-world settings and produce actionable data for payers and institutional buyers. These pilots should be designed to gather adherence, patient-reported outcomes, and operational metrics that inform scalable training and distribution plans. Collectively, these actions will position leaders to convert technical promise into durable clinical and commercial success.

A rigorous mixed-methods research methodology combining clinical literature, practitioner interviews, human factors assessment, and supply chain analysis to ensure evidence-driven insights

The research methodology underpinning this analysis combined a structured review of peer-reviewed clinical literature, regulatory guidance documents, device engineering whitepapers, and selectively sourced industry disclosures, supplemented by primary interviews with clinical experts, device engineers, procurement specialists, and payers. The approach emphasized triangulation: findings from literature and public documentation were cross-validated with practitioner insights to surface practical adoption barriers and enablers.Qualitative interviews prioritized representation across end-user settings including ambulatory care centers, hospitals and clinics, specialty clinics, and home care providers, alongside perspectives from distribution stakeholders in hospital pharmacy, online pharmacy, and retail pharmacy channels. Technical evaluations compared platform characteristics across jet injectors, microneedles in coated, dissolvable, hollow, and solid forms, and patch pumps, assessing attributes such as ease of use, integration feasibility with biologics, and manufacturing complexity.

Where possible, methodology incorporated human factors assessment frameworks to evaluate likely user error modes, training requirements, and acceptance thresholds for adult, geriatric, and pediatric populations. Regulatory pathway mapping synthesized guidance from major jurisdictions to identify common evidence expectations for combination product submissions. Finally, supply chain and tariff sensitivity analysis drew on trade policy reports and supplier interviews to outline practical implications for manufacturing localization and procurement strategies. This mixed-method approach ensures that conclusions are grounded in both empirical evidence and practitioner experience.

A concise conclusion highlighting how integrated planning across design, evidence, and operations will determine the trajectory of needle-free diabetes therapies

In conclusion, needle-free diabetes care represents a confluence of clinical opportunity and practical complexity. Technological advances across jet injectors, microneedles, and patch pumps have expanded therapeutic options, yet successful adoption requires holistic planning across design, evidence generation, reimbursement strategy, and supply chain resilience. The patient-centric imperative-particularly for adult, geriatric, and pediatric cohorts-demands that developers prioritize usability alongside clinical performance.Regulatory and payer landscapes are adapting to novel device categories, and this evolution underscores the need for early and deliberate engagement with stakeholders to ensure that evidence packages capture both safety and real-world utility. Furthermore, regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific influence adoption priorities and manufacturing decisions, making geographic strategy a critical component of commercialization planning.

Ultimately, organizations that align technical innovation with operational readiness, clinician education, and payer-focused value narratives will be best positioned to translate needle-free technologies into durable clinical practice. By integrating human-centered design, regulatory foresight, and supply chain agility, stakeholders can unlock the potential of needle-free delivery to improve adherence, patient experience, and long-term diabetes management outcomes.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Needle Free Diabetes Care Market

Companies Mentioned

The key companies profiled in this Needle Free Diabetes Care market report include:- Abbott Laboratories

- Afon Technology Ltd.

- Bioject Medical Technologies, Inc.

- Biolinq Inc.

- CNOGA Medical Ltd.

- Dexcom, Inc.

- DiaMonTech GmbH

- European Pharma Group Ltd.

- Insulet Corporation

- Know Labs, Inc.

- MannKind Corporation

- Movano Health Inc.

- Nemaura Medical Ltd.

- PharmaJet, Inc.

- Senseonics Holdings Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

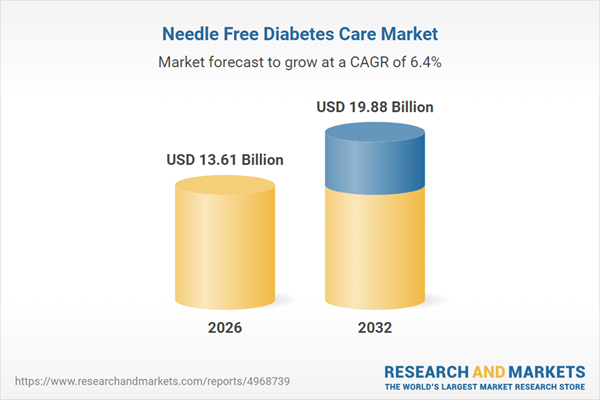

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 13.61 Billion |

| Forecasted Market Value ( USD | $ 19.88 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |