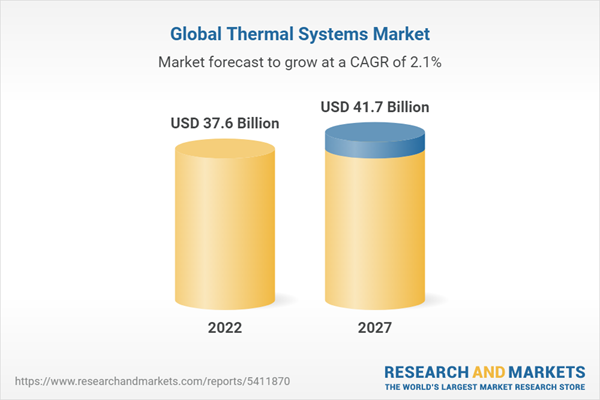

The global thermal systems market is projected to grow from USD 37.6 billion in 2022 to USD 41.7 billion in 2027, at a CAGR of 2.1%. The market has a promising growth potential due to several factors, such as stringent emission norms across various countries, which would create the importance of powertrain thermal management. The growing demand for premium cars with increased comfort features would require thermal management. Lastly, rising electric vehicle vehicles require effective thermal management for batteries, motors, and other power electronics modules.

With the rising demand for luxury cars, especially high-end full-size SUVs, several thermal systems such as heated steering, heated/ventilated seats, automatic climate control, and rear air conditioning have evolved in terms of technology, comfort, and safety. For instance, to provide sufficient cooling to third-row passengers, OEMs are installing separate rear A/C units in full-size SUVs, and with growing demand, the market for rear-seat air conditioning will also grow. Increasing demand for luxury vehicles would drive the need for advanced thermal systems and features, such as grille shutters, passive cabin ventilation, active cabin ventilation, active seat ventilation, and glass or glazing, which currently have very low penetration.

Battery Electric vehicles segment would lead the electric & hybrid vehicle thermal systems market

Stringent emissions regulations have shifted the global focus on electric vehicles, which has resulted in exponential growth of these vehicle types in recent years. An increase in electric vehicle sales has spurred the demand for electric components such as electric compressors, batteries, electric motors, power electronics, and heat exchangers. Also, demand for a higher driving range and fast charging has made battery and motor thermal management an important aspect of electric vehicles. Further, according to a survey of BEV architectures, the industry has been experimenting with combinations of different thermal management concepts such as pre-conditioning of the cabin, air coolant and refrigerant-cooled batteries, heat pumping, collection, and re-use of waste heat, etc. Thus, growing electric vehicles sales would fuel the thermal systems market in the coming future

Waste heat recovery technology to grow at the fastest rate during the forecast period

Waste heat recovery will be the fastest growing segment under the review period owing to increasing emission regulation stringency, especially in Western Europe and North America. European countries, Turkey, and Israel have made the 'Worldwide Harmonized Light Vehicle Test Procedure (WLTP)' mandatory, which helps to achieve reduced emissions and increased fuel efficiency. Some other countries are expected to join this program in the future, which may fuel the adoption of EGR technology, mainly for compact engines in the years to come. This would create a growth opportunity for using Exhaust gas recirculation (EGR) and Thermoelectric Generator (TEG) in the coming year and bring new business opportunities for thermal system providers.

Europe is estimated to be the second largest market for thermal systems market

Europe accounted to be the second largest market for thermal systems. The region has a higher demand for passenger cars, particularly for premium cars (C segment and above). These premium cars are installed with efficient engine cooling, transmission cooling, waste heat recovery systems, advanced HVAC system, heated/ventilated seats, heated steering, etc. These emit less harmful gases, offer enhanced performance, and provide superior cabin comfort to the passengers. With increasing premium car sales, the region's demand for thermal systems is expected to grow. Further, electric & hybrid vehicles also seen a considerable adoption rate in Europe.

According to the Global Electric Vehicle Outlook 2022 publication by IEA, Europe recorded EV sales of 2.3 million units in 2021, with robust growth of about 65% against 2020. Increasing EV sales would positively impact battery thermal and motor thermal management systems. The growing demand for the thermal system will be sufficed by major regional suppliers such as Valeo (France), MAHLE GmbH (Germany), and AKG Group (Germany).

Competitive Landscape Analysis

The study includes an in-depth competitive analysis of the major thermal systems product manufacturers in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies. Denso Corporation (Japan), MAHLE GmbH (Germany), Hanon Systems (South Korea), Valeo SA (France), and BorgWarner Inc. (US) are the leading providers of thermal systems in the global market.

Breakup of Primaries

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 25%, Tier 1 - 65% and Tier 2 - 10%

- By Designation: C Level Executives - 15%, Directors - 20%, and Others - 65%

- By Region: Asia-Pacific - 50%,Europe - 15%, North America - 30%, and RoW - 5%

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with the information on the closest approximations of the revenue numbers for the overall automotive thermal systems market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1.2 Market Definition

1.2.1 Inclusions & Exclusions

1.3 Market Scope

1.3.1 Markets Covered

Figure 1 Thermal Systems Market for Automotive: Market Segmentation

1.3.2 Thermal Systems Market, by Region

1.3.3 Years Considered

1.4 Currency Considered

1.5 Summary of Changes

1.6 Limitations

1.7 Stakeholders

Figure 2 Thermal Systems Market: Research Design

Figure 3 Research Design Model

2.2 Secondary Data

2.2.1 Key Secondary Sources for Vehicle Production and Electric Vehicle Sales

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data from Secondary Sources

2.3 Primary Data

Figure 4 Breakdown of Primary Interviews

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

Figure 5 Research Methodology: Hypothesis Building

2.4.1 Bottom-Up Approach

Figure 6 Bottom-Up Approach

2.4.2 Top-Down Approach

Figure 7 Top-Down Approach

2.4.3 Factor Analysis for Market Sizing: Demand and Supply Side

2.5 Market Breakdown and Data Triangulation

Figure 8 Data Triangulation

2.6 Factor Analysis

2.7 Assumptions & Associated Risks

2.7.1 Research Assumptions

2.7.2 Market Assumptions

Table 1 Assumptions, Associated Risks, and Impact

2.8 Research Limitations

3.2 Report Summary

Figure 9 Thermal Systems Market, by Application (ICE), 2022 vs. 2027 (USD Million)

Figure 10 Stringent Emission Norms, Growing Premium Vehicles, and Rising Demand for Electric Vehicles to Drive Thermal Systems Market

4.2 Thermal Systems Market, by Region (ICE)

Figure 11 Asia-Pacific Expected to Dominate Thermal Systems Market

4.3 Thermal Systems Market, by Application (ICE)

Figure 12 Front Air Conditioning Segment to Hold Largest Market

4.4 Thermal Systems Market, by Technology (ICE)

Figure 13 EGR Led the Technology Market During Forecast Period

4.5 Thermal Systems Market, by Component (ICE)

Figure 14 Heat Exchanger to Hold Largest Share of Components Market

4.6 Thermal Systems Market, by Vehicle Type (ICE)

Figure 15 Passenger Car Segment Projected to Hold Largest Market

4.7 Electric & Hybrid Vehicle Thermal Systems Market, by Application

Figure 16 Waste Heat Recovery Segment to Grow at Highest CAGR During Forecast Period

4.8 Electric & Hybrid Vehicle Thermal Systems Market, by Component

Figure 17 Heat Exchanger to Hold Largest Market Share During Forecast Period

4.9 Electric & Hybrid Vehicle Thermal Systems Market, by Vehicle Type

Figure 18 BEV Segment to Hold Largest Market Share During Forecast Period

4.10 Off-Highway Vehicle Thermal Systems Market, by Equipment

Figure 19 Farm Tractor to Hold Larger Market Share During Forecast Period

4.11 All-Terrain Vehicle Thermal Systems Market, by Region

Figure 20 North America to Hold Largest Market Share During Forecast Period

5.2 Market Dynamics

Figure 21 Thermal Systems: Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Emission Regulations

5.2.1.2 Increasing Demand for Luxury Vehicles and Integration of Advanced Thermal Management Solutions

Figure 22 E & F Segment Vehicle Production of Key Players, 2016-2021 (Thousand Units)

Table 2 Advanced Thermal System Technologies Offered by Key OEMs

5.2.2 Restraints

5.2.2.1 High Cost

Table 3 Economic Comparison of Thermal System Technologies: Value vs. Cost of Co2 Reduction

5.2.3 Opportunities

5.2.3.1 Advancements in Mobility Solutions Require Innovative Thermal Products

5.2.3.2 Growing EV Demand

Figure 23 Electric and Hybrid Passenger Vehicle Sales & Forecast, 2018-2027 (‘000 Units)

5.2.4 Challenges

5.2.4.1 Lack of Standardization

5.2.4.2 Low Adoption of Advanced Thermal Systems in Developing Countries

Table 4 Adoption Rate of Thermal Systems in Passenger Cars in Key Countries

5.3 Trends/Disruptions Impacting Buyers

Figure 24 Trends/Disruptions Impacting Buyers

5.4 Thermal Systems Market Scenario

Figure 25 Thermal Systems Market Scenario, 2018-2027 (USD Million)

5.4.1 Realistic Scenario

Table 5 Thermal Systems Market (Realistic Scenario), by Region, 2018-2027 (USD Billion)

5.4.2 Low-Impact Scenario

Table 6 Thermal Systems Market (Low-Impact Scenario), by Region, 2018-2027 (USD Million)

5.4.3 High-Impact Scenario

Table 7 Thermal Systems Market (High-Impact Scenario), by Region, 2018-2027 (USD Million)

5.5 Porter's Five Forces Analysis

Figure 26 Porter's Five Forces Analysis

Table 8 Porter's Five Forces Analysis

5.5.1 Threat of Substitutes

5.5.2 Threat of New Entrants

5.5.3 Bargaining Power of Buyers

5.5.4 Bargaining Power of Suppliers

5.5.5 Intensity of Competitive Rivalry

5.6 Thermal Systems Market Ecosystem

Figure 27 Thermal Systems Market: Ecosystem Analysis

Table 9 Thermal Systems Market: Role of Companies in Ecosystem

5.7 Supply Chain Analysis

Figure 28 Supply Chain Analysis: Thermal Systems Market

5.8 North America: Key Thermal System Suppliers

Table 10 North America: Key Thermal System Suppliers

5.9 Buying Criteria

Figure 29 Key Buying Criteria for Top 4 Components

Table 11 Key Buying Criteria for Top 4 Components

5.10 Price Analysis

5.10.1 Passenger Car

Table 12 Average Regional Price Trend: Passenger Car Thermal System Components (USD/Unit), 2021

5.10.2 Light Commercial Vehicle

Table 13 Average Regional Price Trend: Light Commercial Vehicle Thermal System Components (USD/Unit), 2021

5.10.3 Truck

Table 14 Average Regional Price Trend: Truck Thermal System Components (USD/Unit), 2021

5.11 Patent Analysis

Table 15 Applications and Patents Granted, 2019-2021

5.12 Case Study Analysis

5.12.1 Cooling System Maintenance and Service Case Study

5.12.2 Optare Case Study

5.12.3 Denso Corporation Case Study

5.12.4 Gentherm and Gm Case Study

5.13 Trade Analysis

5.13.1 Radiators and Parts - Import and Export Data, by Country, 2017-2021 (USD Thousand)

Table 16 Radiators and Parts Import Trade Data, by Country, 2017-2021

Table 17 Radiators and Parts Export Trade Data, by Country, 2017-2021

5.13.2 Air Conditioning Machines Used in Vehicles for Cabin - Import and Export Data of, by Country, 2017-2021 (USD Thousand)

Table 18 Vehicle Air Conditioners Import Trade Data, by Country, 2017-2021

Table 19 Vehicle Air Conditioners Export Trade Data, by Country, 2017-2021

5.14 Regulatory Landscape

Table 20 Emission Norm Specifications in Key Countries for Passenger Cars

5.14.1 Emission Regulations

5.14.1.1 On-Road Vehicles

Table 21 Euro-5 vs. Euro-6 Vehicle Emission Standards on New European Driving Cycle

Table 22 On-Road Vehicle Emission Regulation Outlook for Passenger Cars, 2016-2021

Figure 30 On-Road Vehicle Emission Regulation Outlook for Heavy-Duty Vehicles, 2014-2025

5.14.2 Fuel Economy Norms

5.14.2.1 US

Table 23 US: Cafe Standards for Each Model Year in Miles Per Gallon, 2012-2025

5.14.2.2 Europe

5.14.2.3 China

5.14.2.4 India

5.15 Regulatory Bodies/Government Agencies

Table 24 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 25 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 26 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

5.16 Key Conferences & Events in 2022-2023

5.16.1 Thermal Systems Market: Detailed List of Upcoming Conferences & Events

5.17 Technology Analysis

5.17.1 Thermal Systems Technology Analysis

5.17.2 Passenger Comfort Technology

5.17.3 Indirect Charge Air Cooling

Figure 31 Coolant Circuit in Indirect Charge Air

5.17.4 Liquid-Cooled Charge Air Coolers

6.1.1 Research Methodology

6.1.2 Assumptions

6.1.3 Industry Insights

Figure 32 Thermal Systems Market, by Application (Ice), 2022 vs. 2027 (USD Million)

Table 27 Thermal Systems Market, by Application (Ice), 2018-2021 (‘000 Units)

Table 28 Thermal Systems Market, by Application (Ice), 2022-2027 (‘000 Units)

Table 29 Thermal Systems Market, by Application (Ice), 2018-2021 (USD Million)

Table 30 Thermal Systems Market, by Application (Ice), 2022-2027 (USD Million)

6.2 Engine Cooling

6.2.1 Engine Downsizing and Demand for Low-Emission Engines to Drive Segment

Table 31 Engine Cooling: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 32 Engine Cooling: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 33 Engine Cooling: Thermal Systems Market, by Region, 2018-2021 (Million USD)

Table 34 Engine Cooling: Thermal Systems Market, by Region, 2022-2027 (USD Million)

6.3 Front Air Conditioning

6.3.1 Increasing Demand for Comfort and Advancements in Technology to Drive Segment

Table 35 Front Air Conditioning: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 36 Front Air Conditioning: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 37 Front Air Conditioning: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 38 Front Air Conditioning: Thermal Systems Market, by Region, 2022-2027 (USD Million)

6.4 Rear Air Conditioning

6.4.1 Rising Demand for Full-Size SUVs to Drive Segment

Table 39 Rear Air Conditioning: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 40 Rear Air Conditioning: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 41 Rear Air Conditioning: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 42 Rear Air Conditioning: Thermal Systems Market, by Region, 2022-2027 (USD Million)

6.5 Transmission System

6.5.1 Growing Demand for Automatic Transmission in Developing Countries to Drive Segment

Table 43 Transmission System: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 44 Transmission System: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 45 Transmission System: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 46 Transmission System: Thermal Systems Market, by Region, 2022-2027 (USD Million)

6.6 Heated/Ventilated Seats

6.6.1 Increasing Demand for Cabin Comfort to Drive Segment

Table 47 Heated/Ventilated Seats: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 48 Heated/Ventilated Seats: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 49 Heated/Ventilated Seats: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 50 Heated/Ventilated Seats: Thermal Systems Market, by Region, 2022-2027 (USD Million)

6.7 Heated Steering

6.7.1 Demand for Comfort Features in Cold Regions to Drive Segment

Table 51 Heated Steering: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 52 Heated Steering: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 53 Heated Steering: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 54 Heated Steering: Thermal Systems Market, by Region, 2022-2027 (USD Million)

6.8 Waste Heat Recovery

6.8.1 Emission Regulations and Increasing Demand for Hybrid Vehicles to Drive Segment

Table 55 Waste Heat Recovery: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 56 Waste Heat Recovery: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 57 Waste Heat Recovery: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 58 Waste Heat Recovery: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.1.1 Research Methodology

7.1.2 Assumptions

7.1.3 Industry Insights

Figure 33 Thermal Systems Market, by Component, 2022 vs. 2027 (USD Million)

Table 59 Thermal Systems Market, by Component, 2018-2021 (‘000 Units)

Table 60 Thermal Systems Market, by Component, 2022-2027 (‘000 Units)

Table 61 Thermal Systems Market, by Component, 2018-2021 (USD Million)

Table 62 Thermal Systems Market, by Component, 2022-2027 (USD Million)

7.2 Air Filter

7.2.1 Demand for Complex Flow Guidance Designs to Drive Segment

Table 63 Air Filter: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 64 Air Filter: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 65 Air Filter: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 66 Air Filter: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.3 Condenser

7.3.1 Focus on Reducing Power Consumption and Increasing Fuel Efficiency to Drive Segment

Table 67 Condenser: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 68 Condenser: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 69 Condenser: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 70 Condenser: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.4 Compressor

7.4.1 Growing Trend of Advanced Comfort and Convenience Features to Drive Segment

Table 71 Compressor: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 72 Compressor: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 73 Compressor: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 74 Compressor: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.5 Water Pump

7.5.1 Demand for Increasing Engine Efficiency to Drive Segment

Table 75 Water Pump: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 76 Water Pump: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 77 Water Pump: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 78 Water Pump: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.6 Motor

7.6.1 Benefits Like Better Efficiency and Performance to Drive Segment

Table 79 Motor: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 80 Motor: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 81 Motor: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 82 Motor: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.7 Heat Exchanger

7.7.1 Increasing Demand for Electric and Hybrid Vehicles to Drive Segment

Table 83 Heat Exchanger: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 84 Heat Exchanger: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 85 Heat Exchanger: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 86 Heat Exchanger: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.8 Heater Control

7.8.1 Increasing Demand for Luxury and Comfort to Drive Segment

Table 87 Heater Control: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 88 Heater Control: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 89 Heater Control: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 90 Heater Control: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.9 Thermoelectric Generator

7.9.1 Need for Reduction in Fuel Consumption to Drive Segment

Table 91 Thermoelectric Generator: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 92 Thermoelectric Generator: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 93 Thermoelectric Generator: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 94 Thermoelectric Generator: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.1 EGR Valve

7.10.1 Stringent Fuel Consumption and Emission Norms to Drive Segment

Table 95 EGR Valve: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 96 EGR Valve: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 97 EGR Valve: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 98 EGR Valve: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.11 A/C Valve

7.11.1 Demand for Efficient Cabin Climate Control Technologies to Drive Segment

Table 99 A/C Valve: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 100 A/C Valve: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 101 A/C Valve: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 102 A/C Valve: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.12 Oxygen Sensor

7.12.1 Growing Environmental Awareness to Drive Segment

Table 103 Oxygen Sensor: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 104 Oxygen Sensor: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 105 Oxygen Sensor: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 106 Oxygen Sensor: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.13 Temperature Sensor

7.13.1 Need for Measuring High Temperatures to Drive Segment

Table 107 Temperature Sensor: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 108 Temperature Sensor: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 109 Temperature Sensor: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 110 Temperature Sensor: Thermal Systems Market, by Region, 2022-2027 (USD Million)

7.14 Charge Air Cooler

7.14.1 Need for High-Power Engine Output to Drive Segment

Table 111 Charge Air Cooler: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 112 Charge Air Cooler: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 113 Charge Air Cooler: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 114 Charge Air Cooler: Thermal Systems Market, by Region, 2022-2027 (USD Million)

8.1.1 Research Methodology

8.1.2 Assumptions

8.1.3 Industry Insights

Figure 34 Thermal Systems Market, by Technology, 2022 vs. 2027 (‘000 Units)

Table 115 Automotive Thermal Systems Market, by Technology, 2018-2021 (‘000 Units)

Table 116 Automotive Thermal Systems Market, by Technology, 2022-2027 (‘000 Units)

8.2 Active Transmission Warm Up

8.2.1 Fuel Economy and Faster Transmission Technology to Drive Segment

Table 117 Active Transmission Warm Up: Automotive Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 118 Active Transmission Warm Up: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

8.3 EGR

8.3.1 Increased Adoption of SCR Systems to Restrain Segment

Table 119 EGR: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 120 EGR: Automotive Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

8.4 Engine Thermal Mass Reduction

8.4.1 Demand for Fuel-Efficient Vehicles to Drive Segment

Table 121 Engine Thermal Mass Reduction: Automotive Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 122 Engine Thermal Mass Reduction: Automotive Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

8.5 Reduced HVAC System Loading

8.5.1 Demand for Enhanced Cabin Comfort to Drive Segment

Table 123 Reduced HVAC System Loading: Automotive Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 124 Reduced HVAC System Loading: Automotive Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

8.6 Other Technologies

Table 125 Other Technologies: Automotive Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 126 Other Technologies: Automotive Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

9.1.1 Research Methodology

9.1.2 Assumptions

9.1.3 Industry Insights

Figure 35 Thermal Systems Market, by Vehicle Type (Ice), 2022 vs. 2027 (USD Million)

Table 127 Thermal Systems Market, by Vehicle Type (Ice), 2018-2021 (‘000 Units)

Table 128 Thermal Systems Market, by Vehicle Type (Ice), 2022-2027 (‘000 Units)

Table 129 Thermal Systems Market, by Vehicle Type (Ice), 2018-2021 (USD Million)

Table 130 Thermal Systems Market, by Vehicle Type (Ice), 2022-2027 (USD Million)

9.2 Passenger Car

9.2.1 Need for Fuel Efficiency to Drive Segment

Table 131 Passenger Car: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 132 Passenger Car: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 133 Passenger Car: Thermal Systems Market, 2018-2021 (USD Million)

Table 134 Passenger Car: Thermal Systems Market, by Region, 2022-2027 (USD Million)

9.3 Light Commercial Vehicle (LCV)

9.3.1 High Demand in North America to Drive Segment

Table 135 Light Commercial Vehicle: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 136 Light Commercial Vehicle: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 137 Light Commercial Vehicle: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 138 Light Commercial Vehicle: Thermal Systems Market, by Region, 2022-2027 (USD Million)

9.4 Truck

9.4.1 Growth of Large-Scale Industries, Logistics, and Construction to Drive Segment

Table 139 Truck: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 140 Truck: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 141 Truck: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 142 Truck: Thermal Systems Market, by Region, 2022-2027 (USD Million)

9.5 Bus

9.5.1 High Dependency on Public Transport to Drive Segment

Table 143 Bus: Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 144 Bus: Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 145 Bus: Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 146 Bus: Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.1.1 Research Methodology

10.1.2 Assumptions

10.1.3 Industry Insights

Figure 36 Electric and Hybrid Thermal Systems Market, by Application, 2022 vs. 2027 (USD Million)

Table 147 Electric and Hybrid Vehicle Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 148 Electric and Hybrid Vehicle Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 149 Electric and Hybrid Vehicle Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 150 Electric and Hybrid Vehicle Thermal Systems Market, by Application, 2022-2027 (USD Million)

10.2 Battery Thermal Management

10.2.1 Government Policies for Electric Vehicles to Drive Segment

Table 151 Battery Thermal Management: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 152 Battery Thermal Management: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 153 Battery Thermal Management: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 154 Battery Thermal Management: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.3 Transmission System

10.3.1 Increased Demand for Automatic Transmission and CVT to Drive Segment

Table 155 Transmission System: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 156 Transmission System: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 157 Transmission System: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 158 Transmission System: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.4 Engine Cooling

10.4.1 Demand for Efficient Engines to Drive Segment

Table 159 Engine Cooling: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 160 Engine Cooling: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 161 Engine Cooling: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 162 Engine Cooling: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.5 Front Air Conditioning

10.5.1 Demand for Comfort and Convenience to Drive Segment

Table 163 Front Air Conditioning: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 164 Front Air Conditioning: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 165 Front Air Conditioning: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 166 Front Air Conditioning: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.6 Motor Thermal Management

10.6.1 Demand for Advanced Electric and Hybrid Powertrains to Drive Segment

Table 167 Motor Type Used in Different Electric Vehicles

Table 168 Motor Thermal Management: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 169 Motor Thermal Management: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 170 Motor Thermal Management: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 171 Motor Thermal Management: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.7 Power Electronics

10.7.1 Demand for Smart Emission-Free Vehicles to Drive Segment

Table 172 Power Electronics: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 173 Power Electronics: Electric and Hybrid Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 174 Power Electronics: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 175 Power Electronics: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.8 Rear Air Conditioning

10.8.1 Increased Demand for Luxury and Mid-Segment Vehicles to Drive Segment

Table 176 Rear Air Conditioning: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 177 Rear Air Conditioning: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 178 Rear Air Conditioning: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 179 Rear Air Conditioning: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.9 Heated/Ventilated Seats

10.9.1 Demand for Cabin Comfort Features to Drive Segment

Table 180 Heated/Ventilated Seats: Electric and Hybrid Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 181 Heated/Ventilated Seats: Electric and Hybrid Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 182 Heated/Ventilated Seats: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 183 Heated/Ventilated Seats: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.10 Heated Steering

10.10.1 Demand for Luxury Vehicles to Drive Segment

Table 184 Heated Steering: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 185 Heated Steering: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 186 Heated Steering: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 187 Heated Steering: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

10.11 Waste Heat Recovery

10.11.1 Advent of New Technologies to Drive Segment

Table 188 Waste Heat Recovery: Electric and Hybrid Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 189 Waste Heat Recovery: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 190 Waste Heat Recovery: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 191 Waste Heat Recovery: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

11.1.1 Research Methodology

11.1.2 Assumptions

11.1.3 Industry Insights

Figure 37 Electric and Hybrid Vehicle Thermal Systems Market, by Component, 2022 vs. 2027 (USD Million)

Table 192 Electric and Hybrid Vehicle Thermal Systems Market, by Component, 2018-2021 (‘000 Units)

Table 193 Electric and Hybrid Vehicle Thermal Systems Market, by Component, 2022-2027 (‘000 Units)

Table 194 Electric and Hybrid Vehicle Thermal Systems Market, by Component, 2018-2021 (USD Million)

Table 195 Electric and Hybrid Vehicle Thermal Systems Market, by Component, 2022-2027 (USD Million)

11.2 Air Filter

11.2.1 Demand for Complex Flow Guidance Designs to Drive Segment

Table 196 Air Filter: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 197 Air Filter: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 198 Air Filter: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 199 Air Filter: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

11.3 Condenser

11.3.1 Focus on Reducing Power Consumption and Increasing Fuel Efficiency to Drive Segment

Table 200 Condenser: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 201 Condenser: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 202 Condenser: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 203 Condenser: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

11.4 Electric Compressor

11.4.1 Increasing Electric Vehicle Sales and Trend of Advanced Comfort and Convenience Features to Drive Segment

Table 204 Electric Compressor: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 205 Electric Compressor: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 206 Electric Compressor: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 207 Electric Compressor: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

11.5 Electric Water Pump

11.5.1 Demand for Fuel-Efficient Vehicles to Drive Segment

Table 208 Electric Water Pump: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 209 Electric Water Pump: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 210 Electric Water Pump: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 211 Electric Water Pump: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

11.6 Heat Exchanger

11.6.1 Growing Need for Long Range and Fast Charging to Drive Segment

Table 212 Heat Exchanger: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 213 Heat Exchanger: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 214 Heat Exchanger: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 215 Heat Exchanger: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

11.7 Heater Control

11.7.1 Increasing Demand for Luxury and Comfort to Drive Segment

Table 216 Heater Control: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 217 Heater Control: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 218 Heater Control: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 219 Heater Control: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

11.8 Electric Motor

11.8.1 Benefits Like Low Maintenance and Zero-Emission to Drive Segment

Table 220 Electric Motor: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 221 Electric Motor: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 222 Electric Motor: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 223 Electric Motor: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

11.9 Thermoelectric Generator

11.9.1 Need for Reduction in Fuel Consumption to Drive Segment

Table 224 Thermoelectric Generator: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 225 Thermoelectric Generator: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 226 Thermoelectric Generator: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 227 Thermoelectric Generator: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

12.1.1 Research Methodology

12.1.2 Assumptions

12.1.3 Industry Insights

Figure 38 Electric and Hybrid Vehicle Thermal Systems Market, by Vehicle Type, 2022 vs. 2027 (USD Million)

Table 228 Electric and Hybrid Vehicle Thermal Systems Market, by Vehicle Type, 2018-2021 (‘000 Units)

Table 229 Electric and Hybrid Vehicle Thermal Systems Market, by Vehicle Type, 2022-2027 (‘000 Units)

Table 230 Electric and Hybrid Vehicle Thermal Systems Market, by Vehicle Type, 2018-2021 (USD Million)

Table 231 Electric and Hybrid Vehicle Thermal Systems Market, by Vehicle Type, 2022-2027 (USD Million)

12.2 Battery Electric Vehicle (BEV)

12.2.1 Government Subsidies and Investments in Charging Infrastructure to Drive Segment

Table 232 BEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 233 BEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 234 BEV: Electric and Hybrid Thermal Systems Market, 2018-2021 (USD Million)

Table 235 BEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

12.3 Plug-In Hybrid Electric Vehicle (PHEV)

12.3.1 Benefit of Higher Range to Drive Segment

Table 236 PHEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 237 PHEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 238 PHEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 239 PHEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

12.4 Fuel Cell Electric Vehicle (FCEV)

12.4.1 Advantage of Better Fuel Economy to Drive Segment

Table 240 FCEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 241 FCEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 242 FCEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 243 FCEV: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

12.5 48V Mild-Hybrid

12.5.1 Emission Regulations to Drive Segment

Table 244 Mild-Hybrid (48V): Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 245 Mild-Hybrid (48V): Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 246 Mild-Hybrid (48V): Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 247 Mild-Hybrid (48V): Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

12.6 Electric Commercial Vehicle

12.6.1 Government Support for Zero-Emission Transportation to Drive Segment

Table 248 Electric Commercial Vehicle: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 249 Electric Commercial Vehicle: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 250 Electric Commercial Vehicle: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 251 Electric Commercial Vehicle: Electric and Hybrid Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

13.1.1 Research Methodology

13.1.2 Assumptions

13.1.3 Industry Insights

Figure 39 Off-Highway Thermal Systems Market, by Equipment Type, 2022 vs. 2027 (USD Million)

Table 252 Off-Highway Thermal Systems Market, by Equipment Type, 2018-2021 (‘000 Units)

Table 253 Off-Highway Thermal Systems Market, by Equipment Type, 2022-2027 (‘000 Units)

Table 254 Off-Highway Thermal Systems Market, by Equipment Type, 2018-2021 (USD Million)

Table 255 Off-Highway Thermal Systems Market, by Equipment Type, 2022-2027 (USD Million)

13.2 Construction and Mining Equipment

13.2.1 Increased Construction Activities and Industrial Development Projects to Drive Segment

Table 256 Construction and Mining Equipment Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 257 Construction and Mining Equipment Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 258 Construction and Mining Equipment Thermal Systems Market, 2018-2021 (USD Million)

Table 259 Construction and Mining Equipment Thermal Systems Market, by Region, 2022-2027 (USD Million)

13.3 Farm Tractor

13.3.1 Adoption of Mechanized Farming to Drive Segment

Table 260 Farm Tractor Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 261 Farm Tractor Thermal Systems Market, 2022-2027 (‘000 Units)

Table 262 Farm Tractor Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 263 Farm Tractor Thermal Systems Market, by Region, 2022-2027 (USD Million)

14.1.1 Research Methodology

14.1.2 Assumptions

14.1.3 Industry Insights

Figure 40 All-Terrain Vehicle Thermal Systems Market, 2022 vs. 2027 (USD Million)

Table 264 All-Terrain Vehicle Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 265 All-Terrain Vehicle Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 266 All-Terrain Vehicle Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 267 All-Terrain Vehicle Thermal Systems Market, by Region, 2022-2027 (USD Million)

14.2 Electric ATV

14.2.1 Developments in Batteries and New Electric Model Launches to Drive Market

14.3 Gasoline ATV

14.3.1 Higher Efficiency and Wide Application Areas to Drive Segment

15.1.1 Research Methodology

15.1.2 Assumptions

15.1.3 Industry Insights

Figure 41 Thermal Systems Market, 2022 vs. 2027 (USD Million)

Table 268 Thermal Systems Market, by Region, 2018-2021 (‘000 Units)

Table 269 Thermal Systems Market, by Region, 2022-2027 (‘000 Units)

Table 270 Thermal Systems Market, by Region, 2018-2021 (USD Million)

Table 271 Thermal Systems Market, by Region, 2022-2027 (USD Million)

15.2 Asia-Pacific

Figure 42 Asia-Pacific: Thermal Systems Market Snapshot

Table 272 Asia-Pacific: Thermal Systems Market, by Country, 2018-2021 (‘000 Units)

Table 273 Asia-Pacific: Thermal Systems Market, by Country, 2022-2027 (‘000 Units)

Table 274 Asia-Pacific: Thermal Systems Market, by Country, 2018-2021 (USD Million)

Table 275 Asia-Pacific: Thermal Systems Market, by Country, 2022-2027 (USD Million)

15.2.1 China

15.2.1.1 High Passenger Vehicle Demand to Drive Market

Table 276 China: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 277 China: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 278 China: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 279 China: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.2.2 India

15.2.2.1 Growth in Vehicle Sales and Demand for Comfort Features to Drive Market

Table 280 India: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 281 India: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 282 India: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 283 India: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.2.3 Japan

15.2.3.1 Advanced Features in Cabin Comfort to Drive Market

Table 284 Japan: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 285 Japan: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 286 Japan: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 287 Japan: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.2.4 South Korea

15.2.4.1 Demand for Luxury Cars to Drive Market

Table 288 South Korea: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 289 South Korea: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 290 South Korea: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 291 South Korea: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.2.5 Thailand

15.2.5.1 Growing Demand for Automotive Components to Drive Market

Table 292 Thailand: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 293 Thailand: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 294 Thailand: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 295 Thailand: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.2.6 Rest of Asia-Pacific

Table 296 Rest of Asia-Pacific: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 297 Rest of Asia-Pacific: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 298 Rest of Asia-Pacific: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 299 Rest of Asia-Pacific: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.3 Europe

Figure 43 Europe: Thermal Systems Market, 2022-2027 (USD Million)

Table 300 Europe: Thermal Systems Market, by Country, 2018-2021 (‘000 Units)

Table 301 Europe: Thermal Systems Market, by Country, 2022-2027 (‘000 Units)

Table 302 Europe: Thermal Systems Market, by Country, 2018-2021 (USD Million)

Table 303 Europe: Thermal Systems Market, by Country, 2022-2027 (USD Million)

15.3.1 Germany

15.3.1.1 High Demand for Premium Cars to Drive Market

Table 304 Germany: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 305 Germany: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 306 Germany: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 307 Germany: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.3.2 France

15.3.2.1 Increasing Demand for Premium Comfort Features to Drive Market

Table 308 France: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 309 France: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 310 France: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 311 France: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.3.3 UK

15.3.3.1 Strict Emission Norms to Drive Market

Table 312 UK: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 313 UK: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 314 UK: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 315 UK: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.3.4 Spain

15.3.4.1 Increasing Production of Passenger Cars to Drive Market

Table 316 Spain: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 317 Spain: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 318 Spain: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 319 Spain: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.3.5 Italy

15.3.5.1 Presence of Premium Vehicle Manufacturers to Drive Market

Table 320 Italy: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 321 Italy: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 322 Italy: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 323 Italy: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.3.6 Russia

15.3.6.1 Increasing Sales of Passenger Cars to Drive Market

Table 324 Russia: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 325 Russia: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 326 Russia: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 327 Russia: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.3.7 Rest of Europe

Table 328 Rest of Europe: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 329 Rest of Europe: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 330 Rest of Europe: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 331 Rest of Europe: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.4 North America

Figure 44 North America: Thermal Systems Market Snapshot

Table 332 North America: Thermal Systems Market, by Country, 2018-2021 (‘000 Units)

Table 333 North America: Thermal Systems Market, by Country, 2022-2027 (‘000 Units)

Table 334 North America: Thermal Systems Market, by Country, 2018-2021 (USD Million)

Table 335 North America: Thermal Systems Market, by Country, 2022-2027 (USD Million)

15.4.1 US

15.4.1.1 High Demand for Green Vehicles to Drive Market

Table 336 US: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 337 US: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 338 US: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 339 US: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.4.2 Canada

15.4.2.1 Government Policies and Regulatory Standards to Drive Market

Table 340 Canada: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 341 Canada: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 342 Canada: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 343 Canada: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.4.3 Mexico

15.4.3.1 Advanced Thermal System Solutions to Drive Market

Table 344 Mexico: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 345 Mexico: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 346 Mexico: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 347 Mexico: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.5 RoW

Figure 45 RoW: Thermal Systems Market, 2021-2026 (USD Million)

Table 348 RoW: Thermal Systems Market, by Country, 2018-2021 (‘000 Units)

Table 349 RoW: Thermal Systems Market, by Country, 2022-2027 (‘000 Units)

Table 350 RoW: Thermal Systems Market, by Country, 2018-2021 (USD Million)

Table 351 RoW: Thermal Systems Market, by Country, 2022-2027 (USD Million)

15.5.1 Iran

15.5.1.1 Heavy Investments in Automotive Sector to Drive Market

Table 352 Iran: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 353 Iran: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 354 Iran: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 355 Iran: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.5.2 Brazil

15.5.2.1 Presence of Major Automotive Companies to Drive Market

Table 356 Brazil: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 357 Brazil: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 358 Brazil: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 359 Brazil: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.5.3 Argentina

15.5.3.1 Production of Commercial Vehicles to Drive Market

Table 360 Argentina: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 361 Argentina: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 362 Argentina: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 363 Argentina: Thermal Systems Market, by Application, 2022-2027 (USD Million)

15.5.4 Others

Table 364 Rest of World: Thermal Systems Market, by Application, 2018-2021 (‘000 Units)

Table 365 Rest of World: Thermal Systems Market, by Application, 2022-2027 (‘000 Units)

Table 366 Rest of World: Thermal Systems Market, by Application, 2018-2021 (USD Million)

Table 367 Rest of World: Thermal Systems Market, by Application, 2022-2027 (USD Million)

16.2 Electric & Hybrid Vehicle Thermal System Applications can be Key Focus Area for Manufacturers

16.3 Conclusion

17.2 Thermal Systems Market Share Analysis, 2021

Table 368 Market Share Analysis for Thermal Systems Market, 2021

Figure 46 Thermal Systems Market Share Analysis, 2021

17.3 North America Thermal Systems Market Ranking Analysis, (Top Players) 2021

17.3.1 Front & Rear Air Conditioning: North America Market Ranking and Key Players

Table 369 Front & Rear Air Conditioning: North America Market Ranking and Key Players, 2021

17.3.2 Engine Cooling: North America Market Ranking and Key Players

Table 370 Engine Cooling: North America Market Ranking and Key Players, 2021

17.3.3 Battery Cooling: North America Market Ranking and Key Players

Table 371 Battery Cooling: North America Market Ranking and Key Players, 2021

17.3.4 EGR System: North America Market Ranking and Key Players

Table 372 EGR System: North America Market Ranking and Key Players, 2021

17.3.5 Heated/Ventilated Seats: North America Market Ranking

Table 373 Heated/Ventilated Seats: North America Market Ranking, 2021

17.4 Revenue Analysis of Top Listed/Public Players

17.5 Competitive Evaluation Quadrant - Thermal System Manufacturers

17.5.1 Terminology

17.5.2 Stars

17.5.3 Emerging Leaders

17.5.4 Pervasive Companies

17.5.5 Participants

Table 374 Thermal Systems Market: Company Product Footprint, 2021

Table 375 Thermal Systems Market: Company Application Footprint, 2021

Table 376 Thermal Systems Market: Company Region Footprint, 2021

Figure 47 Thermal System Manufacturers: Competitive Evaluation Matrix, 2021

17.6 Competitive Evaluation Quadrant: Electric and Hybrid Vehicle Thermal System Manufacturers

17.6.1 Stars

17.6.2 Emerging Leaders

17.6.3 Pervasive Companies

17.6.4 Participants

Figure 48 Electric Vehicle Thermal System Manufacturers: Competitive Evaluation Matrix, 2021

17.7 Competitive Scenario

17.7.1 New Product Launches

Table 377 Product Launches, 2020- 2022

17.7.2 Deals

Table 378 Deals, 2020-2022

17.7.3 Expansions

Table 379 Expansions, 2020-2022

17.8 Key Player Strategies/Right to Win, 2018-2022

Table 380 Companies Adopted New Product Developments and Expansion as Key Growth Strategies, 2018-2022

18.1 Thermal Systems Market - Key Players

18.1.1 Denso Corporation

Table 381 Denso Corporation: Business Overview

Figure 49 Denso Corporation: Company Snapshot

Table 382 Denso Corporation - Product Launches

Table 383 Denso Corporation - Deals

Table 384 Denso Corporation: Expansions

18.1.2 Mahle GmbH

Table 385 Mahle GmbH: Business Overview

Figure 50 Mahle GmbH: Company Snapshot

Table 386 Mahle GmbH - Product Launches

Table 387 Mahle GmbH: Deals

Table 388 Mahle GmbH: Expansions

18.1.3 Valeo SA

Table 389 Valeo SA: Business Overview

Figure 51 Valeo: Company Snapshot

18.1.4 Hanon Systems

Table 390 Hanon Systems: Business Overview

Figure 52 Hanon Systems: Company Snapshot

Table 391 Hanon Systems: Deals

Table 392 Hannon Systems: Expansions

18.1.5 Borgwarner Inc.

Table 393 Borgwarner Inc.: Business Overview

Figure 53 Borgwarner Inc.: Company Snapshot

Table 394 Borgwarner - Product Launches

Table 395 Borgwarner Inc.: Deals

Table 396 Borgwarner Inc.: Expansions

18.1.6 Gentherm Inc.

Table 397 Gentherm: Business Overview

Figure 54 Gentherm: Company Snapshot

Table 398 Gentherm - Product Launches

Table 399 Gentherm: Deals

18.1.7 Schaeffler AG

Table 400 Schaeffler AG: Business Overview

Figure 55 Schaeffler AG: Company Snapshot

Table 401 Schaeffler AG: Product Launches

Table 402 Schaeffler AG: Expansions

18.1.8 Johnson Electric Holdings Ltd.

Table 403 Johnson Electric Holdings: Business Overview

Figure 56 Johnson Electric Holdings: Company Snapshot

Table 404 Johnson Electric Holdings Ltd.: Product Launches

18.1.9 Dana Limited

Table 405 Dana Limited: Business Overview

Figure 57 Dana Limited: Company Snapshot

Table 406 Dana Limited: Product Launches

Table 407 Dana Limited: Deals

Table 408 Dana Ltd.: Expansions

18.1.10 Robert Bosch GmbH

Table 409 Robert Bosch GmbH: Business Overview

Figure 58 Robert Bosch GmbH: Company Snapshot

Table 410 Robert Bosch GmbH: Product Launches

18.2 Thermal Systems Market - Additional Players

18.2.1 Eberspächer

Table 411 Eberspächer: Company Overview

18.2.2 Continental AG

Table 412 Continental AG: Company Overview

18.2.3 Voss Automotive GmbH

Table 413 Voss Automotive GmbH: Company Overview

18.2.4 Grayson Thermal Systems

Table 414 Grayson Thermal Systems: Company Overview

18.2.5 Captherm Systems

Table 415 Captherm Systems: Company Overview

18.2.6 DuPont

Table 416 DuPont: Company Overview

18.2.7 Behr-Hella Thermocontrol GmbH (BHTC)

Table 417 Behr-Hella Thermocontrol GmbH (BHTC): Company Overview

18.2.8 Boyd Corporation

Table 418 Boyd Corporation: Company Overview

18.2.9 Sanden Holdings Corporation

Table 419 Sanden Holdings Corporation: Company Overview

18.2.10 Sanhua Automotive

Table 420 Sanhua Automotive: Company Overview

18.2.11 Shandong Houfeng Group

Table 421 Shandong Houfeng Group: Company Overview

18.3 Thermal Systems Market - Additional Players (North America)

18.3.1 Magna International

Table 422 Magna International: Company Overview

18.3.2 Lear Corporation

Table 423 Lear Corporation: Company Overview

18.3.3 Stant Corporation

Table 424 Stant Corporation: Company Overview

18.3.4 Air International Thermal Systems

Table 425 Air International Thermal Systems: Company Overview

18.3.5 Michigan Automotive Compressor, Inc.

Table 426 Michigan Automotive Compressor, Inc.: Company Overview

18.3.6 Modine Manufacturing Company

Table 427 Modine Manufacturing Company: Company Overview

18.3.7 Wells Vehicle Electronics

Table 428 Wells Vehicle Electronics: Company Overview

18.3.8 T.Rad North America, Inc.

Table 429 T.Rad North America, Inc.: Company Overview

18.3.9 Thermal Solution Manufacturing, Inc.

Table 430 Thermal Solutions Manufacturing, Inc.: Company Overview

18.3.10 AKG Thermal Systems Inc.

Table 431 AKG Thermal Systems: Company Overview

*Details on Business Overview, Products Offered, Recent Developments, Analyst's View Might Not be Captured in Case of Unlisted Companies

19.2 Discussion Guide

19.3 KnowledgeStore: The Subscription Portal

19.4 Available Customizations

19.4.1 Electric & Hybrid Thermal Systems Market, by Application Country-Wise Data

19.4.1.1 Battery Thermal System

19.4.1.2 Transmission System

19.4.1.3 Engine Cooling

19.4.1.4 Front Air Conditioning

19.4.1.5 Motor Thermal System

19.4.1.6 Power Electronics

19.4.1.7 Rear Air Conditioning

19.4.1.8 Heated/Ventilated Seats

19.4.1.9 Heated Steering

19.4.1.10 Waste Heat Recovery

19.4.2 Electric & Hybrid Thermal Systems Market, by Vehicle Type Country-Wise Data

19.4.2.1 BEV

19.4.2.2 PHEV

19.4.2.3 FCEV

Companies Mentioned

- Air International Thermal Systems

- AKG Thermal Systems Inc.

- Behr-Hella Thermocontrol GmbH (BHTC)

- Borgwarner Inc.

- Boyd Corporation

- Captherm Systems

- Continental AG

- Dana Limited

- Denso Corporation

- DuPont

- Eberspächer

- Gentherm Inc.

- Grayson Thermal Systems

- Hanon Systems

- Johnson Electric Holdings Ltd.

- Lear Corporation

- Magna International

- Mahle GmbH

- Michigan Automotive Compressor, Inc.

- Modine Manufacturing Company

- Robert Bosch GmbH

- Sanden Holdings Corporation

- Sanhua Automotive

- Schaeffler AG

- Shandong Houfeng Group

- Stant Corporation

- T.Rad North America, Inc.

- Thermal Solution Manufacturing, Inc.

- Valeo SA

- Voss Automotive GmbH

- Wells Vehicle Electronics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 386 |

| Published | July 2022 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 37.6 Billion |

| Forecasted Market Value ( USD | $ 41.7 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |